- within Corporate/Commercial Law topic(s)

- in Asia

- within Compliance topic(s)

Mergers and acquisitions (M&A) often promise the power of scale, expanded market reach, and a competitive edge. However, strategies that appear promising in a due diligence process or a financial deck are often fraught with unexpected complexities in execution. Beneath the surface lies a challenging reality: anticipated selling, general, and administrative (SG&A) cost synergies from M&A activity are often unrealized or lead to an even higher cost structure.

Ankura Office of the CFO® conducted an analysis on Strategy and Performance (S&P) 500 companies that engaged in M&A activities in 2021 and evaluated the SG&A cost structure over the following two years. The results are mixed — while some companies managed to slightly reduce their SG&A costs as a percent of revenue, others experienced notable increases. This trend challenges the traditional theory that M&A naturally drives cost savings and earnings before interest, taxes, depreciation, and amortization (EBITDA) margin improvements. Instead, the analysis reveals that SG&A expenses often rise, complicating the quest for cost efficiency.

M&A remains a powerful tool for growth, but realizing its full potential requires a strategic approach that transcends merely acquiring or adding two companies together. The key to success lies in effective integration management, where proactive planning and execution are paramount.

Ankura's Analysis: Market Dynamics

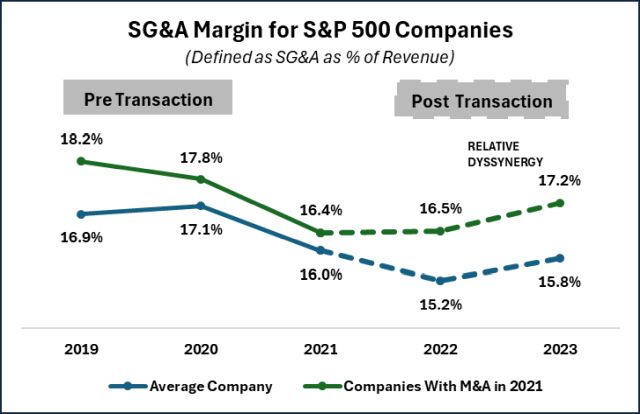

In Ankura's analysis, we examined the SG&A expenses as a percentage of revenue (SG&A margin) for the S&P 500 from 2021 to 2023. This period provides a comprehensive view of the financial performance before and after any major transactions.

Over the period studied, the average SG&A margin for companies in the S&P 500 decreased by 19 basis points to 15.8%, a favorable improvement overall. In contrast, S&P 500 companies that engaged in M&A saw their SG&A margin rise by 76 basis points to 17.2%. While it is common for companies to have transitory deal-related costs in the periods surrounding the transaction, the analysis indicates that the higher costs often become embedded in the cost structure. This disparity highlights a concerning trend: the average company without M&A experienced an overall decrease in SG&A margin, whereas a company that engaged in M&A saw a sustained increase in SG&A margin, which is counter to the desired M&A outcome.

This insight underscores the importance of strategic planning in managing SG&A costs during M&A transactions. As companies navigate the complexities of merging operations and cultures, the risk of expenses escalating is ever-present. Without careful management, the potential for cost overruns or duplicated costs can threaten the anticipated benefits of M&A.

Achieving M&A SG&A Synergies

To achieve SG&A synergies, the first step is optimizing enabling functions (e.g. finance, procurement, human resources (HR), information technology (IT), operations, marketing, legal, etc.) and respective back-office processes. Functions that are technology-enabled and asset-light can serve as a platform for efficient growth and smooth transactions. By eliminating redundant costs, minimizing stranded costs, and converting fixed to variable costs where possible, management can enable the business to efficiently scale and transform. Decisive planning and action are crucial to prevent the lagging impact of increased costs that often follow acquisitions.

Factors Enabling M&A Synergy Achievement Include:

- Effective Project Planning and Management: Establish a structured integration approach and strategically align all aspects of the transaction. Use project management and planning tools that enable real-time tracking, collaboration across teams, and executive-level reporting.

- Teams-Based Approach: Engage all stakeholders, including external partners, in the integration process to maintain effective communication and organizational alignment. Align the integration operating structure and establish a meeting cadence with a group of attendees that strikes a balance between tactical execution and governance.

- People, Process, and Technology: Develop specific plans for each of these areas to ensure a comprehensive integration strategy. Focus on the cross-functional processes at the intersection of finance, IT, and operations, as these are high-risk areas.

- Proactive Synergy Tracking: Regularly monitor and measure the benefits and outcomes of synergy initiatives to ensure they are on track and delivering the expected value. Assign owners and key performance indicators (KPIs) to synergy initiatives to increase accountability and governance over outcomes.

Factors Undermining M&A Synergy Achievement Include:

- Neglecting corporate functions that are critical for seamless integration. While corporate functions are not normally a focal point of integration, operational pain points can snowball into significant disruption for these key areas. It is critical to have a plan for corporate functions to de-risk a transaction.

- Delaying integration efforts, leading to costly reconfigurations at a later date. Nonessential integrations are often deprioritized, pushed back until after the transaction is complete, and often forgotten about — leading to unnecessary or duplicated costs. Instead, deprioritized activities should be documented with a clear timeline to integrate post-transaction

- Over-extending resources on maintaining operations instead of focusing on synergy realization and system integration. Solving problems or challenges with headcount or brute force rather than streamlining processes and leveraging technology can lead to greater cost burdens and heavier reliance on people. This results in a business that is less nimble in adapting to changing business conditions and has higher fixed costs.

- Disregarding succession planning for legacy leadership. Keeping former leaders around longer than necessary can undermine leadership's ability to lead, impede cost reduction, result in inconsistent messaging, and cause delays in decision-making.

How Ankura Can Help

Ankura offers support to companies navigating the complexities of M&A. Merging or acquiring businesses frequently exposes inefficiencies, creates redundancies, and leads to increased costs, which defies the intention of the transaction. Ankura's clients have faced similar challenges, and — through our expertise and partnership — have successfully realized their value-creation ambitions. Ankura assists companies in developing strategies to manage, reduce, or adjust these costs effectively. Ankura also approaches these efforts as tactical change agents and collaboratively manages through the complexity of transactions and transitions. Ankura support includes:

- Designing future state processes and organization structure that are right-sized for the newly formed company

- Developing integration plans to drive the future state operating model

- Implementing effective project planning through digital project management tools

- Implementing zero-based budgeting analytics to mitigate duplicated costs and eliminate stranded costs

- Ensuring cultural and organizational alignment

- Establishing KPIs that reflect the success of synergy initiatives, utilizing interactive dashboards that provide real-time visibility into these metrics, and advising on courses of action to adjust activities or strategy as necessary

- Exploring shared services, business process outsourcing (BPO), or technology enablement

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]