- within Finance and Banking topic(s)

- in United States

- within Litigation and Mediation & Arbitration topic(s)

As 2025 gets underway and a new presidential administration takes shape in Washington, the credit markets are in good health with plenty of available capital to be deployed. We anticipate a busy year ahead. Deal activity was slightly up in the second half of last year after a challenging first half of 2024. We expect that to continue now that U.S. election uncertainty is behind us and there is continued anticipation that interest rates will begin to ease.

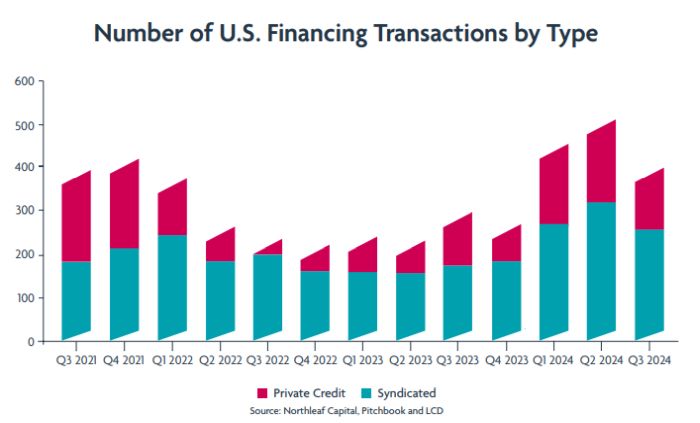

In the second half of 2024, the private credit and broadly syndicated loan (BSL) markets were largely in balance, with neither market dominating, and we saw rough equivalence between the number of private credit loans being refinanced by the BSL market and vice versa. After a period in which refinancings and recapitalizations have dominated and competition to finance deals has been fierce, we expect that an increase in deal flow and a gradual lowering of interest rates will lead to more issuances, which may ultimately result in tighter deal terms for lenders.

We observed a notable increase in direct lenders partnering with banks as 2024 ended, with Citi and Apollo announcing a $25 billion private credit direct lending program, Webster Bank and Marathon Asset Management teaming up to originate directly sourced senior secured loans, and AGL Credit Management signing a deal with Barclays to launch their private credit investment platform. These partnerships were formed during challenging market environments with the thesis that such collaborations will lead to more robust sourcing of deals by pooling contacts and resources.

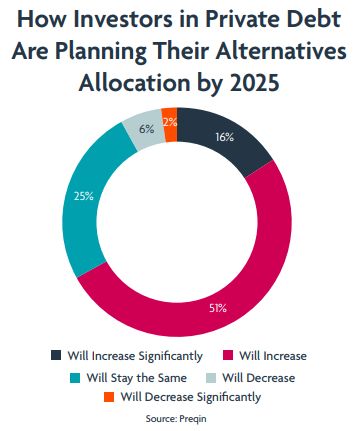

Meanwhile, the swathe of new credit fund launches specifically targeting retail investors continues to gather pace, with Apollo and State Street joining forces to launch the first exchange-traded fund to invest in both public and private credit at year-end. That partnership is one of a number of similar filings currently subject to review by the Securities and Exchange Commission (SEC), and the opening up of private debt to a broader investor base will be a big theme in the year ahead.

Documentation Trends

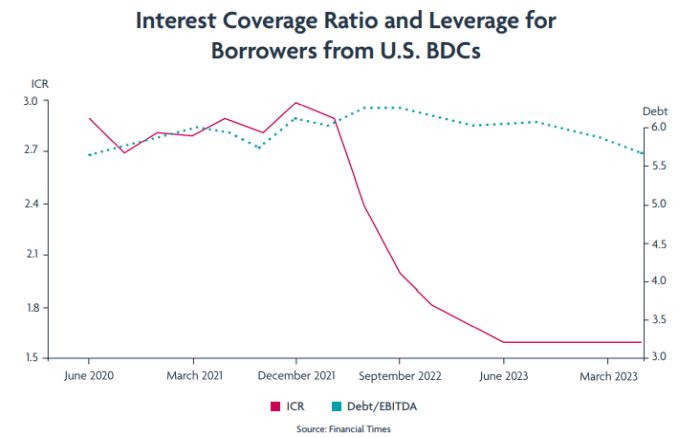

Lender protections came under pressure over the past few years as a shortage of deals and increased competition from a growing base of private lenders led to a race to the bottom in a highly competitive financing market. We have seen more covenant light structures in private credit, the increased use of payment-in-kind (PIK) instruments and large-cap broadly syndicated loan terms coming into middle market private debt transactions.

There is a great deal of focus among lenders on liability management exercises (LMEs), whereby the sponsor, or the sponsor and a small number of key lenders, could attempt to take certain valuable assets out of the loan package in order to put other lenders at a disadvantage during a distress scenario or a liquidity crisis. While there is less risk of LME transactions in private credit club deals, private debt funds are vulnerable, and the focus is now on where the next exposure might come from.

The recent Pluralsight transaction was the first private credit matter where an LME-style transaction made an appearance. In Pluralsight, upon a distress event there was a dropdown of intellectual property (IP) outside of the loan party group into a non-guarantor restricted subsidiary, a sponsor loan to that subsidiary and then the proceeds of that loan were upstreamed to make interest payments to the operating company lenders. The issue there was that non-loan party restricted subsidiaries were not subject to the same basket and protections applicable to unrestricted subsidiaries, and that is a hole that exists in many deals closed over the past few years.

Pluralsight: Key Dates

December 2020

Pluralsight announced its agreement to be acquired by Vista Equity Partners.

