- in United States

- within Wealth Management, Tax and Criminal Law topic(s)

- in United States

- with readers working within the Banking & Credit industries

Key Facts

United States

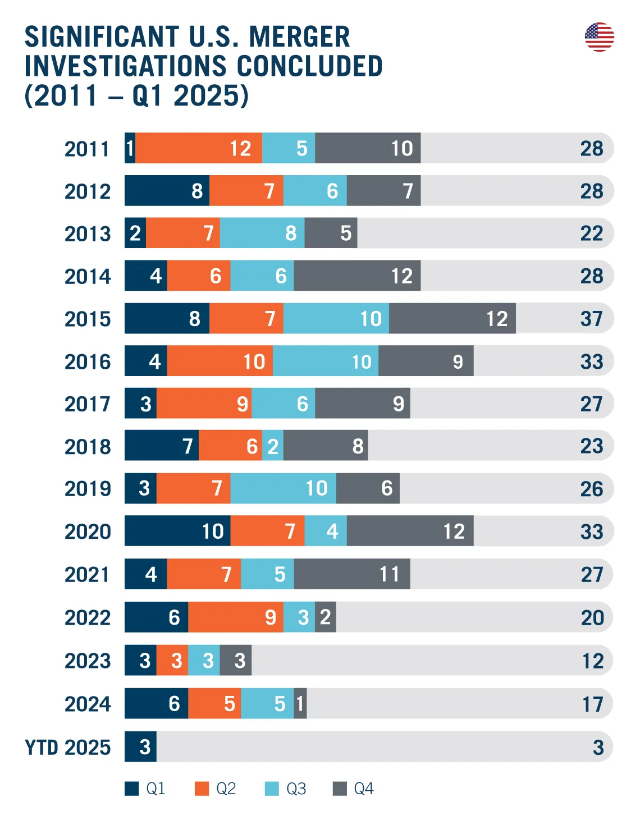

- Only three significant U.S. merger investigations concluded in Q1 2025 during the presidential transition. All three resulted in a complaint seeking to block the merger, including two under the new Trump administration.

- The number of significant U.S. merger investigations concluded in Q1 2025 was similar to the number concluded during the presidential transitions in Q1 2017 and Q1 2021. DAMITT data show that first quarters typically see light activity even in the absence of a change in administration.

- The average duration of a significant merger investigation ticked down slightly to 10.7 months in Q1 2025, compared to 11.3 months in 2024.

