- within Employment and HR topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Technology and Retail & Leisure industries

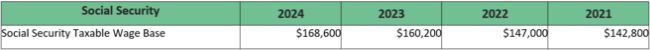

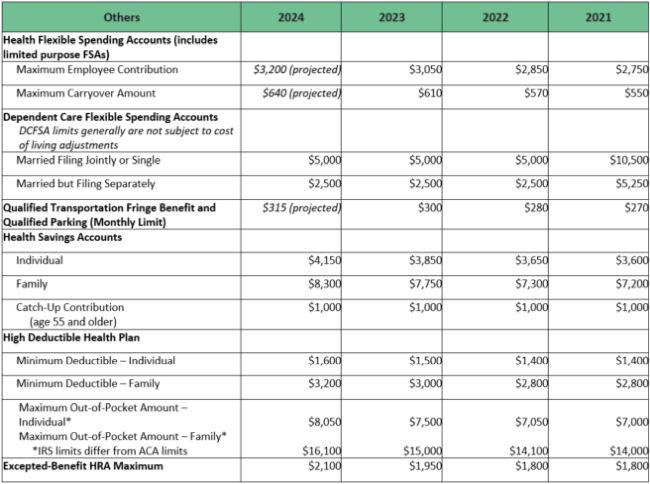

The Internal Revenue Service (IRS) on Wednesday, November 1, 2023, announced the annual cost-of-living adjustments to the dollar limits applicable to certain employer-sponsored retirement and welfare plans. In addition, previously, the IRS released certain other health and welfare plan limits applicable for 2024 and the Social Security Administration (SSA) separately released the taxable wage base amounts for 2024.

The table below provides the IRS and SSA limits for 2024 applicable to the various employer-sponsored retirement and welfare plans or programs reflected below. The table also includes projected limits for certain welfare plans or fringe benefits that have not yet been released (these amounts will be updated when the limits are announced). The table below is based on information contained in IRS Notice 2023-75; IRS Rev. Proc. 2023-23; and SSA Press Release (10.12.2023).

The dollar limits in the table above are generally calendar-year limits; however, certain of the limits are applied based on a plan year, tax year or limitation year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.