- in India

- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

Macro disruptive factors – from geopolitics to new technologies – are converging to re-shape operations and opportunities in satellite communications.

Satellite technology used for communications via space has shifted from well-established geostationary (GEO) orbits into non-geostationary (NGSO) space, bringing its own engineering and operational challenges, as well as new market opportunities. For satellite operators, success is not only having the right strategy, but moreover being positioned operationally to support the execution of it.

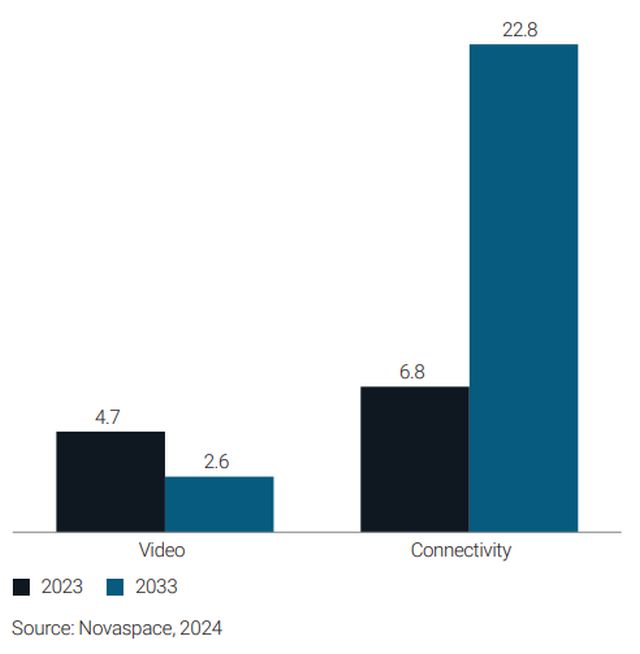

Demand for satellite capacity has moved away from video capacity to connectivity year-on-year – placing new demands upon satellite operators for higher speeds, lower costs, and lower latency.

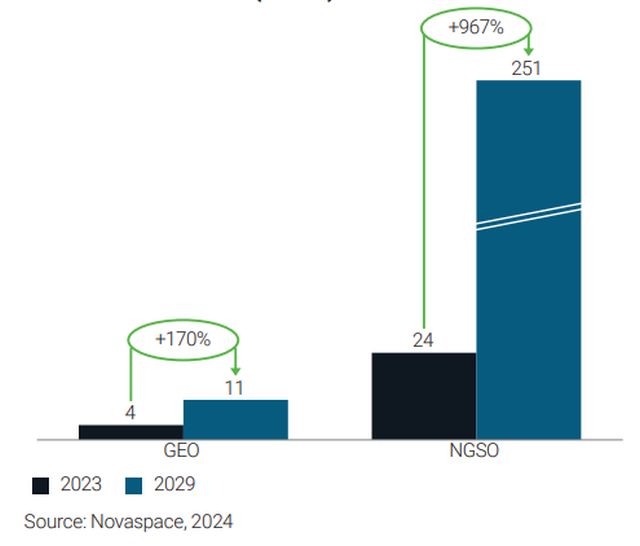

Supply has been transformed, too, shifting towards the NGSO space, specifically low earth orbits. As the chart below demonstrates, NGSO capacity growth will continue to outstrip GEO growth by a huge margin over the next four years.

This supply shift has been led by Starlink: the U.S. enterprise has disrupted the industry norms of satellite launch and operation, establishing an increasingly dominant position in the market as a result. The squeeze on available sites and capability to launch satellites globally – exacerbated by the Russian invasion of Ukraine and ongoing conflict in the region – is one of the factors that has also helped Starlink assume such a commanding position over satellite capacity, with their own highly cost-effective launch vehicles and an impressive launch rate of one launch every 2.42 days, on average, for SpaceX since the beginning of 2025.

While this change, driven by Starlink, has been building for some time, the change in U.S. Administration at the beginning of 2025 has precipitated major geopolitical realignment, calling into question a global reliance on U.S. launched and operated satellites. This creates additional areas of opportunity for companies across the satellite value chain and calls for alternative sovereign solutions.