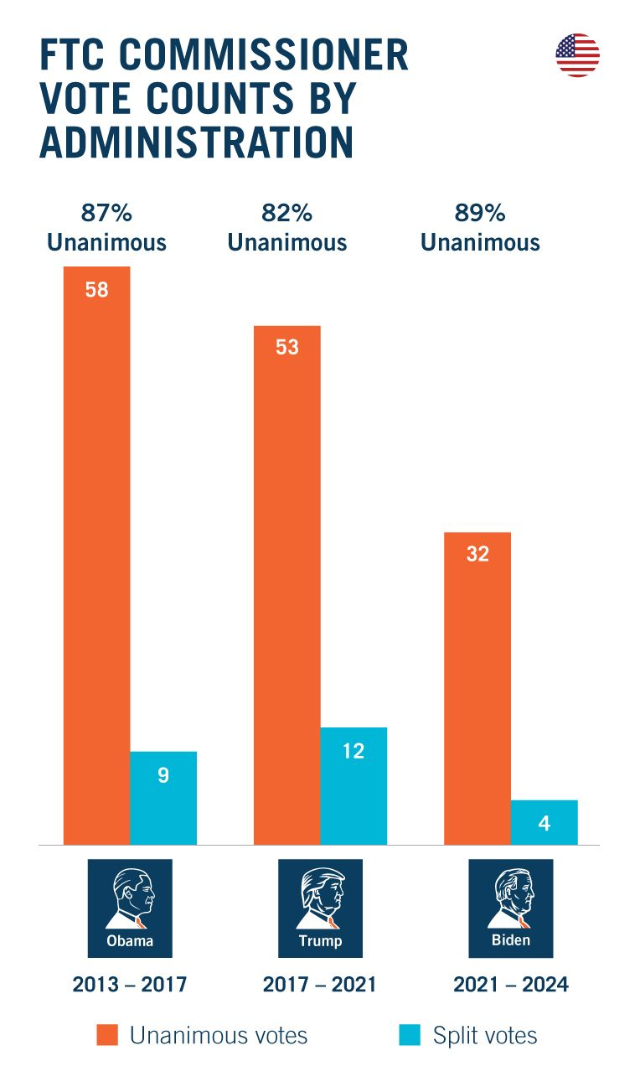

- New DAMITT analysis of FTC Commissioner votes from 2011 to 2024 shows political divisions appear to have had minimal impact on FTC merger enforcement decisions, with approximately 86% of the votes on U.S. significant investigations ending unanimously and only 6.7% strictly along party lines without bipartisan consensus.

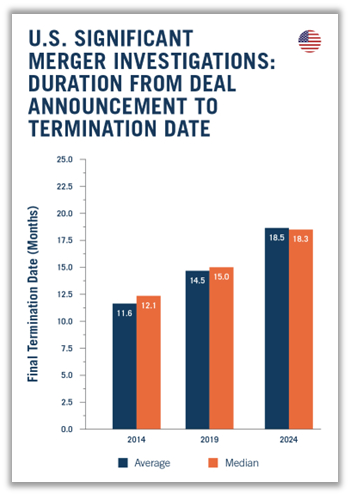

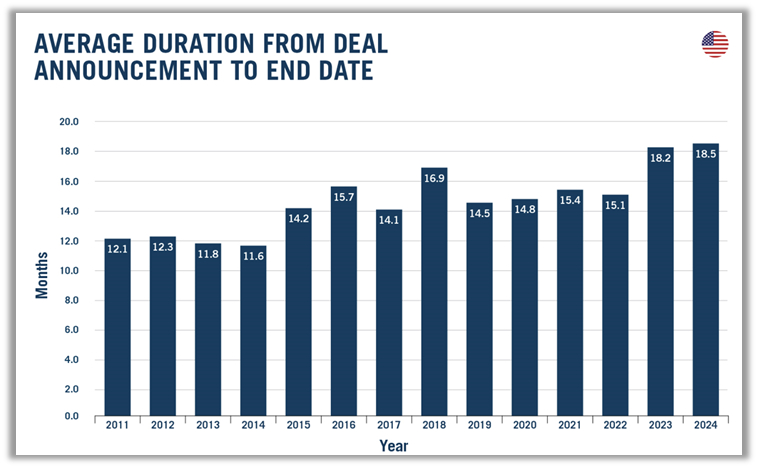

- Over the past decade, merging companies have been agreeing to increasingly longer final termination dates, reaching a record high of 18.5 months on average in 2024, steadily continuing to tick up from just 11.6 months in 2014 and 14.5 months in 2019.

