It all seems simple enough. The concept of "offer" is broad under the securities laws, so companies and underwriters need to be careful about any publicity in connection with a securities transaction. But in practice, the puzzling questions come thick and fast. Can the company issue a press release about its latest product? Can the CEO speak at the upcoming industry conference? Can the CEO be interviewed on CNBC the day after the IPO? And if publicity is so tightly controlled, why is it fine to hold a road show?

Sorting out these issues can be challenging, especially in real time. And you have to be sure of yourself, because you will need a compelling reason to nix a hard-charging CEO's upcoming "Mad Money" appearance. This Client Alert provides a comprehensive summary of the law and lore relating to offers of securities and a guide to maneuvering safely through the maze of available safe harbors and industry customs. We have also included a variety of FAQs to help you answer questions that often come up in practice.

BACKGROUND — REGULATION OF THE OFFER

Let's begin at the beginning. Section 2(a)(3) of the Securities Act of 1933 (Securities Act) defines the term "offer" expansively to include "every attempt or offer to dispose of, or solicitation of an offer to buy, a security or interest in a security, for value." You can see the problem right off the bat — given the breadth of this language, it can be difficult to say with certainty what is or is not an offer under this definition. And the US Securities and Exchange Commission (SEC) long ago stated that any publicity that may "contribute to conditioning the public mind or arousing public interest" in the offering, can itself constitute an offer under the Securities Act.1

Section 2(a)(3) works closely with Section 5 of the Securities Act, which imposes an intricate framework of restrictions on offers in connection with securities transactions. It also closely regulates the use of a "prospectus" — a term defined in Section 2(a)(10) of the Securities Act in a manner that captures all written offers of any kind (and some that are not obviously written, as we discuss in more detail below). Private offerings, such as those made to qualified institutional buyers (QIBs) in reliance on Securities Act Rule 144A, are exempt from Section 5 but have their own set of restrictions. Over the years, the SEC has adopted a number of safe harbors to protect various activities that are either harmless or necessary to the proper functioning of the capital markets. The Appendix to this Client Alert includes a brief refresher course on the workings of Section 5 and the important provisions of private and offshore offerings and transactions. It also contains additional details about a special type of prospectus called a free writing prospectus (FWP) and large companies known as well-known seasoned issuers (WKSIs).

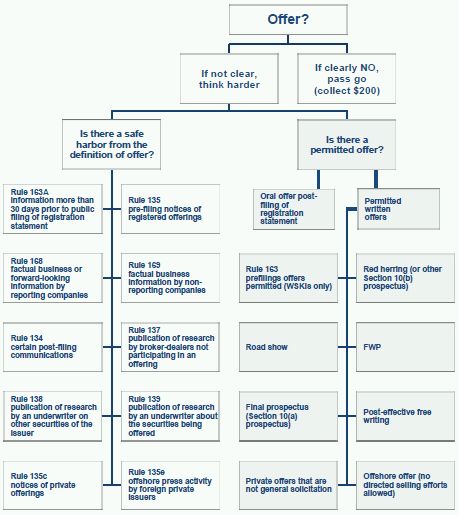

HOW IT ALL HANGS TOGETHER — THE OFFER FLOWCHART

The following flowchart gives an overview of how you can approach questions on offers that come your way.

Is It an Offer?

The first question to ask when analyzing any particular fact pattern is the common-sense question, "Is it an offer?" Despite the broad definition of offer, some activities are not problematic because they are clearly not offers or because an SEC rule provides a safe harbor exclusion from the definition of offer.

Clearly Not Offers

Some communications are far enough afield from an offer of securities that you do not need to worry further. Depending on your specific facts and circumstances, examples of things that may fall outside the definition include:

- Product Advertising and Factual Business

Communications. Just because a securities offering is

planned or ongoing, a company need not stop advertising its

products or refrain from issuing press releases regarding factual

developments in the business (the opening of a new office, for

example).2

As the SEC put it in the context of securities offering reform in 2005, "In general, as we recognized many years ago, ordinary factual business communications that an issuer regularly releases are not considered an offer of securities ... Such communications will not be presumed to be offers, and whether they are offers will depend on the facts and circumstances."3 - The Collision Principle. As a general

matter, where a company faces an obligation under the Securities

Exchange Act of 1934 (Exchange Act) to make a public statement, or

where good corporate citizenship calls for disclosure of important

events to existing public securityholders, the required disclosure

should not be considered an offer.

