- within Antitrust/Competition Law topic(s)

- within Wealth Management, Environment and Consumer Protection topic(s)

Foreword

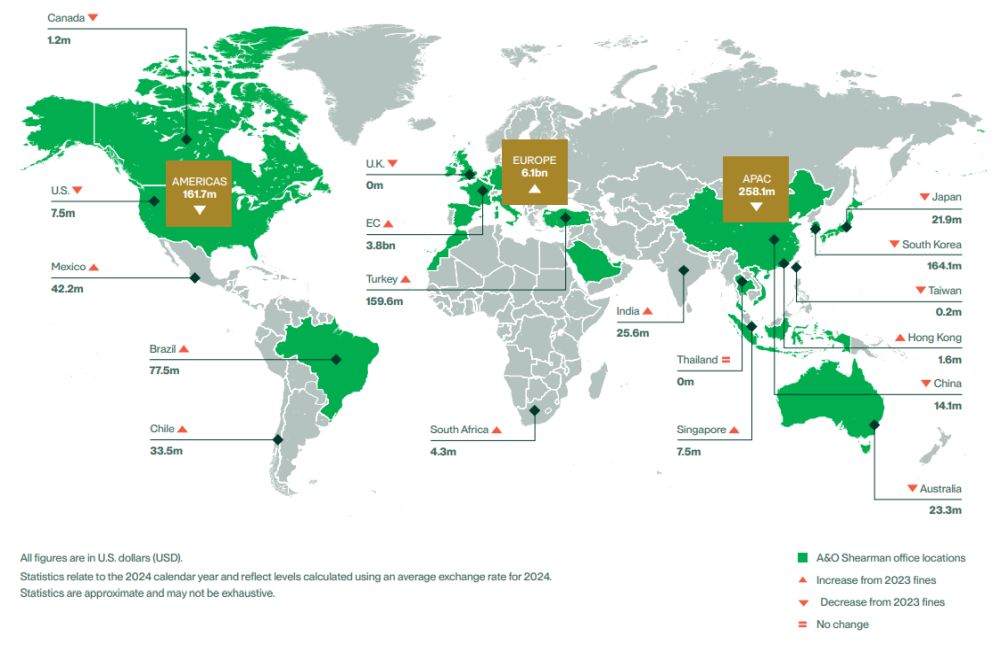

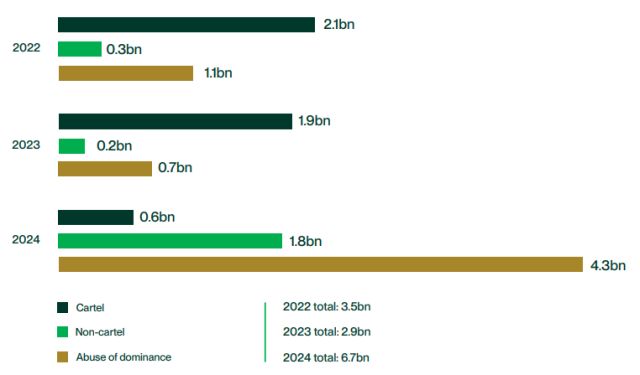

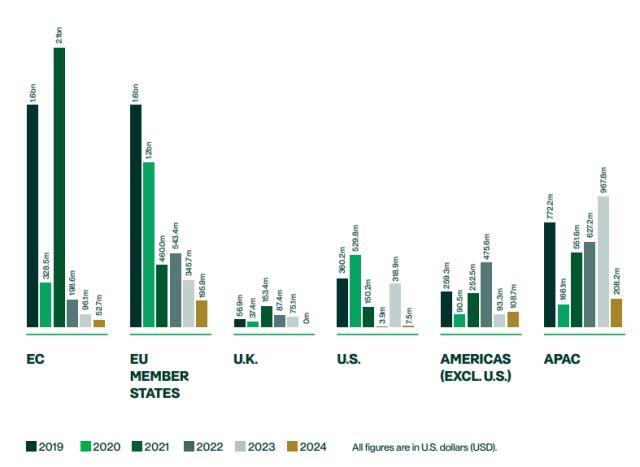

2024 saw a significant increase in overall global fines for antitrust enforcement, with total penalties for the jurisdictions surveyed in our report at USD6.7 billion, over double that of 2023 (USD2.9bn) and substantially higher than 2022 (USD3.5bn). Notably, this increase was largely due to a marked uptick in abuse of dominance fines (USD4.3bn in total), with the bulk of these coming from European Commission (EC) decisions (USD3.4bn). However, while vertical (and other non-cartel) conduct fines were also up year-on-year (USD1.8bn, up from USD195 million in 2023), fines for cartel enforcement saw a marked decrease (USD602.5m, compared to USD1.9bn in 2023), reflecting a continued downward trend.

Although we always caution against drawing significant inferences from year-on-year changes, the impact of the wider scrutiny of digital markets on this year's dataset is impossible to miss. Fines on Big Tech alone amounted to approximately USD3bn, nearly 50% of the overall fine total.

Contrary to initial expectations, the introduction of sweeping ex ante enforcement regimes in the digital sector has not dissuaded regulators from continuing to enforce against digital firms using their traditional antitrust armory—in fact, quite the opposite. Abuse of dominance cases against Big Tech in 2024 bucked a trend of recent decline, with the EC leading the charge in reaching several significant decisions notwithstanding the entry into force of its Digital Markets Regulation (DMA). In doing so, the EC has sent a clear signal that the old and new regimes are intended to sit alongside each other. It remains to be seen whether this approach is followed in other jurisdictions as regulators consider and implement their own ex ante digital regulation.

Relatedly, 2024 saw regulators continue to grapple with the risks posed by the meteoric rise of generative AI. Assessment and debate will no doubt continue apace in 2025, with regulators conscious in particular to prevent the entrenchment of AI strength with a small number of powerful firms. However, it may be some time before we see material enforcement activity in this space given the pace of change and the complexity of the assessment required.

