- within Consumer Protection topic(s)

- with Inhouse Counsel

- in United States

- with readers working within the Banking & Credit industries

The last time AlixPartners ran the Consumer Sentiment Index (CSI), e-commerce accounted for just 4% of total sales, and the iPhone was not yet two years old. Many of the qualities that consumers take for granted today—in-store technical support, buy-online and pick-up-in-store, personalization—were fringe practices.

To understand the complex interaction of purchase drivers today, we relaunched the CSI, surveying 9,000 consumers across the sectors they shop in, and convening retail leaders for an event in New York City.

As CNBC coverage noted, the report reveals category leaders, but it also provides a framework for retailers to understand where to invest resources to a) deliver on consumer expectations, and b) differentiate themselves from competitors.

There is a lot to digest in the report, and I'm excited to reveal some of the key findings.

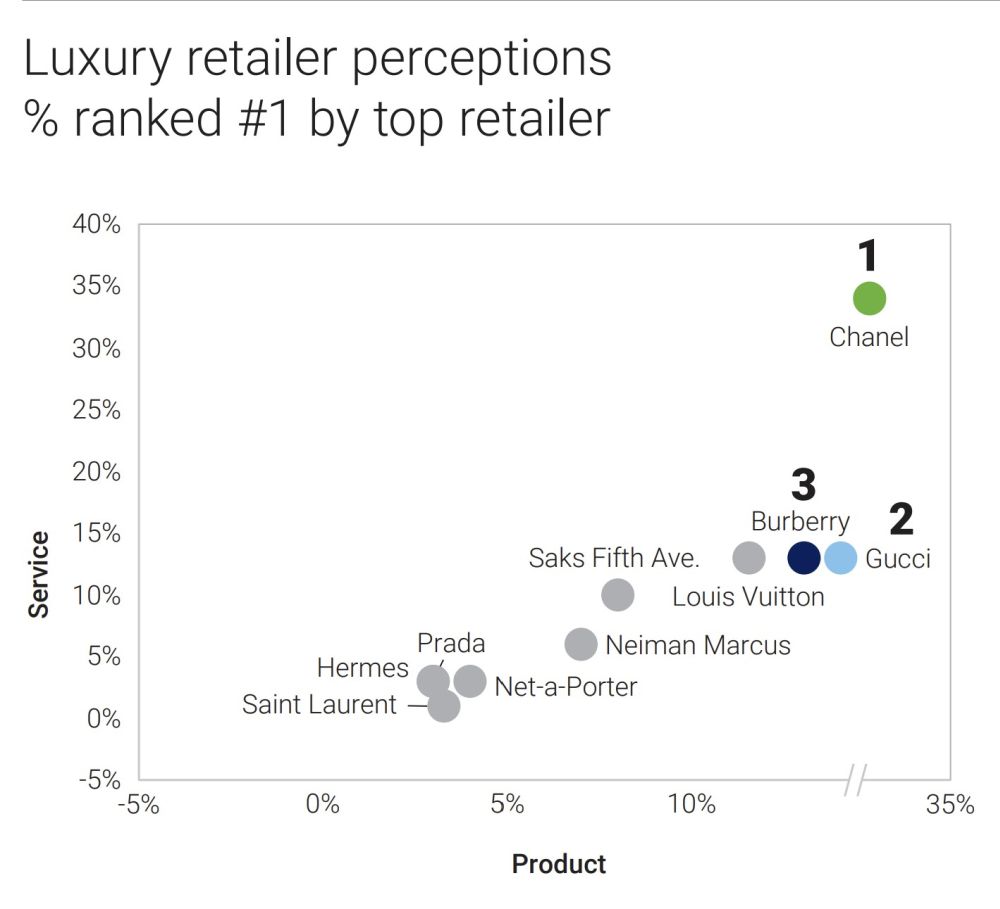

Chanel is winning luxury; no one else is even close

Chanel resonates with consumers the most and ranked number one for all pillars: product, price, access, service and experience. Chanel's experiential initiatives hit the service experience sweet spot and reinforce quality and personalization. Runners-up Louis Vuitton and Gucci scored well on white-glove service and personalization.

Legacy dominates the athletic footwear race, but newcomers are in pursuit

Nike remains the clear leader in the Consumer Sentiment Index, with 2.5 times more respondents ranking it number one than the next name on the list. Hoka made the list due to strength among aging consumers.

Value shapes consumer priorities in the footwear space, but consumers won't go cheaper if it means compromising on quality.

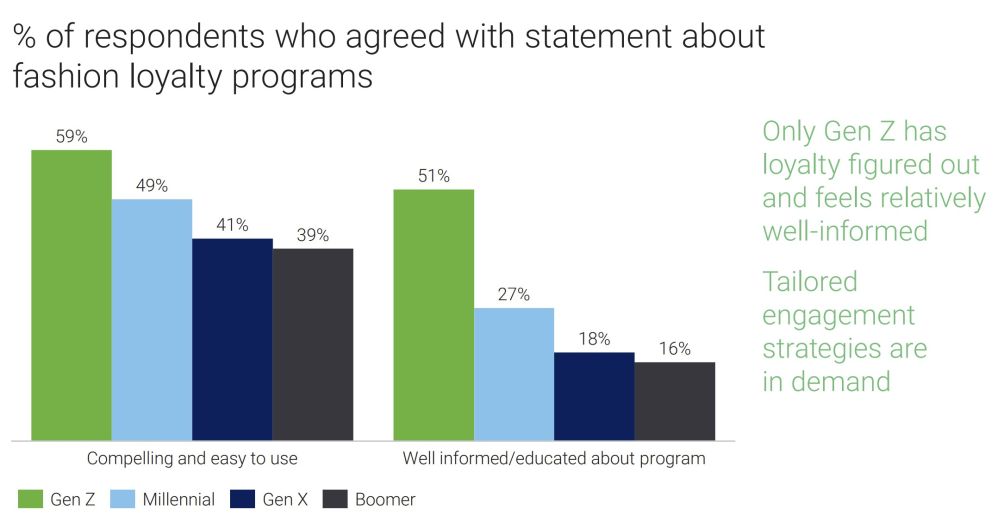

Loyalty is being tested

Eighty percent of consumers want attractive loyalty programs, but less than a third think these programs are worth it or incentivize purchases (Generation Z are more forgiving, but they are also newer to the game). Crucially, the message isn't getting through: Less than half of consumers find programs compelling and easy to use.

The survey dissects demographic preferences across pillars and sectors, from Gen Z to Millennials, Gen X, and Baby Boomers. Below you will find the full report:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.