We tend to think of this as the collision principle — in a collision between the requirements of the Exchange Act and those of the Securities Act, the Exchange Act's ongoing disclosure requirements ought to prevail over the Securities Act's close regulation of offers. As the SEC has explained, "We do not believe that it is beneficial to investors or the markets to force reporting issuers to suspend their ordinary course communications of regularly released information that they would otherwise choose to make because they are raising capital in a registered offering."4 - Release of Material Non-public Information to Satisfy Regulation FD. The SEC Staff has recognized that a reporting company engaged in a private offering may have obligations under Regulation FD to publicly disclose material non-public information it provides to potential investors in the private offering. If so, the SEC Staff has indicated that it is permissible to release the material non-public information on a Form 8-K, so long as the entire private offering memorandum is not included in the filing.5 Arguably, this is simply an application of the collision principle discussed above.

If common sense doesn't clearly answer whether a particular fact pattern constitutes an offer, the next step is to review the many safe harbors and determine if any of them would apply.

Safe Harbors — Public Transactions

Securities Act Rule 163A — The 30-Day Bright-Line Safe Harbor

Rule 163A provides all issuers (whether or not already public filers) with a non-exclusive safe harbor from Section 5(c)'s prohibition on pre-filing offers for certain communications made more than 30 days before the public filing of a registration statement, even if those communications might otherwise have been considered to be offers under Section 2(a)(3). Note, however, that Rule 163A is an issuer-only safe harbor and is not available to prospective underwriters.

The requirements for Rule 163A include that:

- the communication cannot refer to the securities offering;

- the communication must be made by or on behalf of an issuer—in other words, the issuer will need to authorize or approve each Rule 163A communication (and any communication by an underwriter will not come within the safe harbor); and

- the issuer must take "reasonable steps within its control" to prevent further distribution of the communicated information during the 30-day period before filing the registration statement (although the SEC has suggested that the issuer may maintain this information on its website, if the information is appropriately dated, identified as historical material and not referred to as part of the offering activities).6

Securities Act Rule 135 — Pre-filing Public Announcements of a Planned Offering

Rule 135 provides that an issuer will not be deemed to make an offer of securities under Section 5(c) as a result of certain public announcements of a planned registered offering. Rule 135 notices can be released at any time, including before a registration statement is filed.

Under Rule 135, the announcement must contain a legend, as well as limited information, including:

- the name of the issuer;

- the title, amount and basic terms of the securities offered;

- the anticipated timing of the offering; and

- a brief statement of the manner and purpose of the offering, without naming the prospective underwriters for the offering.

Securities Act Rule 168 — Factual Business Communications by Reporting Companies

Rule 168 is a non-exclusive safe harbor from Section 5(c)'s prohibition on pre-filing offers (and from Section 2(a)(10)'s definition of prospectus) that is available only to reporting issuers with a history of making similar public disclosures. It allows a reporting issuer, and certain widely-traded non-reporting foreign private issuers (FPIs) to make continued regular release or dissemination of "factual business information" and "forward-looking information,"7 but not information about an offering or information released as part of offering activities. Rule 168 is not available to underwriters. In addition, voluntary filers may not rely on the Rule, and instead must look to Rule 169.8

Disclosure of Rule 168 information is permitted at any time, including before and after the filing of a registration statement, but only if:

- the issuer has previously released or disseminated Rule 168 information in the ordinary course of its business; and

- the timing, manner and form in which the information is released is materially consistent with similar past disclosures.

