As companies try to navigate choppy and unpredictable economic waters...

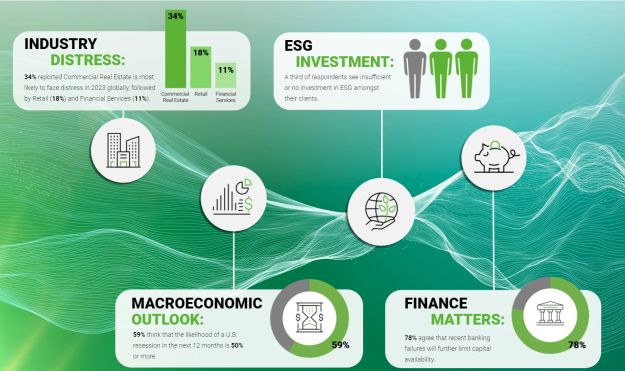

The experts who work with troubled companies have told us that financing - fifth on the list of challenges for these companies last year - has risen to the top, as inflationary spikes, monetary tightening, and higher interest rates drive a crunch on capital that severely threatens recovery and growth efforts. Bankruptcies in the U.S. are at their highest level since the global financial crisis and events witnessed already this year in financial services have done little to steady swaying ships.

OUR 2023 REPORT FEATURES:

- The views of 700 executives

- Macroeconomic and industry outlooks

- Financing, ESG, and M&A predictions

- Year-on-year comparisons

- AlixPartners global perspectives

Nine market-defining data points.

Nine calls to action for business leaders.

HOW BUSINESSES SHOULD RESPOND

Leaders must orient their businesses toward a set of characteristics best suited for continued ambiguity and tightening financial constraints:

1. FOCUS ON CASH

Underpin any new money need with cash flow analysis of operations under various risk scenarios.

2. UNDERSTAND SCENARIOS AND RELATED RISKS

Balance best-case scenarios with a worst-case one to help you act fast as trading conditions change.

3. DRIVE AGILITY ON COST

Map the underlying cost structures of vendors and proactively track commodity rates - and act quickly when market dynamics shift.

4. CHART A PATH FOR CHANGE

Balance short-term challenges against your vision of a long-term upward trajectory, and take steps towards that goal now.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.