- within Compliance topic(s)

The Securities and Exchange Commission (the "SEC") recently proposed amendments to modernize and simplify specific financial disclosure requirements in Regulation S-K as part of the SEC's Disclosure Effectiveness Initiative. The proposed amendments are designed to eliminate duplicative disclosures and modernize, in particular, Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A").

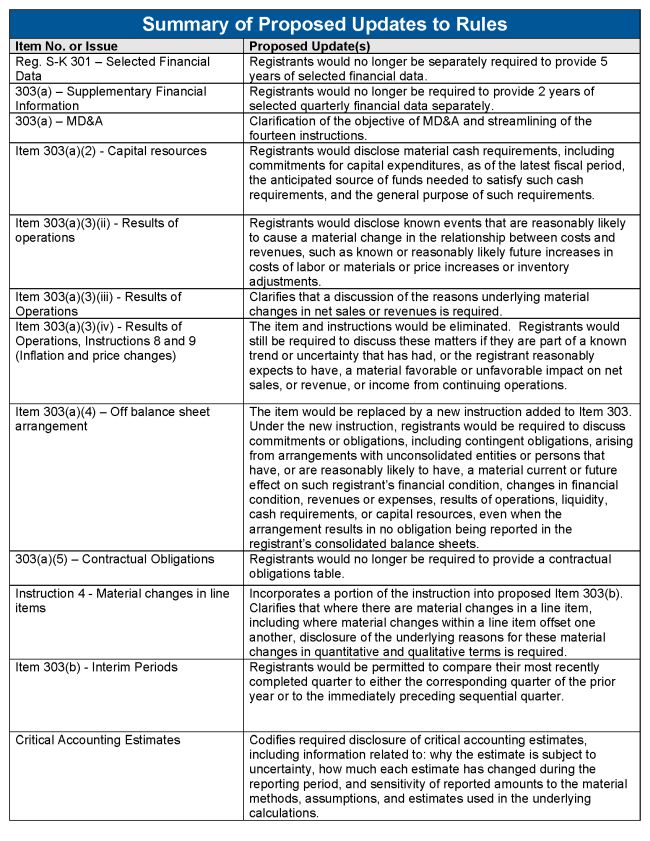

The proposed amendments would, among other changes, eliminate Items 301 (Selected Financial Data) and Item 302 (Supplementary Financial Data) of Regulation S-K, and would amend Item 303 of Regulation S-K (MD&A). Below is a summary of the proposed changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]