- within Energy and Natural Resources topic(s)

- with readers working within the Oil & Gas and Utilities industries

- within Energy and Natural Resources, Transport and Employment and HR topic(s)

- with Inhouse Counsel

On 24 April 2025, HM Revenue & Customs (HMRC) published draft primary legislation for the UK Carbon Adjustment Mechanism (CBAM), alongside a policy update and a technical consultation. In this briefing, we summarise the key provisions of the draft UK CBAM.

Background

On 18 December 2023, the UK Government announced its intention to implement a UK CBAM by 2027 as part of its response to a consultation on "addressing carbon leakage risk to support decarbonisation" (Carbon Leakage Consultation). A further consultation in relation to the specific mechanics and proposals for the UK CBAM ran from March to June 2024 (CBAM Consultation) with the response published on 30 October 2024. The Carbon Leakage Consultation and CBAM Consultation both followed in the wake of the EU CBAM, which entered into application in its transitional phase on 1 October 2023 (see our previous post for further background). On 26 February 2025, the EU Commission proposed significant changes to the EU CBAM, largely aimed at simplifying its requirements, as part of its proposed Omnibus package. The timing of publication of the draft primary legislation for the UK CBAM is therefore particularly salient as the UK Government had the opportunity to consider the proposed changes in the Omnibus package before publishing the draft primary legislation.

Under the EU CBAM, importers are required on an annual basis to purchase and surrender certificates corresponding to the volume of emissions embodied in specified goods. By contrast, the UK CBAM will operate as a straightforward tax on the volume of emissions embodied in specified carbon-intensive goods imported into the UK in sectors that have been identified as most at risk of carbon leakage and will accordingly be administered by HMRC rather than by the UK ETS Authority. The Government has confirmed that it will aim to ensure comparable treatment from a carbon pricing perspective of imported goods with those produced domestically, to reduce the risk of domestic production being relocated.

Scope

The UK CBAM will apply to imports into the UK (including goods entering the UK from the Crown Dependencies) of specified goods (identified by specific commodity codes) within in-scope sectors (CBAM Goods), which originate from outside of the UK according to the UK's non-preferential rules of origin1, on or after 1 January 2027. There is significant overlap in the list of sectors covered by the UK and EU CBAMs, which are set out in the table below for reference.

The list of sectors and CBAM Goods in scope will be kept under review beyond 2027 to reflect evolving carbon leakage risk, as well as the feasibility of implementing the UK CBAM for further sectors or goods.

CBAM liability

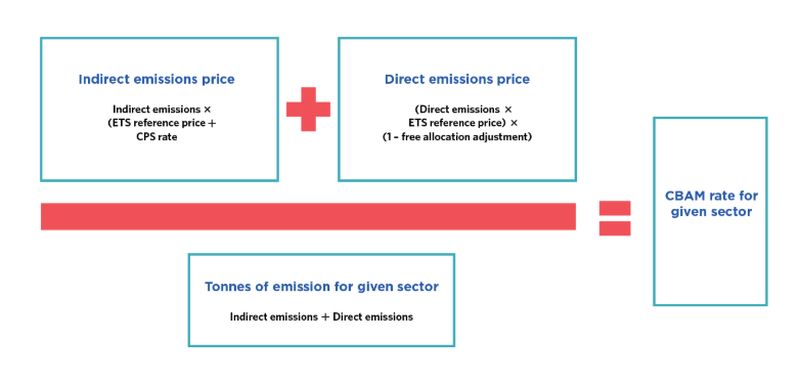

The carbon tax payable on the import of CBAM Goods will be based on the direct and indirect emissions2 embodied within the imported CBAM Goods (measured in tonnes of carbon dioxide equivalent, or tCO2e), multiplied by the 'CBAM rate' applicable to the relevant sector and calculated in accordance with the figure below.

There will be a single CBAM rate per sector which will be calculated by reference to the UK ETS and the Carbon Price Support (applicable to fossil fuels used to generate electricity in GB), taking into account the allocation of free allowances under the UK ETS. HM Treasury will calculate and publish the CBAM rates quarterly from 1 January 2027.

This differs from the approach taken under the EU CBAM where the price of certificates is based on the weekly average price of the EU ETS, with one single price for all certificates rather than different rates per sector.

Determining embodied emissions

When determining the embodied emissions of CBAM Goods, entities may use either the actual data relating to such embodied emissions, or default emissions values determined by the UK Government. This mirrors the approach taken under the EU CBAM.

Where actual data is provided, it will need to be independently verified by a body accredited by an International Accreditation Forum member. Where default values are used, there will be one default emissions value set per CBAM Good which will be published in advance of the UK CBAM coming into force. The UK Government has confirmed that it is considering the feasibility of moving to an alternative approach for default emissions values after 2027. Further detail on both (a) monitoring, reporting and verification of actual emissions and (b) default emissions values will be published in delegated legislation in due course.

