- within Transport, Antitrust/Competition Law and Employment and HR topic(s)

- in Africa

Asia private capital dealmaking defies global uncertainties

We started 2025 by predicting that, after a subdued first quarter, data suggested an imminent uptick in the M&A and exit markets. That optimism proved to be short lived, as 'Liberation Day' tariffs drove uncertainty and reined in dealmaking activity.

However, despite a year marked by geopolitical tension and uneven macroeconomic recovery, the private capital market in Asia has shown resilience, with deal value and numbers exceeding 2024.

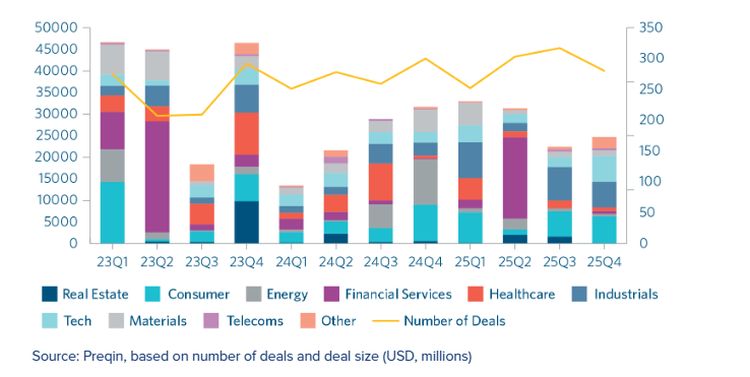

As shown in the charts below, 2H proved to be slightly weaker than 1H across many markets although China had a stronger 2H.

In Q4, nearly 75% of Asia buyout activity occurred in the consumer, tech and industrial sectors.

Consumer, tech and industrials lead Q4 Asia buyout activity

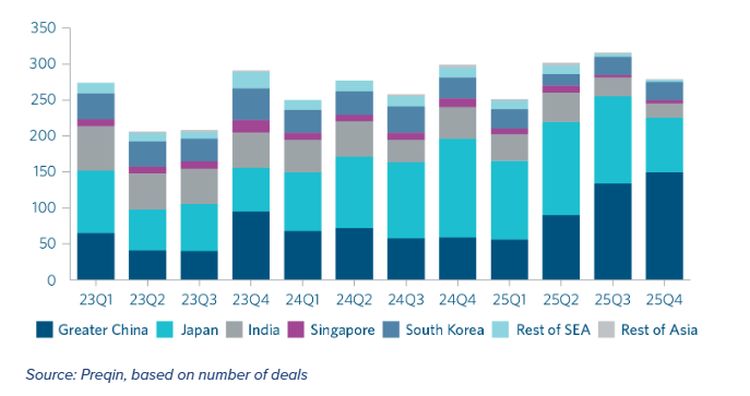

Geographically, Japan was an active market over the first three quarters of the year but showed signs of slowing in Q4. Demand in Japan was driven by a combination of factors, including the lower value of the Yen against the US dollar and corporate governance reforms, which drove take privates and corporate carve outs.

Japan shows signs of slowing

Despite falling deal volumes and values across Asia, particularly in Q4, China dealmaking remained strong in 2H and is driving many western private capital firms to reconsider their investment approach to the country.

With geopolitical tensions and the returns generated from the US, it had been difficult to persuade many private capital firms that inbound investment to China is a smart bet.

However, with lower valuations, the IPO exit markets in Hong Kong and mainland China were resurgent and, with policies announced to increase domestic consumption, we see opportunities for China deployment continuing to grow in 2026.

China buyouts and VC drive activity in the region in 2025

2025 also saw a new trend of multinationals looking to team up with private capital to spur greater growth across their China operations. The recent Starbucks and Burger King deals led the charge, with past deals such as Carlyle's investment into McDonalds China proving that the model can be a success. We expect this aspect of the market to be active in 2026, with a number of other multinationals reported to be considering this option.

We are also seeing greater optimism in Asia for 2026 from many global funds. It was widely reported that KKR expects Asia Pacific to account for half of its global private equity distributions in 2025, a sentiment underlined by KKR holding its first board meeting in Asia in September 2025.

