When Microsoft launched its Xbox console in 2001, the chip manufacturer Nvidia's graphic processing chips were mentioned in press coverage of the gaming system as a key component. On June 18, 2024, Nvidia became the world's largest public company—more valuable than Microsoft. Like other technology "supergrowers" identified in the AlixPartners Fastest Growers study, it helped facilitate the AI gold rush, its chips enabling the training of AI-LLM models that tech companies see as the future.

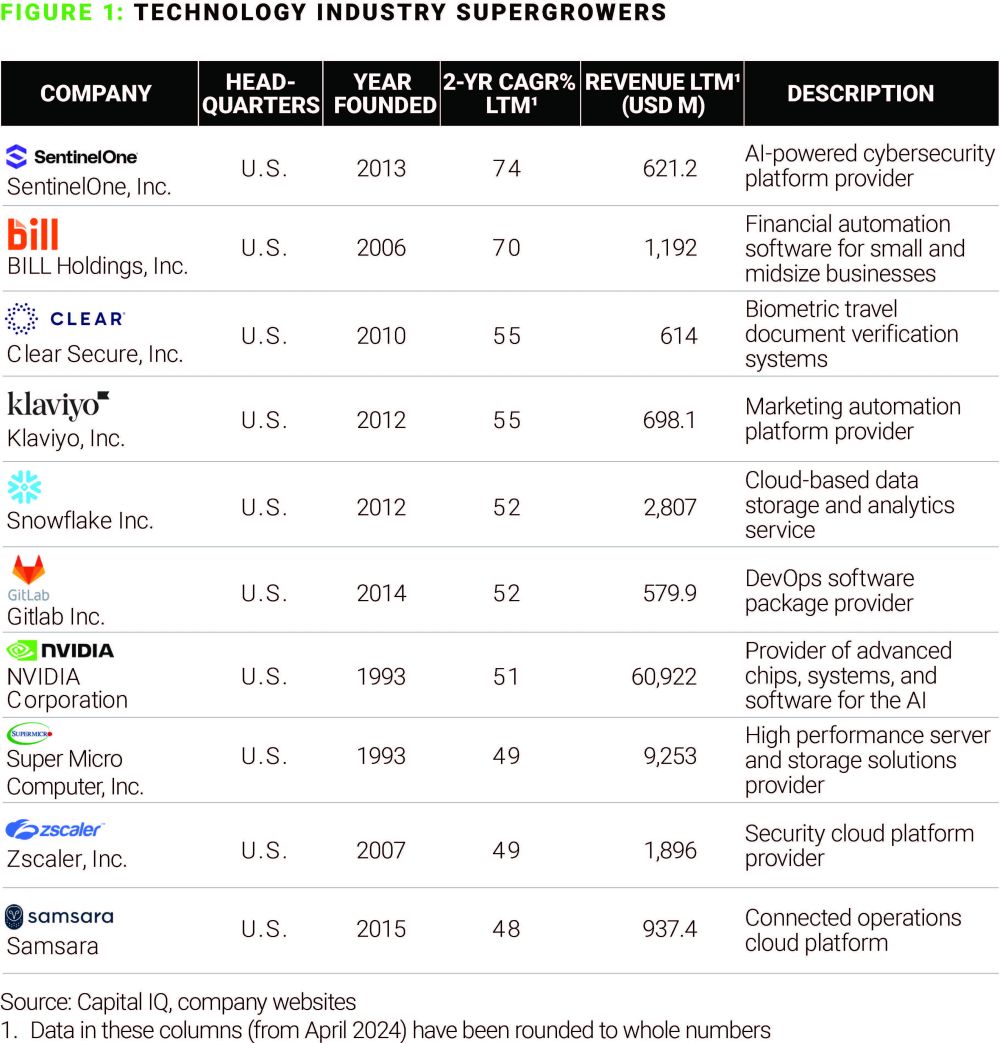

Bloomberg Intelligence has estimated that the generative AI industry will grow from $40 billion in 2023 to $1.3 trillion by 2033, driven by cloud computing services, generative AI (genAI) as a service, servers, storage, AI-assistants, and input equipment. Indeed, 5 of the 10 fastest-growing tech companies we identified provide cloud data and security, or AI chips and infrastructure services, from the high-efficiency servers manufactured by NVIDIA peer Super Micro Computer Inc. to cloud solutions from BILL Holdings, Inc. and Snowflake Inc.

