- in European Union

- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

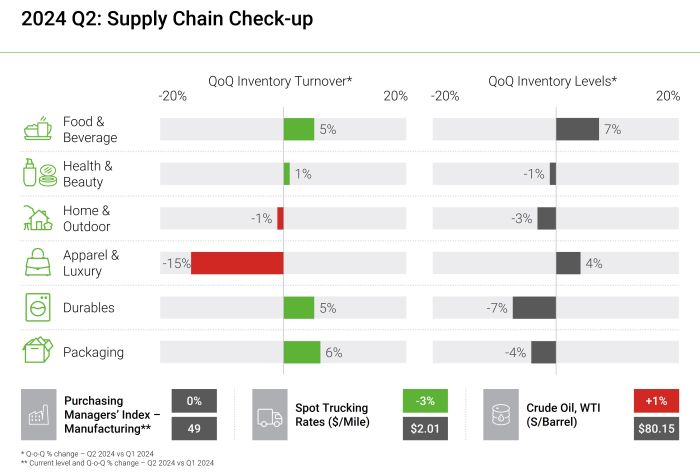

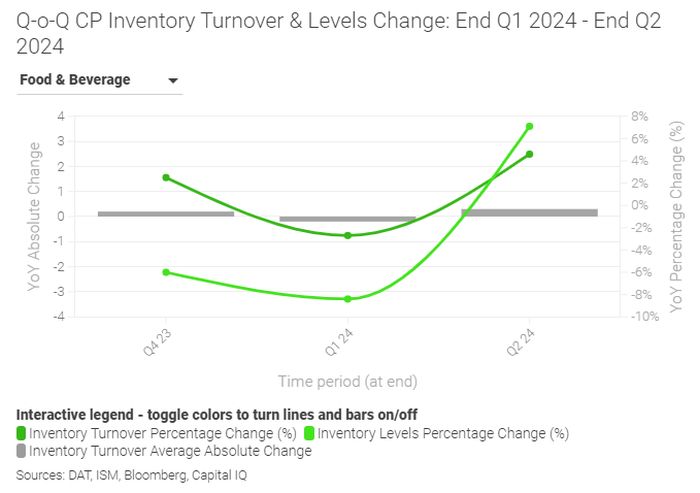

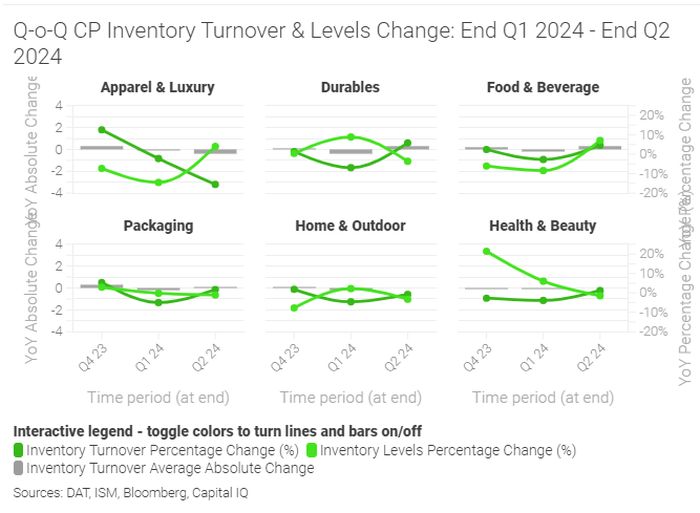

Prior to the recently announced interest rate cut, the consumer products (CP) industry has exhibited mixed results across the supply chain. Apparel and Home sectors both saw declining quarter-over-quarter (QoQ) inventory turnover (-15% and -1%, respectively), as consumers continued to deprioritize discretionary purchases. Most sectors have reduced inventory levels, pushing towards flexibility and risk reduction. From a manufacturing perspective, the Purchasing Managers' Index (PMI) remained flat, reflecting companies' patient outlook as they await the impact of rate changes. Costs were mixed, with trucking rates down 3% while oil prices increased by 1%. Now that rate cuts are official, what will the ultimate impact be on the industry? Will companies have the supply chain agility to quickly respond and pivot if necessary?

a monthly basis, AlixPartners charts sales, sentiment and supply chains in consumer-facing businesses. Learn more about the Consumer Products Corner newsletter and read previous articles, here.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.