Executive Summary

As the digital asset industry continues to mature and advance, accurately valuing businesses within this sector is an increasingly pressing concern for investors, regulators, and entrepreneurs alike. While the characteristics of rapid innovation and change within the industry may tempt some to seek to devise novel methods, history, particularly the dot-com bubble, offers a cautionary tale of the perils of straying too far afield from tested valuation frameworks.

Drawing on our bench of highly credentialed financial experts — which includes experts with extensive industry experience dating back to the very earliest days of crypto — we offer our perspective that investors and the public are best served when analysts adhere to sound and principled valuation analysis, whether valuing blockchain and crypto companies or otherwise. The standard valuation toolkit remains foundational to a rigorous valuation analysis. Moreover, complex commercial disputes involving digital asset businesses often involve large damages claims over lost profits or lost business values. Prevailing in these cases hinges upon the ability to credibly establish and defend reliable company valuations and/or associated business projections.

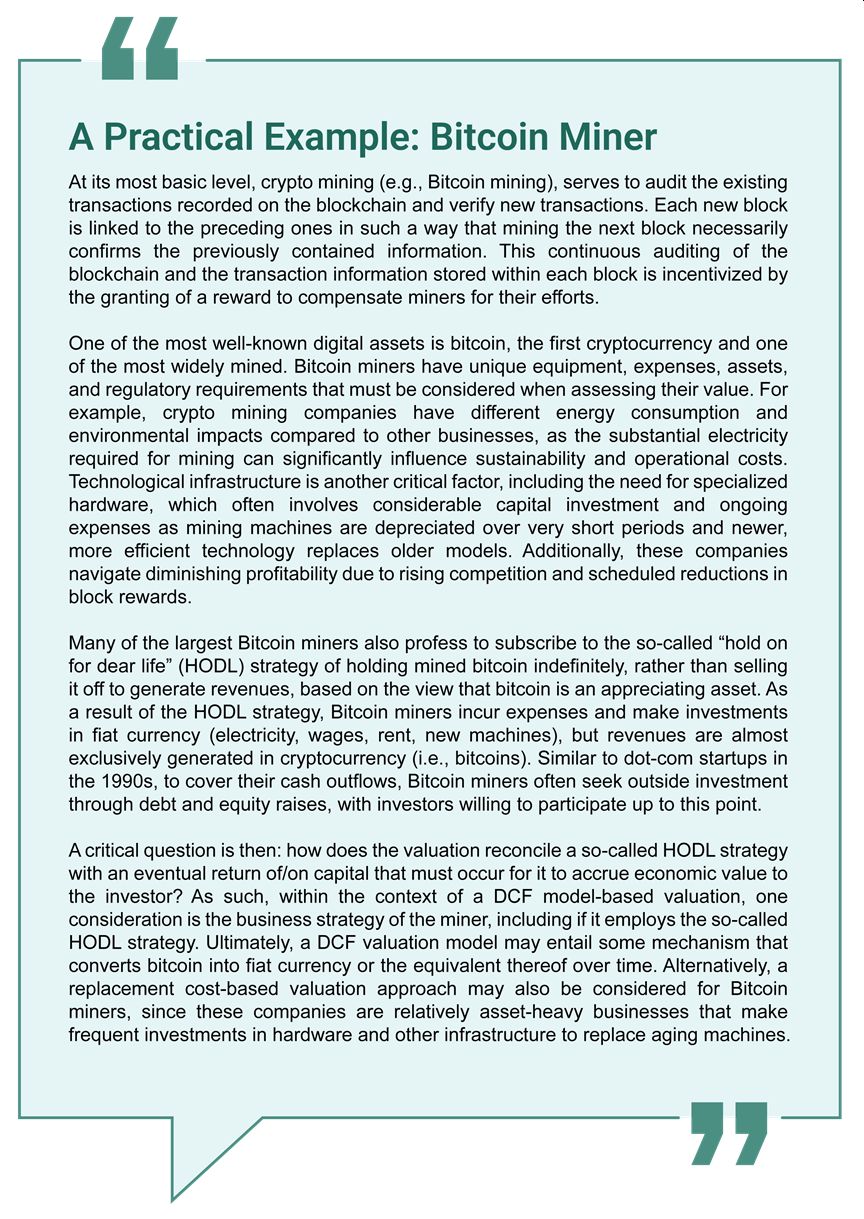

We begin this paper by briefly outlining the current crypto valuation landscape. Next, we address some of the key value drivers and business risks we observe within firms that operate in the sector. Then, we examine pertinent legal cases that offer relevant insights on digital asset businesses within a disputes context. Finally, we offer a crypto miner example to demonstrate the types of information that may be considered in a well-constructed valuation.

