AlixPartners recently collaborated with the American Frozen Food Institute (AFFI) to publish a "How to Win in Frozen" playbook, a landmark study on the state of the department. Download the comprehensive report here and stay tuned to this five-part series, "Opportunities in Frozen," for insight on how to capture the coming growth.

Location, location, location – when you're selling frozen food, where you're selling it matters.

Our latest analysis shows that frozen purchase patterns vary significantly not only by region but by subregion, including in some ways that may surprise even established brands and grocers. In addition, each subregion is distinct in how it engages not only with the frozen department overall but with individual frozen categories.

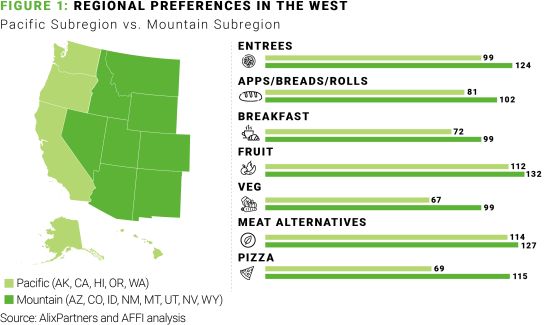

Within the West, for example, heavy shoppers for frozen pizza are considerably over-indexed in the Mountain subregion (115) and significantly under-indexed in the Pacific subregion (69). The two subregions behave uniquely with other categories as well.

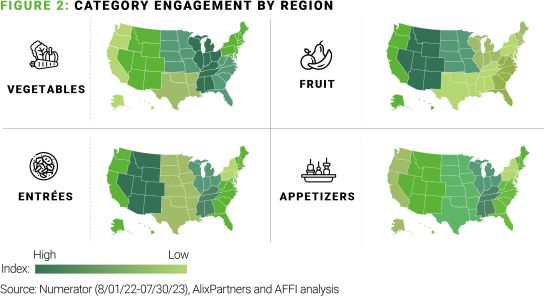

For some frozen categories, outsize interest is concentrated in just two or three subregions, highlighting the territories most critical to driving sales for those categories (Figure 2).

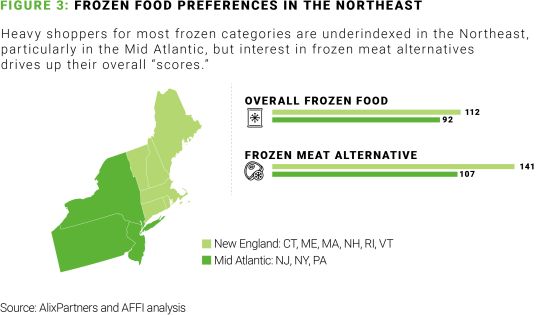

The Northeast is the only region in which heavy shoppers for most frozen categories are under-indexed across the board, but there's a big exception to that rule: frozen meat alternatives, for which New England is the top subregion in the nation (Figure 3).

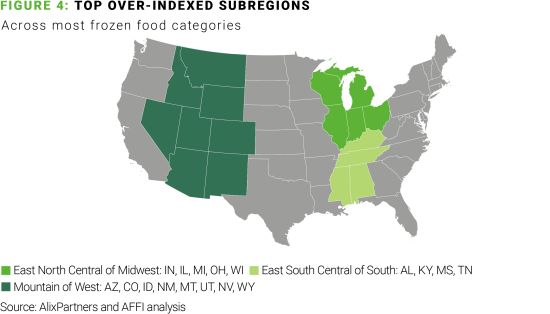

The top three subregions for heavy shoppers of frozen overall belong to the Midwest, the South and the West, showing pockets of committed consumers throughout the country (Figure 4).

The discovery of these and many other regional preferences - which can be explored further in the "How to Win in Frozen" playbook from AlixPartners and the American Frozen Food Institute - has major implications for grocers and brands, and the trends shared here should be considered during both internal and collaborative processes.

CPGs can use this information as a springboard for customer conversations about in-stock priorities. Knowledge of regional preferences becomes especially critical when supply constraints arise. Instead of fulfilling orders on a strictly first-come, first-serve basis or making replenishment decisions chiefly on customer relationship dynamics, suppliers can layer those factors along with regionality to allocate constrained inventory. With this multi-faceted approach, brands can more effectively support customers by differentiating supply chain delivery to ensure that each grocer they serve will have the products and categories in-stock that matter most to shoppers in their area.

Knowing in which subregions different categories resonate can also help CPGs be more judicious in their trade funding and retail media spending. Regional preferences can provide direction on ideal locations for new product launches, line extensions, promotional campaigns and other projects.

These purchase patterns also present a slew of optimization opportunities for grocers. Retailers can re-segment stores and create region-specific assortments based on these trends. They can layer regional preferences into the equation as they decide in which categories they need to provide more choices for their shoppers and in which categories fewer options will suffice.

CPGs and retailers will see the greatest gains by examining these regional preferences together and exploring the opportunities they present. Trading partners who collaborate and make regional preferences a consideration in their strategy will be taking strides toward a more satisfied and loyal frozen shopper base – and strides toward earning their share of the $10 billion in growth that's projected for frozen in the next three years.

Want more? Check out these other recent insights from the experts at AlixPartners.

Opportunities in frozen: $10 billion in growth up for grabs over next three years

Assess before you invest: Why a data deep dive must be the first step for grocers exploring AI

5 undercurrents reshaping the future of the alcoholic beverage industry

The $100 billion opportunity for U.S. grocers

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.