- within Corporate/Commercial Law topic(s)

- with readers working within the Banking & Credit, Business & Consumer Services and Retail & Leisure industries

- within Litigation and Mediation & Arbitration topic(s)

Key Findings

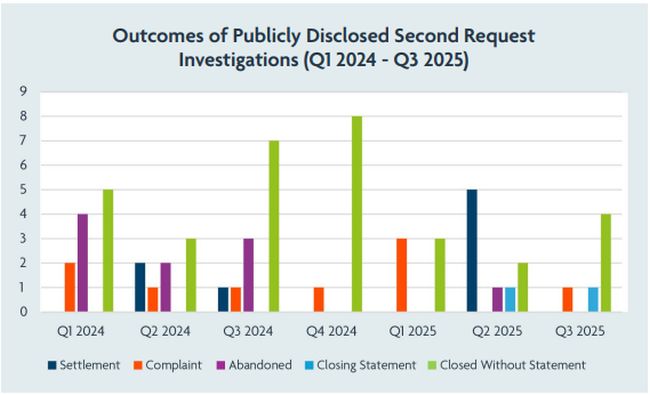

- The most common outcome for Second Request investigations that closed in Q3 2025 was no agency action at all. The U.S. antitrust agencies only announced outcomes for two investigations: one complaint and one closing statement. But at least four other Second Request investigations previously disclosed by the parties closed quietly without any agency statement.

- The low proportion of agency-reported Second Request investigation outcomes this past quarter is consistent with the practice from the Biden administration in which agency statements covered an increasingly small share of Second Request investigations. New data in the agencies' latest HSR Report to Congress for FY 2024 confirms that trend and highlights the importance of looking beyond agency press releases to get a better view of Second Request investigation activity.

- The absence of any merger settlements in Q3 2025 is somewhat curious after merger settlements made up 83% of outcomes announced by the agencies in Q2 2025 but, overall, consistent with the Trump administration's pro-business philosophy. Yet statements from agency leadership continue to support and even encourage pragmatic merger settlements.

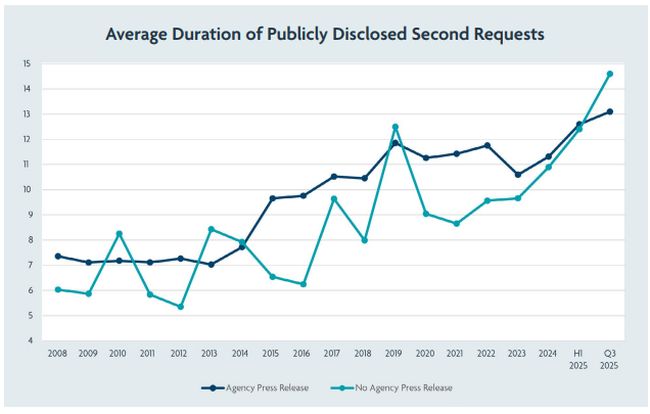

- Similarly, all but one of the Second Request investigations that closed without any agency statement in Q3 2025 were above 12.5 months. These observations align with our finding that investigations that do not result in enforcement actions increasingly have timelines close to those that do. Indeed, for Q3 2025, the average duration of investigations that closed without any agency action was a staggering 14.6 months— above the average for matters that resulted in enforcement. This higher average reinforces the importance of negotiating sufficient time in definitive papers to account for the duration of investigations.

Introduction

Since the outcomes of many Second Requests are frequently not publicly reported by the agencies as they occur, it is important to look beyond agency press releases when evaluating Second Request investigation activity

Agency statements about Second Request investigations were few and far between this past quarter even though many transactions that received Second Request investigations closed. By our count, at least six Second Request investigations closed in Q3 2025, but agency press releases only covered two: one complaint and one closing statement. By contrast, after stealing the show with 83% of all agency announcements last quarter, merger settlements were nowhere to be seen.

