Exploring the incoming Trump administration's potential macroeconomic and geopolitical impacts, including financial markets, foreign policy, fiscal policy and portfolios.

The 2024 U.S. election was unlike any other. The stakes for America's top job and future were higher than ever, with several unprecedented firsts and key issues including the economy and immigration taking center stage.

Following Donald Trump's historic presidential victory and significant Republican sweep, our senior leaders Lisa Egan, David Hoile, Christy Loop, and Samuel Wilkin, hosted a webcast on the investment outlook. The panel discussed the incoming administration's potential macroeconomic and geopolitical impacts on financial markets, foreign policy, fiscal policy and portfolios from a global and domestic lens. These are our biggest takeaways.

01

Initial market reactions were positive, however, the

overall impact on diversified portfolios is expected to be

relatively modest

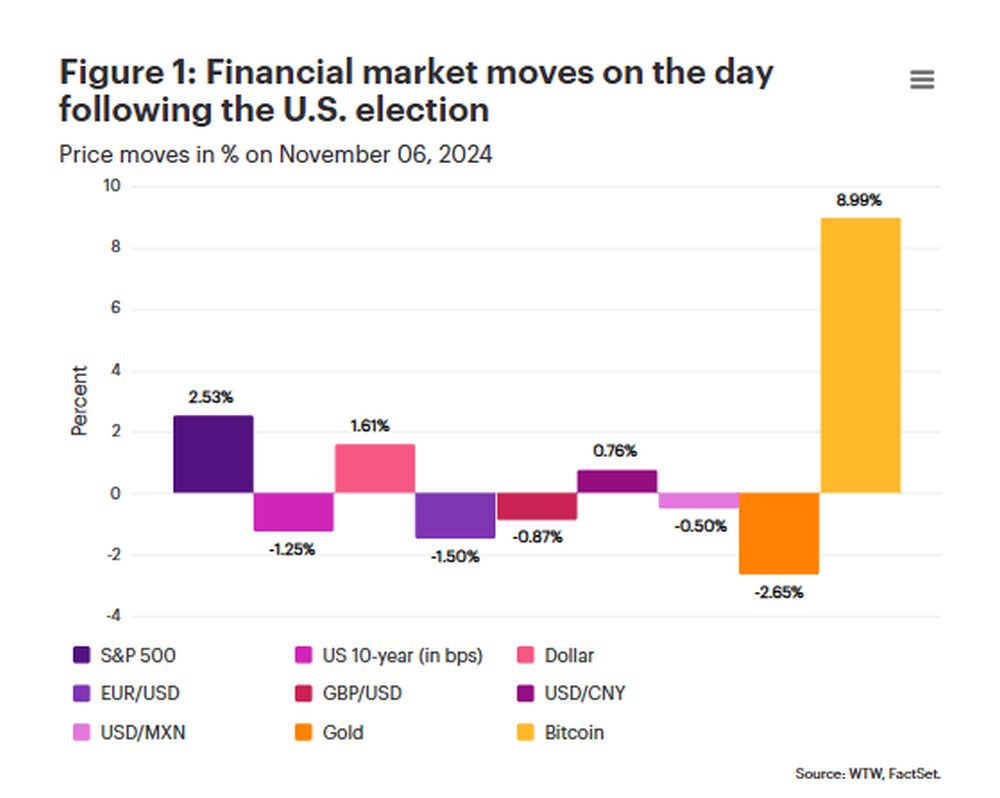

The market's response to the election results was aligned with both our predictions and the way markets moved with changing odds from polling and betting markets leading up to election day. Markets expect President-elect Trump's policies to strengthen the dollar, support corporate profitability, increase the U.S. government deficit moderately, increase inflation a little, and potentially slow down the pace of interest rate cuts by the U.S. Federal Reserve.

On the day after the polls closed, markets initially saw a notable rise in the U.S. dollar against the major currencies due to the potential for U.S. tariffs. U.S. large-cap and small-cap equities experienced significant gains, while U.S. government bond yields rose, leading to negative bond returns. Cryptocurrencies also rose sharply (Figure 1).

The subsequent price action has been more varied across markets – again, in line with our outlook and more focused on what policies are most likely. The U.S. dollar has continued to rise. U.S. equities have held onto their gains. Whereas U.S. bond yields have reversed their post-election rise.

In portfolios, we are not being reactionary and anticipate the impact from the new administration to be relatively modest and, therefore, unlikely to drive strategic portfolio changes. In addition, we are keeping an eye on inflation, including pressures to the upside.

02

Foreign policy will create acute risks for companies caught

in the crossfire

Trump's incoming administration is expected to shift from the multilateral approach of the Biden White House to a bilateral foreign policy, engaging in tough negotiations, one-on-one where possible, to exert pressure on not only U.S. adversaries but also U.S. allies.

