- with readers working within the Pharmaceuticals & BioTech and Law Firm industries

As the deadline for Brexit is getting closer and with increasing likelihood of a no-deal Brexit, we set out below how a transaction might become reviewable by the UK Competition and Markets Authority (Cnoted, John. MA) in addition (or instead of) the European Commission. We also provide a high level outline of the UK merger regime.

JURISDICTIONAL SCENARIOS IN A NO-DEAL BREXIT

The following table sets out a potential shift in jurisdiction where a transaction straddles the Brexit date.

| Status | EU Jurisdiction | UK Jurisdiction |

| Merger notified to and cleared by the EU Commission prior to Brexit but transaction closes after Brexit. | EU decision stands. | UK has no jurisdiction. If the merger decision is quashed wholly or partially following an appeal to the European Court then the UK may have jurisdiction if the UK thresholds are met. |

| Merger notified to EU and referred to UK. | EU continues with any non-UK aspects not referred. | UK continues its review under the referred UK markets. |

| Merger notified but not cleared prior to Brexit. | EU continues to have jurisdiction for its ongoing review. | UK has jurisdiction from Brexit day if the UK thresholds are met. |

| Merger announced but not notified prior to Brexit. | EU has jurisdiction if the EU thresholds are met but only for the EU-27 member states (i.e. excluding the UK). | UK has jurisdiction to review if the UK thresholds are met. |

Two key points to note:

- First, early engagement between the legal teams and both the CMA and the EU Commission is likely to minimises disruption caused by Brexit.

- Second, the UK regime will remain voluntary and there will continue be situations where companies will not want or need to notify.

WHEN TO NOTIFY?

- The UK merger control regime remains voluntary. This means that, even where the jurisdictional thresholds are met, no filing is required and no suspension to closing is necessary.

- Companies typically notify the CMA in cases where there are material overlaps in activities or for timing or process reasons.

- The UK merger thresholds are (i) a Target turnover of £70 million in the UK, or (ii) a share of supply of 25% in the UK market or a substantial part of it. Lower thresholds apply to certain industries.

- Reviewable transactions are not only the acquisition of majority control over a target, but also the acquisition of material influence. This typically applies to voting rights of 25% but has in the past be held to apply to shareholdings of a little as 15%.

WHAT HAPPENS IF I DON'T NOTIFY?

Although filing in the UK is voluntary, the CMA might still "call-in" a deal for merger review if it believes it may have jurisdiction. The CMA may become aware of non-notified transactions through:

- its merger intelligence activity;

- active dialogue with other competition authorities, particularly those of other EU Member States;

- third-party complaints (e.g. customers or competitors).

Even if a merger has been completed, the CMA has powers to, among others:

- make interim orders preventing the merged businesses from taking actions that might pre-empt its decision;

- impose remedies, including ordering the parties to unwind a transaction.

The statistics set out below show that the CMA obtains interim orders in between 26-32% of cases even though more than two-third of all cases result in unconditional clearances.

IS THE DEAL CAUGHT UNDER THE FOREIGN DIRECT INVESTMENT (FDI) REGIME?

Scrutiny of foreign direct investment is becoming more active. For this purpose, the government has reduced thresholds under the merger regime to allow for such a review in sensitive industries. These are set out below. In parallel, the government has proposed an entirely separate and self-standing regime but the timing that is, as yet, unclear.

| Threshold for review | For transactions affecting goods and services for military use, computing hardware and quantum technologies where the target turnover threshold is reduced £1m and no increment is needed to satisfy the share of supply test. |

| Grounds for intervention | The UK government has the power to intervene on grounds of (i) national security, (ii) freedom of expression, (iii) plurality of the media, (iv) availability and high quality of broadcasting, and (v) stability of the UK financial system in any merger. Such a review is in addition and separate from the competition based merger review. |

KEY STAGES OF A UK MERGER REVIEW

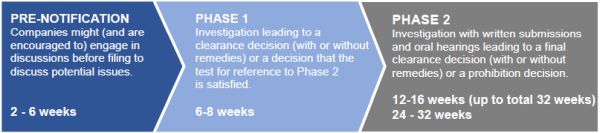

There are statutory deadlines in place for both Phase 1 and Phase 2 merger investigations. The length of the review period will depend on the complexity of the deal and the level of overlaps between the parties:

CMA MERGER STATISTICS

The table below sets out core statistics around UK merger review outcomes. Two key points to note:

- First, there is a disproportionately high rate of cases where the CMA obtains measures that stop further integration pending a final determination of the review.

- Second, the number of Phase 2 outright clearances is higher than in the EU, which suggests that the CMA either is more willing to refer cases to Phase 2 or is more open to taking a fresh look at Phase 2.

| 2019* | 2018 | 2017 | ||||

| Number | % | Number | % | Number | % | |

| Total reviewed | 27 | 56 | 62 | |||

| Phase 1 | 23 | 85% | 45 | 80% | 56 | 90% |

| Phase 2 | 4 | 15% | 11 | 20% | 6 | 10% |

| Initial enforcement orders | 7 | 26% | 29 | 52% | 20 | 32% |

| Cleared unconditionally | 18 | 67% | 44 | 79% | 41 | 66% |

| Cleared conditionally | 3 | 11% | 6 | 11% | 14 | 23% |

| Blocked/withdrawn/abandoned | 2 | 7% | 4 | 7% | 0 | 0% |

| Phase 2 unconditional clearance (as % of Phase 2) | 1 | 25% | 3 | 27% | 4 | 66% |

* Up to 31 August 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]