For the information to be considered previously released in the ordinary course of business, the method of releasing or disseminating the information, and not just the content, will be required to be consistent in material respects with prior practice.9 The SEC has acknowledged that one prior release could establish a sufficient track record,10 although it has also cautioned that an issuer's release of "new types of financial information or projections just before or during a registered offering will likely prevent a conclusion" that the issuer regularly releases that information.11

Where does this leave you? Because Rule 168 looks to track record, a newly public company should establish a pattern of issuing information and then stick to it. Concluding that the safe harbor for any particular situation is available is going to be easier if a company can point to a prior record of releasing the same general information on reasonably similar timing.

Securities Act Rule 169 — Factual Business Communications by Non-Reporting Companies

Rule 169 is similar to Rule 168 in that it provides a non-exclusive safe harbor for non-reporting issuers (including voluntary filers) from both Section 5(c)'s restriction on pre-filing offers and Section 2(a)(10)'s definition of prospectus. It is, however, more limited in a number of ways. First, under Rule 169, non-reporting issuers are permitted to continue to release factual business information, but not forward-looking information. Second, Rule 169 is available only for communications intended for customers, suppliers and other non-investors. The SEC has nonetheless made clear that the safe harbor will continue to be available if the information released is received by a person who is both a customer and an investor.12

Securities Act Rule 134 — Limited Post- Filing Communications

Rule 134 provides that certain limited written communications related to a securities offering as to which a registration statement has been filed will not be considered to be a prospectus (in other words, will be exempt from the restrictions applicable to written offers). Rule 134 is available only after filing a preliminary prospectus that meets the requirements of Section 10. IPO issuers may nevertheless rely on some aspects of Rule 134 before filing a price-range prospectus, but certain specific statements require a price-range prospectus, as discussed below.13 Rule 134 is often relied on for the press release announcing the commencement of a registered offering, as well as the tombstone advertisement following the closing.

Rule 134 requires a specified legend and permits:

- certain basic factual information about the legal identity and business location of the issuer, including contact details for the issuer;

- the title and amounts of securities being offered;

- a brief description of the general type of business of the issuer, limited to information such as the general types of products it sells;

- the price of the security or the method for determining price (note that in the case of an IPO, this information cannot be provided until a price-range prospectus has been filed);

- in the case of a fixed-income security, the final maturity, interest rate or yield (note that in the case of an IPO, this information cannot be provided until a price-range prospectus has been filed);

- anticipated use of proceeds, if then disclosed in the prospectus on file;

- the name, address, phone number and email address of the sender of the communication, and whether or not it is participating in the offering;

- the names of all underwriters participating in the offering and their additional role in the underwriting syndicate;

- the anticipated schedule for the offering and a description of marketing events;

- a description of the procedures by which the underwriters will conduct the offering and information about procedures for opening accounts and submitting indications of interest, including in connection with directed share programs;

- in the case of rights offerings, the class of securities the holders of which will be entitled to subscribe, the subscription ratio and certain additional information; and

- the names of selling securities holders, the exchanges on which the securities will be listed and the ticker symbols.

Securities Act Rule 137 — Publication of Research by Non-Participating Broker-Dealers

Rule 137 provides that a broker- dealer that is not a participant in a registered offering but publishes or distributes research regarding the issuer will not be deemed to offer securities in a distribution and, therefore, will not fall within the statutory definition of "underwriter" in Section 2(a)(11) of the Securities Act.

Rule 137 applies to public companies as well as non-reporting issuers such as voluntary filers. It is available only to broker-dealers that are not participating in the registered offering of the issuer's securities and have not received compensation for participating in the securities distribution. Rule 137 also requires that the broker-dealer must publish or distribute the research report in the regular course of its business.

Securities Act Rule 138 — Publication of Research by an Underwriter on Other Securities of an Issuer

Rule 138 provides that an underwriter participating in a distribution of securities by an issuer that is Form S-3 eligible is not deemed to make an offer of those securities if it publishes or distributes research that is confined to a different type of security of that same issuer. For example, Rule 138 allows publication of research with respect to debt securities by an underwriter when participating in a distribution of the issuer's common stock, and vice versa.