April 2021

Acquisition by Vista Equity Partners officially completed.

May 2024

Vista Equity Partners engaged in a liability management transaction for Pluralsight, transferring certain intellectual property into a new subsidiary and using those assets as collateral to back loans from the sponsor.

July 2024

Reports surfaced about discussions of Vista Equity Partners handing over control of Pluralsight to creditors.

August 2024

Vista agrees to partial debt-for-equity exchange with private credit lenders to take full ownership of Pluralsight.

Given that a number of similar holes exist in recent private credit transactions, sponsors have generally been receptive to plugging gaps highlighted by big-name LME transactions as the media spotlight has exerted pressure to do so. However, these moves are all backward-looking and there exist numerous other avenues for potential LME-style transactions if the sponsors desire to take advantage of such loopholes. A few examples of certain BSL terms that have not yet been tested, but which have made their way into private credit matters include:

Commitment Increase Sacred Rights:

Most large sponsor private credit deals have a sacred right around commitment increases. The risk arises where there is a small priority or first-out revolver in the facility and the sponsor can team up with the revolving lender to massively increase the super-priority revolver commitment with only the consent of the revolving lender needed.

To fix this, any commitment increase should need a required lender vote.

Non-Ratable Open Market Purchases:

Most large sponsor private credit deals permit open market purchases and non pro rata purchases. The risk is that a borrower selects one lender to cut a sweetheart deal and enacts a selective debt exchange of existing loans for a new tranche, putting other lenders in a worse position.

As a fix for this, non pro rata open market purchases should be removed from terms, or at a minimum require a ratable cash purchase not in connection with a debt exchange.

Minority Lender Protections – PIK and Forbearances:

Most large sponsor private credit deals do not include PIK and forbearances as sacred rights. That creates a risk that a borrower can drag all lenders into a PIK scenario for a long duration with the consent of one large lender who constitutes required lenders, or that, when the maturity date comes, the borrower asks one large lender who constitutes required lenders to forbear over a payment default at maturity. In both scenarios, other lenders are forced along with no remedy.

To fix this, lenders should add forbearances to the lead-in of sacred rights as an all lender vote and add "changing manner of payment" or specifically address PIK interest turn-on as a sacred right.

Trends in Private Credit Distress

While we are not currently seeing widespread distress in private credit deals, there have been early signs of liquidity issues resulting in so-called "amend-and-pretend" solutions that allow borrowers to put off addressing problems.

Given that increased interest rates have been behind many of the liquidity issues in certain industries, lenders have been broadly receptive to PIK periods, payment holidays and covenant holidays in exchange for document tightening or increased rates. Such solutions have been used to bring borrowers to the table, tighten documentation and buy time in the hope that balance sheets will improve as rates start to come down, avoiding the need for a more meaningful restructure.

Lender groups have so far tended to be cooperative with one another and we have not seen any notable or widespread lender-on-lender violence. Rather, lender "co-ops" are now a growing trend, whereby some or all lenders in a private credit club transaction agree to certain actions in advance (often in early anticipation of potential distress), such as voting in a certain way or agreeing not to entertain certain transactions or events without others.

The Rise of Specialty Finance

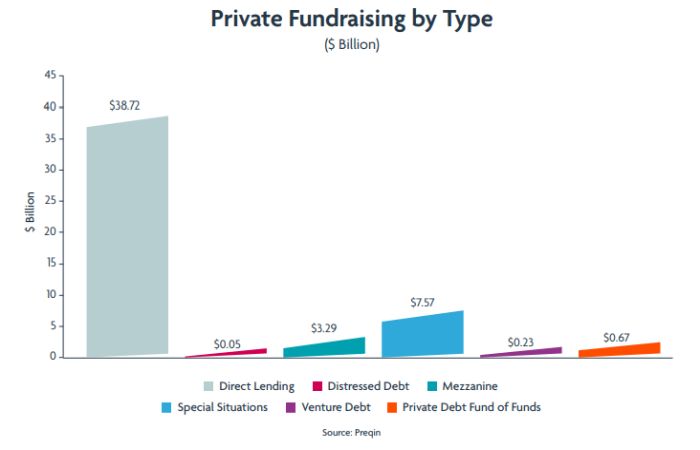

There is a growing appetite among both private credit managers and their investors to diversify portfolios beyond direct lending and we expect the growth of specialty finance to be a theme for 2025.

Following a period of depressed leveraged buyout (LBO) activity, we now see the vast majority of private credit firms looking into alternative asset classes and starting to deploy significant amounts of capital into asset-based lending (ABL) strategies.

We see significant diversity in the range of asset-based lending and creative capital strategies being pursued, covering everything from receivables and asset-based financing and aircraft leasing to franchise financing, equipment leasing, the financing of fiber networks, broadcast rights, sports lending, royalties, net asset value (NAV) loans, litigation finance and hybrid-equity type products.

The key benefits of specialty finance include added stability through a specific link to the cashflows from underlying assets, along with bankruptcy-remote structures, tighter documentary protections and often an in-built inflation hedge.

As with corporate credit, these are markets where private credit has been able to step in to fill a gap left by regulated banks pulling back, where there remains a huge growth opportunity. The asset-based finance market is already a $5 trillion market by some estimates and is forecast to grow to nearly $8 trillion in the next three years.

For managers, underlying asset expertise is critical and significant investment can often be required to build meaningful specialty finance platforms. We expect this to be a focus area for debt funds in 2025, as many continue to build out capabilities in areas like consumer and mortgage finance, commercial finance, hard assets and contractual cashflows.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]