A family investment company (FIC) structure is a useful tool for wealthy parents to pass on future growth in their wealth to their children, without giving up the ability to use the capital themselves in the future. This is therefore an inheritance tax (IHT) liability freezing tool, rather than an IHT liability reducing tool.

In this article, we explain how FICs are structured, their advantages and their disadvantages.

Structure

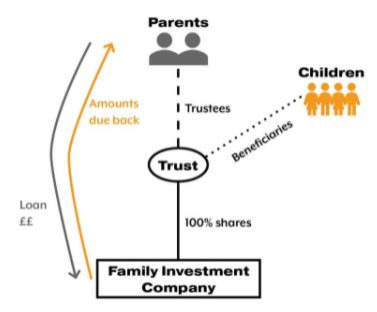

In its purest form, a company is set up and shares are allotted solely to the children. The parents loan cash to the company and the company invests the cash to generate a return.

The return on the cash is attributable to the shares owned by the children, giving the children an increased amount of wealth over time, derived through their ownership in the shares of a company with retained earnings wholly attributable to shares which they hold. The parents will then draw down on their loan account to fund their living expenses.

A FIC becomes more complex where parents want their children to benefit from the growth in value of the investments, but do not want them to have control over the company and investment decisions. In such a case, we favour a structure whereby the shares in the company are put into one or more trusts: the beneficiaries of the trust are the children and the trustees are the parents.

This enables the parents to control the trust and therefore the voting rights of the shares in the trust, ultimately allowing the parents to control the FIC without having the shares in the FIC forming part of their estate for IHT purposes.

The FIC can be incorporated as either a limited or unlimited company. The benefit of using an unlimited company is that information regarding the company's assets and liabilities does not have to be put on the public register: the information is provided annually to HMRC for corporation tax (CT) purposes.

An unlimited company does not have limited liability: the shareholders are ultimately liable for all the liabilities of the company. The type of company used should therefore be carefully considered.

If the ultimate aim is to reduce the value of the parents' estate for IHT purposes, the loan asset which the parents hold can be gifted to the children. This would constitute a potentially exempt transfer (PET) for IHT purposes.

The parents would need to survive seven years from the date of the gift to ensure that no IHT becomes payable on the gift of the loan receivable from the parents to the children. There is a tapering of relief given where a parent survives more than three years but less than seven years.

Advantages of using a FIC

FICs are corporate entities. Any profits generated by them are therefore subject to CT (currently at 19% but set to rise to an effective rate of up to 25% from 1 April 2023). If the parents need cash, they can draw funds out of the FIC against their loan account and not suffer any tax on the withdrawal as it is treated as a loan repayment.

In calculating taxable profits for the company, expenses incurred in relation to the management of the investments and investment advice are allowable expenses to the company and will be deducted from the company's income. By contrast, when these expenses are paid by an individual, they are not allowable expenses for tax purposes so cannot be deducted from the income received by the individual when calculating their taxable income.

Where dividends are received by the company from equity investments, there is usually no CT to pay by the company on this dividend income. This differs when they are received in the hands of an individual and dividend tax rates of up to 38.1% apply. The difference in tax treatment enables a greater amount of funds to be reinvested in the FIC, when compared to an individual holding and reinvesting into equities.

It may be possible to add gearing in a FIC, borrowing against the assets invested into so that additional assets can be purchased. The interest charged by the lender will be an allowable expense when calculating the profits chargeable to CT. This differs for an individual, where such borrowing expenses would not be allowable deductions when calculating the income chargeable to income tax.

If additional income is required by the parents, it would be possible for the loan they made to the company to have interest applied to it. The interest expense would be deductible when calculating the profits chargeable to CT for the company. The parents would be taxed at income tax rates on the interest.

Where additional income is not required by the parents, in the form of interest income, the loan should be shown in the accounts as repayable on demand. This seeks to avoid the potential claim by HMRC that the interest-free loan is an addition to the trust, on which tax liabilities would arise.

Disadvantages of using a FIC

There are costs associated with the initial setup of the FIC structure, along with annual compliance costs for preparing accounts and tax returns for the company and any trusts which have been formed. These annual compliance costs are allowable expenses when calculating taxable profits but do result in cash transfers out of the FIC to settle the amounts due. The initial setup costs and structuring advice are not allowable expenses for tax purposes.

Where the value of the shares in the trust is higher than the IHT threshold (currently at £325,000), there is a tax charge every 10 years, known as the 10 year anniversary charge. The rate of tax applicable is 6% of the value of the assets in the trust which is over the £325,000 nil rate band.

There is also an exit charge when assets are transferred out of the trust to the beneficiaries. It may therefore be beneficial for more than one trust to be set up to hold company shares to avoid these charges: consideration should be given to the running costs of these in comparison to the potential tax saving.

When profits are extracted from the FIC, the FIC will need to declare a dividend. The dividend will be taxable in the hands of the trust, which will be taxed on the dividend at a rate of 38.1%. When the trust makes a distribution to the beneficiaries, the beneficiaries will be taxed on the dividend at income tax rates, claiming a credit for the tax suffered on the dividend by the trust.

Where investments are being made for the purpose of creating gains, a FIC is a less tax-efficient mechanism through which to invest than if investments were to be made personally. When investments are made personally, gains are taxed at the current capital gains tax rate of 20%. If the investment were made through a FIC, the gain would be taxed at the current CT rate of 19%, but dividend tax rates would be applied when the profits are extracted from the FIC, leading to a higher effective tax charge on the gain on the investment than if it were made personally.

You can also watch our webinar on FICs (2018).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.