Rule 138:

- covers research reports on reporting issuers that are current in their Exchange Act reporting (i.e., it does not cover voluntary filers); and

- includes a requirement that the broker or dealer publish research reports on the types of securities in question in the regular course of its business.

The SEC has explained that the underwriter need not have a history of publishing research reports about the particular issuer or its securities in order to avail itself of Rule 138's safe harbor, although the SEC expressed concerns about situations in which an underwriter "begins publishing research about a different type of security around the time of a public offering of an issuer's security and does not have a history of publishing research on those types of securities."14

Securities Act Rule 139 — Publication of Research About the Securities Being Offered by an Underwriter

Rule 139 provides that an underwriter participating in a distribution of securities by certain seasoned issuers can publish ongoing research about those issuers and their securities without being deemed to offer those securities by way of its research reports. Rule 139 research can take the form of issuer-specific reports, or more general reports covering an industry sector. Rule 139 covers Form S-3 eligible issuers that are current in their Exchange Act reporting for issuer-specific research reports; all Exchange Act reporting companies for industry research reports; and certain FPIs for both types of reports. The rule does not, however, cover voluntary filers.

- Issuer-specific reports: To qualify

for the Rule 139 safe harbor, issuer-specific research reports must

be published by the underwriter in the regular course of its

business. The safe harbor does not cover the initiation of research

about the issuer or its securities (or re-initiation of publication

following discontinuation).

However, the SEC has explained that the safe harbor will be available if the underwriter has previously published research on the issuer or its securities at least once, or has published one such report after having discontinued coverage.15 Rule 139 does not define the concept of "discontinuation" of coverage. - Industry reports: The Rule 139 safe harbor is available only if the underwriter publishes research in the regular course of its business and, at the time of the publication of the research report, includes similar information about the issuer or its securities in similar reports.

Bear in mind that Rule 139 no longer limits the safe harbor to underwriter recommendations that are no more favorable than recommendations contained in previous reports. In fact, prior reports need not have included any recommendation.

Safe Harbors — Private Transactions

Securities Act Rule 135c — Limited Notices of Unregistered Offerings

Rule 135c provides that a company subject to the reporting requirements of the Exchange Act (and certain non-reporting FPIs) will not be deemed to make an offer of securities under Section 5(c) if it issues a notice of a proposed or completed unregistered offering. Rule 135c is the safe harbor relied on for the press release announcing the commencement of a private offering by a public company. The safe harbor technically is not available to voluntary filers.

A Rule 135c notice — which can take the form of a press release or a written communication directed to shareholders or employees — does not constitute "general solicitation" for purposes of the Regulation D safe harbor or "directed selling efforts"16 under Regulation S. Rule 135c is another example of the collision principle at work — where Exchange Act requirements collide with Securities Act prohibitions, the Exchange Act wins.

To fall within Rule 135c, the notice must:

- state that the securities offered have not been or will not be registered under the Securities Act and may not be offered absent registration or an exemption from registration;

- contain only limited information, including:

-

- the name of the issuer;

- the title, amount and basic terms of the securities being offered;

- the amount of the offering, if any, being made by selling shareholders;

- the time of the offering; and

- a brief statement of the manner and purpose of the offering, without naming the underwriters; and

- be filed on Form 8-K or, for a foreign private issuer, furnished on Form 6-K.

Safe Harbors — Foreign Private Issuers

Securities Act Rule 135e

Rule 135e provides a safe harbor from the definition of offer for FPIs.17 The rule allows an FPI to provide journalists with access to information related to a securities offering via:

- press conferences held outside the United States;

- meetings with issuer (or selling security holder) representatives conducted outside the United States; and

- written press-related materials released outside the United States.

To use Rule 135e, the offering must be conducted at least partly outside of the United States — meaning that the issuer must have a bona fide intent to make an offering offshore concurrently with the US offering. The issuer must also provide access to both US and non-US journalists, and distribute only outside the United States any written press releases (which must contain a specified legend) to US and non-US journalists alike.

Like notices under Rule 135c, offshore press activity within Rule 135e will not constitute general solicitation or directed selling efforts.18

What About Voluntary Filers?

