- within Finance and Banking topic(s)

- in United Kingdom

- with readers working within the Law Firm industries

- within Family and Matrimonial, International Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Aerospace & Defence industries

Introduction

From 1 November 2024, the UK Securitisation Regulations 20241 and the FCA's and PRA's new rules for securitisation came into full effect (the "UK Securitisation Rules"), six months after their original promulgation, and replacing the retained EU Securitisation Regulation.2 The firm-facing securitisation rules are now set out in the FCA's new Securitisation Sourcebook ("SECN") and the PRA's new Securitisation Part of the PRA Rulebook, alongside an updated PRA supervisory statement.3 The change forms a key pillar of the UK Government's Smarter Regulatory Framework for financial services,4 and follows consultation and final rules issued by both regulators.5

The UK Securitisation Regulations 2024 also set out due diligence requirements for trustees or managers of occupational pension schemes ("OPS") investing in securitisation positions,6 given that The Pensions Regulator does not have powers to make its own rules in relation to securitisation. The drafting of the due diligence requirements in both the FCA and PRA rules and the Securitisation Regulations 2024 (for OPS) is largely aligned.

For the CLO market, as for other securitisation participants, there is much more continuity in the new UK rules than there is change compared with the EU Securitisation Regulation. However, a number of "targeted policy changes" (as the FCA describes them) have been made.7 A second consultation by the UK regulators is expected in the second half of 2025. This is likely to cover, amongst other things, the distinction between public securitisations and private securitisations and the implications for the reporting regime,8 which may pave the way for further divergence from EU rules on these topics.

Summary of key divergence

Key points of divergence of the UK Securitisation Rules from the EU securitisation regime include the following:

- Due Diligence – form of reporting required by investors: There is a more principles-based and proportionate approach to the requirements on institutional investors to verify disclosure made by UK and overseas manufacturers of securitisations. Unlike the approach in the EU rules, which requires investors in securitisations to obtain information in prescribed templates,9 the new UK rules focus on whether a manufacturer has made available sufficient information to enable the institutional investor to independently assess the risk of holding the securitisation position.10 Where a transaction has a UK sponsor, originator or securitisation special purpose entity ("SSPE"), such entities will be required to provide disclosure templates pursuant to the transparency requirements in a prescribed form.11 However, UK institutional investors exposed to UK and non-UK securitisations are no longer required to ensure that the responsible entity discloses information in such prescribed format.

- Transfer of retention: By contrast with the EU rules, the UK Securitisation Rules are less flexible about the circumstances in which a retained interest can be transferred: the UK rules refer to permitting transfer of the retained interest in the event of insolvency of the risk retainer,12 but do not allow for a transfer where the risk retainer is unable to continue acting for legal reasons beyond its control and beyond the control of its shareholders, as permitted under the EU rules.13 While this divergence may indicate additional flexibility under the EU rules, the narrow nature of the "legal reasons" exemption (limited to illegality in respect of the continued ability of the retention holder to hold/retain or, in the case of an NPE servicer acting as retainer under the EU rules, termination of the appointment of such servicer) restricts its practical application. Its absence from the UK regime may, however, pose problems for cross-border compliance (if a risk retainer replacement permitted under the EU regime is not recognised under the UK regime) for transactions involving mixed UK and non-UK originators, sponsors or original lenders. We continue to hope that both the UK and EU authorities will be receptive to changes in this area as part of their respective consultations, as it has a potential impact on the structuring of M&A transactions involving a retention holder.

