- in North America

- with readers working within the Securities & Investment and Law Firm industries

- within Insurance, Real Estate and Construction and Environment topic(s)

Introduction

Geopolitical uncertainty and a softer M&A market made for a challenging environment for dealmaking in 2024. A heightened risk of antitrust and foreign investment intervention added to this complexity. But, looking ahead, there is cause for optimism. A surge in dealmaking is expected in 2025, fueled by "pro-business" and growth agendas in key jurisdictions and a trend towards a generally more permissive regulatory environment.

In this tenth edition of our global merger control enforcement report, looking back over the past year we observe that antitrust authorities frustrated more deals in 2024 than in any of the previous four years. They largely remained unwilling to accept merger remedies, focused on novel concerns, and subjected merging parties to lengthy review procedures. As a result, abandoned cases rose by over 50%.

We consider the antitrust obstacles faced by tech M&A and how AI partnerships grabbed the attention of authorities. We also turn the spotlight on private equity, looking at the mounting regulatory burden on PE firms as well as the increasing scrutiny of roll-up strategies by PE and non-PE buyers. And we reveal how many antitrust authorities pushed hard to get, and use, powers to review transactions falling below merger control filing thresholds.

Beyond merger control, we examine how new and expanding foreign investment screening regimes and the EU Foreign Subsidies Regulation (FSR) raised regulatory hurdles.

We analyze how all these factors played into risk allocation and the negotiation of deal protections last year. We also give you our predictions for 2025.

Perhaps more than at any other time over the last decade of this report's publication, merger control today is at a critical juncture in key jurisdictions.

New political leadership in the U.S., EU and U.K. have been explicit about their goals of removing barriers to growth (including regulatory barriers) and creating a pro-business, pro-investment environment.

We therefore anticipate a degree of regulatory easing over the coming months and years. At least from a merger control perspective, dealmakers should see more paths to closing.

We have collected and analyzed data on merger control activity for 2024 from 26 jurisdictions 1. We have also gathered statistics on the operation of key foreign investment control regimes. In this report we give you the key trends and developments from the past year, focusing on the U.S., EU, U.K., and APAC.

Report highlights

- Merger control frustrates more M&A, but are the

tides turning?

Deal mortality rates may fall if a more permissive approach to merger control enforcement emerges in key jurisdictions. - Antitrust authorities' skepticism of merger

remedies causes headwinds for dealmakers

But authorities are starting to recalibrate their positions, which could ease the path to clearance for strategic M&A. - Stormy skies for tech deals as antitrust scrutiny

intensifies

AI partnerships are in the spotlight. Merger control intervention also targets transport, energy, healthcare and telecoms M&A. - Private equity and serial acquisitions continue to feel

the antitrust heat

Roll-up strategies are in enforcers' sights, particularly in the U.S., while across the globe PE firms face intense regulatory scrutiny. - Rising review risk for deals not meeting merger control

thresholds

Antitrust authorities' increasing appetite to assess below-threshold M&A means significant uncertainty for merging parties.

- Antitrust authorities on high alert for merger control

violations

Record fines, sanctions on individuals and reinvigorated enforcement by key agencies show the dangers of not complying with merger control rules. - Merger control reviews speed up (at least for

straightforward cases)

Authorities' eagerness to streamline investigations leads to some improvements but deals raising significant antitrust concerns still face lengthy reviews, impacting deal timetables.

- Foreign investment control regimes reach far and hit

hard

New and expanding rules create obstacles for investors, with varying intervention rates and increasing protectionism adding to an already complex environment. - EU Foreign Subsidies Regulation rains down new

challenges for M&A

The regime is catching far more deals than expected, adding a major regulatory burden in the EU, especially for investment funds.

- Uncertain regulatory climate makes deal protections

crucial

Antitrust and foreign investment conditions precedent and related remedies obligations are heavily negotiated as merging parties continue to prioritize the allocation of an execution risk that has become increasingly hard to quantify.

Merger control frustrates more M&A, but are the tides turning?

Antitrust authorities killed more deals in 2024, marking a third year of rising mortality levels. Where prohibition was on the cards, many dealmakers abandoned their transactions rather than staying the course.

