- within Consumer Protection topic(s)

- with readers working within the Retail & Leisure industries

- within Antitrust/Competition Law and Compliance topic(s)

The pet industry continues to evolve as consumer demand for premium services grows. From luxury boarding to specialized transportation, retailers are expanding their offerings to meet sophisticated pet parent needs. Holiday seasons particularly highlight this shift toward premium services, with pet owners seeking elevated experiences for their furry family members. This trend toward premium services reflects the deepening bond between pets and their owners, driving significant market opportunities during the festive season.

Our Performance Improvement team helps providers transform these operational complexities into opportunities for enhanced efficiency and growth, as demonstrated by our work with a leading national provider where we identified significant labor optimization opportunities while enhancing quality of care. Let Ankura show you how data-driven labor optimization can help balance regulatory compliance, operational efficiency, and program excellence.

Holiday Pet Spending Takes Center Stage: Trends & Top Picks

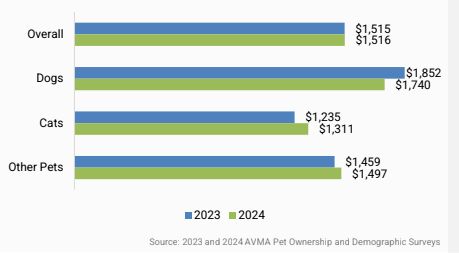

As holiday shopping kicks off, American households put their money where their hearts are, investing $1,500+ annually in their furry family members.

Pet Owner Spending

Average Total spent per household on pets

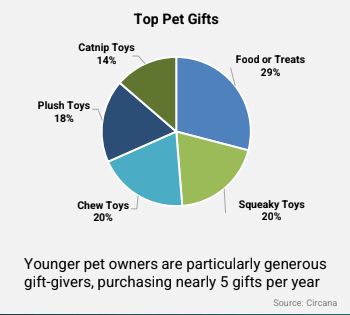

Daily necessities lead yearly costs, but pet parents set aside $51-$75 for holiday toy splurges. Top gifts include -

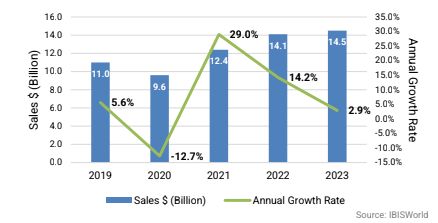

$15B Pet Boarding & Grooming Industry Preps for Holiday Surge

US Pet Grooming & Boarding Spending Continues to Grow

As holiday travel plans take shape, pet grooming and boarding services anticipate their annual festive rush. The industry, which generated approximately $15B in sales in 2023, sees one of its peak periods during the winter holidays. Key drivers include:

- Holiday Travel Surge: Premium boarding facilities report increased bookings for "pet vacation stays" during family holiday getaways.

- Special Occasion Grooming: Pet parents prioritize professional grooming services for holiday photos and family gatherings.

- Extended Holiday Hours: Many facilities expand their services during peak holiday periods to meet increased seasonal demand.

Pet Industry Holiday Outlook Market Trends & Consumer Behavior

As pet retailers prepare for the holiday season, four key market trends are shaping consumer behavior:

|

HEALTH & WELLNESS Pet owners demonstrate increasing commitment to premium nutrition products and are willing to invest more in high-quality food and treats this holiday season. Consumers report higher spending on hygiene products and supplements, creating significant opportunity for retailers to optimize their wellness inventory. |

GENERATIONAL SHOPPING PATTERNS Millennial and Gen Z pet parents lead holiday spending with strong preference for premium products and sustainable brands, while investing heavily in pet holiday experiences. Gen X demonstrates the highest per-pet holiday budget, focusing on luxury care items and specialized holiday services, marking distinct generational approaches to seasonal pet spending. |

|

PREMIUM HOLIDAY SERVICES The holiday season drives expansion of premium pet services, from luxury boarding to enhanced grooming packages. Retailers are adding transportation services and spa treatments to capture seasonal demand, as pet parents seek convenient, elevated experiences during the festive period. |

DIGITAL SHOPPING TRENDS E-commerce platforms continue to capture market share, with online pet spending projected to reach $28.5 billion in 2024, marking significant holiday season opportunities. Social media influence continues to grow through influencer partnerships and digital gift cards, as the e- commerce market share expands from 22% toward a projected 30% by 2030. |

The Big Stories

|

PetSmart is making strategic moves with both leadership and digital innovation: the retailer has appointed Ken Hicks, former CEO of Academy Sports and Outdoors and Foot Locker, as its new President and CEO effective October 31, 2024, following J.K. Symancyk's departure to Signet Jewelers. |

|

On the digital front, PetSmart is breaking new ground through a first-of-its-kind partnership with Grubhub, making over 14,000 pet products available for on-demand delivery from more than 1,400 locations nationwide. The partnership, which targets shifting millennial and Gen Z shopping habits where over half now purchase pet products online, marks Grubhub's first expansion into pet retail and includes integration with their Grubhub+ loyalty program. |

|

Tractor Supply is expanding its pet retail presence through the acquisition of Allivet, leveraging its strong customer base where about 75% of its 37 million loyalty members are pet owners. The retailer, operating 2,270 Tractor Supply stores and 205 Petsense locations, is capitalizing on post- pandemic "rural revitalization" while continuing its "Project Fusion" renovation program that has upgraded nearly half its fleet, though the company expects cautious consumer spending heading into the election year. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.