- within Criminal Law topic(s)

- in United States

- within Strategy and Accounting and Audit topic(s)

On May 12, 2025, the Department of Justice Criminal Division announced significant changes to its corporate white-collar criminal enforcement priorities. In line with the Trump administration's recalibration toward prioritizing an "America First" agenda, the Criminal Division published a memorandum highlighting new enforcement priorities and modifications to existing corporate white-collar enforcement programs. Notable changes include a reduced emphasis on corporate monitorships, a clearer avenue to qualify for a declination, and a pivot in corporate enforcement activity to protect American Interests.

This White Paper reviews the Criminal Division's newly announced enforcement priorities, as well as the potential impact on corporate white collar enforcement going forward.

OVERVIEW

On May 12, 2025, the U.S. Department of Justice ("DOJ") Criminal Division announced the Trump administration's whitecollar enforcement priorities and published several revised corporate enforcement policies aligning with the administration's "America First" agenda.

Specifically, the Criminal Division announced the following changes:

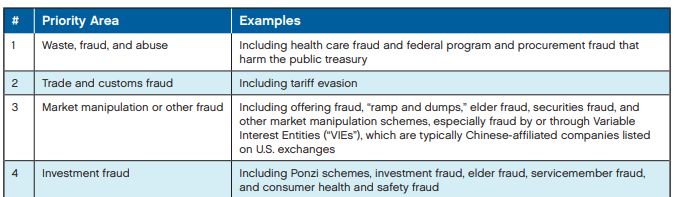

- New White Collar Criminal Enforcement Priorities: In a memorandum titled "Focus, Fairness, and Efficiency in the Fight Against White-Collar Crime" (the "Memorandum"), the Criminal Division announced a reprioritization toward prosecuting corporate crime that will protect American interests, while helping ensure American businesses are on a level playing field in global trade and commerce, such as focusing enforcement efforts on waste, fraud, and abuse; entities that support cartels and Transnational Criminal Organizations ("TCOs"); and Chinese money laundering.

- Expanded Criminal Division Corporate Whistleblower Awards Pilot Program: The Criminal Division expanded its corporate whistleblower pilot program (the "Pilot Program") to encourage tips concerning priority criminal offenses that harm American interests.

- Revised Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy ("CEP"): The CEP now offers a clearer path toward a declination for companies that voluntarily self-disclose, fully cooperate, fully remediate, and lack aggravating factors. The CEP also offers enhanced benefits to companies that do not self-disclose but otherwise cooperate and remediate. This reflects the administration's view that not all corporate misconduct will warrant criminal prosecution.

- Mandate to Speed Up Corporate Investigations and Narrowly Tailor Use of Monitors: The Criminal Division announced additional meaningful changes, including a mandate to streamline corporate criminal investigations and narrowly tailor the use of corporate monitors.

Taken together, these changes represent the most significant recalibration of corporate criminal enforcement in more than a decade. They reflect a strategic reallocation of resources toward matters that align with the administration's objectives of protecting U.S. economic and security interests, such as reducing terrorist financing and narcotics trafficking, eliminating cartels and TCOs, and protecting investors and consumers. The changes also highlight the DOJ's increased willingness to resolve criminal investigations of companies that have selfdisclosed and cooperated expeditiously and without bringing criminal charges, if warranted (e.g., through declinations and non-prosecution agreements ("NPAs")).

FOCUS: CRIMINAL DIVISION WILL PRIORITIZE PROSECUTING CORPORATE CRIME THAT HARMS U.S. INTERESTS AND INDIVIDUALS

This list of priorities reflects the Criminal Division's focus on protecting U.S. business interests and allocating resources toward crimes that implicate national security interests, fraud, and support of TCOs and cartels. In this regard, the list of priorities includes "bribery and associated money laundering" that harms U.S. national interests, undermines U.S. national security, harms the competitiveness of U.S. businesses, and/or enriches foreign corrupt officials. The inclusion of bribery and related money laundering on this list affirms the Criminal Division's interest in investigating bribery in cases it deems in the U.S. national interest, which is consistent with President Trump's Executive Order issued on February 10, 2025, pausing the enforcement of the Foreign Corrupt Practices Act ("FCPA").

As we noted in our prior Commentary on this subject, given the emphasis on promoting American interests and the competitiveness of American companies, non-U.S. companies and individuals subject to the FCPA's jurisdiction in particular may face greater scrutiny from the DOJ moving forward. And this is also true with respect to the DOJ's enforcement of the Foreign Extortion Prevention Act ("FEPA"), which targets the demand side of foreign bribery—namely, foreign government officials who demand or accept bribes.