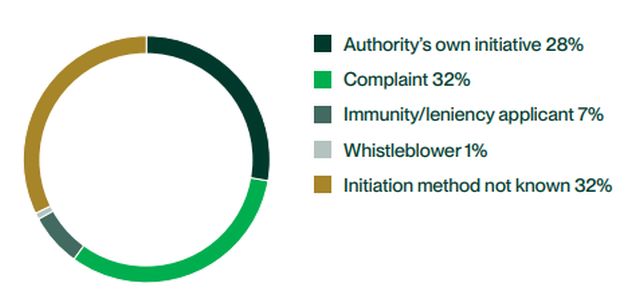

In stark contrast to abuse of dominance enforcement, fines for cartel enforcement were the lowest recorded for several years, with no landmark decisions of note. With immunity and leniency applications remaining muted, reflecting an increased reluctance of businesses to come forward given the ever-growing threat of follow-on damages actions, regulators continued to focus on other parts of their detection toolkit to beef up enforcement. Dawn raid activity has been consistently high since the end of the pandemic; 2024 was no different, and we expect that trend to continue.

The proliferation of private enforcement activity that we have observed in recent years continued throughout 2024, most notably in the continued extraordinary rise of collective actions in the U.K. Consistent with public enforcement, abuse of dominance cases continued to make up the vast majority of recently-filed collective actions, with novel theories of harm articulated and Big Tech a focus for claimant firms and proposed class representatives. It will be interesting to see whether activity in this space is impacted by the dismissal of the first claim to reach trial (in December 2024), by the judgments in several other leading cases which are expected in 2025, or indeed by the ongoing wider review into the litigation funding market.

Looking ahead more generally, 2025 may mark a significant turning point in the directional travel of antitrust enforcement globally. The recent shifts in political power have the potential to have significant repercussions, with newly appointed leaders and regulator heads in both the U.S. and the U.K. already seeking to redefine the approach to antitrust enforcement strategies. While the renewed focus on "economic growth" arguably has a more immediate connection to regulators' enforcement of the merger control rules, it will be interesting to see the extent to which policy shifts also filter through into the behavioral antitrust enforcement environment. We may see a more lenient approach in the digital sector where new powers have only recently come into force. Conversely, consumer-facing and public sector industries are likely to come under greater scrutiny. Similarly, the start of 2025 has already seen the potential for antitrust investigations to be used as a tool in the context of rising geopolitical trade tensions—although it remains to be seen the extent to which those will be followed through in practice.