The U.S. agencies led the charge in taking a tough approach. But change is on the horizon. New administrations are expected to adopt a more balanced attitude to merger control enforcement in the year ahead.

In 2024, 13 transactions were prohibited and a further 26 were abandoned due to antitrust concerns. Frustration levels across the jurisdictions surveyed have increased by 30% since 2021, despite fewer merger control filings.

In two thirds of deals frustrated, the parties walked away from the transaction due to authority concerns, up from just under half in 2023.

This is striking. It suggests that in the face of significant antitrust hurdles, merging parties have become less willing to fight their case to the end. Authorities' persistent skepticism over remedies, their focus on non-traditional concerns such as innovation, labor issues and ecosystems, plus lengthy review procedures, have all likely played a part.

Our data on abandoned M&A is only part of the picture. It does not capture cases where antitrust risk forced parties to drop transactions at an early stage, in some cases even before a formal notification. For many antitrust authorities, this "deterrence" is itself a mark of success.

However, the tide may be turning. New leaders of antitrust agencies have been appointed in key jurisdictions at a time when a growing number of governments are prioritizing domestic growth, innovation and "competitiveness" over perceived regulatory burden. We expect political agendas to nudge at least some antitrust authorities toward a more permissive approach to merger control in 2025 and beyond. As a result, we expect some strategic deals that were previously seen as untenable to be back on the table.

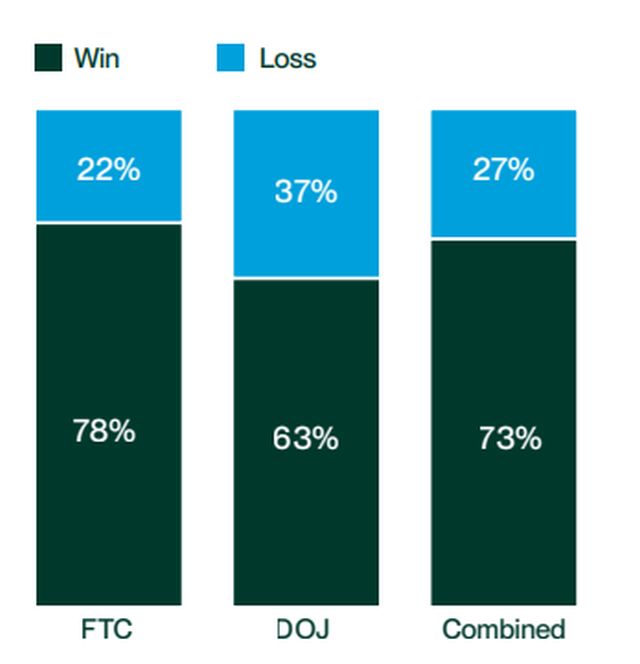

Win rate of U.S. agencies under Biden administration (as a proportion of contested deals resulting in a trial verdict)

Image height: 664 px

Image height: 664 px

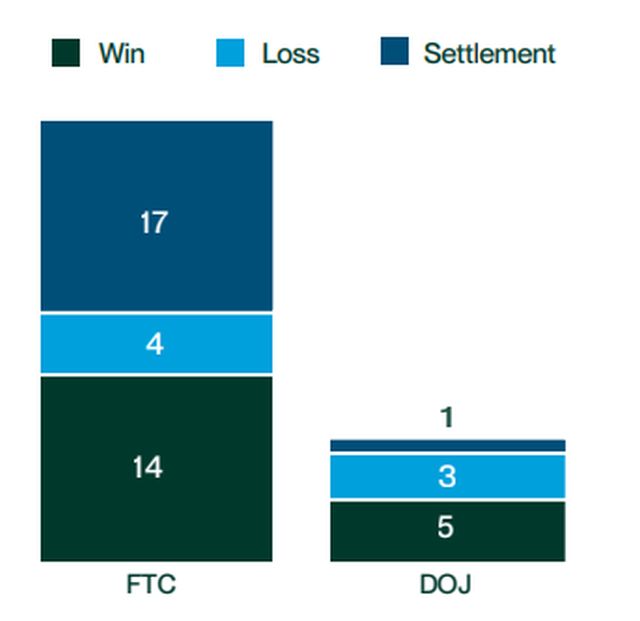

Outcomes of U.S. agency complaints under Biden

U.S. agencies are the standout enforcers but for how long?

