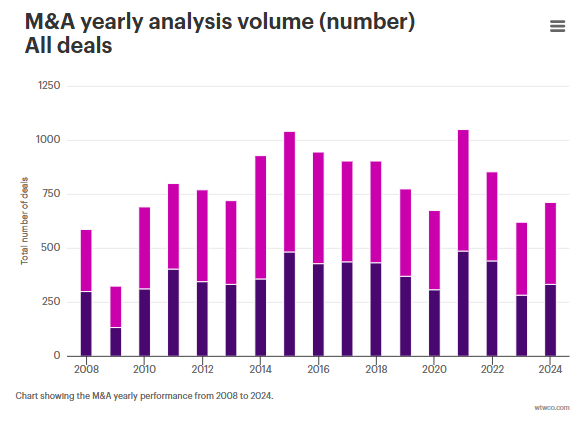

Global mergers and acquisitions (M&A) achieved a significant rise in completed deals in 2024, led by a resurgence in large transactions driving momentum into 2025, according to research from WTW's Quarterly Deal Performance Monitor (QDPM).

Run in partnership with the M&A Research Centre at Bayes Business School, the full year figures reveal 710 deals valued over $100 million were completed globally during the last 12 months. This compares to 619 transactions in 2023, representing a 15% increase in volume.

The dramatic uptick in large transactions (valued between US$1 billion and $10 billion) was especially pronounced during the second half of 2024, with 99 completed deals representing a 36% rise compared to the same period in 2023. Over a 12 month-period, large deals were up 21% in 2024 at 162 deals compared to 134 in 2023. Meanwhile, 15 megadeals (valued at over $10 billion) were completed worldwide last year, compared to 11 in 2023.

Jana Mercereau, Head of Europe M&A Consulting, WTW, said: "Buyers have endured a prolonged period of volatility and challenges on multiple fronts. Yet the underlying drivers of strategic growth and desire for new capabilities persist, with pent-up demand and strong balance sheets set to provide a tailwind for more M&A in 2025."

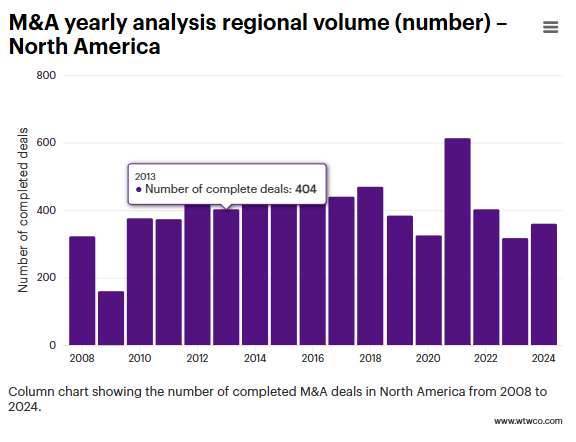

North America acquirers closed 361 deals in 2024, 14% more than the 317 transactions completed the previous year. Deal numbers were also up by 32% in Europe, from 117 completions in 2023 to 155 last year, and in Asia Pacific, where 163 deals were completed last year compared to 155 in 2023.

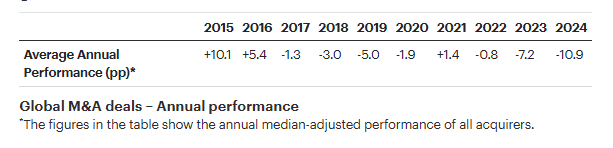

In a year of strong equity returns, 37% of companies completing deals still managed to outperform the wider market based on share price performance. However, the aggregate performance of all deals reveals the majority of acquirers underperformed the market1 by -10.9pp (percentage points) for completed acquisitions valued over $100 million during 2024.

Global M&A deals – Annual performance

Based on activity during the second half of 2024, Europe was the only region to resist the negative trend by recording a positive performance of +0.7pp, providing a welcome boost to dealmakers in the region expecting a busy year ahead. Buyers in North America and Asia-Pacific underperformed their own regional indices during the same period by -8.7pp and -11.2pp respectively.

Mercereau said: "Financing conditions have improved, with interest rates stabilizing and a new U.S. administration signaling looser regulatory scrutiny. However, getting complex M&A transactions right in 2025 will remain challenging. Dealmakers face 'known unknowns' including the risk of new tariffs and policies refueling inflation, affecting supply chain stability and consumer prices.

"The tremendous growth and influence of private equity on M&A will also increasingly impact on buying behavior. Under pressure to deploy trillions in dry powder, PE firms will use their knowledge of performing complex deals to drive aggressive timelines, forcing corporate buyers to compete with greater efficiency and agility in pursuit of closing strategic deals."

Footnote

1 The M&A research tracks the number of completed deals over $100 million and the share price performance of the acquiring company against the MSCI World Index, which is used as default, unless stated otherwise.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.