- within Environment topic(s)

- within Environment topic(s)

- within Environment and Criminal Law topic(s)

What is the UK CBAM?

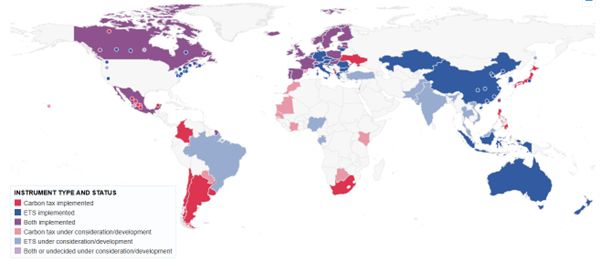

Recognising the risk of carbon leakage1 as not all jurisdictions are moving at the same pace in adopting Emissions Trading Scheme (ETS) (Figure 1), the UK government has considered adopting a carbon border adjustment mechanism (CBAM), among other potential domestic carbon leakage mitigation measures.2,3 Following consultations conducted in 2023-2024, the UK is planning to introduce a Carbon Border Adjustment Mechanism (CBAM) by January 2027. Similar to the EU's CBAM, the UK's CBAM will place a carbon price on some of the most emissions-intensive industrial goods imported to the UK.

Figure 1. Compliance carbon pricing instruments around the world

P

Source: World Bank Carbon Pricing Dashboard

Initially, the UK's CBAM targeted a wide range of carbon-intensive goods with a high risk of carbon leakage, including Aluminium, Cement, Ceramics, Fertilisers, Glass, Hydrogen, and Iron & Steel. Following extensive consultation during March-June 2024, the UK government confirmed the coverage of products from aluminium, cement, fertiliser, hydrogen and iron & steel sectors ('CBAM goods').4 Products from the glass and ceramic sectors will be considered for future inclusion but will not be in the scope of the UK's CBAM from 2027.5

The CBAM rate applied by the UK on the embodied emissions will reflect explicit carbon pricing in the UK, net of free allowances and other reductions to the carbon price paid domestically. This will ensure that imported goods are subject to a carbon price comparable to that incurred by UK production. The overall CBAM liability will account for explicit carbon prices applicable in other jurisdictions to ensure the measure focuses on mitigating the risk of carbon leakage driven by the differentials in carbon pricing between jurisdictions.6

The UK government is still finalising the details of its CBAM. Based on the outcomes of the consultation paper released in October 2024, the UK will (i) cover both direct and indirect emissions; (ii) a single default value set per product will be provided where actual emissions data is not available. The methodology to be used for the calculation of default values will be provided in advance of the introduction of the CBAM in 2027.7

The CBAM rate will be applicable per tonne of embodied emissions attributed to CBAM goods. There would be an individual rate for each sector of goods in the scope of the UK CBAM.8 These rates will be set by the government at the beginning of each quarter and will reflect the UK ETS, Carbon Price Support (CPS), free allowances, and the domestic pricing mechanisms expected to be in place for 2027.9 The UK CBAM liability can be reduced if the embodied emissions in the imported CBAM goods are subject to an explicit carbon price10 overseas with supporting evidence.11 The overseas carbon price would need to be verified by an independent third party. The independent person responsible for verifying emissions would need to be accredited by a member of the International Accreditation Forum (IAF), such as the United Kingdom Accreditation Service (UKAS) in the UK.12 Mutual recognition of overseas verification schemes may be considered.13

The UK CBAM is expected to operate as a tax. Liable person will be the person responsible for the goods when they are released into free circulation14 or, where there are no customs controls, the person on whose behalf the goods are moved to the UK. To reduce the administrative burden for those importing small quantities of covered goods and balance the cost of administering the UK CBAM against the carbon leakage objectives, a threshold was proposed at £50,000 over a rolling 12-month rolling period for UK CBAM registration.15 For tax filings, the first accounting period would be 12 months, with a five-month return window (i.e., 31 May 2028). From 1 January 2028, the accounting periods would be quarterly and gradually transition to returns and payments due a month later to align with general tax administration regimes by HMRC.16 As the UK CBAM will operate as a tax-based mechanism, non-compliance will be subject to regulatory specific penalties.17

So far, with the planned UK CBAM, there are only 2 such regimes globally. UK CBAM bear some similarities to the EU CBAM, such in the scope of sectors covered (except for treatment of electricity),18 and the methods for calculation of emissions. However, the UK CBAM would have higher de minimis threshold, which is supposed to benefit smaller traders (Table 1). The reporting frequency may also have some implications for businesses in monitoring and reporting on the embedded emissions in their products.