Voluntary filers are not true reporting companies in the SEC's eyes because, even though they file Exchange Act reports, voluntary filers are not required to do so under Exchange Act Section 13 or 15(d).19 As a result, a number of the safe harbors discussed above are not expressly available to voluntary filers.

But that may not be the end of the story. For example, even though Rule 135c is technically limited to reporting companies, the policy concern that animates Rule 135c — namely, that reporting companies have a legitimate interest in communicating with their securityholders about financing activities — apply with equal force to voluntary filers. As a result, practitioners often conclude that the rule should by analogy protect communications by voluntary filers as well, in the same way that the SEC has itself applied Rule 135c principles by analogy.20

Similarly, ordinary ongoing communications by a voluntary filer with its investors (such as quarterly earnings releases) are within the spirit, but not the letter, of the Rule 168 safe harbor. (Rule 169 is no help here because that rule is available only for communications to non-investors.) Fortunately, though, there is life outside Rules 168 and 169. As the SEC said when adopting Rules 168 and 169, they are not intended to "affect in any way the Securities Act analysis regarding ordinary course business communications that are not within the safe harbors."21 Accordingly, where a particular public statement by a voluntary filer is consistent with past practice, Exchange Act reporting principles or the policies underlying Regulation FD, most practitioners are inclined to find that it is not problematic for Securities Act purposes. This is just another example of the collision principle at work.

IT'S AN OFFER — BUT IT'S OK

Public Transactions

Securities Act Rule 163 — Pre-Filing Offers By WKSIs

Rule 163 creates a non-exclusive safe harbor for WKSIs from Section 5(c)'s prohibition on pre-filing offers. Note that this exemption is not available to underwriters. Although the SEC in 2009 proposed broadening Rule 163 to include certain underwriters and dealers authorized by an issuer to approach the market on the issuer's behalf, the proposal has not been brought up as a final rule, and it remains unclear if the SEC will take any further steps toward adoption. 22

Under Rule 163, offers by or on behalf of a WKSI before filing a registration statement are free from the restraints of Section 5(c) if certain conditions are met. These include that any written offer must contain a prescribed legend and must be filed with the SEC promptly upon filing of the registration statement for the offering (unless the communication has previously been filed with the SEC or is exempt from filing under the terms of Rule 433, which we discuss below). If no registration statement is ever filed, however, a Rule 163 communication will not need to be filed.23

Oral Offer After Filing

For any issuer that has filed a registration statement, Section 5 permits oral offers but only certain types of written offers.

All written offers must comply with Section 10 of the Securities Act:

- Section 10(b) authorizes the SEC to adopt rules permitting written offers through a preliminary offering document, often called a Section 10(b) prospectus, which Section 5 permits an issuer to use to offer securities.

- Section 10(a) prescribes the information required in a final prospectus, the delivery of which Section 5 requires at or before any sale in a registered offering.

Permitting oral offers while restricting certain written offers seems simple enough in theory. As usual, though, the devil is in the details. The category of "written offers" includes a few surprises.

For example, what do radio broadcasts, blast voicemails and TV advertisements have in common? They all are written offers for these purposes. The slightly roundabout way to reach this conclusion starts with the definition of prospectus in Section 2(a)(10) of the Securities Act, which includes any offer made by means of a written communication, or any radio or TV broadcast. The term written communication in turn includes any "graphic communication," which is itself defined to cover all forms of electronic media.

There is, however, one important exception to the definition of graphic communication — it does not include a communication that originates live, in real-time to a live audience (not in recorded form or otherwise as a graphic communication), although it may be transmitted electronically as long as the transmission is live.24 This is the exception that permits live road shows, which we will discuss below.

Red Herrings

A "red herring" or "red" is the colloquial term for a type of preliminary prospectus permitted by Section 10(b) of the Securities Act.25 A red herring can be used to make written offers but cannot be used to satisfy the prospectus delivery obligations that apply when orders are confirmed and securities are sold. This is because a red herring is a Section 10(b) prospectus but not a Section 10(a) prospectus.