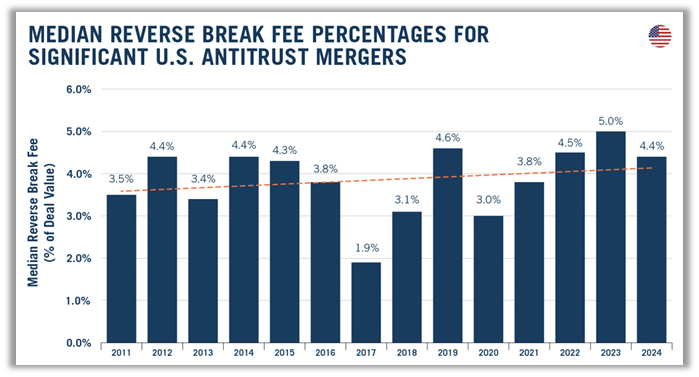

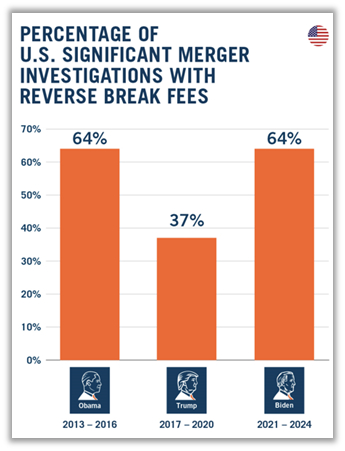

- While the median reverse break fee has remained steady between about 3-5% of the transaction value over the past decade, sellers seem to have negotiated reverse break fees more frequently during the Biden administration, potentially in response to the dearth of merger settlements and increased risk of terminated deals during the Biden era.

European Union

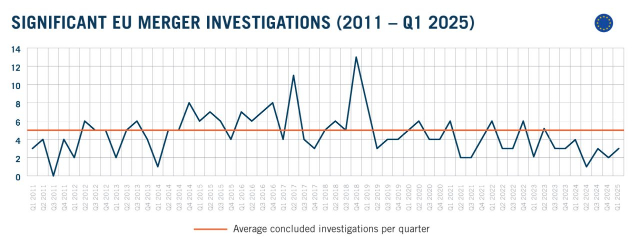

- The European Commission concluded only three significant merger investigations in Q1 2025 - all cleared in Phase I with remedies - marking the first Q1 without any Phase II decision since 2020.

- With this limited enforcement activity, the Commission starts 2025 on the same trend as 2024, when it concluded just 10 significant investigations overall, setting a new annual record low.

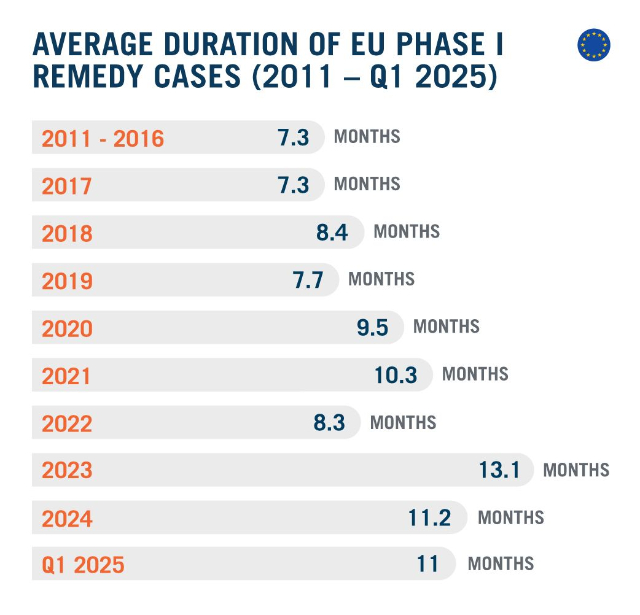

- At 11 months, the average duration of Phase I remedy cases in Q1 2025 remained notably above historical averages, and nearly four months above the average Phase I remedy duration observed between 2011 and 2019.

- All three Phase I remedy cases involved divestitures of standalone business operations, confirming the Commission's continued reliance on structural remedies.

- With no Phase II outcomes and only one Phase II investigation pending as of the end of Q1, the Commission's pipeline for significant investigations remains exceptionally thin.

United States

Few Significant U.S. Merger Investigations Concluded in Q1 2025 Amid Presidential Transition

The U.S. antitrust agencies concluded three significant merger investigations in the first quarter of 2025. This relatively low level of activity is consistent with the trend observed during previous presidential transitions. During President Trump's first transition in Q1 2017, only three significant merger investigations were concluded. Similarly, during President Biden's transition in Q1 2021, there were only four.