FOCUS: CORPORATE WHISTLEBLOWER AWARDS PILOT PROGRAM ADDS PRIORITY AREAS

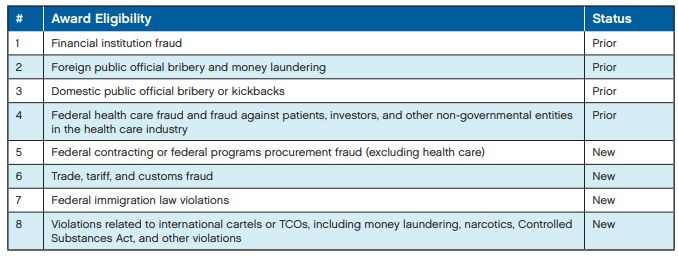

The Criminal Division also amended its Corporate Whistleblower Awards Pilot Program, which was unveiled in August 2024. The program focused initially on foreign and domestic corruption, certain crimes involving financial institutions, and health care fraud schemes targeting private insurers not subject to qui tam recovery under the False Claims Act.

Under the expanded Pilot Program, the Criminal Division has added four new "priority" offenses to the list of subject matter areas to which a whistleblower tip must relate for award eligibility. Tips that lead to forfeiture in customs, trade, procurement, immigration, terrorism, and sanctions offenses will now be eligible for awards. These additions are largely reflective of the "most egregious" offenses that the Criminal Division has identified as white-collar enforcement priorities.

Under the Pilot Program, whistleblowers are still eligible for an award if they provide original, truthful information about criminal misconduct relating to one or more designated program areas that leads to forfeiture exceeding $1,000,000 in net proceeds. Awards will be contingent upon tips that lead to forfeiture, underscoring the DOJ's commitment to recovering ill-gotten gains while targeting the most culpable actors.

FAIRNESS: REVISED CEP PROVIDES ADDITIONAL BENEFITS TO COMPANIES THAT SELF-DISCLOSE, COOPERATE, AND REMEDIATE

The Criminal Division published key updates to the CEP setting forth incentives for corporations to voluntarily self-disclose, fully cooperate, and fully remediate. These revisions do not change the core concepts in the prior CEP, but instead are intended to provide greater predictability and transparency regarding these incentives and the potential benefits to businesses. Overall, the Criminal Division is projecting a greater willingness to enter into non-criminal resolutions with companies that self-disclose, fully cooperate, and remediate

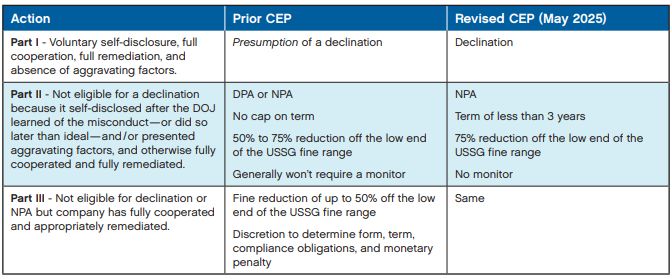

Part I – Declination. Under the revised CEP, companies that voluntarily self-disclose to the Criminal Division, fully cooperate, timely and fully remediate, and present no aggravating circumstances will receive a declination (rather than a presumption of a declination).

Notably, the revised CEP has updated the definition of a voluntary self-disclosure, making it easier to qualify

- A disclosure is voluntary as long as the company has no preexisting obligation to disclose the misconduct to the DOJ (under the prior version, disclosure was not considered voluntary if there was a preexisting obligation to disclose to any regulator or enforcement agency).

- A disclosure does not need to include "all relevant facts and evidence about all individuals involved in or responsible for the misconduct at issue."

- Based on a recent "temporary" amendment to the CEP, if a whistleblower makes both an internal report to the company and a submission to the DOJ, the company will qualify for a presumption of declination if it: (i) self-reports the conduct to the DOJ within 120 days of receiving the submission, even if the whistleblower reports to the DOJ before the company does; and (ii) meets the other requirements for voluntary self-disclosure and presumption of a declination under the policy

Part II – "Near Miss" Self-Disclosures or Aggravating Factors. If a company fully cooperates and timely and appropriately remediates, but is otherwise ineligible for a declination because it self-disclosed after the DOJ had independently learned of the misconduct (referred to as a "near miss" selfdisclosure in the CEP) or voluntarily self-disclosed but aggravating factors warranting a criminal resolution are present, the company is still eligible to receive greater benefits than those offered under the prior version of the CEP.