The second closing statement released by this administration, of course, continues a notable shift from the last administration, which did not issue a single closing statement for any transaction. That this second closing statement was issued by the U.S. Department of Justice (DOJ) is also notable since the first closing statement came from the Federal Trade Commission (FTC) last quarter. Now both agencies have signaled a return to this practice, which provides valuable insight into agency thinking.

Yet as we warned in our last Transparency In Merger Enforcement (TIME) Report for Q2 2025, "[G]aps remain in the agencies' merger enforcement record." Those gaps widened over the last quarter. By our count, agency press releases only covered one-third of publicly disclosed Second Request investigations that concluded in Q3 2025. The upside is that the remaining transactions each closed and, presumably, received unconditional clearance from the agencies. The downside is that all but one of those investigations had extremely long timelines, with an average well above the average for outcomes announced by the agencies. And, as discussed in our report, the sole exception also is an important data point.

Findings By Outcome

Second Request outcomes were largely positive over the past quarter. But you will not find much of that information if you only look at agency press releases.

The relative silence from the agencies on Second Request investigations this past quarter left us triple checking agency websites, but we believe we have it right: the agencies only announced outcomes for two Second Request investigations in Q3 2025 (one at each agency). This is a sharp decline from last quarter, when the agencies announced outcomes for six transactions. And in stark contrast with last quarter—when 83% of merger agencyannounced outcomes were pre-litigation settlements—none of the announced outcomes were settlements. Instead, the FTC issued its second complaint under Chair Ferguson, and DOJ issued its first closing statement since July 2020.

As shown below, however, a closed investigation with no agency press release was the most common outcome observed in Q3 2025. By our count, at least four additional transactions subject to Second Request investigations disclosed by the parties themselves closed in Q3 2025 without any agency statement. All four investigations were conducted by DOJ rather than the FTC.

This result—with no agency statement as the most common outcome—feels a bit like a return to the last administration from a transparency perspective. But there are important differences, including the return of closing statements and a drop in transactions reportedly abandoned because of agency investigation.

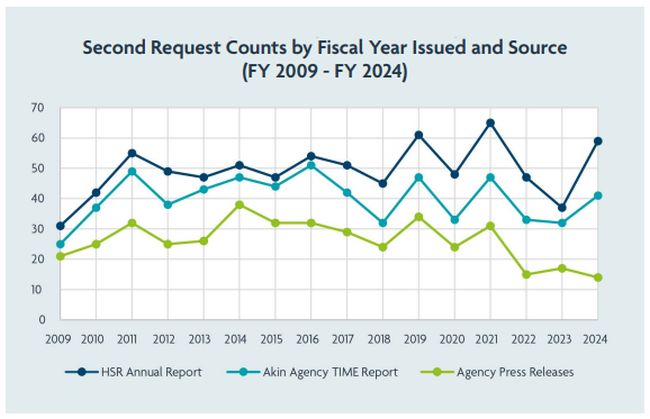

While our data on the concluded Second Request investigations that are not included in agency press releases necessarily relies on public sources other than agency materials, our findings have been directionally confirmed by the agencies' public reporting to Congress. On September 17, 2025, for example, the agencies released their latest Hart-Scott-Rodino Annual Report to Congress for Fiscal Year (FY) 2024 (the HSR Report), which showed a dramatic, nearly 60% jump in Second Requests issued between FY 2023 (37 Second Requests) and FY 2024 (59 Second Requests). As shown below, our data showed a similar spike in Second Request activity for FY 2024, even as agency press releases may have convinced some that Second Request investigation activity had reached a low tide in 2024.

As the chart above demonstrates, if anything, our data underreport the number of Second Request investigations that closed without any agency press release or formal action. Our data only include about 70% of Second Requests issued in FY 2024, down from 86% of Second Requests in FY 2024. By contrast, agency press releases covered less than 25% of Second Requests issued in FY 2024—or just a third of the Second Request investigations we found after investigating public sources. Those numbers might be seen as the canary in the coal mine when it comes to agency transparency, showing how rare agency reporting of Second Request investigation outcomes has become in recent years. Here it is important to keep in mind that these figures cover the last full fiscal year of the prior administration, not the current administration.

