On July 2, 2013, the Federal Reserve Board (the Board) approved revisions to its capital adequacy guidelines and prompt corrective action rules that implement the revised standards of the Basel Committee on Banking Supervision, commonly called Basel III, and address relevant provisions of the Dodd-Frank Act. The OCC and the FDIC will act on the joint rule by July 9. The final rule adopts the framework proposed in June 2012, but makes several important improvements that should ease the impact on community banking institutions. Most significantly for community banks, the final rule permanently grandfathers outstanding trust preferred securities issued by holding companies with less than $15 billion in assets, keeps residential mortgages at their current risk weighting for purposes of calculating risk-weighted assets, and allows most banking organizations to opt out of including in regulatory capital unrealized gains and losses on AFS debt securities.

This alert highlights the portions of the final rule that are most relevant to smaller, non-complex banking organizations. Organizations with $250 billion or more in consolidated assets or foreign exposures of at least $10 billion are subject to additional requirements and accelerated compliance deadlines (advanced approaches banking organizations).

To implement Basel III and the Dodd-Frank Act, the final rule:

- Imposes new minimum regulatory capital requirements;

- Introduces a new regulatory capital buffer above the minimum capital requirement;

- Redefines regulatory capital elements, resulting in trust preferred instruments no longer qualifying as Tier 1 capital (but grandfathering instruments issued prior to May 19, 2010 for institutions with less than $15 billion in assets); and

- Revises deductions and adjustments to capital and risk weighting of assets.

Scope of the Final Rule

The final rule applies to all depository institutions, all bank holding companies with consolidated assets of $500 million or more, and all savings and loan holding companies (SLHCs) except for those that are substantially engaged in insurance underwriting or commercial activities. This latter group of SLHCs was given a temporary exemption while the Board further evaluates appropriate consolidated capital requirements for these types of companies.

Although small bank holding companies remain subject to the Board's Small Bank Holding Company Policy Statement, which generally exempts bank holding companies with consolidated assets of less than $500 million from consolidated capital requirements, the Board found that the Dodd-Frank Act did not provide an exemption for SLHCs of a similar size. Accordingly, all covered SLHCs will be subject to consolidated capital requirements until legislation allows the Board to bring SLHCs under its policy for small bank holding companies Minimum Regulatory Capital Requirements

Consistent with Basel III and the rules proposed last June, the final rule requires banking organizations to comply with the following minimum capital ratios:

- A new common equity tier 1 capital ratio of 4.5% of risk-weighted assets;

- A tier 1 capital ratio of 6% of risk-weighted assets (increased from the current requirement of 4%);

- A total capital ratio of 8% of risk-weighted assets (unchanged from current requirement); and

- A leverage ratio of 4% of total assets.

The new minimum capital requirements will be effective January 1, 2015 for all banking organizations that are not advanced approaches banking organizations and for all covered SLHCs. The delayed effective date replaces the original proposal of a transition period leading up to full implementation in 2015.

Capital Conservation Buffer

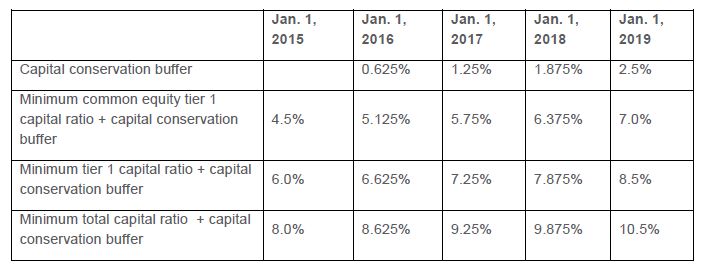

The final rule limits capital distributions and discretionary bonus payments to executive officers-for banking organizations that do not hold a buffer of common equity tier 1 capital above its minimum risk-based capital requirements in an amount greater than 2.5% of its total risk-weighted assets. For all banking organizations that are not advanced approaches banking organizations and for all covered SLHCs, the capital conservation buffer will be implemented over a transition period beginning in 2016 as follows:

A banking organization that maintains the required capital conservation buffer is permitted to pay out an unlimited amount of its eligible retained income in the form of capital distributions (which includes share repurchases) and discretionary bonuses to executive officers. Organizations whose capital conservation buffer is less than the required amount will be subject to a maximum payout ratio that ranges from 0% to 60%.

