- within Criminal Law topic(s)

- with readers working within the Banking & Credit industries

An overview of the UK-Vietnam relations

This year, 2023, the United Kingdom and Vietnam celebrate 50 years of diplomatic relations. The strategic partnership between the United Kingdom (UK) and Vietnam has been tightening over the years.

The UK established formal diplomatic relations with the then-Democratic Republic of Vietnam on 16th July 1973, following the signing of the Paris Peace Accords. The bilateral relationship however only really took off at the end of 1990s, with the opening of the Department for International Development (DFID) office in Hanoi in 1998.

The UK and Vietnam also have a Double Tax Agreement (BTA) signed in 1994 and a Bilateral Investment Treaty (BIT) signed in 2002. In 2010, the UK and Vietnam signed a Strategic Partnership Declaration that aimed to elevates cooperation in seven key areas: political, global and regional issues; trade and investment; sustainable socio-economic development; education and training; science and technology; security and defence; and people to people links.1 The strategic partnership was then refreshed in 2020 to focus on trade and investment, sustainable economic growth, security, education, and human right.2

In addition to the UK, Vietnam is also party to other 14 FTAs with 52 countries globally. Vietnam is currently a member of two mega trade deals – the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) – which give Vietnam access to a gross market accounting for 32% of world population and 35% of world GDP. The UK, on the other hand, has signed 38 FTAs with 94 countries globally. In enhancing partnership with existing Asian FTA partners, the UK has signed a Digital Economy Agreement (DEA) with Singapore in 2022 and is considering an enhanced deal with the Republic of Korea covering SME support, investment and digital trade, among others.3 The UK is also seeking to join the CPTPP and is under the process of accession negotiations, for which Vietnam, as a Party, showed support.4

Major commitments under the UK-Vietnam Free Trade Agreement

The UK-Vietnam Free Trade Agreement (UKVFTA) was signed on December 29, 2020. Following its entry into force on 1 May 2021, 65% of all tariff lines were eliminated, increasing to 99% by 2027, at the end of the transition period. 5 For exports from the UK to Vietnam, tariffs on computers, electronic products and components will be eliminated after 2-4 years; tariffs on pharmaceuticals, chemicals, footwear, and textile will be eliminated after 4-6 years; tariffs on machinery, vehicles, wine and spirits will be eliminated after 6-9 years. Upon full implementation, this will equate to tariff savings of $134.65 million per year on Vietnamese exports to the UK, and of $42.52 million per year on UK exports to Vietnam, based on current trade flows.6

In terms of cumulation of origin, the UKVFTA allow for bilateral cumulation (i.e., cumulation between the Parties to the Agreement), as well as cumulation the EU. Similar to the EUVFTA, only cumulation with fabric from the Republic of Korea is allowed, while the scope for regional cumulation (i.e., cumulation with ASEAN country that has an FTA with the UK) remains limited.

In the last decade, bilateral merchandise export between the United Kingdom and Vietnam has seen 5.7% annual growth from the UK and 7.4% annual growth from Vietnam. Bilateral trade witnessed a sharp drop in the first year of the COVID-19 outbreak but quickly bounced back to its pre-pandemic levels in 2021. In 2021, the UK imported USD 6.3 billion worth of goods from Vietnam, and exported more than USD 764 million. Intra-industry trade takes place especially in the electrical equipment and machinery. In addition, the UK also exported to Vietnam significant volume of pharmaceutical products, wood pulp, optical and medical instrument, and beverages. In turns, the kingdom imported footwear, apparel, and iron and steel.

Source: IEC Calculations, based on ITC Trademap (2022)

There are ample rooms for expanding bilateral trade still. The UK holds $1.1 billion of export potential to Vietnam, covering pharmaceuticals, electronic integrated circuits, motor vehicles, among others. Vietnam, on the other hand, holds $4.5 billion of potential to the UK, covering electronics components, footwear, and apparel, etc7.

