- within Real Estate and Construction topic(s)

- in United States

- within Real Estate and Construction topic(s)

- in United States

- within Real Estate and Construction, Law Practice Management and Law Department Performance topic(s)

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Insurance industries

Key Takeaways:

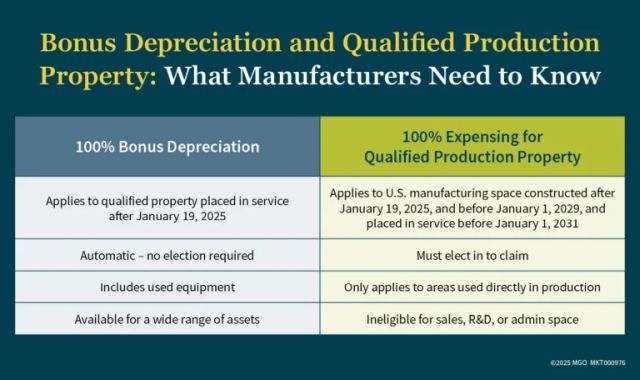

- The One Big Beautiful Bill Act restores 100% bonus depreciation for qualified property placed in service after January 19, 2025.

- A new provision allows 100% expensing of qualified production property used directly in U.S.-based manufacturing, with strict eligibility criteria.

- Manufacturers should begin planning now to align construction timelines and tax strategy.

—

The One Big Beautiful Bill Act (OBBBA) contains wide-reaching tax provisions that could reshape capital investment decisions for manufacturers and distributors. Two potentially impactful provisions are the return of 100% bonus depreciation and the introduction of a new incentive for qualified production property (QPP). For asset-intensive businesses, the new rules present significant planning opportunities.

This article outlines the OBBBA's key bonus depreciation and QPP provisions, and how they apply to your manufacturing or distribution business.

100% Bonus Depreciation Returns in 2025

Bonus depreciation allows your business to immediately deduct a significant portion of the cost of qualifying property in the year it's placed in service, rather than depreciating it over several years. Under prior law, bonus depreciation was gradually phasing down from 100% to 0% by 2027.

OBBBA resets that clock: For qualified property placed in service after January 19, 2025, 100% bonus depreciation is restored and made permanent. This applies to a wide range of capital investments — including machinery, equipment, and certain improvements to nonresidential real property.

However, for 2025, it's crucial to keep the placed-in-service date in mind. Property placed in service on or before January 19, 2025, remains subject to the prior phase-down schedule (40% for 2025).

Bonus depreciation is generally automatic, meaning you need to elect out of it if you don't want to take it. It's available for both new and used property.

New: 100% Expensing for Qualified Production Property

In addition to bonus depreciation, OBBBA introduces a new, separate provision for 100% expensing of QPP with unique eligibility rules and timelines.

This is a major development if your manufacturing business is planning new facility construction, as bonus depreciation generally doesn't apply to buildings (although it does apply to certain qualified improvements).

What Is Qualified Production Property?

Qualified production property includes a portion of nonresidential real property that is:

- Newly constructed in the United States

- Used as an integral part of manufacturing activities

- With construction beginning after January 19, 2025, and before January 1, 2029

- Placed in service before January 1, 2031

To qualify, the space must be used directly in the manufacturing process. The provision doesn't apply to any square footage used for administrative offices, research and development, sales, or other ancillary functions.

Crucially, there is node minimis exception — meaning there's no threshold below which non-manufacturing space can be ignored. So even small areas used for offices or other non-manufacturing functions must be identified and excluded from the QPP calculation. This will likely drive demand for more detailed cost segregation studies to allocate building costs appropriately.

It's also important to note that, unlike bonus depreciation, QPP expensing is not automatic. Taxpayers must affirmatively elect into this deduction. Final regulations will clarify how and when taxpayers must make the election and whether a single election applies across multi-year construction projects.

Who Qualifies?

This provision applies specifically to manufacturing businesses engaged in the production of tangible property involving "substantial transformation". The IRS will issue regulations to define this standard more precisely, but the intent is to reward activities that significantly alter raw materials or components into finished goods.

Some exclusions apply. Lessors of the property and businesses preparing food and beverages on-site (such as a deli in a grocery store) are not eligible. Additionally, property subject to the alternative depreciation system (ADS) does not qualify.

A Word on Recapture

There's also a 10-year recapture provision. If the use of the property changes during that period — such as converting a manufacturing area into administrative offices — the taxpayer may have to recapture the expensed depreciation as ordinary income under Section 1245.

Section 179: Increased Limits, but Strategic Considerations

OBBBA also raises Section 179 expensing limits. For 2025, your business can expense up to $1 million in qualifying property — with the deduction phasing out once total equipment placed in service exceeds $2.5 million. For assets placed in service after December 31, 2025, the expense limit increases to $2.5 million — with the deduction phasing out if total fixed assets placed in service exceed $4 million.

While small and mid-sized businesses often use Section 179 to write off qualifying property, it can be more limited in application than bonus depreciation (if available) since Section 179 is (a) limited to the amount of business taxable income; and (b) only available for assets used 50% or more for business purposes.

However, it may still be worth considering when bonus depreciation isn't available or when coordination with taxable income limitations makes Section 179 more beneficial. There also may be benefits at the state level, as some states conform with the federal 179 expensing provisions while decoupling from federal bonus depreciation rules.

Taxpayers should discuss their fixed asset strategy with their advisors to decide how and when to leverage bonus depreciation, Section 179, and QPP expensing.

Implications for Manufacturing and Distribution

The manufacturing sector can benefit from these provisions with careful planning and implementation. Here are some decisions and considerations to discuss with your tax advisor:

- Facility construction and expansions: The QPP rules reward businesses that start new construction after January 19, 2025, but before January 1, 2029. Companies on the fence may want to move quickly to meet the deadline and qualify for 100% expensing.

- Cost segregation studies: Because only certain portions of a facility count as "qualified production property", taxpayers will need cost breakdowns to support their deductions if any part of the building is used for non-qualified activities.

- State conformity is uncertain: Some states may decouple from the federal rules, particularly for QPP expensing, given its potentially large impact on revenue. Businesses with operations in multiple jurisdictions will need to monitor state responses.

- Private equity and tax-exempt complications: The use of ADS, especially when tax-exempt entities are involved, could disqualify certain projects from QPP expensing. Additional analysis will be required in joint ownership scenarios.

- Recapture risk: Planning should also account for potential changes in facility use within the 10-year recapture window.

Looking Ahead

Bonus depreciation has been part of the tax code in various forms since 2001, but this is the first time it's been made permanent. Meanwhile, the addition of a new QPP expensing provision clearly shows that the federal government wants to incentivize domestic manufacturing investment.

As with any major tax law, the details matter — and many remain forthcoming. We expect the U.S. Treasury Department and the IRS to release additional regulations clarifying key definitions, election mechanics, and compliance requirements.

In the meantime, manufacturers and distributors should begin evaluating capital plans for the next five years — especially if you are contemplating large-scale facility construction.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.