FIGURE 1: GLOBAL SATELLITE COMMUNICATIONS CAPACITY SUPPLY (TBPS)

Observatory Guide – the terms of satellite communications

GEO – Geostationary Orbit: The fixed orbit of satellites along the path of the equator at a high altitude, 35,786km.

NGSO – Non-Geostationary Satellite Orbit: Refers to a type of orbit used by satellites in which the satellite is not stationary relative to the surface of the Earth. NGSO is divided into LEO and MEO.

LEO – Low Earth Orbit: An orbit relatively close to Earth's surface, less than 2,000km and as low as 160km.

MEO – Medium Earth Orbit: An orbit above LEO altitude but below the level of GEO satellites. This was historically used for navigation satellites and also is now being used for data communications.

FTTX – Fibre To The X: A generic acronym to describe a fibre connection that runs directly to a premises, home, or building; the sub acronyms are FTTP, FTTH or FTTB accordingly.

Cellular backhaul: The provision of bandwidth to Mobile Network Operators for backhauling Cellular Base Stations (2G, 3G, 4G, 5G), usually in hard to reach areas with no fibre connectivity and where microwave backhauling would not be cost-effective.

Direct to Device: The provision of satellite connection for individual mobile phones, increasing outdoor geographic coverage and providing a back-up to terrestrial network outages.

IoT – Internet of Things: The connectivity of a multiplicity of device types to the internet, usually requiring low throughput and low latency for certain use cases.

Tbps – Terabits per second: A measure of data transfer representing one trillion information bits per second.

Spectrum allocation: Refers to the radiofrequency spectrum that satellite communications rely on and how this is allocated to satellites by the International Telecommunication Union (ITU).

Demand and dominance

Broadcast video via satellite has provided the main capacity demand for operators until now. Connectivity has already taken over and capacity revenues in dollar terms are increasing on average by 23% year-on-year and forecast to reach nearly $23bn by 2033.

Demand for connectivity is coming from fixed broadband, consumer and enterprise broadband support, and meeting smartphone connection demand via cellular backhaul – as well as providing services to maritime, aerospace, and defence sectors.

Emerging use cases are solidifying as tangible opportunities. These include IoT and Direct to Device, an alternative to terrestrial cellular networks to ensure 100% coverage of national territories. NGSO – specifically LEO – is key to meeting these connectivity demands.

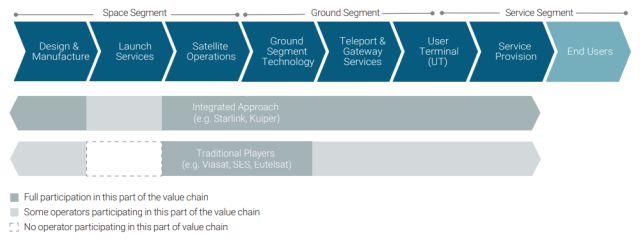

Launching and operating satellites in low orbit has seen the emergence of a new operating model, which is active across the satellite value chain, from design and manufacture to service provision. The diagram below shows how the sector is currently positioned, with the relatively new US entrants taking a fully integrated value chain approach to LEO satellite communications.

FIGURE 2: GLOBAL SATELLITE CAPACITY REVENUES (USD)

FIGURE 3: VALUE CHAIN POSITIONING OF SATELLITE COMMUNICATION OPERATORS

Recent work at Starlink to develop much larger constellations of satellites – with greater data capacity and larger rockets to launch them – led analysts at Enders to forecast a near total domination of future satellite connectivity – accounting for 95% of the market. Enders estimate that Starlink will operate 565 Tbps by 2028, with Kuiper (the satellite company established by Amazon) reaching 20 Tbps and other operators just 11 Tbps combined.

Low-orbit business models

The rise of Starlink reveals valuable lessons in how to be successful in a satellite communications sector, pivoting away from traditional GEO-based satellite comms.

