- within Criminal Law topic(s)

- in South America

- with Senior Company Executives, HR and Inhouse Counsel

- in South America

- with readers working within the Healthcare and Pharmaceuticals & BioTech industries

In a speech on May 12, 2025, the Head of the Department of Justice's (DOJ) Criminal Division, Matthew Galeotti, announced changes to three DOJ policies. These changes are designed to provide companies with greater assurances that their cooperation with the Government will be rewarded. At the same time, the DOJ emphasized that it will continue to focus its efforts in certain areas, including healthcare fraud and trade and customs fraud.

The revisions affect three Criminal Division corporate enforcement policies: (1) the Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP), (2) the Monitor Selection Policy, and (3) the Corporate Whistleblower Awards Pilot Program.

The revised CEP now guarantees declination for companies that meet the DOJ's requirements for voluntary self-disclosure. The CEP further clarifies that companies that self-disclose after — unbeknownst to them — the DOJ is already aware of the criminal misconduct, remain eligible for a non-prosecution agreement (NPA) of less than three years, a 75% reduction in criminal fines, and no monitor. As Galeotti said, the "key here is self-disclosure."

These policies, as enacted by the Biden Administration, had often been criticized for failing to provide adequate assurances to companies that their cooperation and self-disclosure would be adequately rewarded. The recent revisions — according to the DOJ — aim to change that.

Along with the revamped policies, the Criminal Division unveiled its White-Collar Enforcement Plan, which outlines the DOJ's enforcement priorities regarding the prosecution of corporate and white-collar crimes. Areas of focus for this DOJ include fraud perpetrated against U.S. individuals, fraud against the Government, and exploitation of the U.S. financial system. More specifically, the Plan directs the DOJ to prioritize investigations and prosecutions of health care fraud, trade and customs fraud, elder securities fraud, and money laundering and terrorist/transnational criminal organization (TCO) financing.

Corporate Enforcement and Voluntary Self-Disclosure Policy Changes

The DOJ announced changes to the CEP, which was revamped under the last administration to incentivize self-disclosure of corporate misconduct. Galeotti acknowledged that further revisions were necessary to clarify when companies can expect to receive a declination and streamline the process for doing so if companies promptly self-disclose corporate misconduct.

Part 1: Voluntary Self-Disclosure Leads to Declination under the CEP

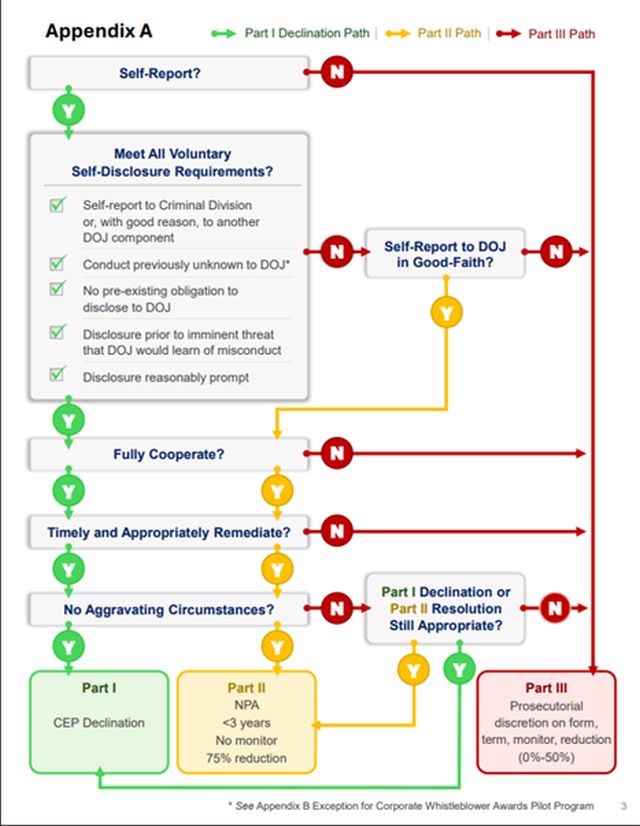

The revised CEP provides that when companies (1) voluntarily self-disclose misconduct to the Criminal Division, (2) fully cooperate with the Criminal Division, (3) timely and appropriately remediate, and (4) have no aggravating circumstances, they will receive a declination—not just a presumption of declination as outlined in the previous version of the CEP.

There are several voluntary self-disclosure requirements including that: (1) the company must self-report to the Criminal Division, or, with good reason, to another DOJ component; (2) the misconduct is not previously known to the DOJ; (3) the company had no preexisting obligation to disclose the misconduct to the DOJ; (4) the company's voluntary disclosure occurred prior to imminent threat that DOJ would learn of misconduct; and (5) the company disclosed the conduct with a reasonably prompt time after becoming aware of the misconduct.