Moving forward, such companies will be eligible for: (i) an NPA (rather than a Deferred Prosecution Agreement or an NPA); (ii) a resolution term of less than three years (rather than a fixed term of three years); (iii) a 75% reduction off the low end of the U.S. Sentencing Guidelines ("USSG") fine range (rather than a 50% to 75% reduction off the low end of the USSG fine range); and (iv) no independent compliance monitor (rather than a statement that the DOJ "generally" will not require a monitor).

Part III – Companies Not Eligible for a Declination or an NPA. For companies that do not voluntarily self-disclose or fail to meet the other factors described in the CEP—and thus are not eligible for a declination (Part I) or an NPA with a reduced term (Part II)—DOJ prosecutors maintain discretion to determine the appropriate form, term length, compliance obligations, and monetary penalty for the corporate resolution. Prosecutors can recommend a fine reduction up to 50%, with a presumption that the reduction will be taken off the low end of the USSG range for companies that fully cooperate and appropriately remediate.

FAIRNESS: REAFFIRMED COMMITMENT TO PROSECUTING CULPABLE INDIVIDUALS

Invoking the "fairness" principle, the Memorandum reaffirmed that "the Department's first priority is to prosecute individual" executives, officers, or employees. It notes that prosecutions of individuals, coupled with civil and administrative remedies directed at corporations, are often sufficient to address misconduct and protect U.S. interests.

Consistent with prior Criminal Division memoranda, DOJ prosecutors are instructed to:

- Focus on culpable individuals, including senior-level personnel;

- Document and credit corporate cooperation that identifies all individuals involved; and

- Decline or defer charging decisions against the company where individuals can be held accountable and the corporate remediation is adequate.

EFFICIENCY: MANDATE TO STREAMLINE CORPORATE INVESTIGATIONS

The Memorandum also lays out reforms intended to prevent Criminal Division investigations from being overly costly and intrusive for businesses, investors, and other stakeholders. These reforms indicate that moving forward, the Criminal Division's prosecutors will be encouraged to expedite investigations, more quickly reach charging decisions, and resolve current investigations.

To help implement this mandate, Criminal Division prosecutors must now:

- Track investigative milestones with Main Justice oversight;

- Justify extensions beyond standard timelines; and

- Prioritize early identification and seizure of assets tied to the alleged offense.

It is reasonable to expect that these measures will push DOJ prosecutors to conduct and resolve corporate criminal investigations more quickly, and provide corporate counsel with a stronger basis to advocate for the earlier termination of investigations that may have proceeded under prior DOJ policy

EFFICIENCY: NARROWLY TAILORED USE OF MONITORS

The Memorandum expressed concern that unrestrained monitors can burden companies that are already committed to compliance and self-improvement. To address these concerns, the Criminal Division announced in an accompanying Memorandum on Selection of Monitors in Criminal Division Matters that monitorships will be rarer and more tightly scoped, and used only when the Criminal Division deems them "necessary."

When deciding whether to impose a monitor, prosecutors must assess whether the benefits outweigh the costs, taking into account the severity of misconduct, risk of recurrence of criminal misconduct that could impact U.S. interests, existing regulatory oversight, maturity of the company's compliance program at the time of resolution, and whether the company took appropriate action against culpable employees.

If a monitor is imposed, the Criminal Division will be mindful of key safeguards to ensure that the monitorship is appropriately tailored and focused. Those safeguards include mandatory fee caps; DOJ-approved budgets; and biannual tripartite meetings among the DOJ, the monitor, and the company to ensure alignment on goals and cost control.

Separately, the Criminal Division is evaluating ongoing monitorships to determine whether they are imposing unwarranted expense or unnecessarily interfering with the monitored company's business. Indeed, thus far in 2025, the Criminal Division has terminated two FCPA monitorships.

KEY TAKEAWAYS

- The DOJ's announcements align with this administration's "America First" agenda and signal that the department's investigation and prosecution of white-collar crimes will prioritize enforcement against those who harm U.S. government programs, U.S. citizens and interests, and U.S. investors and markets.

- The path to receiving a declination still leaves prosecutors with significant discretion. Therefore, companies considering whether to voluntarily self-disclose suspected corporate misconduct must carefully weigh the pros and cons of self-disclosure, including the incentives provided by the new policy, as well as potential collateral consequences of self-disclosure, such as civil litigation, parallel investigations by other enforcement authorities (including authorities in foreign jurisdictions, where applicable), regulatory actions based on the underlying conduct, and reputational harm.

- The Criminal Division plans to concentrate resources on conduct that threatens U.S. economic or national security interests, including sanctions evasion, cartel facilitation, international money laundering, and bribery that harms U.S. competitiveness. Companies should consider reassessing their risk profile and compliance programs in light of the newly-articulated enforcement policies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]