Welcome to the next blog post in our Bridging the Gap series. This time, we are exploring the evolving landscape of risk and how investment firms can proactively manage these changes to stay ahead.

The perfect storm

In the fast-paced and ever-evolving world of risk, investment firms must remain vigilant and proactive. Since the global pandemic, the industry has faced a myriad of challenges, including rapid technological advancements, the rise of hybrid working, and a constantly shifting regulatory environment. However, these challenges also present opportunities for growth and innovation.

Aligning risk to insurance through a diligent process ensures that an organization's vulnerabilities are identified and adequately covered.

In 2025, investment firms will continue to grapple with digital transformation. New risks, such as AI-driven process efficiency, deepfakes, and sophisticated vishing attacks, are merging with existing concerns like internal and external fraud, human error, and regulatory changes. To effectively manage these risks, a comprehensive and proactive approach is essential.

Will an umbrella be enough?

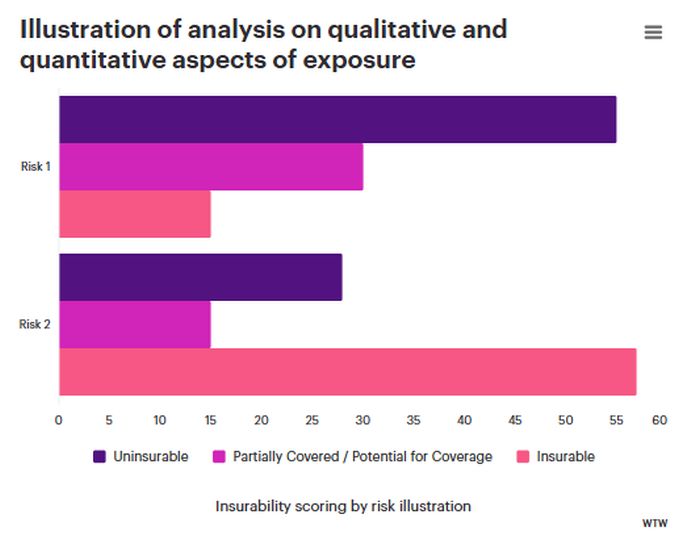

A robust framework of implementation guidelines, protocols and procedures is essential for minimizing risk. When combined with insurance, it provides a safety net to mitigate potential losses. Aligning risk to insurance through a diligent process ensures that an organization's vulnerabilities are identified and adequately covered. Trusted data sources play a crucial role in understanding current risks and emerging trends, as well as analysing both qualitative and quantitative aspects of exposure.

Structuring the optimal risk/insurance program

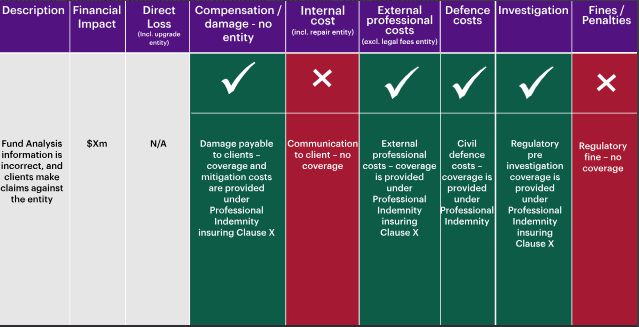

The optimal insurance structure aligns with business needs and considers risk appetite, available mitigation strategies, and cost. This approach should be supported by reliable data from both internal and external sources. It is important to maximize coverage for insurable risks while understanding that not all risks are insurable. Knowing how your insurance responds to different scenarios is key to effective risk management.

Insurability score by risk scenario

"As well as identifying key business risks, it is important to fully calibrate the potential financial impacts of the risk exposures you have across the business."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.