Securities Act Rule 430 provides that, in order to be a Section 10(b) prospectus, a red herring must include substantially all of the information required in a final prospectus, other than the final offering price and matters that depend on the offering price, such as offering proceeds and underwriting discounts.

In addition, Regulation S-K Item 501(b) (3) requires a preliminary prospectus used in an IPO to contain a "bona fide estimate" of the price range. The SEC Staff generally takes the position that a bona fide price range cannot exceed the greater of $2 (for ranges below $20) or 10 percent of the high end of the range (for ranges that go above $20), although relief may be available in exceptional situations. S-K Item 501(b)(10) specifies the required "subject to completion" legend that must appear on the front cover of any preliminary prospectus. This legend, printed in red ink, gives rise to the name red herring.

If a filed prospectus does not yet include a bona fide price range (in the case of an IPO) or otherwise does not comply with Rule 430, it is known in the trade as a "pink herring" — i.e., a filed prospectus that is not quite a red because it does not yet meet the requirements of Section 10(b) and hence cannot be used to solicit customer orders.

Road Shows

Road shows are the duck-billed platypus of the securities world — the evolutionary missing link with traits of both oral and written offers. Securities Act Rule 433(h)(4) provides a formal definition of "road show" as an offer, other than a statutory prospectus, that "contains a presentation regarding an offering by one or more members of an issuer's management" and discusses any of the issuer, management and the offered securities.

You can see why a traditional road show is a quintessential oral offer. Road shows traditionally entail an intensive series of in-person meetings between members of the issuer's management and key members of the buy-side community over a multi-day period in multiple cities and, sometimes, in multiple countries. But what about the slide deck that is typically distributed at road shows?

The explanatory note to Rule 433(d)(8) indicates that road show slides and other road show graphic communications are not written offers, so long as copies are not left behind:

"A communication that is provided or transmitted simultaneously with a road show and is provided or transmitted in a manner designed to make the communication available only as part of the road show and not separately is deemed to be part of the road show. Therefore, if the road show is not a written communication, such a simultaneous communication (even if it would otherwise be a graphic communication or other written communication) is also deemed not to be written."

Even handouts are not considered to be written offers so long as they are collected at the end of the presentation. If they are left behind, though, they become a type of statutory prospectus known as a free writing prospectus, and must comply with Securities Act Rules 164 and 433, which we discuss below.

FWPs

Securities Act Rule 405 defines a "free writing prospectus" as any "written communication" that constitutes a post-filing offer to sell, or solicitation of an offer to buy, the securities that are the subject of a registered offering. A supplement to a statutory prospectus can be an FWP, as can press releases, emails, blast voicemails and even press interviews.

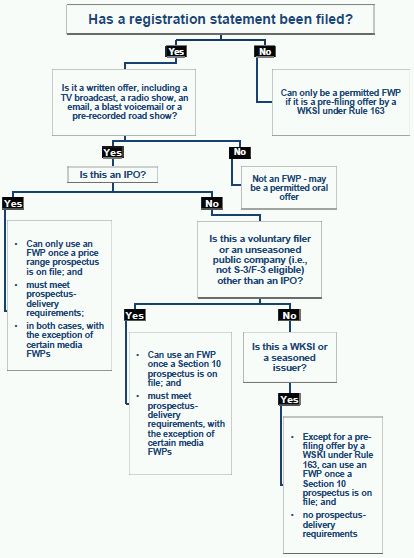

Rules 164 and 433 govern the use of FWPs. Rule 164 provides that, after filing a registration statement, an issuer or an underwriter may use an FWP if both the issuer and the offering are eligible and if the additional conditions of Rule 433 are met.26 The following flowcharts provide a road map to help guide you through these two rules. For more detail, see the Appendix.

WHEN CAN YOU USE AN FWP?

1. Securities Act Rule 433(b) — Use of FWPs

Rule 433(b) distinguishes between the use of FWPs by certain seasoned and unseasoned issuers.