If there are aggravating circumstances (like a prior criminal resolution of the involvement of high-level management), prosecutors can still recommend a declination based on the weight of the severity of those circumstances and the company's cooperation and remediation.

Part 2: Voluntary Self-Disclosures or Aggravating Factors Warranting Resolutions

The CEP Policy also addresses what occurs when a company fully and timely cooperates with the DOJ, but is ineligible for declination under Part 1. This could be because it acted in good faith by self-reporting the misconduct, but that self-report did not qualify as a voluntary self-disclosure (because, for example, a whistleblower had reported the conduct to the Government), or because it had aggravating factors that warrant a criminal resolution. Under these circumstances, the Criminal Division shall:

- Provide an NPA term of less than 3 years;

- Not require an independent compliance monitor; and

- Provide a reduction of 75% off the low end of the criminal fine range.

This eliminates the "extraordinary cooperation" and "immediate self-disclosure" requirements under the previous CEP, both of which left considerable discretion to prosecutors and left companies in the dark as to whether the burden of disclosure was worthwhile.

Part 3: Resolutions in Other Cases

Lastly, if the company is not eligible for remedies under Parts 1 or 2, prosecutors will maintain discretion to determine the appropriate resolution, including form, term length, compliance obligations, and monetary penalty. With respect to the monetary penalty, the company will not receive, and the Criminal Division will not recommend to a sentencing court, a reduction of more than 50% of the fine.

Prosecutors will have discretion to determine the specific percentage reduction, but there will be a presumption that the reduction will be taken from the low end of the U.S.S.G. range for companies that fully cooperate and timely and appropriately remediate. Otherwise, prosecutors will determine the starting point in the range based on the particular facts and circumstances of the case, including, but not limited to, the company's recidivism.

The Criminal Division published a flow chart and supporting materials to aid companies in understanding the benefits of these revised self-reporting methods:

Monitor Selection Policy Changes

Galeotti's announced changes to the Monitor Selection Policy clarify the factors prosecutors must consider to impose a monitor. These changes also narrow and tailor the scope of the monitor's mandate. Going forward, Galeotti stated that there would be a reduction in monitorships and that pre-existing monitorships will be reviewed in an effort to either narrow the scope or terminate the monitorship.

Under the updated policy, Galeotti stated that the benefits of the monitor should outweigh its monetary costs and the burden on the business's operations, and these costs must be proportionate to the severity of the underlying conduct, profits of the company, and the company's present size and risk profile. The prosecutor will consider the following factors:

- The nature and seriousness of the conduct, and the risk that it will happen again;

- The availability of other effective independent government oversight, such as regulator oversight;

- The company's compliance program and culture of compliance; and

- The maturity of the company's controls and the ability of the company to test and update its compliance program.

Ultimately, the new policy seeks to align the DOJ, the monitor, and the company to bring the company back into good standing and prevent future misconduct. The DOJ will also implement a fee cap, approve budgets for all workplans, and require biannual meetings between the DOJ, the monitor, and the company to ensure that the monitorship costs are proportionate to the underlying criminal conduct, the company's profits, and the company's size and risk profile.

Corporate Whistleblower Awards Pilot Program Changes

Finally, Galeotti announced changes to the DOJ Corporate Whistleblower Awards Pilot Program, which was introduced in March 2024 to pay monetary awards to individuals who provide information or assistance leading to civil or criminal forfeitures regarding certain criminal misconduct. The Criminal Division expanded priority areas for tips to include:

- Procurement and federal program fraud;

- Trade, tariff, and customs fraud;

- Violations of federal immigration law; and

- Violations involving sanctions, material support of foreign terrorist organizations, or those that facilitate cartels and TCOs, including money laundering, narcotics, and Controlled Substances Act violations.

The CEP Policy provides an exception for the DOJ Corporate Whistleblower Awards Pilot Program where if the whistleblower makes both an internal report and a submission to the Criminal Division, the company will qualify for a presumption of declination under the CEP, provided the company self-reports the conduct to the DOJ within 120 days after receiving the whistleblower's internal report, and meets the other requirements for voluntary self-disclosure and presumption of a declination under the policy.

Key Takeaways

The Criminal Division's new policy changes represent a shift in its approach to white-collar criminal enforcement. They (1) provide companies with greater transparency around the benefits of self-reporting and cooperation, (2) narrow the use of compliance monitors, and (3) expand areas of interest for corporate whistleblowers. These are meaningful changes in the corporate enforcement arena that companies should heed while assessing their compliance programs and future corporate misconduct.

At the same time, the DOJ made clear that it will continue to aggressively enforce the law in certain areas, including healthcare fraud and international trade compliance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.