Because the agencies are bound by strict confidentiality obligations under the HSR Act, some transactions will naturally fly under the radar and not be captured in our data. Not all Second Request investigations are publicly disclosed by the parties. But the gap between what the agencies disclosed versus what the parties disclosed is surprisingly large. In FY 2024, for example, agency press releases covered less than 34% of Second Request investigations that were publicly disclosed by the parties. Similarly, in Q3 2025, agency press releases also covered less than 34% of Second Request investigations that were publicly disclosed by the parties. This drop in transparency was a change from the first half of 2025—when agency press releases covered about 60% of publicly disclosed Second Request investigations—but only time will tell whether this is a new trend.

Findings By Duration

Despite largely positive outcomes, timelines for concluded Second Request investigations remain elevated. Parties should account for these durations as they allocate risk in definitive documents.

Our last three reports highlighted the convergence between the duration of agency-announced merger enforcement actions and the duration of Second Request investigations that concluded without any announcement. Last quarter, we reported that the average duration observed for a Second Request investigation hovered around 12.5 months in the first half of 2025. But at that time, there was also considerable variation around the mean. For example, the average duration of a DOJ Second Request investigation that closed in Q2 2025 was a jaw-dropping 17.4 months, while the average duration of an FTC Second Request investigation was 10.6 months.

For agency announced outcomes, the gap between the agencies narrowed considerably in Q3 2025. The sole outcome announced by DOJ—a closing statement—followed an investigation lasting 13.6 months, while the only outcome announced by the FTC—a complaint—followed a 12.6-month investigation. Both results are well above the historical average duration for Second Request investigations. But both durations still fall short of the 14.6-month average duration for Second Request investigations that ended in a closed transaction with no agency announcement.

Keep in mind, however, that all four Second Request investigations that concluded without any agency announcement were conducted by DOJ, so the apparent narrowing of the gap between agency durations may not tell the full story. DOJ Second Request investigations, on average, are still taking longer than their FTC counterparts after considering Second Request outcomes not announced by the agencies. In fairness to DOJ, however, the agency did conclude one Second Request investigation in just 8.4 months in Q3 2025, which was the shortest investigation for the quarter and the only investigation in our data from either agency that fell below 12.5 months over the same period.

Conclusion

The relatively low number of concluded Second Request investigations announced by the U.S. antitrust agencies in Q3 2025 masks substantial activity that went unreported by the agencies—including warning flags about creeping investigation timelines.

Most of this unannounced activity occurred at DOJ. Indeed, in addition to its first formal closing statement in five years, DOJ appears to have quietly closed out at least three additional Second Request investigations held over from the last administration, pushing average Second Request investigation durations upwards. Yet DOJ also concluded one additional matter in a brisk 8.4 months, demonstrating that getting a deal through the Second Request process is possible in shorter periods, too.

While the agencies announced no merger settlements last quarter, we would not read too much into that outcome. After all, the most common result announced by the agencies in Q2 2025 was a settlement, and both FTC and DOJ leadership continue to emphasize the value of real, meaningful settlements. FTC Chair Andrew Ferguson has even encouraged parties to "come work with us" on remedies (and sooner rather than later).

Looking forward, we expect shorter timelines to return once the backlog of matters from the last administration clears. Indeed, our data on outstanding Second Request investigations suggest that DOJ may be getting to that point already. Nevertheless, parties planning significant merger activity that could be subject to a Second Request would be wise to budget at least 10-12 months to reach a decision and an additional 5-8 months to defend the transaction in court, if necessary. Although these timelines are long, even achieving clearance without litigation took more than 12.5 months for most Second Request investigations that concluded in Q3 2025. Planning for sufficient time can be a key differentiating factor between a successful closing and an abandonment for transactions that can achieve clearance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]