It was also reported that EQT "is doubling down on Asia, calling the region a big growth engine and home to some of the most compelling opportunities across private equity and infrastructure."

"This sentiment is not unique, and the confidence being shown in the Asia markets by some of the world's largest private capital investors drives positive sentiment for the region as we start 2026," said private capital partner Anthony Vasey.

per analysis of both public and private M&A activity across Asia.

Asia's private funds in 2025

Five themes dominated conversations around capital formation for private funds in Asia in 2025:

- sluggish fundraising

- a geographical reallocation of capital

- private credit

- secondaries

- evergreen funds and "retailisation."

Overall fundraising down year-on-year

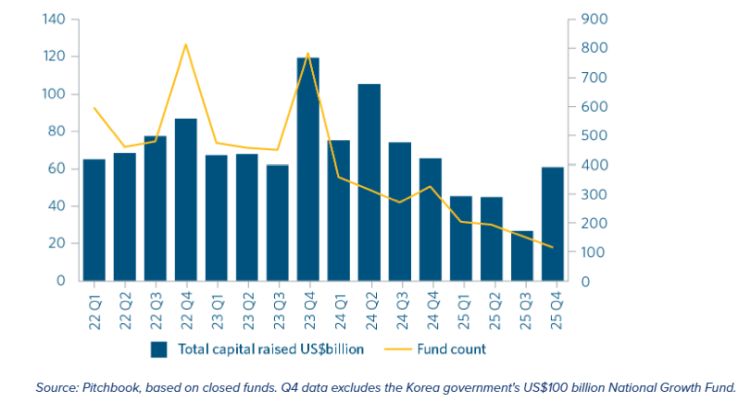

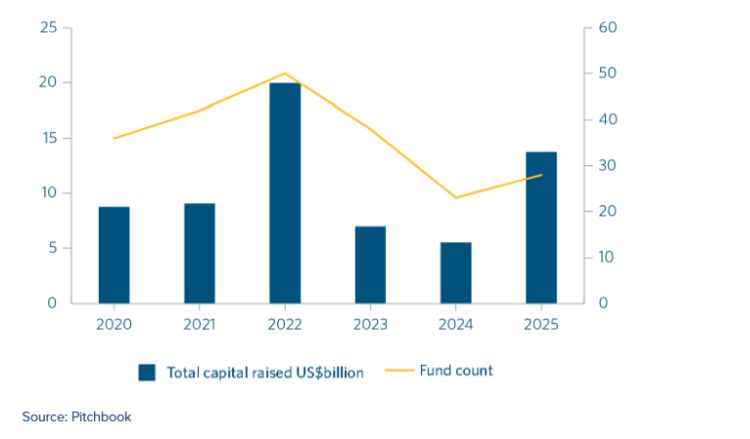

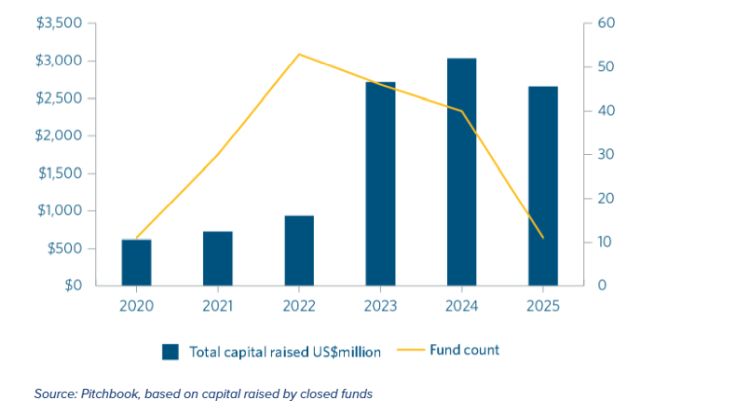

Asia private capital fundraising continues to slow

Although Q4 saw a significant uptick in capital raised due to a number of closings late in the quarter, Asia private capital fundraising for 2025 as a whole still ended well below the levels seen in 2022, 2023 and even 2024. Both the number of funds as well as the amount of capital raised has decreased year on year from 2024.