Introduction

The emergence of blockchain technology and cryptocurrencies over the past decade and a half has driven a range of entirely new categories of business enterprises, ranging from layer-1 protocols and decentralized finance (DeFi) platforms to infrastructure providers and centralized exchanges. Market participants in these businesses are a driving force of tremendous change and disruption spanning a diverse range of economic sectors, including finance, technology, politics, art, real estate, and various other industries. However, the disruptive nature of these businesses can also attract a proliferation of unconventional and unsound valuation approaches, many of which mirror some of the more speculative methods seen during the dot-com bubble. With the increasing flow of investment dollars into the industry, coupled with continued scrutiny by both the courts and regulators around the world, the need for standardized, rigorous valuation frameworks remains not only prudent but essential.

Current State of Valuation in the Blockchain Sector

Overview of Digital Assets

"Digital assets" may be defined as assets created on a distributed ledger based on blockchain technology that are secured through cryptography and include cryptocurrencies, non-fungible tokens (NFTs), stablecoins, and more.1 A distributed ledger is a decentralized database that is shared and maintained by multiple independent nodes across a network, where there is no central authority in control of the entire ledger. Cryptography is a field nearly as old as time and involves mathematical or algorithmic techniques through data encryption (and decryption) to secure communication from access and/or tampering by unauthorized adversaries.

Over the past decade and a half, the universe of digital assets grew and evolved rapidly in sync with various technological and automation-driven innovation. The digital assets space is built around the idea that decentralized technology will continue to grow in use while the decentralized nature of the technology acts to support security and resiliency.2

Recent developments are positioning 2025 as a pivotal year, including legislation like the CLARITY Act and GENIUS Act in the U.S. that contribute to establishing clearer regulatory frameworks and standards, particularly with respect to stablecoins, and the convergence of artificial intelligence (AI), blockchain, and DeFi protocol technologies. In mid-August 2025, the digital assets industry reached a significant milestone, with the total global cryptocurrency market capitalization surpassing $4.0 trillion, based on current cryptocurrency trading prices.3

Current Valuation Practices

As of the date of writing this paper, valuation practices across the digital assets sector remain inconsistent. Despite growing institutional interest, many ventures, particularly those issuing tokens, often lack conventional publicly available financial disclosures, making the application of standard multiples-based and other valuation methods difficult to apply.

Two broad practices currently dominate:

- Token-centric valuation models:Models that rely on projected token price appreciation, on-chain activity metrics (e.g., TVL, wallet count), or "network value to transactions" (NVT) ratios, among other things.

- Equity-centric models: More familiar to traditional finance, models that are often used for centralized entities like Coinbase or Circle, focusing on cash flow, revenues, and guideline public company analysis.

While both may have merits, many token-centric approaches suffer from a lack of empirical validation, transparency, or consistency, and often obscure risks and inflate valuations.

Standard Valuation Methodologies

Traditional valuation methodologies, such as discounted cash flow (DCF), Guideline Public Company Method (GPCM), and precedent transactions, are established frameworks that are grounded in principles of finance and economics, and offer critical insights to investors4:

- DCF models: Drive clarity on cash flow generation, performance risks, and capital efficiency.

- GPC models: Contextualize a company in relation to its peer group and/or industry and sector benchmarks.

- Precedent transactions models: Provide insights into market sentiment and comparable public and/or private deal values.

