- within Immigration topic(s)

In the CARES Act that became law with President Trump's signature on March 27, $100 billion (of the more than $2 trillion authorized in the bill) is set aside for "health care related expenses or lost revenues that are attributable" to the COVID-19 pandemic. An additional $75 billion was appropriated through the Paycheck Protection Program and Health Care Enhancement Act less than a month later. These funds are being made available through the U.S. Department of Health and Human Services' (HHS) Public Health and Social Services Emergency Fund for provider relief (the "Relief Fund"). Previous updates related to the Relief Fund can be found here: https://www.butlersnow.com/2020/05/update-hhs-sets-june-3-deadline-for-certain-attestations-healthcare-providers-must-attest-to-and-comply-with/.

Quarterly Reports Temporarily Suspended

Since our last update, HHS has made a number of announcements and updates to its Relief Fund guidance, most of which are detailed in the agency's Frequently Asked Questions (FAQ) document that can be found here: https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/index.html. One of the most notable recent program changes came with a June 13, 2020, update to the FAQ document, announcing the agency's temporary suspension of the recipient quarterly reporting requirement. Found in Section 15011 of the CARES Act and also referenced in the Relief Fund Terms and Conditions (https://www.hhs.gov/sites/default/files/terms-and-conditions-provider-relief-30-b.pdf), this provision requires recipients of "large covered funds," defined in the Act to include recipients of more than $150,000 in CARES Act and other coronavirus funds, to file quarterly reports with HHS (and the Pandemic Response Accountability Committee) detailing the amount of funds received and expended and the uses to which such funds have been put. The June 13 FAQ confirms that applicable fund recipients do not need to submit quarterly reports at this time. Rather, in satisfaction of this reporting requirement, HHS will develop a report that includes the names of payment recipients and their program payment amounts, which data will also be posted on the HHS Tracking Spending - Increasing Accountability website https://taggs.hhs.gov/Coronavirus/Providers. Note, however, that HHS has also made clear in its latest FAQ guidance that the agency will be requiring applicable recipients to submit future reports relating to the use of Relief Fund payments, the contents of which would be detailed "in the coming weeks."

Where Things Stand

By our count, more than $100 billion of the Relief Fund is set to be distributed through General and Targeted distributions, summarized as follows:

- General Distributions. HHS is now on track to distribute an estimated $50 billion to providers through, what the agency calls, General Distributions. To be eligible a provider must have billed Medicare fee-for-service (Parts A and B) in calendar year 2019. $30 billion was sent directly to providers between April 10 and 17. An additional $20 billion, intended to true-up to a provider's 2% of gross receipts for 2018, was made available to those who applied for the funds and submitted the required documentation on or before June 3.

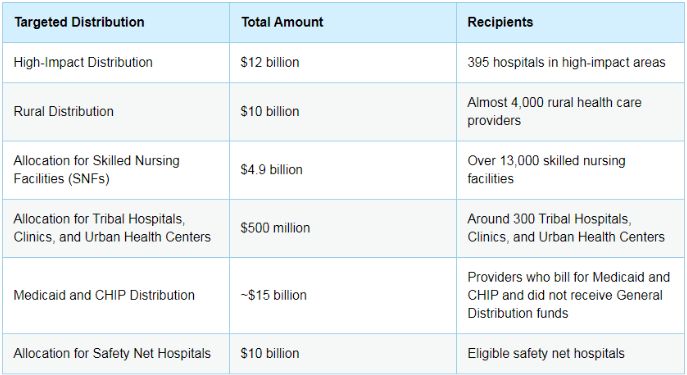

- Targeted Distributions. HHS has made more than $52 billion available to providers believed to be particularly impacted by the COVID-19 pandemic.

At the time of this posting all deadlines for initial applications for these targeted distributions had expired, with the exception of the Medicaid and CHIP Distribution, discussed in more detail below.

- Medicaid or CHIP Distribution. Providers who received payments from the $50 billion General Distribution are not eligible to receive payments under this Targeted Distribution. Of those remaining, providers who billed Medicaid or CHIP for healthcare-related services during the period of January 1, 2018, to December 31, 2019, are eligible to receive 2% of gross revenue (as a percent of gross revenues from patient care) for CY 2017, or 2018 or 2019, as selected by the applicant and verified by the required documentation. There are a number of other requirements detailed in the HHS Instructions For the Medicaid Provider Distribution, available here https://www.hhs.gov/sites/default/files/medicaid-provider-distribution-instructions.pdf. Applicants must submit the required application and documentation through the Enhanced Provider Relief Fund Payment Portal on or before July 20, 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.