- within International Law topic(s)

- within Antitrust/Competition Law, Real Estate and Construction and Intellectual Property topic(s)

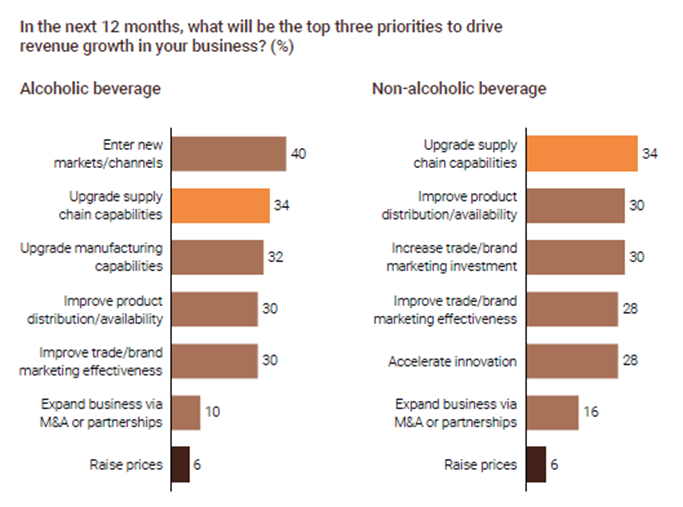

- AlixPartners survey finds supply chain resiliency and cost efficiency now outrank market expansion as top priorities.

- Tackling volatile input prices, tariffs, and workforce shortages are the immediate priorities for executives.

NEW YORK (October 28, 2025) -- The beverage industry is under pressure—and responding by doubling down on productivity. According to AlixPartners' inaugural Beverage Executive Survey, conducted among 100 industry leaders across alcohol and non-alcoholic categories, executives are prioritizing supply chain resiliency and cost efficiency over traditional growth levers like market expansion or distribution gains.

Amid rising input costs, global trade tensions, and evolving consumer trends, supply chain resiliency emerged as a top priority for driving revenue growth, matching strategies such as entering new markets or extending product lines. Surging expenses in transportation, aluminum cans, and key crops have significantly impacted production budgets over the past year, the report notes.

Productivity Push Gains Momentum Across

Sectors

Nearly all respondents said the drive for productivity extends

beyond the supply chain. Reducing brand, trade, and improving

R&D efficiencies ranked among the top levers for cost

improvement, reflecting executives' recognition that pricing

power is limited in today's marketplace.

Manufacturing labor costs have climbed 11% since mid-2023, while aluminum prices—accounting for about one-third of can costs—have risen 30% since early 2025. Meanwhile, new tariffs and commodity price volatility are disrupting budgets across the board, and tariffs on equipment are disrupting investment plans.

A Tale of Two Beverage Aisles

While both sectors are focused on productivity, the motivations

diverge sharply:

- Non-Alcoholic Beverages: Executives are optimistic. Momentum in energy, sports, and functional drinks—as consumers seek "better-for-you" products—is fueling reinvestment in marketing and innovation. Productivity gains are being used to self-fund growth through M&A and new product launches.

- Alcoholic Beverages: The mood is more defensive. With declining per-capita alcohol consumption and ongoing tariff and input-cost pressures, executives are turning to productivity measures to protect margins. Marketing and innovation spending rank lower, with many companies focusing instead on SKU rationalization.

Supply Chain Disruption Tops the List of

Disruptors

Executives ranked supply chain disruption, material costs, labor

costs and trade policy as the most disruptive factors facing the

industry—even above changing consumer behavior. This shift

underscores the extent to which external pressures are shaping

strategic priorities for the next several years.

"Many beverage leaders have recognized that the old growth playbook no longer works," said Randy Burt, Americas Leader of AlixPartners' Consumer Products practice. "With continued inflation, tariffs, labor challenges mounting, and a consumer under pressure, driving year on year productivity isn't just about cost control—it's about freeing up capital for innovation and resilience. The companies that prioritize productivity as a growth enabler and take an end-to-end -- vs just supply chain -- view, will thrive."

The Bottom Line

"Productivity is no longer just about operating expense

—it's the foundation of growth," added Burt.

"Whether companies are innovating the next functional beverage

or defending margins in a mature alcohol market, the ability to

drive material year over year productivity will separate winners

and losers."

Survey Methodology

The AlixPartners Beverage Executive Survey was conducted online

among 100 senior beverage executives in North America between July

7 and July 16, 2025. For access to the full survey report,

Stirring: Beverage executives focus on productivity as

megatrends shake the industry, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.