Key Takeaways

- Workforce availability and skills are critical factors in site selection. Companies must evaluate not just current labor pools but also demographic trends and educational attainment to ensure long-term access to qualified workers.

- Labor costs vary significantly by region. Differences in wage-and-benefit costs along with state mandates can dramatically affect operating expenses and overall ROI.

- The local labor environment influences long-term stability. Unionization risks and labor laws differ across states, shaping the ease of workforce management and potential exposure to labor disputes.

You've made the most difficult decision. You've weighed the pros and cons, and you're going to reshore (or expand) your U.S. manufacturing operations. You're committed to investing the millions (or tens or hundreds of millions) of dollars needed to build and ramp up a new greenfield facility or retrofit a brownfield site in the U.S.

You know this will be one of the most expensive and important decisions your company will ever make, so you've got to get it right. Among the questions swirling around in your mind, one stands out above all others: Where? Where do we invest this huge sum of capital in order to maximize our ROI?

While every business will have unique factors to consider when answering this critical question, almost all will need to consider a fundamental one: the workforce that will staff the operation. Without the right workforce, all the new construction, equipment purchases, and marketing campaigns could amount to nothing.

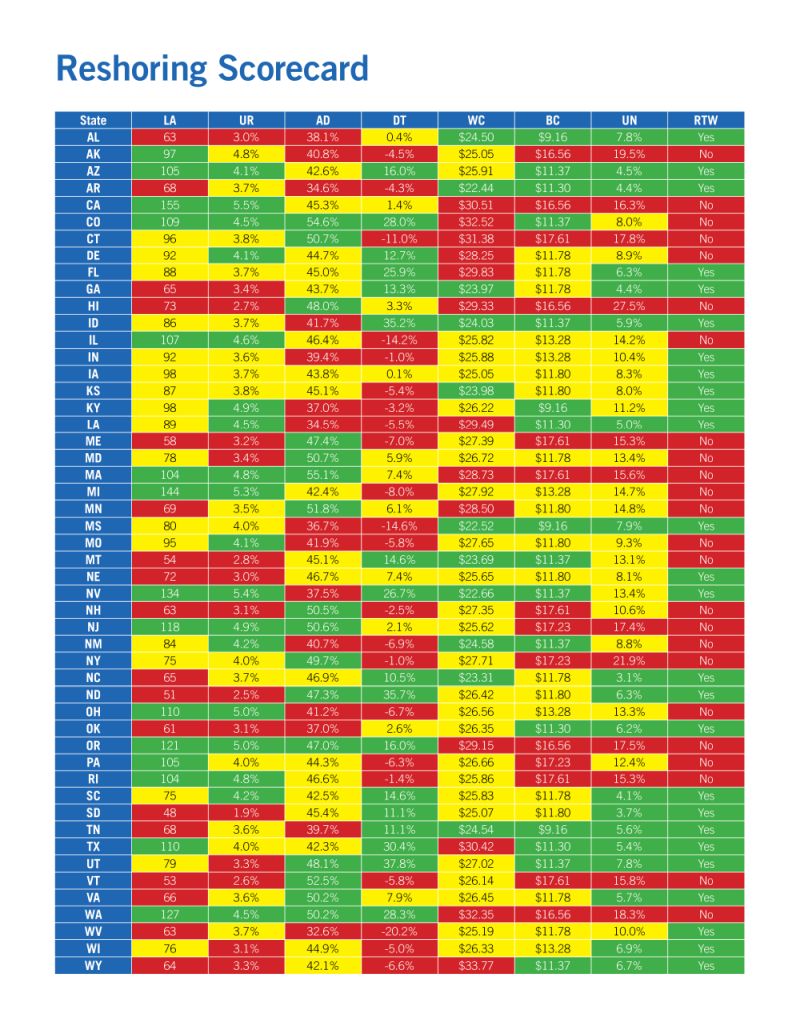

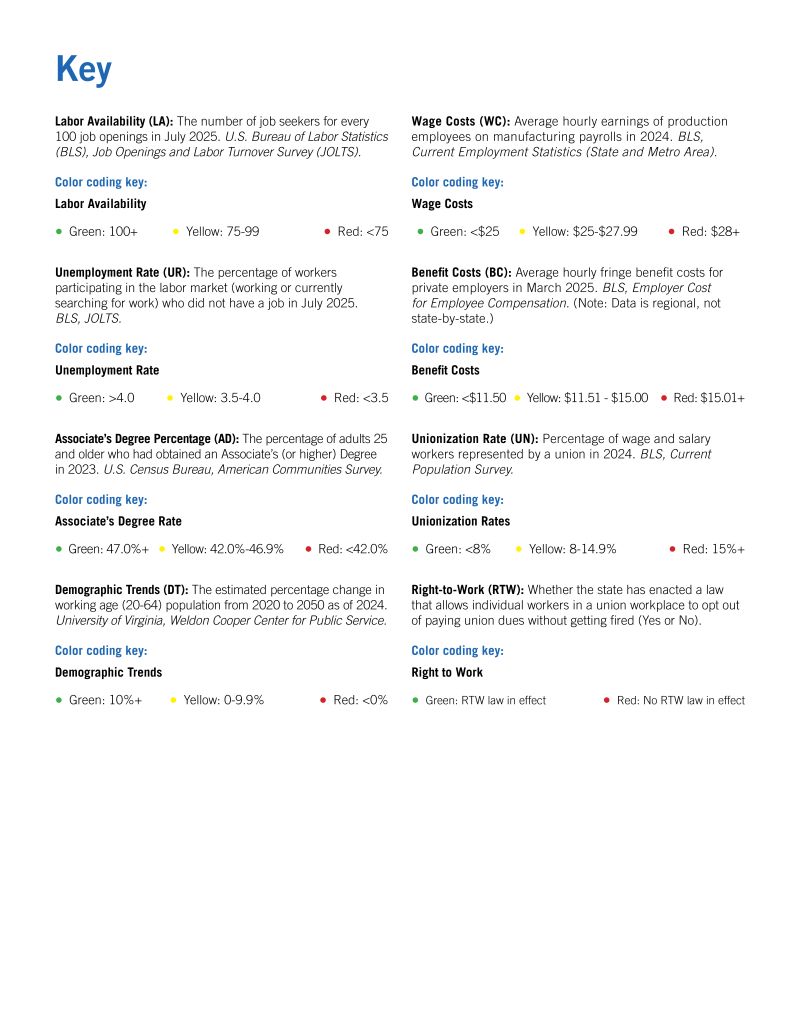

This article identifies various labor factors that could affect where you site a new manufacturing operation and measures states' scores across each one. To be sure, individual circumstances (e.g., the level of automation in the operation and the technical capabilities demanded by the work) and perspectives (e.g., the importance of remaining union-free) will affect how each business weighs each factor. But looking at all of the statistics holistically provides a great starting point.

1. Labor Availability

The most basic labor consideration is simply being able to find qualified people to work in your new operation. Anyone who tried to hire workers through the post-COVID recovery boom in 2022 knows just how hard it was to find – and retain – capable candidates.

Available Worker Ratio. Of course, it was even harder in some states than others. Not surprisingly, the availability of labor is not spread evenly across the United States. The nationwide average of available unemployed workers per 100 job openings is 98, suggesting that there is roughly one potential applicant per opening (putting aside questions about the right skill set).

However, some states have consistently had more "available" labor than others. For example, California currently has 150 unemployed workers for every 100 job openings, suggesting that there is a broadly available labor force able to take on new jobs. By contrast, Alabama has just 69 unemployed workers per 100 job openings.