Global antitrust enforcement fines in 2024 were USD6.7bn, a notable increase from 2023

TOTAL GLOBAL FINES BY CONDUCT TYPE, 2022–2024

AVERAGE LENGTH OF INVESTIGATION (CALENDAR DAYS), 2022–2024

MODE OF INITIATION OF ENFORCEMENT ACTION, 2024

Global cartel fines see dramatic drop

REGIONAL CARTEL FINE COMPARISON (2024 TOTAL: USD602.5M)

Overall, global fines for cartel activity in 2024 (USD602.5m) were the lowest recorded for several years, and significantly lower than the 2023 total (USD1.9bn). Unlike in previous years, 2024 saw relatively few 'landmark' decisions, with no individual fines exceeding USD100m. However, the total number of cartel enforcement decisions remained broadly steady, with 170 decisions issued in 2024 compared with 163 decisions in 2023.

While the lower fine totals may therefore at least in part be indicative of the nature of the cases that reached decision in 2024, as opposed to reflecting a broader reduction in cartel enforcement activity, there remains a view that the proliferation of private enforcement across the U.S., U.K. and EU is having a chilling effect on immunity/leniency applications, and consequently on cartel enforcement. However, regulators have typically been keen to signal that this is not the case. Significantly, a senior official at the EC confirmed in January 2025 that the EC expects to issue more cartel decisions this year, with a particular focus on unlawful information exchanges and collusion facilitated by new technologies and tools.

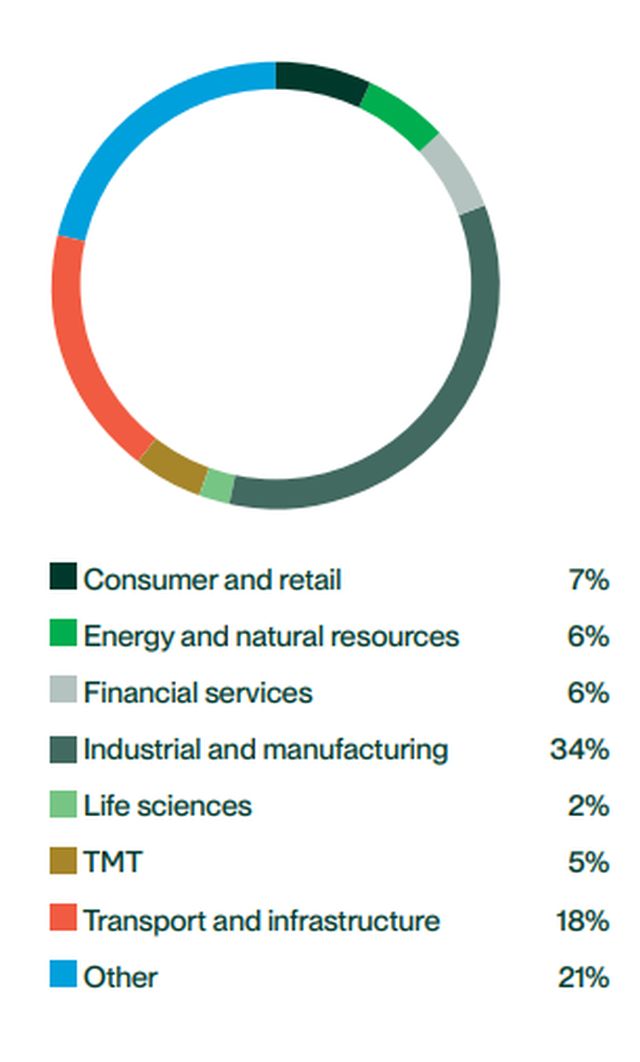

CARTEL DECISIONS BY SECTOR

Industrial and manufacturing: Hotspot for cartels

Industrial and manufacturing industries were a particular area of cartel enforcement activity in 2024, accounting for 34% of decisions (an increase from 27% of decisions in 2023). Fines for price-fixing were issued in relation to the manufacture of newspaper paper in South Korea, waterproofing products in Mexico, ready-mix concrete in Turkey, and welding technology in Austria. Further discussion of the key bid-rigging enforcement decisions in the construction sector is set out below.

