- within Technology topic(s)

- in United States

- with readers working within the Media & Information and Law Firm industries

- within Antitrust/Competition Law and Intellectual Property topic(s)

Over the course of 2025, our semiconductor team released a three-part series focused on disruptions within the semiconductor ecosystem. Along with the listed authors, our former colleague Dr. Markus Bolte — who now serves as Chief Transformation Officer at semiconductor company ams OSRAM — played a major role in the creation of the series.

Part 1: Confidence amid geopolitical pressure

In January 2025, we released our sixth annual AlixPartners Disruption Index, the firm's signature piece of thought leadership. The report, based on a survey of 3,200 senior executives, digs into the challenges that companies across sectors expect to face in the year ahead, as well as the behaviors they can enact to thrive in this disrupted world.

Among the survey participants were dozens of global semiconductor leaders, who overall feel well-prepared for change. 40% increased their profits by more than 10% last year, compared to just 20% in other industries. These executives expect to see the same in 2025—44% are forecasting significant growth, compared to 26% in other industries.

Given the importance of semiconductors in the world's supply chains and in the latest technologies, it's no surprise that 61% of sector leaders believe their companies are always driving disruption, compared to 37% of leaders in other industries.

But as geopolitics take center stage and tariffs threaten supply chains, will the disruptors become the disrupted?

The impact of geopolitical tensions on semiconductor operations and business strategies

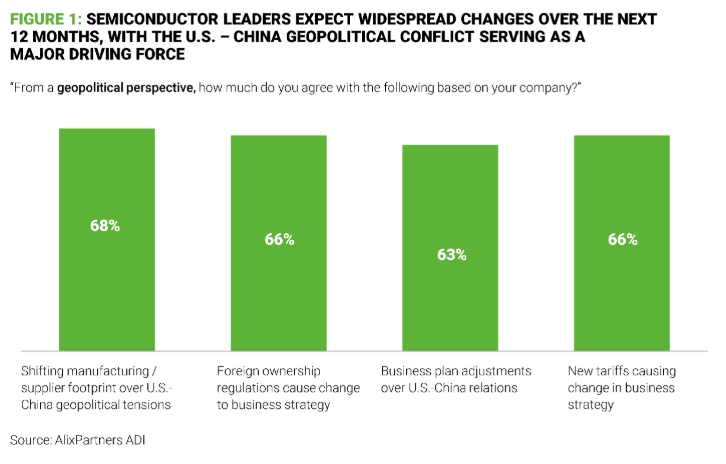

Quickly after taking office, the new U.S. administration proposed potential tariffs on a host of countries, including China, which may shake up semiconductor operations for the foreseeable future. 66% of semiconductor executives fear tariffs would interfere with their business strategies and 63% say they would need to adjust their business plans due to shifting U.S.-China relations. 71% say their business models will change significantly over the next 12 months, compared to 40% of respondents in other industries.

Despite the geopolitical turmoil, semiconductor players are pushing ahead with growth plans. Per the Disruption Index, an astounding 83% of respondents are increasing their investments in China (compared to 63% in other industries) and 84% plan to pursue M&A activity in the next 12 months (compared to 58% in other industries).

Shifting supplier and manufacturing footprints has been under consideration for a while. The U.S. government has provided incentives through initiatives like the CHIPS and Science Act to encourage domestic semiconductor production. Taiwan Semiconductor Manufacturing Company (TSMC) has already taken advantage of these subsidies, building a new plant in Arizona. Samsung and Intel have followed suit, investing in production capacity to fabricate the latest tech node chips on U.S. soil. Based on geopolitical tensions, companies may soon not have a choice—Intel, for instance, is withdrawing from Europe to further pivot its operations to the U.S.

Two out of three semiconductor executives fear they need to change their business strategy due to ownership regulations or tariffs. British semiconductor giant ARM comes to mind, which is reportedly aiming to bypass its Chinese subsidiary Arm China and offer IP licenses directly to Chinese customers. But fears here go beyond IP and into where the value of a product or service originates. It used to be enough for no more than 10 to 25% of a product to be fabricated in the U.S. for authorities to claim jurisdiction and exert export limitations. In the near future, the U.S.-based percentage could be much lower, meaning companies would not be allowed to export their products into Chinese high-growth markets. Entire sectors may soon become negotiation collateral—anticipation of such moves and enacting value creation models robust enough for changes will be key.