The Biden administration's tough approach to merger control continued in 2024.

Five deals were formally prohibited, the most reported in a year since starting this report a decade ago. A further eight transactions were abandoned due to U.S. antitrust concerns8. Enforcement hit a wide range of sectors, including consumer, tech, healthcare and transport.

The U.S. antitrust agencies also won all but one merger challenge in federal court. This has boosted their total win rate during the Biden-era to 78% for the Federal Trade Commission (FTC) and 63% for the Department of Justice Antitrust Division (DOJ). Together, they won at trial in nearly three quarters of cases during President Biden's term.

Last year, litigation was buttressed by the 2023 revised merger guidelines. These set out a lower concentration threshold for presuming illegality of horizontal mergers. They also promote less traditional theories of harm, such as serial acquisitions, vertical mergers and potential adverse impact on labor markets.

The guidelines have already received judicial endorsement. But the agencies must take care to substantiate their claims. In Kroger/Albertsons, a district judge dismissed the FTC's labor market concerns as lacking evidence. Ultimately, though, the judge found sufficient harm to competition to block the deal, rejecting the parties' offer to sell off 600 stores/assets and make multibillion-dollar investments.

Internal documents have been key to the U.S. agencies' arguments in many merger challenges. Statements that merged firms can, for example, "kneecap competitors and dominate the market" have appeared front and center in complaints.

It is a clear reminder that what the merging parties communicate about a transaction, in internal and external materials, can impact how a fact finder views the likely competitve effects of a deal.

This will be even more important now the updated Hart-ScottRodino (HSR) filing form has taken effect. It requires far more extensive disclosure, including on overlaps, labor issues, minority interests, prior acquisitions, foreign subsidies, and ordinary course documents. This raises the stakes for merging parties. It not only significantly increases their administrative burden but also gives the agencies access to more information upfront on which to assess a deal.

In the coming months, all eyes will be on just how far the new Trump administration's "pro-business" agenda, as well as new heads of the FTC (Andrew Ferguson) and DOJ (Gail Slater, once appointed) will impact the agencies' policies and enforcement.

We are unlikely to see a relaxation of merger control enforcement across the board. Challenges to M&A are still expected. These may well focus on sectors that have a direct impact on consumers (such as energy, healthcare and transport) and tech M&A.

However, we anticipate a greater openness to accepting merger remedies (see chapter 2). And, while the agency heads have said they will continue to apply the revised merger guidelines as the framework for their analysis, we may see them recenter their focus on more traditional theories of harm (rather than novel concerns such as labor market issues).

The upshot? More M&A is likely to proceed unscathed, with fewer deals being challenged, blocked or abandoned.

EU focuses on innovation concerns as new commissioner takes the helm

No deals were blocked at EU-level in 2024, but four were abandoned after the European Commission (EC) raised concerns9.

The impact of M&A on innovation continued to be a focus. In Amazon/iRobot, for example, the EC was concerned that possible foreclosure strategies, including self-preferencing, could lead to less innovation (as well as higher prices and lower quality) for consumers of robot vacuum cleaners. The parties walked away from the deal late in the in-depth review.

Innovation concerns look set to remain high on the EC's agenda going forward. New Competition Commissioner Teresa Ribera took office on December 1, 2024, amid a flurry of debate over the future of EU merger control policy. Influential reports by Enrico Letta and Mario Draghi called for greater European growth, competitiveness and innovation.

Draghi recommended the introduction of an "innovation defense" to enable innovation-enhancing effects of a deal to outweigh any harm to competition. He also recommended greater significance be given to security and resilience in antitrust assessments, particularly in energy, defense and space sectors, and for more consolidation in certain industries, such as telecoms.

Ribera's mission statement encapsulates some of these elements.

She is tasked with modernizing EU competition policy, including reviewing the EC's horizontal merger control guidelines to give "adequate weight" to the EU's needs in respect of resilience, efficiency and innovation.

What will this mean in practice?

We could see the EC becoming more supportive of European companies scaling up in global markets.