And while AI is at the center of the latest tech growth spurt, companies are recognizing such advanced, powerful and complex technology products require even stronger security solutions. Among cybersecurity firms, SentinelOne and Zscaler are in the first and ninth slots for 2-year compound annual growth. The potential for cybercrime to undermine any business anywhere was clear in the September 2023 hacking of MGM Resorts. A phone call to company tech support by a supposed "employee" (whose identity had been gleaned from a prior data leak) opened the door for a collective of hackers to breach the firm's IT infrastructure. To resolve the breach, the company had to shut down electronic communications, disabling slot machines across casinos and leaving front desk staff to check-in hotel guests by pen and paper. The global cost of cybercrime is forecast to nearly double from 2022 levels to $23.84 trillion by 2027, according to Statista estimates, and corporate leaders want an insurance policy against an evolving threat: SentinelOne's CEO Tomer Weingarten told Reuters the company continued to win contracts against next-gen and legacy endpoint providers.

The company's last two-year CAGR for revenue was 74%, but profits remain in the red, as do those of six other of the fastest-growers in the tech space. We do see a change taking place wherein tech leaders look at how to shift from growth to profitability. This tactical mindset can allow companies to avoid pitfalls like tech debt and over-hiring, and set themselves up for sustainable scaling.

SentinelOne

SentinelOne pioneered the world's first purpose-built AI-powered "extended detection and response" (XDR) platform, and has made its name leveraging AI and machine-learning in the fight against cybercrime. The company has positioned itself to serve large corporates as they contend with a porous cybersecurity environment—a leak elsewhere can still compromise a company, as the MGM hacking showed. SentinelOne's platform approach helps enterprise companies consolidate security tools while enhancing enterprise-wide coverage.

By extending its security capabilities to cloud-native applications and workloads, SentinelOne has tapped into the growing demand for cloud security solutions, positioning itself strongly in this expanding market. The rich ecosystem of partners—from independent software vendors to distributors, resellers, managed detection and response providers, original equipment manufacturers, and on—speaks to the company's success in leading the evolution of cybersecurity.

Nvidia

The chip that was at one time responsible for better graphics in video games is now vital to automotive companies, data centers, cloud-services companies, and general processor companies. Big 4 tech companies accounted for 40% of chip sales in 2023, per Bloomberg, thanks to "insatiable demand" for AI accelerators. It also sells thousands of chips to category standouts like ByteDance, Tesla, and Lambda.

As the wider market has shifted its view on what the future of AI looks like, Nvidia has seen its star soar—as a top-performing stock, dips have been treated like seismic events. Growing investments in data centers and cloud computing have boosted demand for Nvidia's high-performance computing solutions, while the company's development of software platforms like CUDA and AI frameworks has created an ecosystem that drives further adoption of its hardware products.

Clear Secure

Providing the must-have add-on for travelers who detest long lines, Clear Secure has steadily grown in popularity as travel picks up. For the second quarter of 2024, the firm recorded a 24.6% year-over-year increase in revenue (to $186.7 million). The company's identity verification technology is active in 58 international airports as CLEAR, and in 46 U.S. airports as TSA PreCheck, and the company continues to expand its partnerships with airports, stadiums, financial services, and healthcare institutions.

Clear Secure has benefitted from, and invested in, continuous improvements in biometric technology, and has acquired complementary businesses and technologies to seize consumer appetite for faster and more secure travel experiences. Customers are happy with the service, which has 83% retention, and added a record 2.3 million members in Q2 2024 alone.

Snowflake Inc.

The challenge across industries is to store and manage exponentially more data. Snowflake has built momentum providing data cloud solutions that can support AI and data-intensive tools. One of the company's selling points is its interoperability through Snowgrid, a "cross-cloud technology layer" that allows organizations to connect applications to others in the data cloud, without having to upload data and programs or design around separate cloud locations.

Snowflake has permeated 7,200 brands as diverse as OrangeTheory, Canva, Disney Advertising, and JetBlue, and recorded 30% year-over-year growth in the second quarter of 2024, growing revenue to $829.3 million. Looking ahead, the company's relationships with other key players (Snowflake has partnered with Meta on its Llama LLMs) have embedded it in the leader pack of AI innovators. As tools are geared to be more and more advanced, the challenges on software grow: addressing latency, cost effectiveness, and memory requirements takes a team of dedicated data engineers and knowledge-sharing arrangements.

Klaviyo, Inc.

Online customers bring with them a trove of information—past purchases, wants, events, and on—creating an opening for companies like Klaviyo to help manage the online interface. Chiefly, Klaviyo's products allow companies to automate their eCommerce SMS and email marketing, and have been promoted through Klaviyo's partnerships and integrations with Shopify, Square Online, Magento 2, and others.

The company's revenue grew by 35% year-over-year in the second quarter of 2024, hitting $222.2 million, while its customer base grew by 64% year-over-year. Leadership have been focused on integrations, adding Toast, TikTo, and Pinterest to the list in 2024, and extending its reach in Europe. Part of the value lies in its utility for both small-scale companies and large enterprises. Klaviyo is also focused on keeping its tools at the leading edge, with personalized campaigns and review sentiment AI tools among recent offerings.

Return to the Practical Growth homepage to learn more about our Supergrowers research.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.