- within Real Estate and Construction topic(s)

- in United States

- within Antitrust/Competition Law and Compliance topic(s)

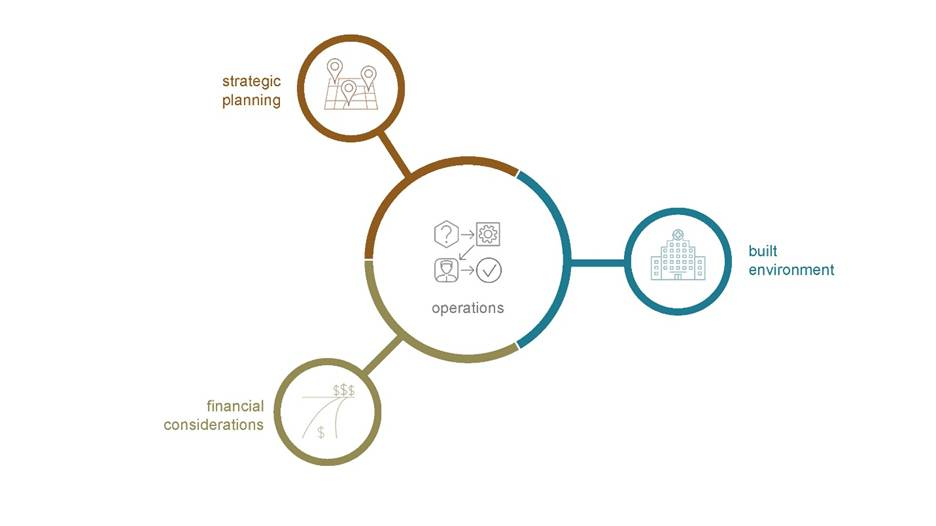

The Strategic Triangle: Capital, Operations, and the Built Environment

We encourage clients to view capital investment as a dynamic triangle — balancing strategic intent, financial feasibility, and physical infrastructure. At the center of this model is operations, which acts as the system's shock absorber. By improving throughput and utilization, organizations can optimize pro forma performance and protect margin integrity.

A project's feasibility is the combination of building size and capacity (cost) with revenue generating services (type of volume and utilization). Each project has a unique tipping point —where volume, case mix, and utilization are sufficient to cover fixed costs. Beyond this point, margin is achieved by increasing volume and utilization.

To illustrate the use of operations as a buffer for leaner facilities, healthcare facility planning has historically followed standardized design ratios — allocating key planning units (KPUs), like exam rooms, operating rooms, and inpatient beds, in multiples of two, four, or eight. These configurations were optimized for operational efficiency. The logic was simple: Designing for odd numbers would result in under-utilized labor and higher per-unit operating costs, so one would "round up" to the next even number.

In the past, this approach made sense. Even if that last "rounded up" KPU was not always full, the marginal cost was justified by the potential for incremental revenue and the operational leverage gained. However, today's capital environment demands a more disciplined approach, and we now "round down" to fewer KPUs, knowing that they will all be maximally utilized.

With construction escalation costs rising approximately 40% since 2020, of facility planning have undergone a fundamental shift.1 What once cost $1 million per bed may now cost $4 million, dramatically altering the break-even calculus. Building that "rounded up" bed might have made sense when a bed cost $1 million, but when it costs $4 million, it will take a very long time for the cost of operational inefficiency — in the form of staff salaries — to catch up to the cost of that extra bed.

By "rounding down," it may become difficult to generate enough volume to cover the cost of the facility — causing the pro forma to fall below the tipping point. This leads to the revenue per square foot concept: The more that planners size the facility down, the more critical it is to drive revenue per square foot up. For example, a $4 million inpatient bed pays for itself more efficiently when used for higher-acuity, better-reimbursed cases rather than lower-complexity, lower-reimbursed ones.

Today, building for sustainable volume is paramount. That means:

- Validating growth assumptions against realistic population trends and market share capture rates.

- Strengthening provider alignment to ensure durable referral patterns and utilization.

- Conducting robust sensitivity analyses to understand volume risk and financial exposure.

In today's environment, many providers are shifting their focus toward operational strategies that generate incremental revenue — not to expand their footprint, but to more effectively absorb fixed costs and maintain financial resilience.

Ankura delivers value in every project by providing clear insight into capital cost implications early in the strategic planning process, empowering providers to fully evaluate all relevant variables, ensuring alignment with their broader strategic vision and profitability objectives.

Footnote

1 Will U.S. Construction Thrive or Dive in the Rest

of '25? Ken Simonson, Chief Economist, Associated General

Contractors of America

https://www.agc.org/sites/default/files/users/user21902/Construction%20trends%20%26%20outlook.pdf,

accessed 10/15/2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.