WKSIs, Form S-3 or F-3 issuers and certain of their majority-owned subsidiaries may generally use FWPs after filing a registration statement that includes a Section 10 prospectus.

Things work differently for unseasoned issuers and voluntary filers. Unseasoned issuers for these purposes include IPO issuers, as well as SEC-reporting companies that are not eligible to register offerings on Form S-3 or F-3, for example, because they have not timely filed required Exchange Act reports in the previous 12 calendar months:

- First, recall that for an IPO, the prospectus must contain a bona fide price range in order to qualify as a Section 10(b) prospectus. So, IPO issuers cannot use an FWP until they have filed a price range prospectus. The requirement to have a price range does not apply, however, in the case of a media FWP that was not published in exchange for payment and was filed with a required legend within four business days (as we describe in more detail below).

- Second, a Section 10 prospectus must accompany or precede the FWP, unless either:

-

- a statutory prospectus has already been provided and there is no material change from the most recent prospectus on file with the SEC;27 or

- the FWP is a media FWP that was not published in exchange for payment and was timely filed with a legend.

Note that an electronic FWP emailed with the proper hyperlink will obviate the need for physical delivery of a prospectus.

2. Securities Act Rule 433(f) — Media FWPs

Rule 433(f) provides that any written offer that includes information provided, authorized or approved by the issuer or any other offering participant that is prepared and disseminated by an unaffiliated media third party will be deemed to be an issuer FWP.

This is the so-called "Google provision" that the SEC adopted in response to a controversial Playboy magazine article about Google in advance of its IPO. The requirements for prospectus delivery, legending and filing on the date of first use that would otherwise apply to media FWPs will not apply if:

- no payment is made or consideration given for the publication by the issuer or other offering participants; and

- the issuer or other offering participant files the media FWP with the required legend within four business days after the issuer or other offering participant becomes aware of publication or dissemination (unless the substance of the written communication has previously been filed, in which case the FWP need not be filed).

Any filing of a media FWP in these circumstances may include information that the issuer or offering participant believes is needed to correct information included in the media FWP. In addition, in lieu of filing the media communication as actually published, the issuer or offering participant may file a copy of the materials provided to the media, including transcripts of interviews.

3. Securities Act Rule 433(d) — When Must FWPs be Filed?

The general rule is that an FWP must be filed with the SEC no later than the day the FWP is first used. If you miss the SEC's EDGAR filing cut-off for that day (5:30 pm Eastern time) you should still file the FWP as soon as possible.28

Issuers must generally file any issuer FWP, which is defined broadly to include an FWP prepared by or on behalf of the issuer or an FWP used or referred to by the issuer. Issuers must also generally file a description of the final terms of the securities in a pricing term sheet (whether contained in an issuer or an underwriter FWP).

By contrast, an underwriter needs to file an FWP only if it has distributed the FWP in a manner reasonably designed to lead to its "broad unrestricted dissemination." The SEC has explained that an FWP prepared by an underwriter that is made available only on a website restricted to the underwriter's customers or a subset of its customers will not require filing with the SEC, nor will an email sent by an underwriter to its customers, regardless of the number of customers involved.29

There are certain exceptions to the FWP filing requirement:

- an FWP does not need to be filed if it does not contain substantive "changes from or additions" to a previously filed FWP;

- an issuer does not need to file issuer information contained in an underwriter FWP if that information is already included in a previously filed statutory prospectus or FWP relating to the offering; and

- an FWP that is a preliminary term sheet does not need to be filed (recall that an FWP that is a final pricing term sheet must be filed by the issuer within two days of the later of establishing the terms and the date of first use).

To read this Client Alert in full, please click here.

Footnotes

* Mr. Yaecker is currently on temporary assignment.

1 See Publication of Information Prior to or After the Effective Date of a Registration Statement, Release No. 33-3844 (Oct. 8, 1957).

2 See Guidelines for the Release of Information by Issuers Whose Securities are in Registration, Release No. 33-5180 (Aug. 16, 1971).

3 See Securities Offering Reform, Release No. 33-8591 (July 19, 2005) at 82 n.122 [hereinafter "Offering Reform Release"].