Carbon price relief

Similar to the EU CBAM, carbon price relief will be available to reduce CBAM liability if the embodied emissions in the CBAM Goods have been subject to a carbon price outside the UK (Deductible Carbon Price). In order to claim carbon price relief, the relevant entity will be required to hold verified evidence that a liability to pay a carbon price has been incurred (but it need not have already been paid). The Government will consider the use of international agreements in relation to the claiming of carbon price relief where CBAM Goods have been subject to a Deductible Carbon Price. The draft primary legislation allows the government to implement international agreements that can simplify the calculations and the evidence requirement for claiming carbon price relief.

The UK Government will have the power to confer an exemption from CBAM liability for goods originating in a jurisdiction that has a linked ETS with the UK ETS (ie, the EU ETS – see here the UK Government's announcement with respect to the prospective linking of the UK and EU ETS).

Registration

The entity liable under the UK CBAM will be the importer of record (for customs purposes) or the person on whose behalf the goods are moved to the UK. The liable person must be importing CBAM Goods for business purposes and can appoint a tax agent to act on their behalf and submit CBAM returns (but no liability will accrue to the tax agent). Entities will be required to register under the UK CBAM if they meet at least one of the following tests on or after 1 January 2027.

- Forward-looking test: If they expect, on any given day, that the total value of CBAM Goods they import into the UK over the next 30 days will meet or exceed a £50,000 de minimis threshold. Liability under the UK CBAM will accrue from the date on which the forward-looking test is met.

- Backwards-looking test: On the first day of the month, the total value of CBAM Goods they import into the UK over the preceding 12-month period met or exceeded a £50,000 de minimis threshold (provided that in the first year, the look-back period will extend only to 1 January 2027). Where the test is met, liability under the UK CBAM will accrue from the day on which the test was applied.

If a liable person meets both tests, liability starts from the earliest of the two dates. Once liability starts, the liable person will have 30 days to register with HMRC (although this period will be extended in the first year of UK CBAM). If they fail to register within the 30 days, HMRC will be able to compulsorily register them and assess the tax due.

This differs from the EU CBAM approach, under which goods are currently exempt from EU CBAM obligations if their value does not exceed EUR 150 per consignment. In recognition of the inefficiency of this previous approach, the Omnibus Package proposed to exempt importers if they import an annual cumulative mass of EU CBAM goods below 50 tonnes.

Group treatment

Corporate bodies that are connected can apply to be treated as a group. In order to qualify for group treatment, the following criteria must be satisfied:

- each member must be a corporate body;

- at least one member must have an established place of business in the UK; and

- all members must be under the same control.

Each group will assign a representative to be responsible for submitting CBAM returns and paying the CBAM liability on behalf of the entire group. The representative must be a resident of the UK or have a permanent establishment in the UK. Once an application for group treatment has been submitted by eligible bodies, HMRC will have 90 days to confirm whether they accept or refuse the application and, if they accept the application, to specify the date from which the applicants are to be treated as members of a group. Members of the group will be jointly and severally liable for the CBAM liability of the whole group.

Artificial separation of business activities

If liable persons attempt to artificially separate their activities so as to fall under the £50,000 de minimis threshold, HMRC may make a direction naming them as jointly and severally liable for the full extent of the CBAM liability.

Accounting periods and payment

Once they become registrable, liable persons need to complete and submit a tax return for the CBAM at the end of each accounting period unless they de-register.

The first accounting period will run for 12 months from 1 January 2027 to 31 December 2027, with returns and payments due on 31 May 2028, 5 months after the end of the accounting period. From 1 January 2028, accounting periods will be quarterly, with returns and payments due before the end of the last working day of the second month after the end of the accounting period. HMRC is considering extending the return and payment deadline for the first quarterly accounting period to ensure deadlines do not overlap with that of the first accounting period.

Offences

The draft primary legislation establishes both civil and criminal offences.

Civil offences

The following civil offences will be introduced:

- failure to notify HMRC of liability under the UK CBAM;

- failure to submit a UK CBAM return;

- failure to pay an amount which is payable in respect of the UK CBAM;

- errors in documents which support the accounting of the UK CBAM;

- failure to disclose a tax avoidance scheme, and serial tax avoidance; and

- failure to comply with an information notice.

HMRC will impose penalties for such offences to ensure compliance. The Government has confirmed that HMRC is also introducing a general regulatory penalty for failure to comply with specific CBAM rules and regulations.

Criminal offences

The draft primary legislation also creates criminal offences for:

- fraudulent evasion (the penalty for which will be imprisonment and/or a fine not exceeding £20,000 or, if greater, three times the total of the amount of CBAM liability that was or was intended to be evaded); and

- fraudulent misstatement (the penalty for which will be imprisonment and/or a fine not exceeding £20,000).

Next steps

HM Treasury and HMRC will set out further details and information on various aspects of the UK CBAM in delegated legislation and guidance ahead of the commencement of the UK CBAM, although no indication has been given as to when these would be published.

Key areas include:

- details on monitoring, reporting and verifying actual emissions embedded in CBAM Goods;

- details on the measurement of the weight of CBAM Goods and the timing of the measurements;

- the methodology for calculating the effective carbon price incurred (the price paid by producers after accounting for the impact of free allowances and other support mechanisms) and details for verifying the Deductible Carbon Price; and

- the method for calculating the value of CBAM Goods.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.