We might also see the EC accepting efficiency arguments (which under current guidelines are subject to a very onerous standard of proof), perhaps based on pro-innovation effects or environmental/sustainability grounds. The latter is a key focus for Ribera—her antitrust portfolio is combined with responsibility for implementing the European Green Deal.

But this does not equate to waving all deals through the EU merger control process.

U.K. hits completed deals, updates thresholds and gets a new chair

The number of frustrated deals in the U.K. fell to two in 202410. However, the Competition and Market Authority (CMA)'s enforcement action once again showed the authority's hard-hitting powers to unwind completed transactions.

In blocking Spreadex's completed acquisition of Sporting Index, the CMA required the sale of the entire target business. This will be a tricky maneuver for the parties—the target's sports spread betting platform was shut down as a result of the deal and must be redeveloped to form part of the divestment package. Spreadex is appealing.

The U.K. has just updated its merger control thresholds for the first time in over two decades.

In addition to an increased turnover test and a "safe harbor" for small mergers, a new threshold enables the CMA to take jurisdiction more easily over non-horizontal mergers and killer acquisitions. In theory, this could lead to more frustrated M&A, particularly in the digital sector (see chapter 3).

In terms of enforcement policy, the U.K. is at a similar crossroads as the U.S. and the EU.

The U.K.'s 2024 general election brought in a Labour government that is urging the CMA to prioritize growth, investment and innovation.

Chancellor Rachel Reeves has said that "[e]very regulator, no matter what sector, has a part to play by tearing down the regulatory barriers that hold back growth," while Prime Minister Keir Starmer took direct aim at the CMA when he announced to an international investment summit soon after the election that "[w]e will rip up the bureaucracy that blocks investment... We will march through the institutions and make sure that every regulator in the country—especially our economic and competition regulators— take growth as seriously as this room does."

Perhaps consistent with that rhetoric, in a dramatic move in January 2025, ministers replaced the CMA's chair with a former Amazon executive.

What this might mean for U.K. merger control enforcement is starting to take shape.

The government's strategic "steer" to the CMA sets out broad objectives, including that the CMA should use its powers in ways that enhance growth, international competitiveness and/or investment, and should act in ways that minimize uncertainty for businesses.

In parallel, the CMA has announced areas for improvement, such as shorter review periods and a "step change" in engagement with businesses. It will also review its approach to merger remedies, looking at when behavioral commitments may be appropriate as well as the scope for remedies that lock in efficiencies or preserve customer benefits. And it will consider, in global transactions, whether action by other authorities could resolve any U.K. concerns.

Arguably, a shift in direction was already underway—late last year, the CMA approved Vodafone's merger with Three subject to unprecedented behavioral remedies, including price caps (read more in chapter 2).

Ultimately, all this could pave the way for a more light-touch approach to merger control enforcement in the U.K. Developments over the coming months will be pivotal.

Footnotes

1. Australia, Belgium, Brazil, Canada, China, COMESA, the Czech Republic, the EU, France, Germany, Hungary, India, Ireland, Italy, Japan, the Netherlands, Poland, Romania, Singapore, Slovakia, South Africa, South Korea, Spain, Turkey, the U.K. and the U.S.

2. Includes EC decision to prohibit Illumina/GRAIL, withdrawn in 2024 following a court ruling that overturned the EC's jurisdiction to review the deal.

3. Includes Cochlear/Oticon, which is a partial prohibition (the CMA approved the sale of one business to the acquirer).

4. Includes the prohibition of a joint venture to create a platform to exchange information related to the auto industry, which was conditionally cleared in 2022 and then blocked in 2023 after the parties did not comply with the remedies.

5. Prohibition was partial and only related to certain COMESA Member States.

6. Adobe/Figma, abandoned due to antitrust concerns in the U.K. and at EU level.

7. Qualcomm/Autotalks, abandoned due to "lack of regulatory approvals in a timely fashion". It was being reviewed in the U.S., the EU and the U.K.

8. Includes Qualcomm/Autotalks—see footnote 7.

9. Includes Qualcomm/Autotalks—see footnote 7.

10. Includes Qualcomm/Autotalks—see footnote 7.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.