Historically, the first quarter in any year (even in the absence of a presidential transition) tends to see fewer concluded significant investigations than the rest of the year. On average, 4.9 significant investigations have concluded in the first quarter each year since 2011, compared to 7.6 in the fourth quarter—when many dealmakers and the agencies may be trying to hit year-end deadlines. Since DAMITT began tracking, the first quarter had four or fewer concluded significant merger investigations in 8 of the prior 14 years.

As DAMITT has cautioned before, the business community should not be tempted to interpret this low level of activity as indicative of future trends for an incoming presidential administration. During President Trump's first year in office, the U.S. antitrust agencies concluded nine significant merger investigations in Q2 2017, up from three in Q1 2017. Similarly, during President Biden's transition year, the number of significant merger investigations nearly doubled from four in Q1 2021 to seven in Q2 2021.

Significant U.S. Merger Investigation Activity is Expected to Increase in Upcoming Quarters

As we reported in our 2024 Annual DAMITT report, the first Trump administration completed substantially more significant merger investigations (109) than the Biden administration (77). If history repeats itself and volatility in the market cools, we anticipate a similar uptick in the number of significant merger investigations during Trump's second term compared to the level of activity under Biden. The current U.S. antitrust agency leadership is signaling continued close scrutiny of mergers. Unlike the agencies' approach under Biden, however, the incoming agency leadership has expressed "no ideological predisposition against merger and acquisition activity."

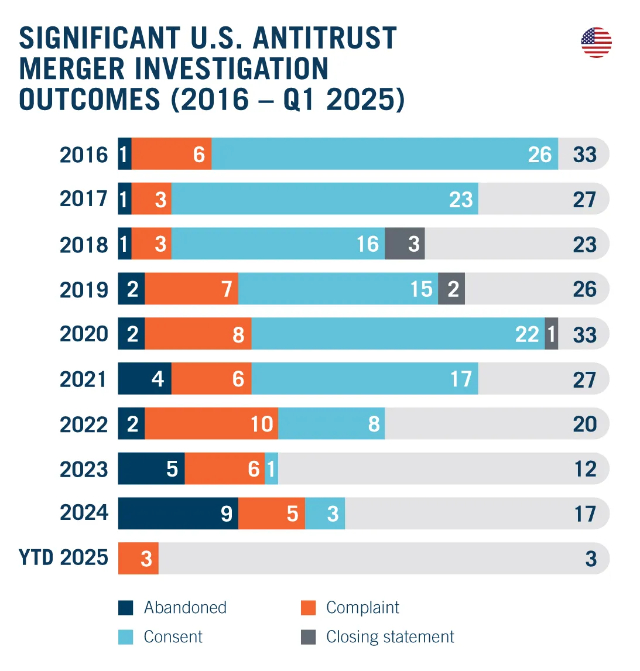

Of note, all three of the significant merger investigations concluding in Q1 2025 led to complaints rather than settlements, continuing the Biden administration's trend a relative increase in merger litigation. The complaint challenging Amex GBT's acquisition of CWT was filed in the waning days of the Biden administration. The other two complaints were initiated by the new Trump administration early in the transition. DOJ acted first, filing a complaint seeking to block Hewlett Packard Enterprise's acquisition of Juniper Networks in January 2025. Then-acting Assistant Attorney General (AAG) for Antitrust Omeed A. Assefi initiated the complaint before now-confirmed AAG Gail Slater took office. The FTC followed suit in March 2025, initiating a lawsuit to block GTCR BC Holdings, LLC's acquisition of Surmodics, Inc.

The Duration of Significant U.S. Merger Investigations Remains Elevated

The average duration of significant U.S. merger investigations concluded in Q1 2025 was 10.7 months, which was a decrease of about half a month compared to 2024. After ramping up from an average of 8.1 months between 2011-2016 to as high as 11.9 months in 2019, significant merger timelines have flattened or declined slightly. In recent years, merging companies have been less willing to agree to lengthy timing agreements, particularly where the agencies have been unwilling to agree to reasonably reduce the burden of Second Request investigations in exchange for more time.