Tariffs were once seen as a minor issue in the global economy, but now their unpredictability may quickly shift the balance to certain manufacturing locations and suppliers over others. Companies with broad supplier or manufacturing networks are better positioned, but the cost burden will ultimately fall on the weakest links in the supply chain—those with the least negotiating power. It is critical that companies develop strategies that strengthen both their sales and procurement teams, empowering them to lead negotiations. At AlixPartners, we believe many leading supply chains, from automotive to semiconductors to industrials, are unprepared for the tough negotiations ahead, especially regarding price and delivery priorities.

Finally, a review of one's operating model might be beneficial. Over the past few decades, companies have thrived in a global economy that made it cost effective to, for example, design a chip in California, handle frontend production in Taiwan, conduct testing and packaging in Malaysia, and then ship the product to assemble into larger systems in Italy. Uncertainty about tariffs and export controls call this model into question. While most semiconductor companies have traditionally been organized by product or market category, companies should now consider regional models, in which individual regions are largely self-sufficient.

Mitigating supply chain impacts amid shifting regulations while pursuing M&A activity will require threading the needle in the middle of a perfect storm. Those that are best prepared will most effectively navigate the stormy waters.

Part 2: AI driving growth and causing a workforce evolution

In the last episode, we discussed the impact that geopolitical tensions will have on semiconductor operations—which, according to Disruption Index data, will profoundly affect companies' business models and strategies. But interestingly, despite these tensions, 83% of semiconductor leaders say they will still increase their investments in China over the next 12 months—far greater than in other industries and a direct challenge to those seeking to limit China's progress in semiconductors and AI.

Different players respond to these challenges in different ways. While U.S.-based companies may reduce their China exposure, some global industry leaders have separated their business functions and IP portfolios to limit the exchange of knowledge between China and the rest of the world. Others have preferred to remain neutral, capitalizing on China's market growth.

What is clear is that the speed of innovation continues to increase. In AI, the overnight success of China's DeepSeek shocked the world and the semiconductor industry. Market leaders that benefitted from the initial AI investment frenzy now face early signs of a slowdown. Investors are questioning how the industry's projected growth trajectory will shift if demand for semiconductors—crucial to AI's growth and development—were to flatten.

Amid these rapid advances in AI, it's critical

to consider how these tools may redefine workforce requirements.

Could the progress that semiconductor employees helped achieve come

back to bite white-collar workers across industries?

Semiconductor leaders believe AI will boost company revenue

Overall, semiconductor executives are optimistic about the AI evolution. According to the Disruption Index, 52% see AI as positive for their businesses, while 69% plan to use AI to increase their revenues.

Plans to increase revenue using AI can be broadly sorted into four groups across the semiconductor industry. The first is to utilize AI to enhance existing products or features. The second focuses on pivoting to products that drive value from high-performance AI data centers, such as accelerators, high-bandwidth memory (HBM) in computing, and advanced driver-assistance systems (ADAS) in automotive. These semiconductor use cases enjoyed strong growth over the last two years, but they now fluctuate as former AI leaders undergo a reevaluation period.

A third category centers on the shift toward open AI software ecosystems, as companies seek to build alternatives to NVIDIA's dominance in AI computing. While new entrants can develop competitive AI chips, matching NVIDIA's software—particularly its CUDA platform—remains a significant challenge. To address this, major semiconductor players including Intel, Google, Arm, Qualcomm, Broadcom, and Samsung have joined forces under the UXL Foundation, an open-source initiative aimed at creating a more accessible AI software stack. This collaboration reflects AI's growing influence not just on product innovation but also on the fundamental structure of the semiconductor workforce, requiring engineers to develop expertise in open AI frameworks alongside traditional chip design.

The fourth category holds the greatest short-term promise—companies that adopted AI into their products and services, as well as their internal processes, prior to or early in the AI hype cycle. With their adapted business and operating models, these semiconductor players are truly AI powered and have already used the technology to revamp workflows, engineering and design processes, supply chains, and back-office functions. As such, they are able to innovate much quicker and maintain a competitive edge while competitors play catch up.