Launch capacity has been critical to Starlink's rapid growth and is key to the domination that Enders predicts. While this is a challenge for much of the sector and for certain regions, the geopolitical factors mentioned earlier drive demand for alternative reliable, trusted, and scalable satellite-based connectivity in Europe.

To take advantage of the demand for NGSO and compete with newer entrants, satellite businesses will have to reimagine their operations to focus on the applications they need to serve in this evolving environment, alongside building a deeper understanding of those applications to manage them effectively.

To date, much of the industry has focused solely on running satellites and the necessary related ground operations. Merger and acquisition activity in the sector has also been horizontal – building scale rather than adding services.

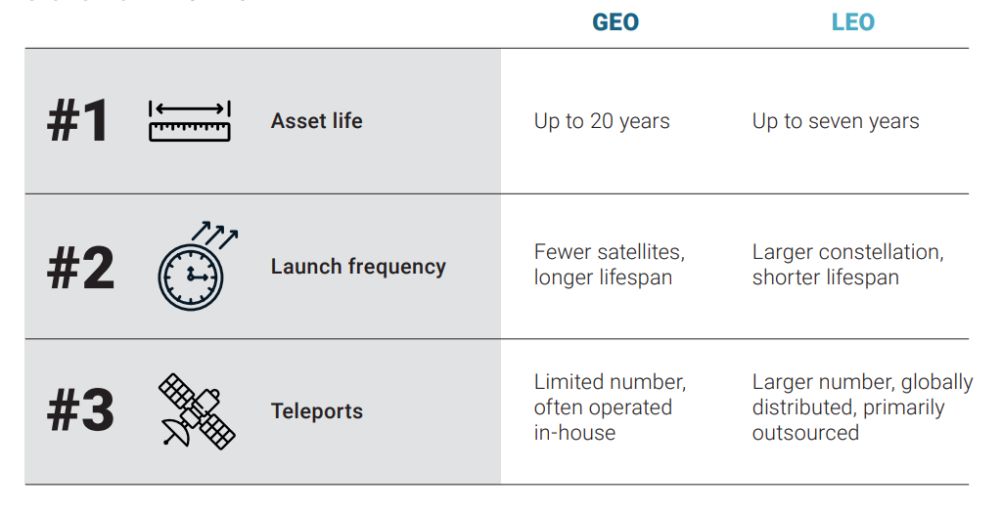

GEO VS LEO: AT A GLANCE

Making the shift to LEO satellite operation now would mark a watershed moment for GEO-focused satellite operators – but it does require a fundamental re-think both strategically and operationally.

While a strategic move towards NGSO is a multi-factorial decision, irrespective of the rationale, aspiring NGSO players need to carefully plan and consider the operational implications.

Despite some similarities in the engineering and operation of GEO and LEO satellites that allow for synergies, the characteristics of the two orbit types vary widely with significant implications.

The frequency of launches and number of assets physically in orbit is much higher for LEO satellites; constellations are less stable (needing constant adjustment) and the potential customer bases are different, requiring different applications, from enterprises demanding high-speed and low-latency connections to consumers being linked to orbiting assets directly from their device.

What Really Matters

Navigating the connected future of satellites calls for renewed focus and new approaches among satellite communications players.

LEO is more than a new technology; it's an entirely different way to operate and sell satellite services, requiring careful consideration in several areas.

1. Market refocus

A number of new market opportunities have emerged for consideration, including:

- Direct to Device, which opens up cellular handsets to direct satellite connections, driven by regions where certain geographies are hard to reach and spectrum supported by standard mobile handsets is available.

- Also in the consumer space, the provision of an alternative to FTTX in deep rural areas, where satellite connectivity is more cost-effective than laying fibre, providing public subsidy savings.

- IoT deployment requires connections to reach anywhere and potentially be mobile; satellites can secure that coverage.

- Other enterprise needs include Earth Observation and alternative Precise Navigation Timing (altPNT) – enabling a shift away from GPS reliance.