Examining the data further, the average duration of significant merger investigations during Trump's first term was 11.2 months, compared to 11.4 months under Biden. The average time from deal announcement to a complaint was 10.9 months during Trump's first term, compared to 11.6 months during Biden's term.

A decrease in the average duration of significant merger investigations is welcomed by the business community. There is some hope that the new Trump administration will revisit previous initiatives to shorten merger reviews. Near the end of the first Trump administration, both the FTC Chair and head of DOJ's Antitrust Division cited DAMITT findings in announcing reforms to U.S. merger review. The second Trump administration has signaled it may head in a similar direction. During a recent TV interview, FTC Chair Andew Ferguson said if the FTC does not believe it will be able to show a merger is anticompetitive, "I'm going to get the hell out of the way."

The new Trump antitrust enforcers also endorsed a return to settlements to resolve any competition concerns in mergers. This change is a positive for merging companies as it could help increase closing certainty.

FTC Merger Voting Patterns Suggest Strong Bipartisan Consensus on Merger Enforcement Despite Broader Political Division

In an era marked by sharp political division, DAMITT has sought to empirically measure the impact of partisanship in FTC merger enforcement decisions. The FTC, traditionally comprised of a bipartisan group of five commissioners (with no more than three commissioners from a single party), publishes vote tallies for each significant merger investigation.

DAMITT's analysis of FTC votes from 2011 to 2024 reveals a remarkable level of consensus among FTC commissioners. Approximately 86% of the votes ended unanimously between 2011-2024. Of the 27 significant investigations (14%) ending with a split vote, the FTC majority was bipartisan 14 times (i.e., at least one Republican and one Democrat voted with the majority). Only 13 votes were strictly along party lines without any bipartisan consensus among voting commissioners, representing just 6.7% of the total votes during the overall period.

The trend of unanimous voting has remained remarkably steady across different administrations regardless of political party, with 82% unanimity during Trump's first term, 87% unanimity during Obama's second term, and 89% under Biden. Overall, 92% of the votes were either unanimous or garnered a bipartisan majority. This consistency suggests that political division may not have a significant impact on the FTC's merger enforcement decisions. Overall, the bipartisan structure of the FTC traditionally has fostered a collaborative approach to merger enforcement, regardless of the prevailing political climate. Now-FTC Chair Andrew Ferguson highlighted this point last year: "I think one of the advantages that the FTC has as a multi-member bipartisan commission is that multi-member bipartisan commissions were created and I think tend to sort of stoke deliberation and care, and test theories internally before marching them out the door."

Split votes were distributed across different types of actions: 9 were complaints (all with Republican dissenters), 17 were consents (with an even distribution of Republican and Democrat consents), and only 1 was a closing statement (Express Scripts/Medco Health Solutions, a 4-1 vote with only 1 of 3 Democrats dissenting). On average, unanimous votes were resolved in 9.7 months, while split votes took slightly longer, at 10.9 months. Among the commissioners, Joshua Wright (2013-2015) was the most frequent dissenter, with 9 dissenting votes, followed closely by Rohit Chopra (2018-2021), who dissented 8 times.

Increasing Merger Litigation Risk May Be Leading Companies to Negotiate Longer Deal Termination Dates and More Frequent Reverse Break Fees

In our Q1 2019 DAMITT report, we analyzed publicly available transaction agreements for deals resulting in significant U.S. merger investigations and found merging companies were agreeing to increasingly longer termination periods (i.e., the amount of time between the deal announcement and the final walk-away date in the transaction agreement).

DAMITT's latest analysis of publicly available filings shows that the average time from deal announcement to the final termination date in transaction agreements for significant U.S. merger investigations concluding in 2024 was 18.5 months. This marks a nearly 28% increase from the 14.5-month average observed in 2019 and a 59% increase from the 11.6-month average observed in 2014, when significant investigations took much less time to complete.