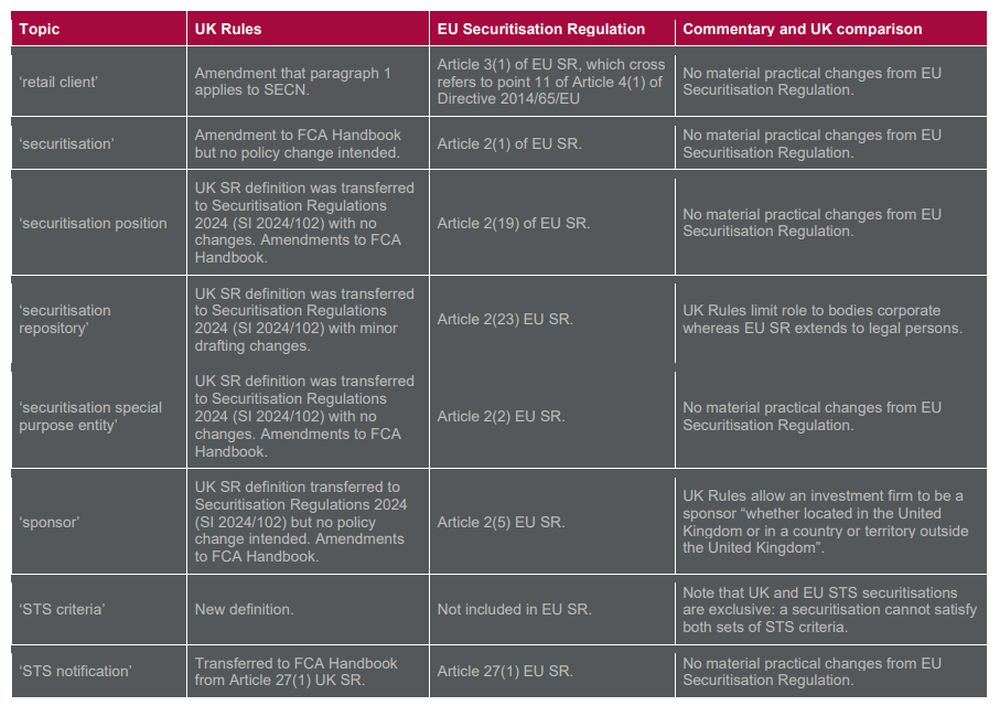

- STS: Synthetic securitisations have not been included within the definition of an STS (simple, transparent and standardised) securitisation.14 This approach aligns with the Basel standards on criteria for identifying securitisations as simple, transparent and comparable, but deviates from the approach under the EU Securitisation Regulation which extends its STS framework to certain qualifying synthetic securitisations. The PRA currently has, to date, been minded not to deviate from the Basel STC standards in order to advance its objectives (in particular, whether extending the preferential capital treatment currently available for exposures of STS securitisations under the UK Capital Requirements Regulation ("UK CRR") to synthetic securitisations might pose risks to the safety and soundness of PRA-authorised firms).15

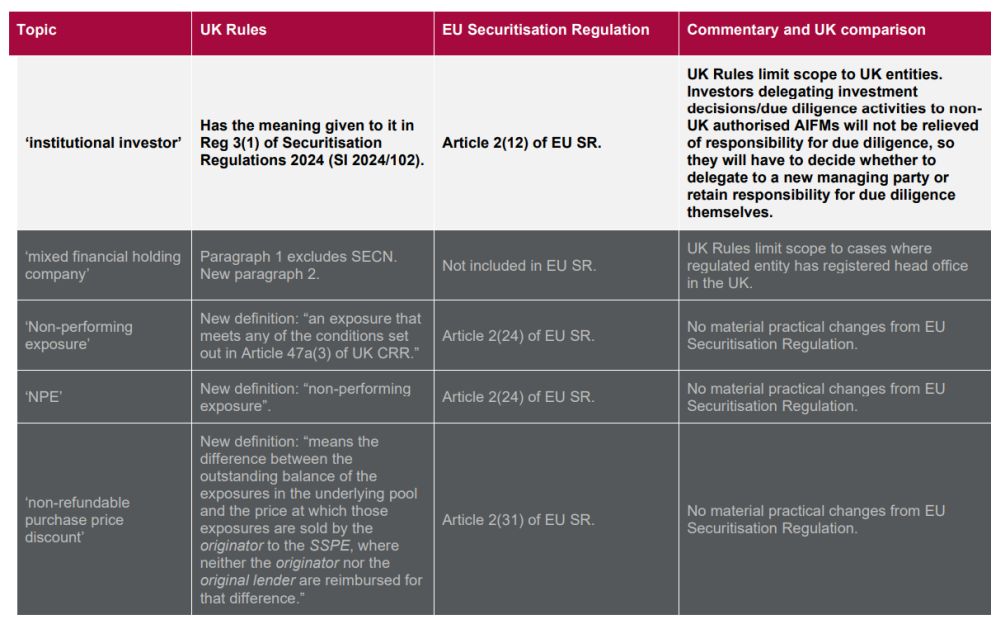

- Due Diligence – alternative investment fund managers: Under the UK rules, the only alternative investment fund managers ("AIFMs") within the definition of "institutional investor" are UKauthorised AIFMs, those AIFMs marketing or managing an AIF in the UK, and small, registered UK AIFMs: i.e., not including non-UK AIFMs.16 This has practical implications for delegation arrangements in that investors delegating investment decisions/due diligence activities to non-UK AIFMs will not be relieved of responsibility for compliance.