We believe that Asia's subdued 2025 fundraising environment was caused mainly by a lack of exits and therefore distributions to LPs, weakness in the Chinese growth and PE market, and a lack of interest in Asia by international investors exacerbated by geopolitical factors (including the US outbound investment restrictions aimed at the Chinese technology sector).

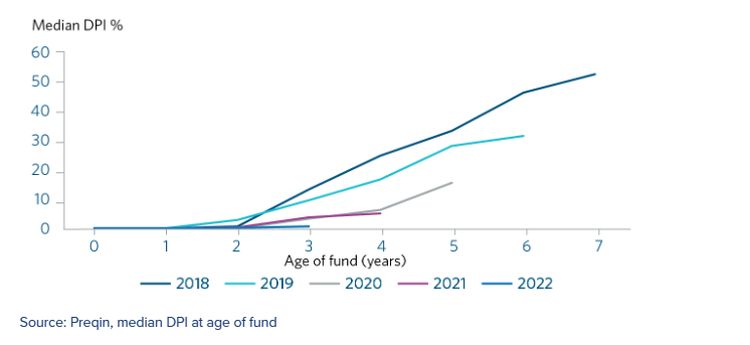

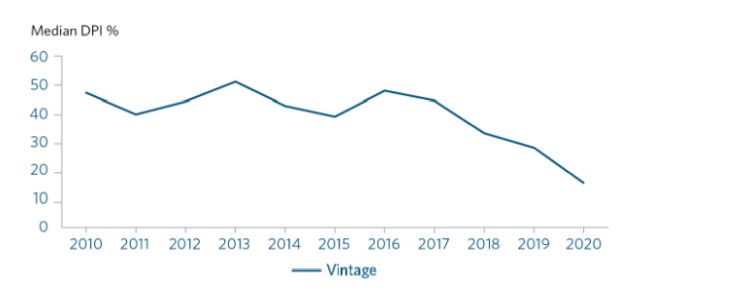

The following graphs illustrate the liquidity problem that plagued private capital markets in 2025. According to Preqin data, median DPI is lower for later vintages.

Distribution slower for newer vintages

To offer another perspective on this data, it is helpful to compare median DPI five years after fund closing over vintages from 2010 to 2020. The median DPI at that point for 2018, 2019 and 2020 vintages is significantly below that of earlier vintages.

This indicates that funds of later vintages hold assets longer, creating a growing pool of privately held assets that has been accumulating over several vintages.

With M&A activity expected to recover in 2026, there is a possibility that GPs will be able to start clearing this backlog and achieve exits for these assets.

Median DPI at 5 years (%)

However, our prediction for 2026 is that the fundraising environment for Asia funds will remain challenging, but we still expect fundraising for Asia funds to improve as the factors that held back 2025 fundraising ease.

This improvement will be driven by distributions funded by exits through the highly active Hong Kong IPO market, by value creation in China (especially in the EV, batteries and AI sectors), and through renewed interest in China among international investors as they recognise the potential for value creation and as they moderate their exposure to the US market (see more on this below).

Geographical reallocation of fundraising

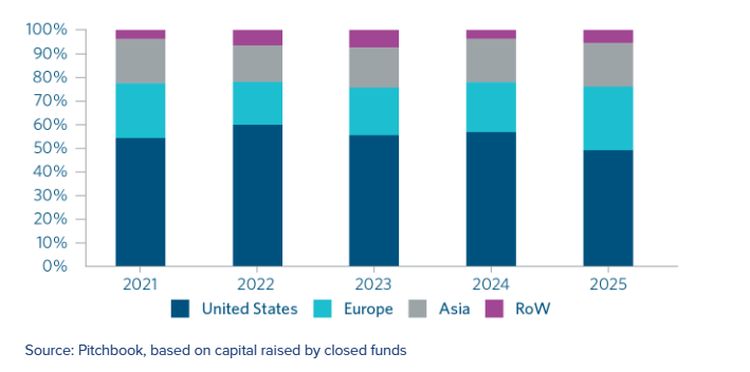

2025 was the year that the seemingly unbreakable dominance of the US market in fundraising broke. Our analysis over the year showed a consistent shift of fundraising towards Europe, a trend first identified in our Q2 analysis following the announcement of wide-ranging tariffs by the US government.

