- within Finance and Banking topic(s)

- in United States

- within Wealth Management, Law Practice Management and Coronavirus (COVID-19) topic(s)

In recent years, non-bank lending to private equity-owned, small- and middle-market companies has increased significantly. Within this growing sector, private and non-traded BDCs have outperformed other non-bank lenders in many respects. Private and non-traded BDCs have demonstrated notable advantages in terms of portfolio return and quality and investor alignment, and they often benefit from less exposure to the volatility of public markets. Since 2020, assets under management by BDCs has increased from approximately $127 billion to approximately $451 billion in 2025, representing a compounded annual growth rate in excess of 28%. This expansion reflects both growing investor appetite for yield and the increasing confidence in BDCs as viable, long-term sources of capital for middle-market borrowers.

The U.S. private corporate credit market now exceeds $1.5 trillion and is expected to continue to grow in coming years. Private credit has emerged as a particularly compelling strategy as investors look for new investment vehicles that provide yield, diversification and downside protection. Sponsors of BDCs holding private credit assets have made these investment opportunities increasingly available to institutional investors in recent years. However, recent and anticipated regulatory reforms and evolving market trends have the potential to expand access to these private credit assets to retail investors. Retail investor interest in BDCs has already grown significantly, especially for those looking to gain exposure to private credit and middle-market lending.

New private and non-traded BDCs now have the opportunity to be structured with multiple share classes and a limit on investor liquidity requests subject to a quarterly or annual redemption cap. In March 2025, the SEC issued exemptive relief allowing private BDCs to offer multiple share classes with varying sales loads and distribution fees even if the shares are not publicly offered. This exemptive relief allows private BDCs to attract a broader range of investors with varying and customized fee structures and increases their capital raising opportunities. This regulatory accommodation provides the structuring flexibility institutional asset managers need to raise capital through established institutional channels. Institutional asset managers now have the ability to raise capital at a BDC's net asset value without subjecting the vehicle to public market volatility and the below net asset value trading prices that many public BDCs have historically experienced.

Additionally, in April 2025, the SEC issued exemptive relief creating a more streamlined, modern coinvestment framework for BDCs. These changes significantly ease compliance and governance burdens by allowing affiliated joint ventures of BDCs to participate in co-investment transactions with other affiliated investment vehicles. The new process reduces board approval requirements for co-investment transactions, clarifies the roles and responsibilities of advisers and boards of directors in these investments, expands the types of investment opportunities in which closed-end funds can engage and streamlines investment allocation decisions. Given many BDCs are sponsored by private equity or private credit platforms, with multiple public and private vehicles, the ability to engage in co-investment and joint exit transactions is an important regulatory reform.

Total net equity capital raised by private and non-traded BDCs has increased from approximately $5 billion in 2020 to approximately $96 billion in 2025. Many sponsors of new BDCs partnering with large institutional investors also offer a concurrent investment in the BDC's external investment adviser or general manager in order to further enhance the investor's return and align interests. These joint venture or strategic investments have proven appealing to pension fund, insurance and alternative investment managers.

We hope you find our updated BDC Facts & Stats helpful.

Additional information regarding our practice and resources can be found at the end of the materials.