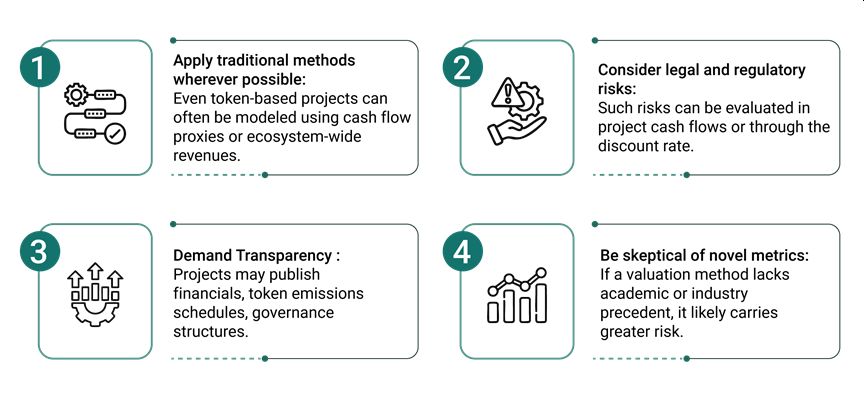

Applying these methods to blockchain businesses may require adaptation, but abandoning them entirely risks opening the door to misleading assumptions and poorly supported investment decisions.

Valuing Digital Asset Businesses: Lessons from the Dot-Com Bubble

As cryptocurrency investing and the popularity of digital asset companies continue to rise, investors and courts must consider what approaches and methods to apply in conducting fair and accurate valuations of companies operating across the digital assets industry. Relying on misleading or inapplicable criteria could lead to over- (or under-) valuations.

For those of us with long memories, the dot-com bubble provides a cautionary tale. The introduction of personal computers and the World Wide Web led to a rapid and widespread wave of new investments in internet and technology startup companies. Investors, caught up in the excitement of a rapidly transforming economy, often ignored fundamental business analyses and focused on what ultimately proved to be inconsequential performance metrics.

In an effort to keep up with the pace of innovation, far too many investors and financial analysts turned towards novel metrics such as "price per eyeball" or "clicks per day" in place of more traditional revenue and/or profit-based valuation metrics. The use of such speculative valuation metrics arguably contributed to the massive over-investment by investors as they eagerly bought up stocks and poured money into the various internet-startup companies despite a lack of demonstrable, viable business models. Rather than evaluating companies based on the viability and economic soundness of their businesses, revenue generation capabilities, expected cash flows, and abilities to create and capture value, investors turned toward metrics such as website traffic growth and/or other more superficial performance indicators, leading to greatly inflated valuation considerations.5

When the dot-com bubble burst in 2000, investors quickly learned a lesson concerning dubious business models, and many startups found themselves strapped for cash and unable to continue operations. The collapse of the dot-com bubble resulted in a drastic decline in the Nasdaq index and contributed to a prolonged economic recession. The Nasdaq index, which reached its peak in March 2000, fell 77% by October of the same year and would not reach those heights again until 15 years later in April 2015.6

Parallels abound to today's digital assets space, where some analysts have proposed valuing projects solely based on esoteric metrics like7:

- TVL: Without assessing capital retention or protocol monetization.

- "Token velocity" theories: Many of which lack reliable empirical support.

- User growth: Without evidence of conversion to monetizable services.

Just as the collapse of Pets.com, for instance, reminded investors that successful ventures must be based on solid business plans that create and capture value,8 so too do recent crypto failures like Terra/Luna and Celsius reveal the dangers of prioritizing hype over fundamentals. It remains the view of this paper's authors that the wise investor must remain cautious of novel valuation approaches that stray too far from tried-and-true finance- and economics-based methodologies and frameworks.

Understanding Key Value Drivers and Risks

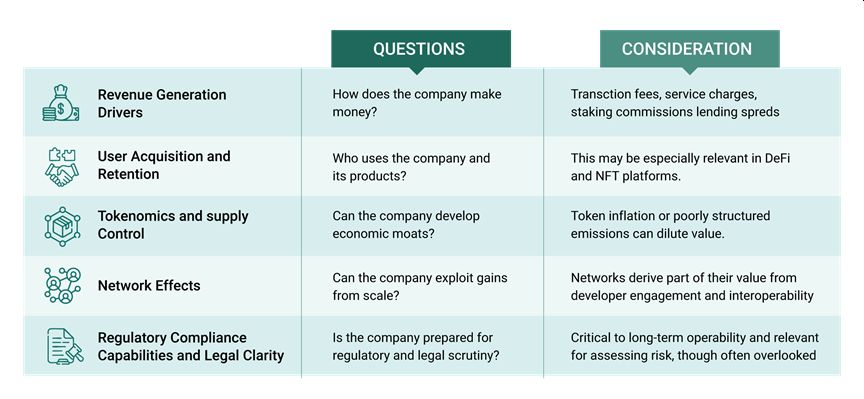

So what does a defensible business valuation entail? Of course, each business is subject to different specific facts and circumstances. However, what is universal is the need for the valuation to properly demonstrate a keen understanding of the underlying business of the subject company, including its key mechanisms to create and retain value. For example, for digital assets companies, such as crypto exchanges, one might evaluate the questions and considerations posed in the table below.