- Sole Purpose Test: When assessing whether an originator is not operating for the "sole purpose" of securitising exposures and therefore may act as an eligible risk retainer,17 the UK has specified certain factors as mandatory to be taken into account, including whether the originator has a strategy consistent with a broader business model, capacity to meet payment obligations without relying on securitised exposures or related risk retention, sufficiently experienced management, and adequate corporate governance arrangements.18 This test differs from the EU rules, which require that the originator must not rely on securitised exposures or related risk retention "as its sole or predominant source of revenue".19 The new UK test is therefore potentially easier for originators to satisfy. However, the matters specified in the UK rules are only factors to be taken into account (which implies a more principles-based approach) rather than constituting, if satisfied, a safe harbour as under the EU rules.

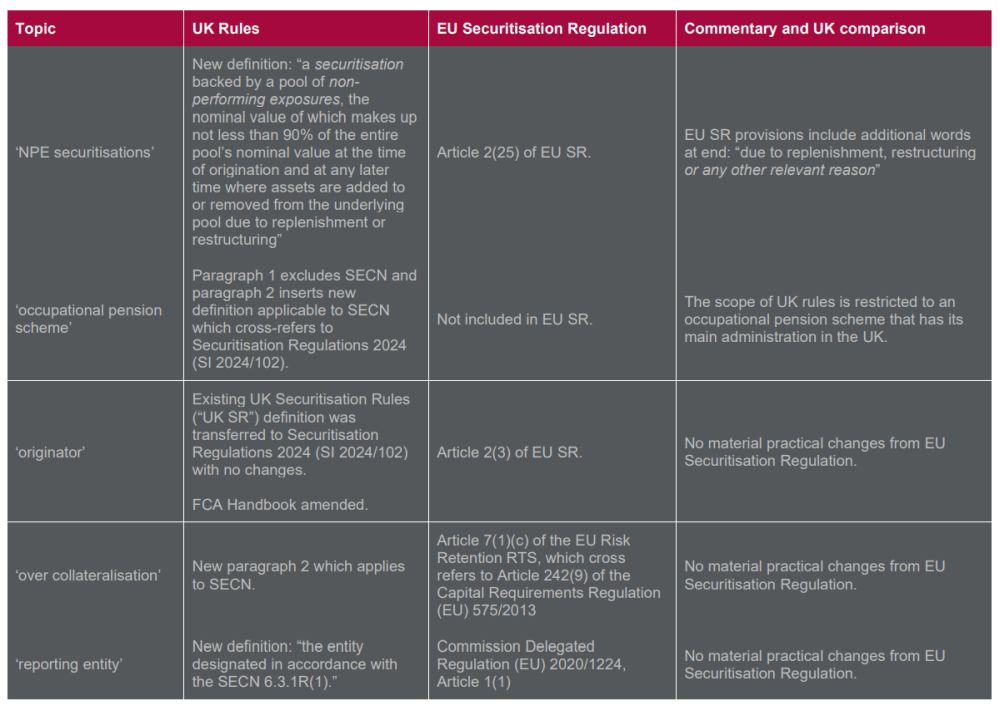

- NPE Securitisations: Unlike under the EU regime and despite being considered by HM Treasury in initial consultations on the new UK framework,20 the asset servicer in a securitisation of nonperforming exposures ("NPEs") cannot act as an eligible risk retainer under the new UK Securitisation Rules.21 However, consistent with the current EU rules,22 securitisation of NPEs will be facilitated by allowing the net value of the NPEs to be used instead of nominal value for the purpose of calculating the risk retention requirements.23

- Transparency and Due Diligence – initial information: The UK rules allow transparency and due diligence information in respect of private transactions to be provided "before pricing or commitment to invest",24 rather than only "before pricing" as under the EU rules,25 and the final form of legal documentation needed to understand the transaction can be provided up to 15 days after closing of the transaction.26 This clarification is consistent with current market practice and acknowledges the difficulty in ascertaining a pricing date for private transactions. It also provides certainty for investors purchasing positions in the secondary market that they will not be required to verify a transaction's compliance prior to their commitment to invest.