This trend solidified over the year, and our year-end figures show a significant increase in the percentage of global fundraising heading to Europe. This shift came at some cost to Asia, which saw a very small 0.1% increase in its share of global fundraising.

Europe outpaces Asia in fundraising

"We expect 2026 to be another year of good fundraising for Europe funds at the expense of US funds, based on current sentiment among international investors and on investment corridor activity that we are currently seeing from Asia," said funds partner Benjamin Lohr.

"However, we also expect Asia funds to increase their share of global fundraising this year, as appetite for investment in China returns and in light of potential constraints in Europe to absorb the capital available."

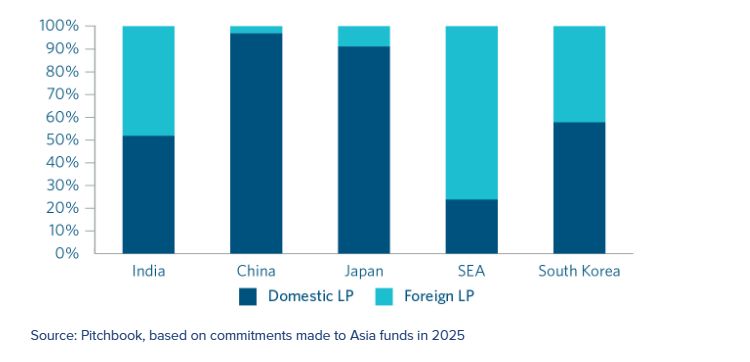

Throughout 2025, both the Chinese and the Japanese markets attracted mainly domestic capital, with international investors interested mostly in Southeast Asia and India (regions that arguably have limited domestic capital to deploy).

Domestic LPs key to China, Japan and South Korea, while SEA and India attract foreign LPs

Private credit

Private credit attracted a lot of global attention in 2025, and fundraising for Asia private credit funds outperformed 2024 significantly, with thanks to an uptick in Q4 fundraising due to US$5.6 billion and US$2.79 billion raises late in the quarter. That said, there has been no explosion in fundraising either, and the 2025 total sits between the heights of 2022 and the depths of 2024.

As we discussed at our annual private capital event in Singapore in September 2025, non-bank credit penetration in Asia lags Europe and the US by a significant margin. Based on the fundraising data, the shift in Asia private credit may be gradual (if it comes at all) and we expect different jurisdictions across Asia to develop differently in this regard.

Asia private credit fundraising largely stable

Asia secondaries continue to rise

Secondaries transactions during 2025 were driven by a lack of distributions and a need for liquidity among LPs (and pressure on GPs to generate distributions) and by the geographical reallocation of investments already discussed above.

In our Q2 analysis, we noted media reports of institutional investors seeking to sell portfolios of LP interests. At the end of Q3, we wondered whether deals would actually follow. In Q4, we finally saw reports of (almost) done deals for the sale of significant portfolios (see here and here).

Longer holding periods for Asia funds have not yet generated the glut of continuation vehicle and GP-led secondaries deals that were seen in recent years in the US and in Europe.

That said, while the Asia secondaries market is still disproportionately small compared to the US and European markets (depending on the data provider, just 2-3% of the global total), it continues to grow as an exit route for GPs with long holding periods for their private equity assets.

2025 was not a good year for fundraising for secondaries funds however. The trend of fundraising growth dropped off in 2025 with a significant reduction in the number of funds raised and a lower aggregate commitments figure.