Table 1. EU CBAM vs. UK CBAM

| EU CBAM | UK CBAM | |

|---|---|---|

| Start date |

|

1 January 2027 (e) |

| De minimis | €150 per consignment19 | £50,000 over 12 months |

| Sector covered |

|

|

| Emissions covered |

|

Direct and Indirect for covered sectors (detail TBD) |

| Calculation of emissions |

|

|

| How to fulfil CBAM liability | Render certificates purchased at prices linked to EU ETS weekly average auction price (€/tCO2e) | Tax rates updated quarterly, referenced to UK ETS price each quarter (£/tCO2e) |

| Offset with carbon price paid in the country of origin | Yes, for carbon price "effectively paid in the country of origin" (detailed to be provided by the end of 2025)20 | Yes, for "explicit carbon price" paid overseas |

| Frequency of reporting | Annual reporting |

|

Source: Authors' compilation

How will the CBAM impact UK businesses?

By addressing the risk of carbon leakage, the CBAM will contribute to the decarbonisation efforts domestically and globally while also level the playing field for domestic producers by setting the same standards for foreign manufacturers of the covered products. However, the introduction of the UK CBAM will have clear impacts on UK businesses, particularly those involved in the production or import of carbon-intensive goods. As shown in Table 2, the UK is a net importer of all CBAM products, which implies a high reliance on imports of inputs for the UK's manufacturing exports, such as machinery and vehicles.

Table 2. The UK's imports of CBAM products

| UK CBAM Product | Imports, 2023, USD million | Trade balance, 2023, USD million | Imports, 2023, tonnes | Tops 5 supplying countries |

|---|---|---|---|---|

| Aluminium | 5,586 | -3,406 | 1,033,126 | Germany, China, France, Italy, Spain |

| Cement | 635 | -349 | 4,691,150 | Ireland, Spain, Germany, Portugal, Greece* |

| Fertilisers | 1,305 | -985 | 3.015,124 | Netherlands, Egypt, Norway, Germany, US |

| Iron & Steel | 17,520 | -3,237 | 7,994,486 | China, Germany, Spain, Italy, France |

| Hydrogen | 4.4 | -3.9 | 436 | Netherlands, Ireland, Belgium, France, China |

Notes: * For cement, mirror data was used as direct trade data shows Area NES as the major supplier, accounting for more than 83% of all the UK's cement imports. Source: Authors based on ITC Trademap

At the beginning of the implementation, CBAM implementation will add to the administrative burden of companies to track and report the carbon emissions associated with their imported goods, or to make necessary supply chain adjustments to source materials from countries with lower carbon footprints or equivalent carbon pricing mechanisms to minimise CBAM-related costs. UK businesses may also need to invest in cleaner technologies and processes to remain competitive against imports subject to the CBAM. This could drive innovation but also require significant upfront investment. On the positive side, the CBAM could create opportunities for businesses that produce low-carbon goods, as demand for such products may increase both domestically and internationally. While there is still a 2-year gap until the official rolling-out of the UK CBAM, businesses can already embark upon necessary strategic changes, such as undertaking an internal assessment of the data and capacity gap for implementation, the potential financial impacts of CBAM compliance to inform coping strategies, as well as to identify the opportunities for supply chain reconfiguration and technology upgrades.

Footnotes

1. Carbon leakage refers to the movement of production and associated emissions from one country to another due to different carbon pricing and climate regulations.

2. These may include product standards, low emission products market, emissions reporting etc.

3. HM Treasury & Department for Energy Security & Net Zero (2023, December 18). Factsheet: UK Carbon Border Adjustment Mechanism. GOV.UK

4. HM Treasury and HM Revenue & Customs (2024, October 30). Consultation on the introduction of a UK carbon border adjustment mechanism. GOV.UK

5. HM Treasury and HM Revenue & Customs (2024, October 30). Introduction of a UK Carbon Border Adjustment Mechanism from January 2027: Government response to the policy design consultation. Paragraph 1.11.

6. Ibid, paragraph 1.13

7. Ibid, paragraph 3.34

8. Ibid, paragraph 3.58

9. Ibid, paragraph 3.74

10. Defined as a price placed directly on greenhouse gas emissions (tCO2e) produced during a given process, such as an emissions trading scheme with a market-based price or a carbon tax with a fixed price.

11. Ibid, paragraph 3.77

12. Ibid, paragraph 3.37

13. Ibid, paragraph 3.46

14. Individuals importing CBAM goods for personal use will not be liable for the UK CBAM.

15. Ibid, paragraph 4.23

16. Ibid, paragraph 4.36.

17. Ibid, paragraph 4.48

18. The HS codes of covered sectors are similar between the two regimes, except for electricity.

19. European Commission (2023, December 22). Carbon Border Adjustment Mechanism (CBAM). Questions and Answers.

20. Ibid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.