As shown below, DAMITT's analysis observes a noticeable lengthening of the final termination date for significant merger investigations concluded in 2023 and 2024, the final two years of the Biden administration.

This sharp increase comes amid the U.S. antitrust agencies practically ending merger settlements toward the end of the Biden administration. From 2021 to 2022, the FTC and DOJ entered into 25 settlements with merging companies, compared to only 4 settlements between 2023 and 2024. At the same time, the frequency of complaints and abandonments increased significantly between 2023 and 2024, accounting for nearly 86% of significant merger investigation outcomes, compared to 47% between 2021 and 2022.

This recent increase in final termination periods may be an effect of the Biden administration's more binary approach to merger enforcement—i.e., either challenging a merger in court or clearing a merger with no conditions. The reduced number of settlements and increased likelihood of more protracted investigations and legal challenges created greater closing uncertainty for merging companies. With a shorter termination period, agencies can effectively run out the clock on deals without having to win in court. Former FTC Commissioner Christine Wilson recently called out the former FTC Chair Lina Khan for engaging in these "deadly procedural shenanigans" that "sought to increase the time, the risk and the expense to do deals." FTC Chair Andrew Ferguson also lamented this approach, noting under his new leadership that the "FTC is not going to try to use sort of sub-regulatory means to hold up mergers without actually taking people to court and hope that they die on the vine. That's over." As DAMITT has repeatedly cautioned in the past, building in additional time to litigate mergers beyond the investigation phase gives merging companies the opportunity to litigate an adverse investigation outcome. Otherwise, the agencies may use "procedural shenanigans" to kill deals without earning a victory on the merits.

This observation dovetails with DAMITT's analysis of reverse break fees triggered by the failure to obtain antitrust clearances. While the median break fee (as a percentage of transaction value) has remained steady between about 3-5% over the past decade, sellers appear to be negotiating for reverse break fees more frequently in recent years. Given the greater uncertainty of getting a merger cleared through settlement or otherwise in the Biden era, sellers may be placing greater value on reverse break fees than in the past as the risk of terminated deals has increased.

The percentage of publicly available transaction agreements containing an antitrust-related reverse break fee for significant U.S. merger investigations concluded during the Biden administration was 64%, compared to just 37% during Trump's first term. This trend could shift again if the U.S. agencies under the current Trump administration make good on their word to pursue a "realistic remedies program" for mergers, as FTC Chair Andrew Ferguson recently announced.

European Union

Faint Pulse: Q1 2025 Confirms Continued Low in EU Merger Control Enforcement

Merger control enforcement activity remained subdued in the first quarter of 2025. Only three transactions were cleared subject to Phase I remedies, mirroring the pace on the U.S. side. And notably no Phase II decisions were issued - a first in Q1 in recent years. This figure confirms a continued downward trajectory in EU merger enforcement, with Q1 2025 falling below the already small average of 4.5 significant outcome recorded in Q1 between 2021 and 2024.

While quarter-to-quarter fluctuations are not unusual, the sustained decline in interventionist outcomes over the past several years suggests a more structural shift. The low number of outcomes this quarter is in line with a broader trend of reduced scrutiny at EU level, particularly in the early months of the year, with Q1 2024 and Q1 2023 also yielding only four and two significant outcomes respectively.

The trend is further illustrated by the Commission's quarterly enforcement pattern, which has settled into a visibly lower rhythm. As the chart above shows, the number of significant merger investigations has hovered around or below the historical average for several years, and Q1 2025 is no exception. The sharp peaks and irregular spikes of earlier years have given way to a steadier, more subdued line - the once-variable heartbeat of merger control now faint and increasingly regular. And no change should be expected any time soon: with only one Phase II investigation currently pending, the pipeline remains sparse. Whether this reflects a conscious shift in enforcement posture is still an open question, though.