Asia secondaries grow at 34% CAGR 2020 to 2025 (US$ million)

The top five fundraises in secondaries in 2025 according to Pitchbook were:

| Funds | Investor | Fund status | Fund size (USD, millions) | Close date | Location |

|---|---|---|---|---|---|

| NewQuest Asia Fund V | TPG NewQuest | Closed | 981.00 | 19 May 2025 | Hong Kong |

| AIP Secondary Fund II | Aquilius Investment Partners | Closed | 750.00 | 2 Nov 2025 | Singapore |

| 360 One Secondaries Fund | 360 ONE | Closed | 590.00 | 25 Feb 2025 | India |

| Japan Private Equity Opportunity 2024 | Alternative Investment Capital, WM PARTNERS (Tokyo) | Closed | 207.44 | 30 Jun 2025 | Japan |

| Jiangxi Runxin Gantou Relay Secondary Fund | China Capital Management | Closed | 68.89 | 17 Feb 2025 | China |

We remain of the view expressed in our Q3 analysis that secondaries, in particular GP-led secondaries and direct secondaries, can play a larger role in providing liquidity in Asia's private capital markets.

We do not, however, expect that US volumes of GP-led transactions will be replicated in Asia in the near future.

Evergreen funds and "retailisation"

In 2025, Hong Kong and Singapore regulators responded to industry demand for evergreen funds for distributions to non-institutional investors.

In Hong Kong, the SFC issued a circular in February 2025 outlining conditions under which a fund investing in alternative assets may be authorised under the Securities and Futures Ordinance for distribution to the general public and listed under Chapter 20 of the Listing Rules. Much discussion among market participants and between market participants and the SFC followed. One fund has since filed a prospectus proof and may launch in due course.

The SFC also launched a public consultation in October 2025 on proposed amendments to the Code on Unit Trusts and Mutual Funds (UT Code). This contains a proposal to enable retail investors to access private markets by allowing SFC-authorised unlisted funds to invest in illiquid assets, including private market assets, beyond the current 15% investment limit.

As of the date of this analysis, no major global GP has filed a prospectus proof indicating the launch of a product. We believe that there are two key factors that are holding issuers back: a yet unproven demand side and because it remains difficult, or at least unclear, how to comply with regulatory expectations expressed by the SFC.

If the growth of evergreen funds for broader distribution in the US and Europe is an indicator for Asia, the demand side likely exists, and may be additionally fed by Hong Kong's pension system.

However, the regulatory environment requires further work, and we expect ongoing discussions between market participants and the SFC on this topic.

In Singapore, the Monetary Authority of Singapore (MAS) has proposed a Long-term Investment Fund (LIF) framework with two different fund structures - a direct fund structure that would make direct private market investments, and a fund-of-funds structure that would primarily invest in other private market investment funds. These would govern retail access to private market investment funds to offer more investment choices for retail investors.

Our prediction - in light of the above - is that a small number of funds investing in credit managed by smaller specialist GPs will launch in 2026, but that global GPs will largely remain absent unless regulatory expectations are clarified.

Asia private capital disputes in 2025

Disputes 'mood music' shifts as Asia optimism returns

Given the ongoing lack of exits across the region, strategy discussions on when and how to exit legacy investments remains a hot topic, particularly in markets such as China.

As 2025 closed, more QIPO put option triggers were coming into play with insufficient funds to repay all investors, despite the active Hong Kong IPO market. This is adding pressure to the race both to secure and then release funds, with investors jostling over whether to be first movers or to find alternative ways to realise cash.

At the same time, and as discussed above, Asia is a growth target again – with China firmly back online. This creates opportunities for investment, but with an increasingly weary eye on risk and the ability to exit and enforce investment obligations, particularly in less mature markets. The experience of the firm's disputes practice means that our insight is being sought more and more to shape more investment-friendly solutions.

"Where issues do emerge, our disputes practice is being used to restructure, price and shape investments, rather than just exercising put options or activating full-scale disputes," said disputes partner Kathryn Sanger, co-head of private capital.

"Deal flow is cautious but building – particularly amongst the larger, more Asia-experienced firms – and our experience is also being sought for deal structuring, alongside our corporate colleagues."

Our Asia private capital team advises funds, asset managers, pension and sovereign wealth funds, and other institutional investor clients across the lifecycle.

With expertise in seven offices across Asia, we advise on fund structuring and fundraising, through M&A, financing, consortium arrangements, asset management, and exits and disputes.

Our sector focus adds value for clients with Asia market expertise in tech, financial services, consumer, infrastructure, energy/renewables, industrials and healthcare.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.