A double-edged sword: AI's impact on semiconductor workforces

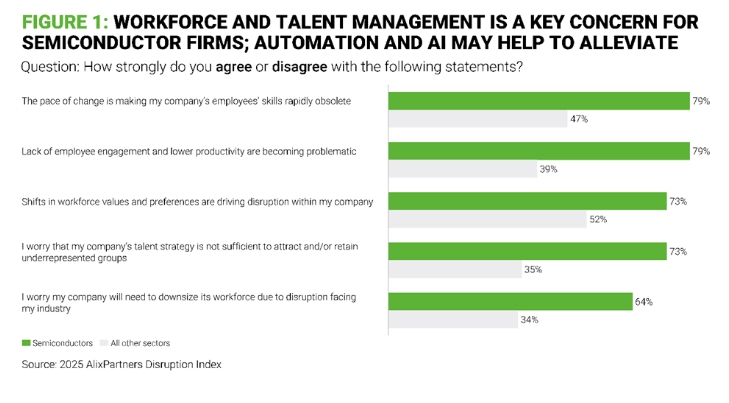

Leaders know that the efficiency improvements brought on by AI will also necessitate a rethink of business models and workforce needs. According to the Disruption Index, 79% of semiconductor executives believe the pace of change is making their employees' skills rapidly obsolete, compared to 47% of executives in other industries. 64% worry that their company will need to downsize its workforce due to disruption facing the industry, compared to just 34% of other respondents.

This change of business model and operations could start with finance and HR teams, but even R&D could see redundancies as AI drives higher efficiency in the chip research and development processes. With that said, companies must be careful about applying the same cost tools to R&D as they would to other areas, as they risk running into what we recently termed the "efficiency paradox." In an industry that relies so heavily on innovation, doing things that save money in the short term should not come at the expense of medium and long-term value.

Indeed, almost four out of five semiconductor leaders (vs. only 40% in other industries) reported rising problems due to a "lack of employee engagement and lower productivity." These trends must be addressed—active transformation and change management needs to be part of the AI implementation process. For a more in-depth guide on how to implement AI into your organization, read our "Practical AI for CEOs" playbook or reach out to the authors.

From a business model perspective, 71% of semiconductor leaders feel they will have to change their models significantly in the next 12 months compared to only 40% of executives in other industries. Shifting sales tactics to a more multi-channel approach will help, but fundamentally, companies need to rethink how they deliver value to clients (and how that value is perceived). Reaching the next level of customer experience via AI applications is key. As more companies utilize AI, customers now expect a certain level of intelligence in their tech products. Embedding AI into semiconductor offerings can be challenging, but upleveling where possible will aid in meeting heightened customer expectations.

42% of semiconductor executives say their companies have already invested heavily in AI and automation—but there is a difference between driving growth with AI and feeding into the hype with less impactful applications. Adding AI to R&D processes along with streamlining back-office operations can accelerate innovation while driving down costs.

Anticipating and navigating the impact AI will have on the semiconductor industry is both an art and a science. Optimizing workforces amid a shifting market will be no easy feat—AlixPartners is here to help.

Part 3: Drivers of long-term semiconductor growth

Among Disruption Index participants, there was widespread optimism about how AI will drive positive evolution in the semiconductor industry across three major aspects. First, industry experts are confident that AI will lead to enhanced products and improved productivity. Second, AI will drive the need for more high-value and complex semiconductor devices, such as graphics processing unit (GPU) and high-bandwidth memory (HBM) chips, that will act as catalysts for innovation. Finally, AI will create a new ecosystem of software and hardware solutions that will span across multiple industries, creating a broader and more diversified demand for semiconductors.

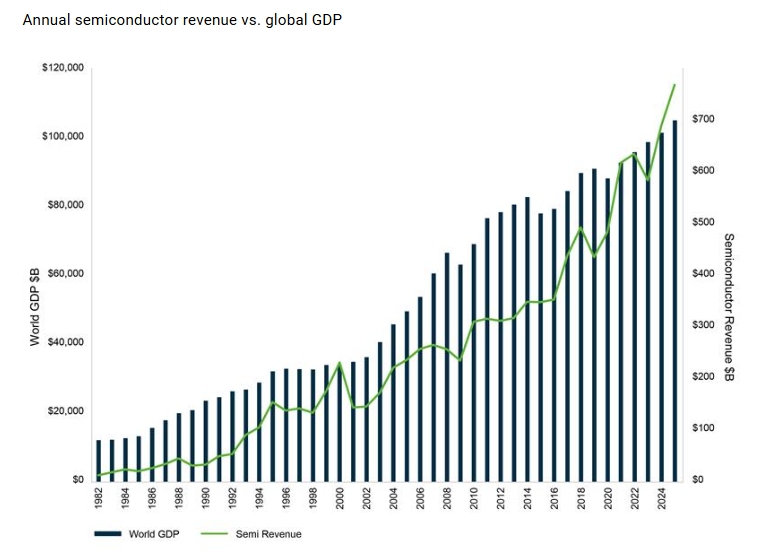

Building on this optimism, it is important to consider how the industry arrived at today's AI-driven environment. Toward the end of last decade, cloud computing started to drive a significant percentage of semiconductor demand, overtaking the smartphone as the top industry driver. This shift marked the beginning of the data inflection that continues to reshape the industry today. Since this inflection point, semiconductor revenue has exceeded GDP growth as the following graph outlines:

The semiconductor industry is known to be cyclical because of its combination of demand fluctuation and long cycles between investment and mass production. Although cycles are not expected to disappear, more diverse end markets will balance the impact of a slowdown across the sector, reducing overall volatility.