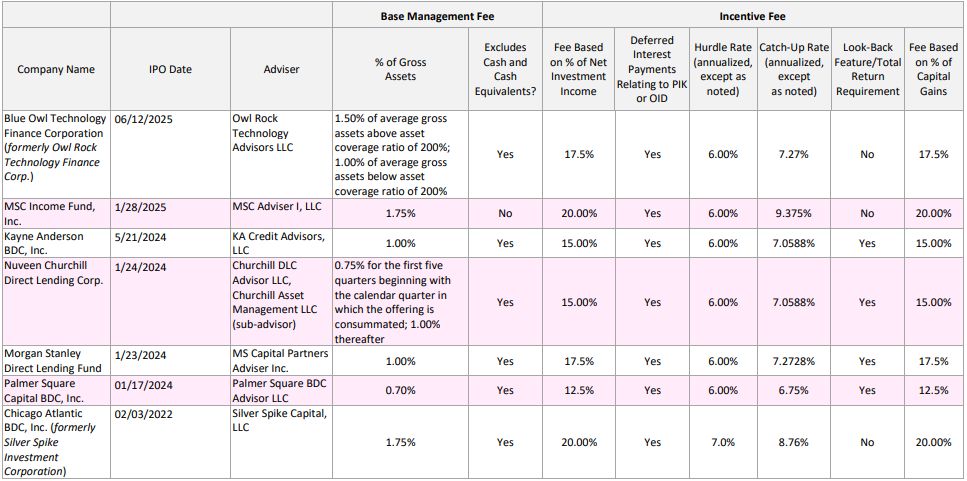

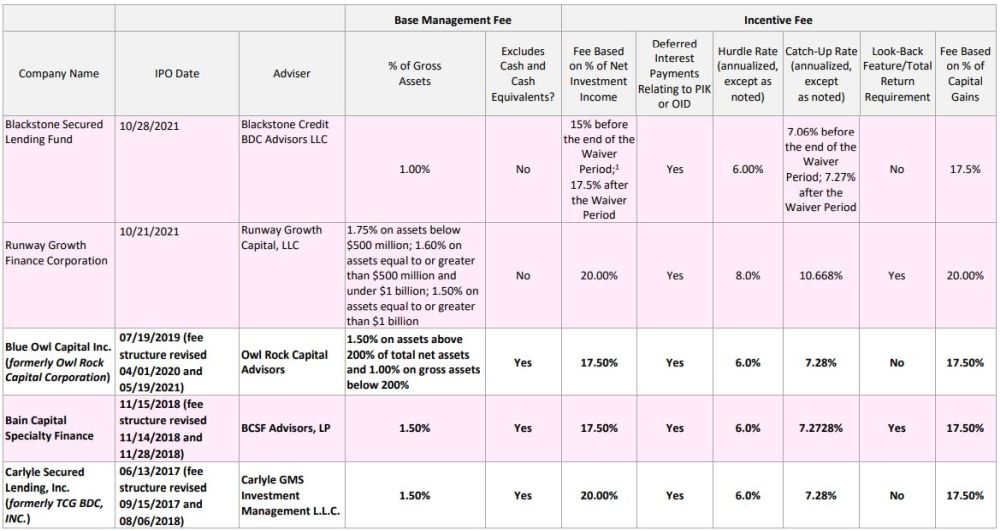

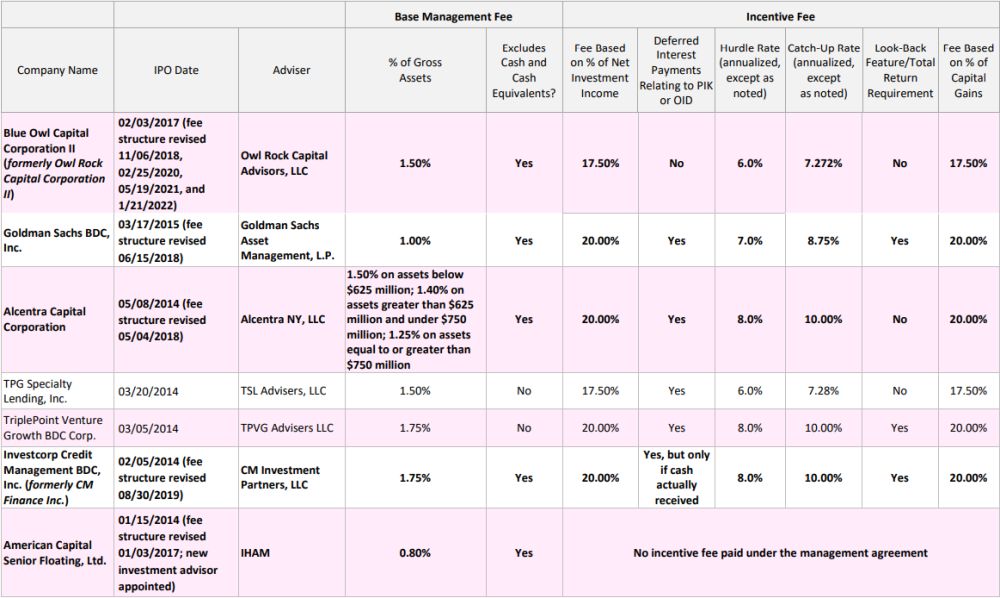

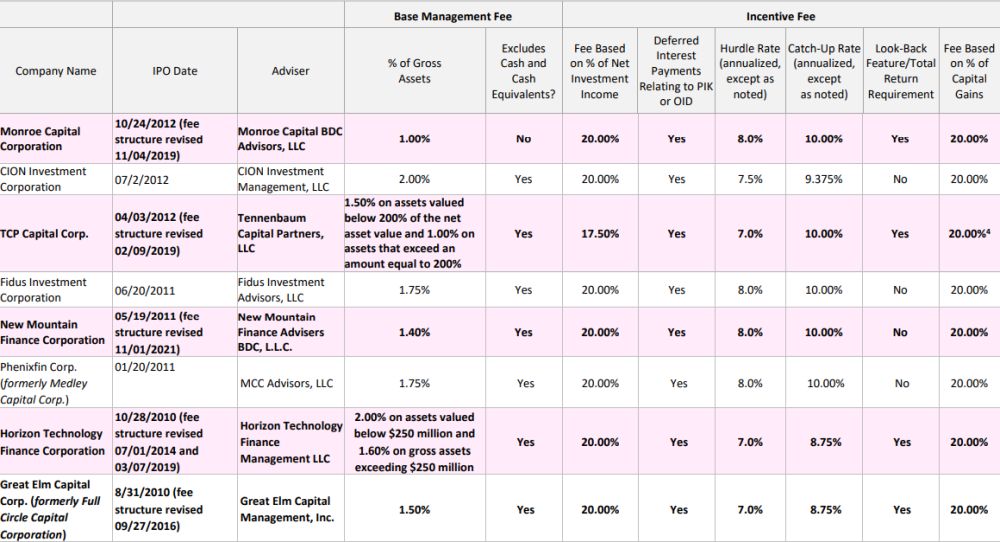

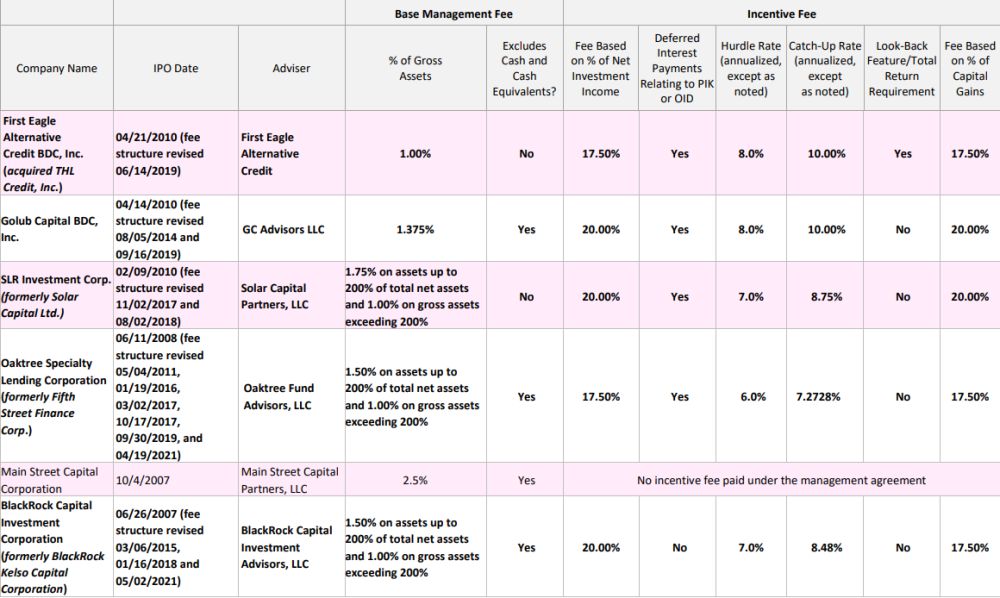

BDC Adviser Fees

The chart below summarizes the adviser fee structures for BDCs based on filings made with the SEC through June 15, 2025. BDCs are listed in reverse chronological order based on the date of their respective initial public offerings, or "IPOs." All BDCs listed have a class of securities that is traded on an exchange.

The BDCs shown in bold below have amended their adviser fee structures between January 1, 2019, and June 15, 2025.

To view the full article, click here.

Footnotes

1. The "Waiver Period" is the two years following the IPO.

2. Deferral mechanism for incentive fee.

3. Deferral mechanism for incentive fee.

4. Capital gains portion of incentive fee subject to total return requirement.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.