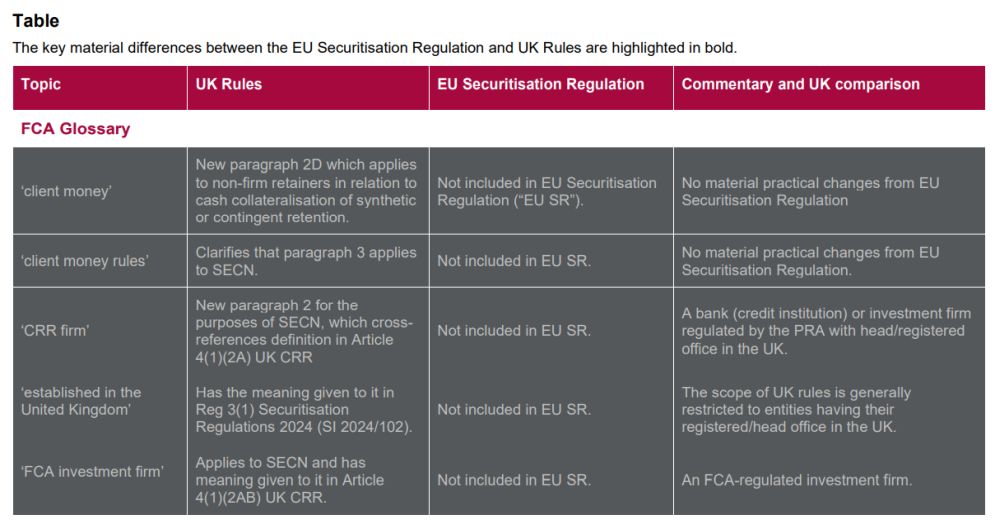

A detailed analysis of the material differences between the new UK regime and the current EU regime is set out in the table below.

There are also various points in the new UK rules which do not diverge from EU standards but represent helpful points of clarification compared with the previous UK approach, such as the clarification that hedging of the retained interest is permitted in certain circumstances, including pre-securitisation hedging undertaken as a prudent element of credit granting or risk management.27

Transitional Provisions

Transitional rules mean that the existing retained EU rules largely apply to transactions which closed before 1 November 2024,28 except in the case of delegation of due diligence compliance to non-UK authorised alternative investment fund managers prior to 1 November 2024, which will not be grandfathered.29 On 7 October 2024, HM Treasury published a draft new statutory instrument extending the temporary grandfathering regime for EU securitisations notified to ESMA as meeting EU STS criteria also to qualify as UK STS securitisations, from 31 December 2024 to 30 June 2026,30 in order to provide greater certainty to investors.31

Final Thoughts

The UK has moved from the firm-facing rules applicable to securitisations being set out mainly in primary legislation, to the majority of these now being set out in the FCA and PRA rulebooks. This allows the UK regulators more flexibility to adapt quickly to market changes and regulatory concerns. However, given the cross-border nature of most securitisation transactions (including CLOs), the UK regulators will no doubt seek to ensure a material level of alignment with the EU except where there are clear policy reasons for further divergence. The new consultation by the FCA and PRA expected in the second half of 2025 may well include proposals for the disclosure requirements for private securitisations to become more streamlined and proportionate than they are currently under both UK and EU rules.

Footnotes

1. The Securitisation Regulations 2024 (SI 2024/102), as amended by the Securitisation (Amendment) Regulations 2024 (SI 2024/705), brought into effect by the Financial Services and Markets Act 2023 (Commencement No.7) Regulations 2024 (SI 2024/891): https://www.legislation.gov.uk/uksi/2024/102/.

2. Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation ("EU Securitisation Regulation"): https://eur-lex.europa.eu/eli/reg/2017/2402/oj.