Against this backdrop, broader discussions about the future of EU merger control are gaining momentum. Policymakers and industry voices are increasingly questioning whether current merger control policy strikes the right balance between protecting competition and supporting European industrial competitiveness. While any legislative or policy shift remains uncertain, the current low enforcement activity in Q1 2025 may reflect a Commission in transition, carefully assessing how to reconcile traditional competition principles with emerging industrial policy goals.

No Quick Fix: Phase I Remedy Durations Remain Protracted

With three Phase I remedy cases concluded in Q1 2025, it seems that the Commission is once again open to the parties "fixing" their deals in Phase I rather than going through an in-depth investigation. But doing so does not necessarily equals swift clearance: in Q1, the average duration stood at 11.0 months, maintaining the elevated timeline observed over the past two years. While this marks a modest decline from the record-setting 13.1-month average recorded in 2023, it remains well above the long-term average and nearly four months longer than the average Phase I remedy case duration between 2011 and 2019.

This latest figure offers little evidence of a return to earlier timelines. In fact, Q1 2025 confirms that protracted Phase I reviews in remedy cases are no longer the exception but the norm. A deal resolved with remedies in Phase I now routinely takes nearly as long as a Phase II case in the past.

Phase I Remedies Carry the Load

In terms of outcomes, the three Phase I remedy cases concluded in Q1 2025 were cleared subject to divestitures of standalone business units or products.

The Constantia/Aluflexpack deal followed a familiar pattern: a focused horizontal overlap in niche packaging segments (sterilisable aluminium containers and lids for pet and human food) resolved by a full carve-out of Aluflexpack's overlapping operations. The case is characterized by its clear-cut remedy - the divestiture of a single plant and all associated assets.

The International Paper/DS Smith case shows the Commission's continuing focus on localised competition issues in heavy industries. The divestment of five production facilities across France, Portugal and Spain addressed not only horizontal overlaps but also potential vertical foreclosure concerns. This level of granularity in geographic market definition, and the tailored remedy package it produced, reflects the Commission's enduring attentiveness to regional dynamics in the packaging sector.

The Synopsys/Ansys case stands out as a rare example of a large, innovation-focused global transaction resolved in Phase I. The Commission identified concerns in the global markets for optics and photonics software as well as register-transfer-level power analysis tools, all used in semiconductor design. Although the parties' activities were largely complementary, the Commission raised both horizontal and interoperability-based vertical concerns, examining whether the merged entity could restrict compatibility between its electronic design automation (EDA) tools and third-party software or semiconductor IP.

To address these concerns, the parties committed to divest a targeted set of software products. The Commission accepted these commitments following a positive market test, concluding that divestiture of specific tools - rather than entire business units - would be sufficient to maintain competition. The case illustrates a degree of flexibility in remedy design in digital markets, where standalone software tools may constitute viable divestiture packages.

At the time of clearance, the UK CMA had provisionally accepted remedies, the US FTC review remained ongoing, and China's SAMR had accepted the parties' filing, with its review still in progress. As discussions continue over whether merger control should better support industrial resilience, transactions involving strategically important technologies and global dynamics-such as Synopsys/Ansys may increasingly test the boundaries of current enforcement practice, especially in cases where interoperability concerns, rather than traditional overlaps, play a central role.

Conclusion

US Section

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deals blocked or abandoned on both sides of the Atlantic. To ensure the ability to defend their deals through a potential investigation, parties to the average "significant" deal in the U.S. should plan on up to 12 months for the agencies to investigate their transaction. Parties should also consider allocating an additional 6 to 12 months in their transaction agreements if they want to preserve their right to litigate an adverse agency decision, for a total of 18-24 months.

EU Section

On the EU side, while the Q1 2025 figures mark a timid return of clearances in Phase I with remedies, after years of Phase II reviews, it still does not mean that parties subject to a significant investigation will be able to close their deal quickly. If parties still plan on obtaining a Phase I clearance with commitments, they should factor in about 11 months from announcement to a decision, with significant time set aside for pre-notification talks with the EU Commission and the potential need to pull and refile their notification.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.