- within Corporate/Commercial Law topic(s)

- in European Union

- in European Union

- in European Union

- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

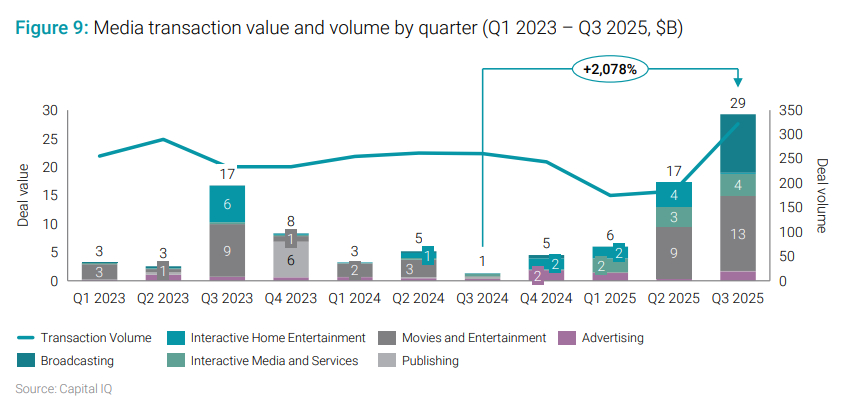

Last year in this report, we predicted that media M&A activity would rebound in 2025, driven by reduced regulatory scrutiny and lower capital costs that would improve conditions for dealmaking and fuel additional spinoffs of cable assets.

Despite a slow start to 2025, this prediction has proven accurate. In Q3 2025, we saw closed transaction value increase by more than 2,000% compared to Q3 2024, led by media holding company mega mergers and cable TV carve-outs.

Despite a slow start to 2025, this prediction has proven accurate. In Q3 2025, we saw closed transaction value increase by more than 2,000% compared to Q3 2024, led by media holding company mega mergers and cable TV carve-outs.

Adapting to a new economic normal

After years of elevated interest rates, Goldman Sachs expects the U.S. Federal Reserve to deliver three 25-basispoint interest rate cuts by the end of 2025 and two more in 2026. This would drop the terminal rate to between 3% and 3.25%, down from the current 4.25% to 4.50% level.

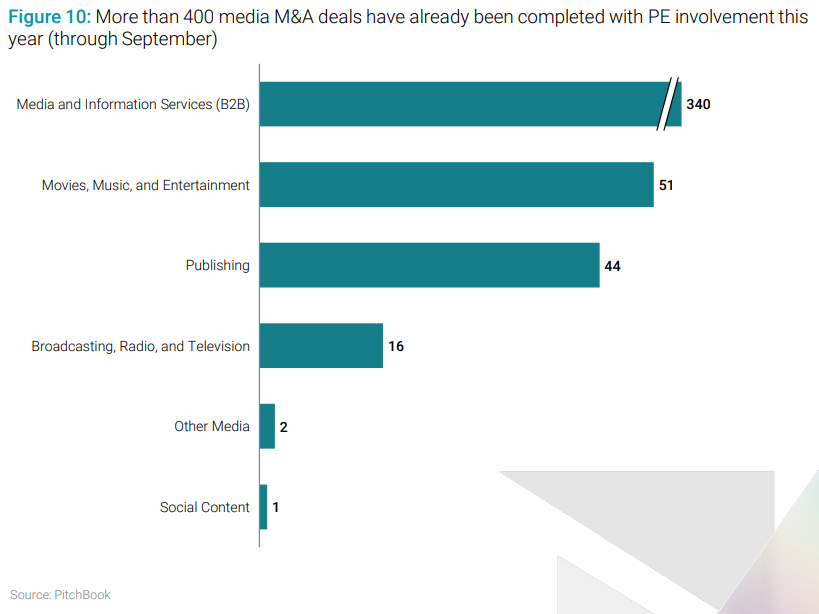

This, plus PE's heavy existing involvement in media deals, positions the sector for heightened activity in the year to come. If companies don't move on their targets now, their competitors or financial buyers will. It will be critical for media firms to survey the market, conduct due diligence, and execute transactions.

Ask for forgiveness, not permission

In July, a federal appeals court struck down the FCC's prohibition on entities owning more than one of the top four TV stations in a single market. As such, local news and national networks are vying for dominance via now-legal transactions, shaking up linear TV in an M&A-driven atmosphere that we predict will persist throughout 2026.

Recently, Sinclair offered to merge its broadcast TV business with rival Tegna in August, right after another rival, Nexstar, agreed to buy Tegna for $6.2 billion. The Tegna-Nexstar deal originated under the assumption that it would be allowed following regulatory shifts, indicating a more aggressive stance on regulatory compliance to come.

Clearly, this is an environment ripe for dealmaking, and as of March, global private equity firms held more than $500 billion in uninvested capital from funds closed in 2020 and 2021. We expect large companies to evaluate their assets and consider carveouts to take advantage of buyer and PE demand— especially around assets that would add value to PE firms' linear TV portfolios.

Higher deal volume, smaller technology-centric deals

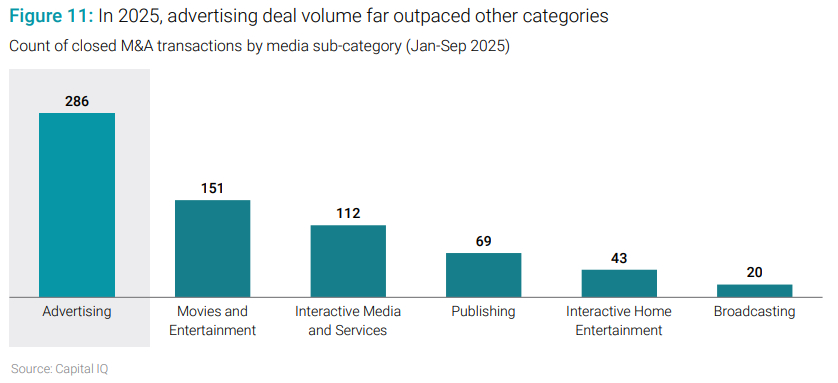

The rapid advances of AI, coupled with shifts in media consumption trends, will drive more deals in 2026 than we saw in 2025, but deals will be smaller in size as media and entertainment companies look to acquire assets that boost their technology and advertising capabilities to compete in a new information age.

Looking at the first eight months of 2024 vs. 2025, advertising transactions far outpaced other media subcategories, indicating an opportunity for industry players to augment their ad offerings via M&A rather than in-house. We expect acquirers to prioritize transactions that offer AI capabilities around ad targeting, content automation, and workflow efficiency to stay ahead of competitors aiming to do the same.

Major media companies that have already earmarked budget for AI include:

WPP Group, which announced £300 million annually for AI. In the near term, the money will go to providing additional funding for Stability AI and the acquisition of InfoSum, which will allow the media conglomerate to integrate GenAI and data collaboration tools into its tech and customer service stacks.

Publicis Group, which allocated €900 million in 2025 for strategic acquisitions to bolster its CoreAI platform.

Reuters, which has committed $200 million annually to AI development. This comes after an initial $100 million investment in AI from the news organization after ChatGPT launched in 2022.

If media companies aren't building AI capabilities now, they'll be forced to catch up later. That's why in 2026, these transactions will accelerate.

For media companies, that means the time is now to determine your role as a buyer or a seller and prepare accordingly. Whether you're identifying targets or positioning your company as an attractive asset, the second wave of media M&A is here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.