Financial services: Further enforcement on the horizon

The financial services sector has been a consistent area of focus for cartel enforcement over recent years. However, in 2024 there were just 11 enforcement decisions in the 31 jurisdictions surveyed.

In Japan, the JFTC issued cease and desist orders and surcharge payment orders totaling USD13.7m against four non-life insurance companies and a non-life insurance agent for collusive price-fixing and bid-rigging practices in relation to insurance contracts with nine policyholders.

In South Africa, there were a number of developments in the Competition Commission's case against 28 banks accused of manipulating the USD/ZAR foreign exchange rate between 2007 and 2013. In January 2024, the Competition Appeal Court dismissed the charges against most of the banks, leaving just five banks to face trial. The Commission announced in February 2024 that it had approached the Constitutional Court for leave to appeal the decision.

Despite the lull in enforcement decisions, financial markets look set to remain on antitrust authorities' radars, and a key enforcement priority in certain jurisdictions in 2025— including the EC, where unannounced antitrust inspections were carried out in September 2024 at the premises of financial services companies in two member states in relation to financial derivatives. Indeed, in February 2025, the U.K. CMA fined four banks a total of over GBP100m following settlements in its U.K. government bonds investigation. A fifth bank benefited from full immunity from fines. The CMA found that individual traders at the banks took part in private one-to-one chatrooms in which they shared sensitive information relating to buying and selling U.K. government bonds on specific dates.

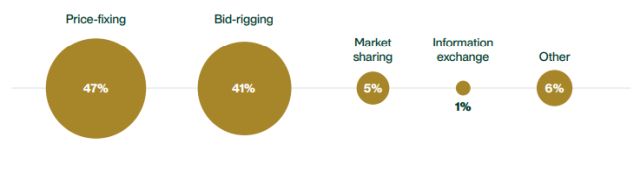

FORMS OF CARTEL CONDUCT

"For the first time in several years, price-fixing was the most commonly enforced type of cartel conduct in 2024"

Price-fixing: Fuel pricing acts as catalyst for antitrust intervention

For the first time in several years, price-fixing was the most commonly enforced type of cartel conduct in 2024 (47% of decisions, increasing from 38% of decisions in 2023), narrowly ahead of bid-rigging conduct (which has typically been the most prevalent in recent years).

The fuel sector has been a specific area of focus for antitrust authorities in recent years— particularly in Europe—where road fuel market studies have been conducted in Germany, Italy, Poland, and the U.K. In terms of enforcement, significant fines were issued in the Americas in 2024 in relation to cartels concerning the retail sale of fuel at gas stations: Brazil's Administrative Council for Economic Defense (CADE) issued fines totaling USD46.2m in decisions against two separate cartels, while Mexico's Federal Economic Competition Commission (COFECE) issued a fine of USD23.9m (including on executives/individuals) in a single decision.

Several agencies have also raised concerns over algorithmic collusion. In March 2024, the U.S. Department of Justice (DOJ) and the U.S. Federal Trade Commission (FTC) filed a statement of interest in a case in the hotel sector, warning that rival companies' use of the same algorithm-based pricing software to determine room prices risked breaching antitrust laws. The U.S. agencies have filed similar statements in real estate algorithmic price-fixing cases. In November 2024, Brazil's CADE launched an investigation into the use of an algorithmic pricing tool at petrol stations in a number of Brazilian cities, and Canada's Competition Bureau confirmed that it had launched a preliminary probe into real estate pricing algorithms. More generally, the competitive impact of AI remains a focus for antitrust authorities—see our section below on digital enforcement for more details.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]