A properly designed voluntary benefit menu enables your employees to purchase cost-effective insurance policies that complement your employer paid benefits and improve financial security.

Valuable voluntary product insurance offerings include life, short and long term disability, dental, vision, and supplemental medical. Most of these products can be offered as a core benefit in lieu of employer paid coverage and some can be offered to supplement the existing employer paid benefit.

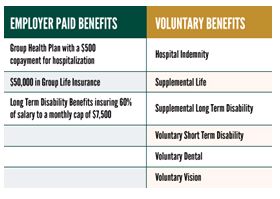

Here is an example benefit menu, displaying how voluntary benefits can effectively complement and round out your employer paid benefits:

However, over time, coverage overlap can occur within a voluntary benefit menu when:

- Multiple agents manage the voluntary product offerings

- Product representatives meet directly with employees

- Insurers seek to maximize revenues by offering their full suite of products, despite possible coverage overlap

In these instances, a professional audit of the voluntary program will isolate any areas in need of correction. Here are some examples of the resulting inefficiencies uncovered in audits we have managed:

- While an employer provided a robust 100% employer paid dental plan benefit, their agent was also enrolling their employees into a voluntary dental product.

- An employer offered voluntary long term disability (LTD) benefits through one agent and voluntary short term disability (STD) through another, and the policy provisions did not dovetail.

- In some instances, employees had STD and LTD policies that concurrently paid benefits for almost 24 months.

- An employee making $30,000 in salary was spending $2,400 per year or 8% of his salary in premiums for voluntary products with coverage overlap.

If your voluntary benefits are in need of review, consider partnering with an experienced benefits professional. Alternatively, conduct the audit internally, using the following steps:

- Run a census of your employees that includes their product selection and corresponding payroll deduction for all of your benefits, employer paid and voluntary.

- Determine if there is coverage overlap in your benefit package

a. Pure overlap: for example, enrollment in both an employer paid dental plan and a voluntary dental plan.

b. Disability overlap: ensure that STD benefits end when LTD benefits begin.

c. Supplemental medical product overlap: when more than one supplemental medical product is offered, the risk adverse may over purchase. For example, an employee with employer paid group health coverage also purchased hospital indemnity, cancer, and critical illness products.

- Determine which products to keep, which to eliminate, and which to modify to eliminate overlap.

- Through a Request for Proposal (RFP) process, select your insurers.

- Effectively communicate your enhanced offering to your employees.

- Moving forward, control the benefit communication and enrollment process to ensure that employees are only offered those products within your set menu.

Whether performed by a benefits professional or conducted internally, an audit of your voluntary benefit plan can streamline coverage, improve benefits and reduce employee costs – all without increasing your budget.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.