4 Id. at 58-59; cf. Securities Act Section 19(a) (providing that no liability provision of the Securities Act "shall apply to any act done or omitted in good faith in conformity with any rule or regulation of the Commission").

5 See SEC Division of Corporation Finance, Compliance and Disclosure Interpretations [hereinafter "C&DI"], Securities Act Sections, Question 139.32.

6 Offering Reform Release at 76-77.

7 Under Rule 168, "factual business information" means: (i) factual information about the issuer, its business or financial developments, or other aspects of its business; (ii) advertisements of, or other information about, the issuer's products or services; and (iii) dividend notices. "Forward-looking information" means: (i) projections of an issuer's revenues, income or loss, earnings or loss per share, capital expenditures, dividends, capital structure, or other financial items; (ii) statements about management's plans and objectives for future operations, including plans or objectives relating to the products or services of the issuer; (iii) statements about the issuer's future economic performance, including statements generally contemplated by the issuer's MD&A; and (iv) assumptions underlying or relating to the foregoing.

8 Offering Reform Release at n. 81.

9 Id. at 63.

10 Id. at 64.

11 Id.

12 Id. at n.147.

13 See id. at n.185.

14 Id. at 164.

15 Id. at 167.

16 Securities Act Rules 502(c) & 902(c)(3)(vi).

17 A foreign private issuer is any issuer (other than a foreign government) incorporated or organized under the laws of a jurisdiction outside the United States, unless (1) more than 50 percent of its outstanding voting securities are directly or indirectly owned by US residents and (2) either (A) the majority of its executive offers or directors are US citizens or residents, (B) more than 50 percent of its assets are located in the United States or (C) its business is principally administered in the United States. See Securities Act Rule 405; Exchange Act Rule 3b-4.

18 Securities Act Rules 502(c) & 902(c)(3)(vii).

19 See Exchange Act Rules C&DI, Question 130.02.

20 See Commission Guidance Regarding Management's Discussion and Analysis of Financial Condition and Results of Operations, Release No. 33-8350 (Dec. 19, 2003) at n.54 and accompanying text (stating that discussion and analysis of future financing plans "should be considered and may be required" and that "disclosure satisfying the requirements of MD&A can be made consistently with the restrictions of Section 5 of the Securities Act" (citing Rule 135c)).

21 See Offering Reform Release at n.122 (citing the Preliminary Note to Rule 168).

22 See Revisions to Rule 163, Release No. 33-9098 (Dec. 18, 2009).

23 See Offering Reform Release at 82.

24 Securities Act Rule 405 (defining "Graphic Communication").

25 You can learn more capital markets slang and terminology, and download our Book of Jargon apps for the iPhone, iPad and iPod Touch, at http://www.lw.com/booksofjargon.aspx.

26 Ineligible issuers include blank check companies and shell issuers, while ineligible offerings include business combinations. See Securities Act Rules 164(e), (f) & (g).

27 This proviso is puzzling, since in most cases there would not be a reason to circulate an FWP if there were nothing material to report. We choose, therefore, to interpret the proviso as meaning that an FWP for an IPO issuer is allowed to convey only material changes if the FWP and the original preliminary prospectus (and each other broadly distributed FWP, if any), taken together, contain materially the same information as is at the time on file with the SEC. We think that this interpretation is more in keeping with the overall purpose of Rule 433 — namely, to encourage sending information to accounts on an as-needed, real-time basis. In any event, however, note 1 to paragraph (b)(2)(i) of Rule 433 makes clear that this technical issue is not a problem for an FWP delivered by e-mail as long as it includes a hyperlink to the most recent preliminary prospectus on file with the SEC. As a result of this helpful note, every FWP to be sent by e-mail in connection with an IPO should include such a hyperlink. In situations where the underwriters are able to distribute FWP to all accounts by e-mail, there is no need to struggle with this interpretive issue.

28 See Securities Act Rules C&DI, Question 232.02.

29 Offering Reform Release at n. 267.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.