Unemployment Rates. This variance in available labor is likewise reflected in states' unemployment rates. Those states with more "available labor" tended to have slightly higher unemployment rates (generally a good thing if you're increasing the hiring demands on a local population). For example, California's unemployment rate is 5.3% while Alabama's is just 3.3%.

Demographic Trends. Yet another factor to consider is long-term population trends. Reshoring or expanding US manufacturing operations is a long-term play, requiring a consideration of not just today's labor market, but the likely market for generations to come.

From 2020 to 2050, the U.S. working age population (20-64) is projected to grow 7.0%. However, some states, generally in the South and Mountain West, are projected to grow much faster (e.g., Colorado (28.0%) and Florida (25.9%)), while others are projected to be stagnant or even decline (e.g., Illinois (-14.2%)). So even if a state has an attractive labor market today, there is no guarantee that will remain the case in future years.

Educational Levels. Finally, in many cases, the question isn't about simply finding a live body to fill a role. It's about finding the right skill set, whether that's a plant manager, a welder, or a financial analyst. No single statistic can capture all the nuances of the skills gap. However, looking at educational attainment rates provides a good proxy for the general availability of skilled labor.

A majority of adults (25-and-over) in a handful of states (including Colorado and Minnesota) have at least an associate's degree. In other states (including Arkansas and Louisiana) the rate is less than one third.

2. Labor Costs

Finding a location with an attractive workforce is Step 1. Next, you have to determine how much you will likely need to pay to attract and retain the talent you need. Of course, labor costs are one part of a much larger economic analysis. But there are clear and stark differences in regional compensation that affect the bottom line.

Average Manufacturing Wage Rates. Six states (California, Colorado, Connecticut, Texas, Washington, and Wyoming) have an average hourly manufacturing wage rate higher than $30, while the average rate in seven states (Arkansas, Georgia, Kansas, Montana, Mississippi, Nevada, and North Carolina) is below $24.

Average Benefit Costs. Regional differences in the costs of fringe benefits can be driven by both state and local government mandates (e.g., mandatory paid sick leave), state insurance rules, and market demand. Collectively, these can create large disparities between the highest and lowest cost regions to provide benefits. In New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont), the average cost of private sector employee benefits is $17.61 per hour, versus just $9.16 per hour in the "East South Central" region (Alabama, Kentucky, Mississippi, Tennessee).

3. The Labor Environment

Finally, the likelihood of unionization is another factor that employers may wish to consider when deciding where to site their operation. New and growing facilities offer a ripe target for union organizers, and the substantial increase in union election petitions has made the risk of union organizing much more salient in recent years.

Right-to-Work Laws. Some states actively encourage union organizing by requiring all workers employed in a union facility to pay dues to the union, regardless of whether the worker supports the union or not. Other states have "right-to-work" legislation, which allows workers to opt out of paying dues if they choose to do so. Not surprisingly, union organizers are less eager to organize in states with right-to-work laws, given that they do not have the same captive market for dues that they have in non-RTW states.

As of publication, twenty-seven states, primarily in the South, Midwest, and Mountain West, have right to work laws. Most recently, Kentucky, Wisconsin, and West Virginia adopted right-to-work laws, while Michigan repealed its law in 2024.

Unionization rates. Not surprisingly, there is a statistically significant correlation between mandatory union dues payments and the rate of unionized employees. The union organization rate in states like New York (21.9%), Washington (18.3%), and California (16.3%) can be five times higher than in states like Georgia (4.4%), South Carolina (4.1%), and North Carolina (3.1%).

4. Labor Intelligence Drives Reshoring Success

Labor is just one piece of the reshoring puzzle—but it can be the piece that determines whether new U.S. operations thrive or stall. An informed siting decision supports long-term operational success. The attached Reshoring Scorecard offers a high-level assessment of each such consideration, and the Detailed Data table provides the raw data and source materials. Don't stop with the data. The most successful manufacturers pair analytics with strategic foresight to build operations that last.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.