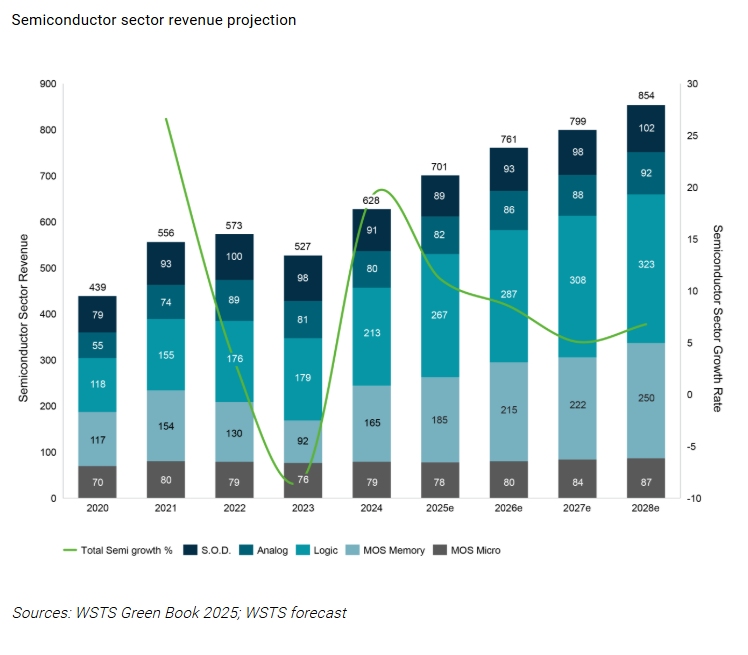

This is what we observe today with strength in high performance computing applications related to AI large language model (LLM) training balancing weaknesses in other sectors, like automotive or industrial. Per World Semiconductor Trade Statistics (WSTS), the global semiconductor market is projected to expand by 11.2% in 2025, reaching a total value of greater than $700 billion, primarily driven by demand in the logic and memory segments of artificial intelligence and cloud infrastructure.

The current semiconductor growth cycle, while slowing down a bit, is expected to continue at least until 2028, led by compute-memory demand for AI data centers. Every dollar of GPU demand will continue to pull multiple dollars of high-bandwidth memory, advanced logic interconnect, and power-control silicon, creating a tightly coupled supply chain where compute, logic, and memory rise together.

We believe that growth in autonomous cars, requiring automotive-grade AI security operations centers, sensors, power semiconductors, and mature-node logic, will offset the reduction in demand from AI data centers post-2028.

Increased chip complexity and the high cost of R&D investment are also expected to moderate the cyclical nature of the industry, while geopolitical tension is likely to increase instability and have a negative effect on the supply-demand balance.

In spite of the continuing tailwinds driving demand for advanced semiconductor chips, the semiconductor industry is at a pivotal and controversial moment in its history.

On the one hand, AI is fueling an explosion of chip demand, which will continue for at least a few more years, driven by the need to train more complex LLMs and the proliferation of edge AI applications.

On the other hand, geopolitical risks can lead to supply chain disruptions, regulatory changes, and market volatility.

To succeed in this period of transformation, semiconductor companies will need to make strategic investment decisions on how to differentiate in the new AI data ecosystem.

First, semiconductor companies will have to build strategic ecosystems, collaborating with key players across entire technology stacks, from system-level companies to equipment and material companies. The fast pace of market changes combined with the complexity of technology roadmaps will increase the need for forging strategic partnerships, including deeper joint design and co-investment arrangements that align customers and suppliers more closely across cycles.

Second, semiconductor companies will have to develop specialized products to meet the growing demand for edge-computing applications across a large range of industries. Strategic investments will help to develop high-performance and power-efficient chips while maintaining costs at an affordable level, supported in part by long-term customer commitments that provide predictable demand for the next generation of products.

Finally, semiconductor companies will have to invest in AI to improve product design and overall productivity from R&D to supply chains.

As observed in the annual AlixPartners Disruption Index, AI represents a pivotal moment in the semiconductor industry, creating unprecedented demand for specialized chips in a more diversified end market while offering unparalleled opportunity to improve the full cycle of chip design and fabrication. It also reinforces the importance of securing long-term customer agreements and co-investment partnerships that help reduce volatility during future downcycles.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.