This approach may lead to the risk of trade wars, notably with the EU, posing risks for the companies and sectors caught in the crossfire. This risk of being one of the specific sectors or companies caught up in either U.S. or foreign trade retaliation is probably the most acute risk we expect from the new administration's trade policy.

At present, WTW expects the U.S. to impose additional, moderate tariffs on China, with a focus on capital goods rather than consumer goods, similar to the previous Trump administration's strategy. We also expect tariffs on specific products from other countries, such as auto imports from Mexico. While these tariffs might sound concerning, their overall impact on the U.S. tariff rate and the economy is expected to be minimal, with only a slight drag on U.S. growth and a modest increase in inflation.

However, there are potential risks from less likely but still plausible scenarios, such as a universal tariff of 10% on all U.S. imports or a much higher tariff on all imports from China. These could have a more significant negative impact on U.S. and global economic growth and a substantial initial impact on inflation, affecting financial markets and the cost of capital. It is important to understand exposure to these non-central but plausible tariff risks, which could significantly impact financial markets and export-oriented cyclical companies.

03

Tax and spending policies are expected to have a slight,

positive impact on U.S. economic growth

In 2017, the previous Trump administration enacted large-scale tax cuts for individuals and businesses which are due to expire by the end of 2025. Their expiration would effectively result in a substantial tax increase equivalent to around 1% of U.S. GDP. Therefore, it is widely expected that all these tax cuts will be extended to avoid this steep tax rise.

Further, it is likely that there will be additional, smaller tax incentives to support business activities, including changes to R&D expensing and interest deductibility. These measures will be partly funded by revenues from new tariffs.

On the fiscal side, there is an anticipation of some moderate rollbacks in investment spending and subsidies from the 2022 Inflation Reduction Act, aimed at slightly reducing expenditure.

Overall, we expect these adjustments to positively impact U.S. economic growth in 2025-2026, adding roughly 0.2 percentage points to an already strongly growing U.S. economy in 2025. We see this additional growth impulse as a positive outcome but not a big change in economic trajectory.

04

The U.S. government deficit and government bonds are

projected to be stable – if there are no significant tax

cuts

The expected tax and spending policies following the 2024 U.S. election are projected to slightly increase the U.S. deficit in 2025, but we then expect the deficit to decrease gradually through 2026, 2027, and 2028.

Given we expect U.S. economic growth to be strong and inflation to fall close to Fed target over 2025, this should still allow the Federal Reserve to normalize its policy interest rate to a lower level over 2025. This should also keep U.S. bond yields relatively stable, at around current levels. We do not think this expected fiscal trajectory will put significant upward pressure on U.S, bond yields.

However, there is a risk if tax cuts, especially to social security benefits and corporate taxes, are deeper than currently anticipated. For instance, a corporate tax cut from 21% to 15% was discussed during the campaign. These cuts are unlikely to pass through Congress and are not considered in our baseline projections. However, if they did occur, they could push U.S. bond yields higher, given higher inflation risks from this expansionary economic policy.

05

Ensure your risk management exposures remain fit for

purpose to safeguard your portfolios

To mitigate potential risks, we recommend that investors ensure that the risk management exposures within their programs are fit for purpose, ensuring risk tolerance is aligned with their strategic objectives and consistent with expected changes in capital market assumptions.

We believe that managing tail risks is a key component of an effective risk management strategy. As a result, we continue to advocate for investors to diversify across different types of risk and return premia in order to build a more resilient strategy. In contrast, portfolios that have more concentrated exposures may be more exposed to specific outcomes.

06

Re-underwrite the four I's within your portfolios:

income, inflation, illiquidity, and impact

As you look ahead to 2025, we recommend monitoring the four key I's: income, inflation, illiquidity, and impact.

Income remains top of mind and a key theme across our portfolios. It can provide a positive carry profile, increase the stability of returns, and act as a volatility dampener.

For inflation, we have seen a shift in return needs from nominal to real returns across many of our clients and a focus on improving program resiliency to inflation-related risks.

Illiquidity budgets are being re-evaluated in relation to the investment program's objectives. For instance, we have seen DB plans reducing private market engagements as they move towards more liquid portfolios.

Impact investing varies by investor type and mission. However, many clients remain interested in ideas that focus on high returns or risk reduction, while integrating positive externalities; typically, these are related to market themes and structural imbalances.

Closing thoughts on how the Trump administration could impact investments

In summary, the 2024 U.S. election results are set to have an important impact on the global landscape, influencing areas including financial markets, foreign policy, fiscal policy, and portfolios.

From a macro perspective, we can attempt to predict which

specific components or uncertainties concerning economic policy

pose the greatest risk and opportunity for portfolios, industries,

and countries by taking an approach that is both probabilistic and,

critically, 'real world.'

At a micro level, understanding how these macroeconomic shifts

impact the financial value of individual businesses, assets, and

securities is crucial, as this is where the most substantial

effects are likely to transpire.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.