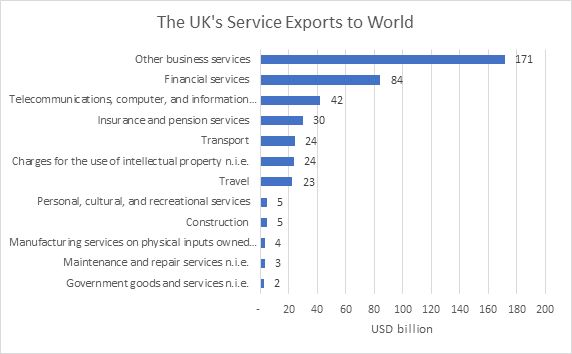

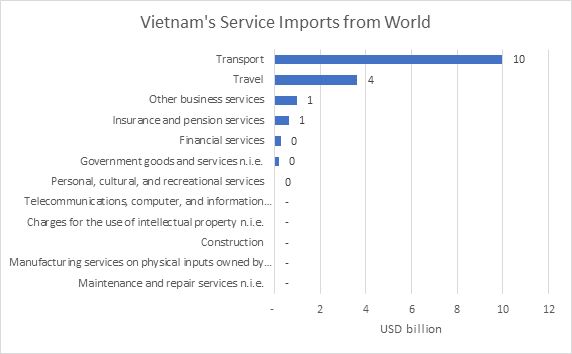

In terms of trade in services, the UK was able to secure better market access compared to Vietnam's commitments under the GATS. For example, UK investors are allowed to invest without limitations in hospital services, dental and medical services, retrocession service, certain environmental services, wholesale and retail with the unlimited number of retail outlets under 500m2.8 Vietnam has also relaxed some restrictions for UK individual services suppliers, including allowing UK services suppliers in 8 service sectors, including architecture, urban planning, engineering, foreign language training, and environment, to stay in Vietnam for up to 6 months to directly provide services to Vietnamese consumers. Potential exists for enhancing bilateral trade in Other Business Services, Financial Services, and Insurance Services, which the UK had surplus in exports and Vietnam experienced deficit in 2021.

Source: IEC Calculations, based on ITC Trademap (2022)

Under the Agreement, Vietnam also commits to opening its public procurement market to UK service providers, granting UK suppliers access to procurement at the central level as well as in Hanoi and Ho Chi Minh city for all goods (with some exceptions), business services, restaurant and hotel, and construction services. Especially for pharmaceuticals, UK suppliers will be able to access to up to 35% of the market share in public procurement in this sector from 2023, increasing up to 50% from 2036. Vietnam's MFN rates on pharmaceutical products range from 0% to 14%. As such, the gradual elimination of import tariffs on UK's pharmaceutical products to Vietnam (100% eliminated in 4-6 years) will provide UK's pharmaceuticals some edges when accessing to the pharmaceutical public procurement market in Vietnam.

Opportunities for deepening the UK-Vietnam trade partnership

According to the IMF, in the next five year, Vietnam will be able to maintain strong economic growth at 6.6%-7% annually, the strongest among ASEAN peers. The prospect for Vietnam as a trade and investment destination is further strengthened by its expanding consumer base and middle-class. Vietnam is projected to add 36 million people to its middle class by 2030, positioning as the 7th market with fastest growing middle-class population in the world. This will drive greater demand for services, especially finance and insurance, healthcare, and education, as well as in green and sustainability sectors such as environmental services and renewable energy.

Footnotes

1. GOV.UK (2010). UK-Vietnam Strategic Partnership Declaration.

2. GOV.UK (2020). UK-Vietnam strategic partnership: forging ahead for another 10 years.

3. GOV.UK (2022). UK kicks off process to negotiate new trade deal with South Korea.

4. Vietnamnet (2020). Vietnam ready to share experience to help UK join CPTPP.

5. Department for International Trade (2021). UK-Vietnam Free Trade Agreement. Opportunities for UK Businesses.

6. Thanh Van (2021). Healthcare focus for Brit investors through UVFTA. Vietnam Investment Review.

7. ITC Export Potential Map

8. Supra note 3.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.