3. PRA's SS 10/18 – Securitisation: General requirements and capital framework: https://www.bankofengland.co.uk/prudentialregulation/publication/2018/securitisation-general-requirements-and-capital-framework-ss. There are also consequential amendments to the Liquidity Coverage Ratio (CRR) Part (https://www.prarulebook.co.uk/pra-rules/liquidity-crr) and the Non-Performing; Exposures Securitisation (CRR) Part ( https://www.prarulebook.co.uk/pra-rules/non-performing-exposures-securitisation-crr) of the PRA Rulebook.

4. https://www.gov.uk/government/collections/a-smarter-regulatory-framework-for-financial-services

5. FCA, CP23/17: Rules relating to Securitisation (August 2023): https://www.fca.org.uk/publication/consultation/cp23-17.pdf PRA, CP15/23: Securitisation: General Requirements (27 July 2023): https://www.bankofengland.co.uk/prudential-regulation/publication/2023/july/securitisation FCA, PS24/4: Rules relating to Securitisation (30 April 2024): https://www.fca.org.uk/publication/policy/ps24-4.pdf PRA, PS7/24: Securitisation: General Requirements (30 April 2024): https://www.bankofengland.co.uk/prudential-regulation/publication/2024/april/securitisationpolicy-statement

6. Securitisation Regulations 2024, regulations 32A-32C.

7. https://www.fca.org.uk/publications/policy-statements/ps24-4-rules-relating-securitisation

8. PD24/4, para.2.4. See the Regulatory Initiatives Grid (latest version November 2023), p.56 (Tranche 1: Wholesale financial markets): https://www.fca.org.uk/publication/corporate/regulatory-initiatives-grid-nov-2023.pdf

9. Articles 5(1)(e), 7(1) and 7(4) of the EU Securitisation Regulation.

10. SECN 4.2.1R(1)(e); Article 5(1)(e) of PRA Rulebook.

11. SECN 6.2.1R, SECN 11 and SECN12.

12. SECN 5.12.1(4)(a); Article 12(3)(a) of PRA Rulebook.

13. Article 12(3)(b) of the EU Risk Retention RTS.

14. Regulation 9 of the Securitisation Regulations 2024; SECN 2.2.1R; Article 1(3) of the PRA Rulebook.

15. Article 26a(1) of the EU Securitisation Regulation.

16. Regulation 3(1) of the Securitisation Regulations 2024.

17. SECN 5.2.5R.

18. SECN 5.3.6R; Article 2(6) of PRA Rulebook.

19. Commission Delegated Regulation (EU) 2023/2175 of 7 July 2023 ("EU Risk Retention RTS"), Article 2(7): https://eur-lex.europa.eu/legalcontent/EN/TXT/?uri=OJ:L_202302175.

20. Article 6(1) of the EU Securitisation Regulation (as inserted by Regulation (EU) 2021/557 of 31 March 2021).

21. SECN 5.2.1R.

22. Article 6(3a) of the EU Securitisation Regulation.

23. SECN 5.2.8R(2); Article 9(1) of the PRA Rulebook.

24. SECN 2.2.25R, 2.2.27R, 2.2.29R, 2.3.16R, 2.3.28R; Article 5(1) and Article 7(1) of PRA Rulebook.

25. Article 7(1)(g) of the EU Securitisation Regulation.

26. i SECN 4.2.1R(1)(e)(4), SECN 6.2.2R(2).

27. SECN 5.12.1R(2); reflecting Recital 7 of the EU Risk Retention RTS (which was introduced post-IP completion day, i.e. 31 December 2020 at 11pm, as defined in the European Union (Withdrawal Agreement) Act 2020).

28. SECN 14.3.1R; Article 3(1) of the PRA Rulebook.

29. SECN 14.3.1R(2)(a).

30. Draft Securitisation (Amendment) (No.2) Regulations 2024: https://www.legislation.gov.uk/ukdsi/2024/9780348263954.

31. Explanatory Memorandum to the Draft Securitisation (Amendment) (No.2) Regulations 2024, para.5.2: https://www.legislation.gov.uk/ukdsi/2024/9780348263954/memorandum/contents.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]