Redefined Capital Elements

Consistent with the proposed rules, the final rule establishes qualification criteria for common equity, additional tier 1 and tier 2 capital instruments. The final criteria are substantially the same as proposed, with the most significant change being the treatment of trust preferred securities.

For depository institution holding companies with less than $15 billion in consolidated total assets as of December 31, 2009 (and companies that were mutual holding companies as of May 19, 2010), the final rule does not require a phase out of non-qualifying tier 1 capital instruments (such as trust preferred securities) issued prior to May 19, 2010. This means that, for these institutions, trust preferred securities issued prior to May 19, 2010 are permanently grandfathered as tier 1 or tier 2 capital instruments. More specifically, these depository institution holding companies will be able to continue to include outstanding trust preferred securities in additional tier 1 capital, subject to the existing limit of 25% of tier 1 capital elements excluding any non-qualifying capital instruments. Any tier 1 capital instrument that is excluded from tier 1 capital because it exceeds the 25% limit can be included in tier 2 capital without limitation.

For banking organizations with $15 billion or more in consolidated total assets as of December 31, 2009, non-qualifying capital instruments will be phased out of tier 1 capital by 2016. However, these institutions may permanently include in tier 2 capital trust preferred securities that are phased out of tier 1 capital notwithstanding that they would otherwise be non-qualifying capital instruments.

Changes to Deductions from Capital and Risk-Weightings

Under the final rule, deductions from regulatory capital are stricter than those required under the agencies' current capital rules, with most deductions taken from common equity tier 1 capital. Certain deferred tax assets, mortgage servicing assets, and significant investments in capital instruments of unconsolidated financial institutions will be subject to deduction if they surpass an individual limit of 10% of common equity tier 1 capital or an aggregate limit of 15%. For all banking organizations that are not advanced approaches banking organizations and for all covered SLHCs, regulatory capital adjustments and deductions will be phased in from January 1, 2015 through January 1, 2018.

The proposed rule would have required that all unrealized gains and losses reflected in accumulated other comprehensive income (AOCI), such as unrealized gains and losses on available-for-sale securities, be reflected in common equity tier 1 capital. In response to concerns regarding the considerable volatility of regulatory capital and compliance burden that would result, the final rule provides banking organizations with a one-time election to opt out of the requirement to include most AOCI components in the calculation of common equity tier 1 capital, effectively retaining the status quo.

Beginning on January 1, 2015, all banking organizations must calculate risk-weighted assets under the final rule. The more significant changes impacting community banks are an increase in the risk weighting for certain acquisition, development and construction loans to 150% an increase to 150% for exposures that are more than 90 days past due or on nonaccrual status. Both types of exposures currently are assigned a 100% risk weight.

The proposed rule would have changed the risk weighting of residential mortgage loans from 50% for most first-lien exposures to a range of 35-200% based on the loan-to-value ratio and certain mortgage product features. In reaction to strong objection, the Board abandoned this change and has retained the current treatment for residential mortgages.

Planning for Implementation

Although the final capital adequacy rules are detailed and complex, the delayed implementation date will provide banking organizations time to evaluate their capital ratios under the new standards. The delayed implementation should be particularly valuable to SLHCs, which have not previously been subject to consolidated capital requirements. Banking organizations whose capital structure includes instruments other than common stock, such as preferred stock or subordinated debt, should evaluate how those instruments will be treated under the new rules, while those who have deferred tax assets, goodwill or other deductible items should evaluate how the deductions will impact their capital calculations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.