2. Operationalising a new technology approach

- Moving to LEO will mean investment or partnerships to develop High Throughput Satellites and a multi-orbit infrastructure, which can deliver more capacity, faster speed, and low latency.

- To keep up with the changing market – and competition – engineering and operations functions must build greater agility in relation to development cycles that need to move faster and deliver incremental value. In addition, new skills are needed, which can be acquired by diversifying existing talent with new starters from adjacent industries such as AI, cloud, and cybersecurity sectors.

3. New product offerings

- The decline in broadcast video demand means switching product and service offers to where demand is growing. This product focus is moving from video provision as raw capacity on a spectrum bandwidth basis to offering end-to-end integrated solutions.

- This necessitates a move along the value chain and a product-centric mindset: product standardisation and rationalisation to create cost-efficiencies, simplifying the portfolio, developing hybrid GEO / LEO product offerings, and having a highly digitised customer journey, moving away from servicing bespoke customer solutions.

4. New partnerships

- Delivering these products and end-to-end services often relies on forming partnerships.

- In the U.K., the regulator Ofcom's approach to enabling Direct to Device service is that "services could only be provided by satellite operators working with the MNO (mobile network operator) who is licenced to use the relevant frequencies nationally."

- It's an approach terrestrial telecommunications companies have taken, for example Orange Business and Palo Alto Networks work in partnership, with Palo Alto providing end-to-end threat management for enterprises using Orange Business across 200 countries.

- In operationalising LEO technology and taking a broader role in the satellite value chain, companies can work with partners in areas such as security, software-defined networking, and quality of service management.

5. Cost reduction

Providing broadcast video via satellite was a high margin business model generating steady and reliable free cash flow, which facilitated borrowing even at high levels of net debt. However, the market changes with the scale and competitive advantages of Starlink, and those emerging in Kuiper, as well as the different nature of LEO satellites, places a far greater emphasis on cost control to avoid constraining funding options.

Satellite companies should exercise tighter capital spending control and use a number of levers to improve efficiency and reduce operational expenditure:

- Review operating models to move to leaner approaches

- Shorten development cycles as part of an agile approach

- Increase digitisation, removing manual tasks

- Explore automation and leverage AI

- Simplify activities and structure, including ending projects with poor returns

- Strengthen governance

6. Preparation for regulation

With the significant regulations that surround space activities, moving to LEO operations poses more complexity than the fixed and established picture for GEO regulation.

For spectrum allocation, there is a need to coordinate with multiple countries and regulatory bodies, while also complying with international treaties, such as the Outer Space Treaty. Non-spectrum regulation includes data sovereignty considerations and the need to broker agreements in different markets.

7. Redefining the operational scope

As funding may be harder to secure, new sources should be explored, such as asset disposal. By way of example:

- Telesat recently sold its non-core satellite services company Infosat Communications, as it focuses on its Lightspeed LEO constellation.

- Eutelsat/Oneweb has agreed to divest its teleport assets and third-party relationships to EQT, to help fund the future replenishment of its LEO constellation as well as their share in Iris2 – an EU-backed LEO and MEO constellation.

While these can be strong sources of funding for a future business model – particularly given favourable infrastructure valuations in the case of teleports – it is essential that the operational implications are understood. Such carve-outs require a new operating model, with new processes and organisational perimeters – and, most of all, it is essential that these are achieved without any disruption to customers and the service provided to them.

Conclusion

The parameters and possibilities for global connectivity are being redefined by the transformation of the satellite communications industry, and a successful step-change for operators in the sector will require a revised strategy, agility, operating model and collaboration across the value chain.

Operators must go beyond mere capacity provision, leveraging partnerships, reimagining operations, and focusing on customer-centric and highly digitised solutions to meet growing demands for high-speed, low-latency connectivity and potentially compensate for the inevitable revenue decline in their legacy business

At this critical juncture, the connected future of satellite communications offers huge potential – but only for those ready to meet the challenge head-on, which includes following through on bold strategies and making the real operational changes required.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]