Following a review commissioned by the Coalition Government on the 27 October 2010, pensions auto-enrolment was ratified by the Department for Work and Pensions. The Government is targeting employers that are not offering a qualifying workplace pension scheme (QWPS) and employees who are not saving for their retirement.

Auto-enrolment is considered to be the simplest way to quickly get more employed people to save for their retirement.

The review also recommended that a low-cost default scheme be introduced alongside automatic enrolment to ensure that "supply could meet demand". The Government has launched a suitable scheme under the banner of NEST (National Employment Savings Trust) which is aimed at those on low incomes.

Key facts about auto-enrolment

- Between 2012 and 2017 every employer has a duty to designate a QWPS into which it will automatically enrol all of its qualifying workers and make contributions on their behalf.

- No employer is exempt from this requirement and the main choice it now faces is which pension scheme or schemes to use to comply with the new regulations.

- Even if the employer has an existing workplace pension scheme, it will have to review it and possibly make changes to it to ensure it complies with the new regulations.

- Business costs to employers will rise.

- The government-instigated NEST scheme will be available for employers to use.

- The Pensions Regulator will police and enforce the new laws. Failure to comply will lead to fines proportionate to the non-compliance and could ultimately result in criminal prosecution.

- Employers will need to educate their employees about the implications of auto-enrolment and the direct effect it will have on them.

- Employers will need to create systems and processes to ensure that both new and existing employees are provided with information and joined into the scheme at the correct time.

The timetable

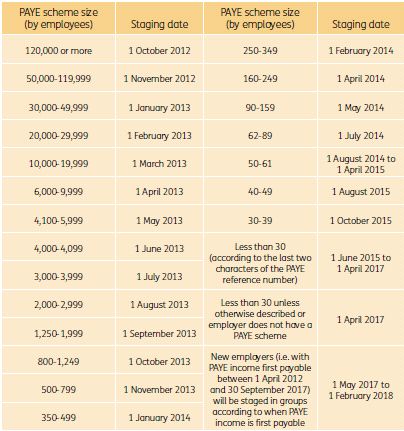

All employers will have to comply with auto enrolment. In order to make this as manageable as possible a staged implementation process has been adopted. The table below provides details of the staging dates which are dependent on the size of each employer's largest PAYE scheme. Please note the Pensions Regulator will contact each employer 12 months prior to the staging date to inform it of its duty to comply with the auto-enrolment laws.

The staging dates for employers with less than 250 employees are indicative and still under consultation at the date of this briefing.

Employer duties

- Provide information to employees about the QWPS in place for them within strict timescales.

- Automatically enrol all eligible employees into a QWPS.

- Make employer contributions for every employee who does not opt-out of the QWPS.

- Employers will be permitted to delay auto enrolment for a period of up to three months.

However, an employee who wishes to join immediately is entitled to do so and benefit from the employer contribution.

The level of contributions

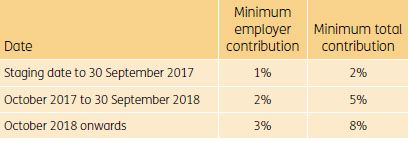

The minimum level of contributions will be phased in over time in line with the table below and starting on the employer's staging date.

Employees with earnings equal to, or higher than, the earnings trigger salary (currently £8,105) should be automatically enrolled. Minimum contributions will then be calculated using a definition of "banded"; earnings, currently between £5,564 and £42,484 per year.

The minimum total contributions includes tax relief granted by the Government so, looking at the final level of contributions, if the employer pays the minimum contribution then the 8% total contribution will be made up of:

- 3% from the employer

- 4% from the employee

- 1% from tax relief

Employees' opt-out

Employees can opt-out of the QWPS but this can only be done after they have been auto-enrolled. If an employee does opt-out, automatic re-enrolment must be executed by the employer every three years within a three-month window around the anniversary of the employer's original staging date. Importantly, an employer is not permitted to dissuade an employee from joining the arrangement or to employ any business practices which would encourage an employee to opt-out. In particular, an employer is not permitted to provide a member with an opt-out form; it should instead be obtained from a third-party source.

This is particularly relevant for those employees with enhanced protection under the A-Day tax regime whose protection would be lost if they made a contribution to a registered pension scheme (or if contributions are made on their behalf). They will need to be particularly careful. These individuals must remember to opt-out immediately after they are auto-enrolled to ensure no contributions are ever actually made.

NEST

For employers that do not have a qualifying scheme and who do not wish to establish one, or employers who simply do not want to use their existing scheme for all employees, the NEST is the scheme they can use.

NEST has been designed specifically to meet the needs of low-to-moderate earners and their employers. It operates as a trust-based occupational pension scheme, with a trustee body, and is subject to regulation by the Pensions Regulator.

NEST is designed to be low cost. It is expected to have a combination charge made up of an annual management charge of 0.3% and a charge on contributions of 1.8%. While this is low cost for those who remain invested for an extended period, it could prove expensive in the short term.

Other pension providers are entering the market all the time with competitive solutions, so careful thought is required to select an appropriate arrangement.

NEST is also intended to be:

- open to any employer that wants to use it to meet the new duties

- an online scheme that's intended to be easy to use

- easy for employers and employees to understand

- run in members' interests by NEST Corporation.

NEST has confirmed that it has appointed State Street Global Advisors, UBS Global Asset Management and BlackRock to run five mandates for its default fund. The three asset management firms will run five mandates which are largely passive in nature and invest in assets like gilts, cash and equities via an index.

It should be remembered that the 'death benefits' attaching to a NEST plan will fall within a member's estate, unlike conventional pension plans/schemes. The current 'key facts' document is available online at www.nestpensions.org.uk/documents/ Key-Fact-Myths.pdf

Many commentators feel that not all employers should rely solely on NEST as they might be better served by offering, or continuing to offer, their own retirement savings solution to employees.

There are specific regulations, such as a relatively low cap on the amount of contributions that can be paid to NEST and (currently) a prohibition on transfers out, which may make NEST less attractive to employers as an alternative to implementing their own QWPS.

Employer actions and choices

All employers should conduct an analysis to see how many employees will be affected and if their existing schemes meet the qualifying requirements.

Even if they do have a qualifying scheme, employers need to decide whether to use this scheme or simply auto-enrol employees into NEST. The introduction of these requirements will almost certainly impact directly on the pension costs an employer faces, and so they may also want to use this as an opportunity to review the benefits strategy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.