Key Value Drivers and Risks

A defensible valuation analysis may consider a range of complexities, such as asset volatility and price fluctuations, along with rapid technological developments and advancements, among other things. Risks associated with the subject business may be considered through adjustments to cash flows or the discount rate. Analysts may also consider conducting sensitivity analyses to test the reasonableness of their assumptions and conclusions.

Legal Cases 9, 10, 11

SEC v. Ripple Labs (2020–2024)12

One of the most significant legal cases in crypto regulation — the Ripple case — centered around whether its native cryptocurrency XRP was a security. The court ultimately found that Ripple's programmatic sales did not meet the definition of a security, but its institutional sales did. The decision emphasized the need to distinguish between how tokens are sold and their broader utility, a nuance that should inform valuation analysts when projecting regulatory costs and risks.

Celsius Network Bankruptcy (2022)13

Celsius promised high yields through crypto lending, staking, and other activities but was unable to fulfill those promises. During bankruptcy, many token holders discovered they lacked enforceable claims. The court's analysis revealed that Celsius had marketed its CEL tokens as investments, but the tokens failed to offer corresponding rights. A separate civil lawsuit accused the company of operating as a "classic Ponzi scheme" and defrauding its customers. The Celsius incident underscores the importance of understanding the business model, capital structure, and economic rights conveyed to participants in the digital asset space.

Terra/Luna Collapse (2022)14, 15

Valuation models for Luna often relied on circular logic, assuming sustained demand for the TerraUSD stable coin, UST, to prop up Luna's price. When demand evaporated, both collapsed. This event exposed the flaw in reflexive (i.e., circular or self-fulfilling) valuation models that ignore economic fundamentals.

Conclusion

Valuing digital asset businesses requires a careful balance of adaptation and discipline. While these industries are innovative and fast-moving, that does not justify abandoning time-tested valuation principles. The lessons from the dot-com episode remain highly relevant. By insisting on rigorous frameworks, transparency, and sober analysis, investors can avoid repeating history and contribute to a more sustainable future for digital assets.

Recommendations for Investors and Analysts

Footnotes

1. Crypto Intangible Assets: Issues In-Depth for Accounting by Entities that are not Broker-Dealers or Investment Companies, KPMG, December 2024.

2. Look Ahead, Fidelity Digital Assets Research, January 7, 2025.

3. See Cryptocurrency Prices Today By Market Cap, Forbes, https://www.forbes.com/digital-assets/crypto-prices/?sh=6773134b2478, last accessed August 15, 2025.

4. Valuing Young, Start-up and Growth Companies, NYU Stern School of Business, Damodaran, A., 2022.

5. Remarks at Aspen Security Forum, U.S. SEC, Gensler, G., 2022.

6. The Late 1990s Dot-Com Bubble Implodes in 2000, Goldman Sachs, 2019.

7. Valuation in the Age of Digital Assets, CFA Institute, 2023.

8. IPOs and the ghost of Pets.com's sock-puppet, Financial Times, 2014, https://www.ft.com/content/db124a89-98bf-3474-97e3-83df3cf6b5ee, last accessed August 29, 2025.

9. Bitcoin Mining Industry Primer and Outlook, Jones Trading, Glagola, S., December 12, 2024.

10. HODL, Corporate Finance Institute, CFI Team, https://corporatefinanceinstitute.com/resources/cryptocurrency/hodl/, last accessed July 10, 2025.

11. What is crypto mining and how does it work?, Britannica, Garnett, A.G., edited by Montevirgen, K., updated July 4, 2025.

12. Securities and Exchange Commission v Ripple Labs Inc No 20 Civ 10832 (AT), 2023 WL 4507900 (SDNY 13 July 2023).

13. Celsius Network LLC, et al., No 22-10964 (MG) (Bankr SDNY 9 July 2025).

14. Securities and Exchange Commission v Terraform Labs Pte Ltd and Do Hyeong Kwon, No 1:23-cv-1346 (JSR) (SDNY 12 June 2024).

15. Terra Research and Analysis Reports, Coin Center, 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.