- with readers working within the Banking & Credit industries

An upward trend...

The "retailisation" of private funds has been one of the industry's most significant trends in recent years, with fund managers seeking sources of capital beyond their usual institutional, professional and sophisticated investor base. "Retail" capital (in particular, private wealth) is already a key source of fundraising for many alternative asset managers but continues to gain traction, with managers pursuing several different options to access this part of the market, whether by directly targeting high net worth individuals, accessing private banks or developing customised products.

Inevitably, there are various regulatory complexities that apply to fund sponsors looking to raise capital from "retail" wealth. Within the European Union and the United Kingdom, for example, marketing an alternative investment fund to "non‑professional" investors will trigger certain requirements, such as the need to prepare and publish a "key information document" under the PRIIPs Regulation (EU/1286/2014). There may also be additional disclosure requirements and potential restrictions on promotions aimed at certain categories of "retail" investors imposed by Member State regulators.

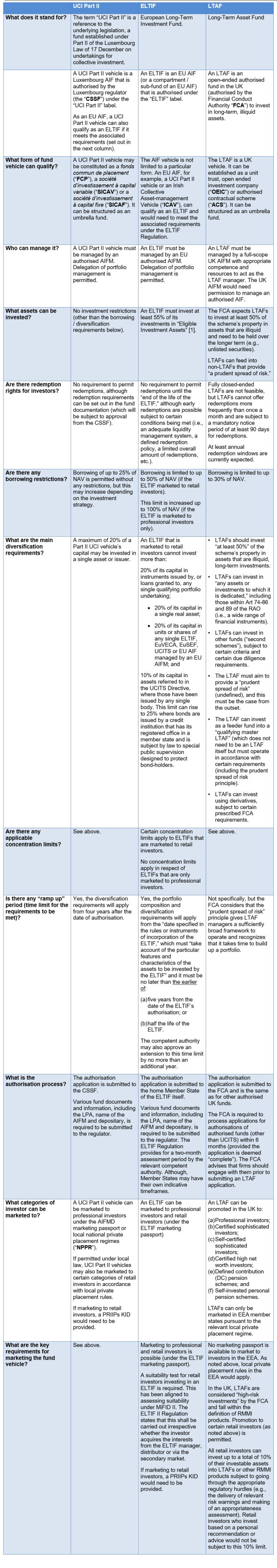

Notwithstanding the above, the Financial Conduct Authority ("FCA") and other European regulators are keen to keep pace with the industry by seeking to facilitate this trend, whilst ensuring that effective safeguards are in place to protect investors and other stakeholders. This is demonstrated by the development of vehicles such as the European Long‑Term Investment Fund ("ELTIF"), the United Kingdom's Long‑Term Asset Fund ("LTAF") and Luxembourg's UCI Part II vehicle.

This alert sets out the key requirements and considerations for fund managers seeking to establish these vehicles to access "retail" capital.

Key Features – ELTIFs, LTAFs and UCI Part II Vehicles

A few final thoughts...

While each of the vehicles listed above may offer opportunities for private fund sponsors to access a greater pool of retail investors, we often see sponsors continue to favour the more traditional closed‑ended model, which can still be used to access private wealth, for example, by targeting private banks or wealth managers.

Ultimately, each structure presents its own benefits and drawbacks. Fund sponsors should familiarise themselves with the relevant requirements before deciding on which structure to pursue. We have yet to see vehicles such as the ELTIF or the LTAF result in a true significant shift in the way sponsors choose to access retail capital, but, given the ever‑changing regulatory landscape and expected further guidance from regulators, we may come to see these structures become more common in the market.

If you have any questions on this topic, please do not hesitate to reach out to the Proskauer London Regulatory team at ukreg@proskauer.com or your usual Proskauer contact.

Notes

[1] "Eligible Investment Assets" include:

- Equity instruments, quasi‑equity instruments (e.g., subordinated loans) and debt instruments issued by "qualified portfolio undertakings" (see below).

- Loans granted by the ELTIF to a qualifying portfolio undertaking where the loan has a maturity no longer than the life of the ELTIF.

- Other ELTIFs, AIFs, UCITS, EUVECAs or EUSETs; provided that those entities (i) invest in eligible investments themselves; and (ii) have not invested more than 10% of their capital in an ELTIF, AIF, UCITS, EUVECA or EUSETs.

- "Real assets" – assets that have intrinsic value due to their substance and properties (e.g., infrastructure).

- "simple, transparent and standardised" securitisations under the EU Securitisation Regulation (such as mortgage‑backed securities, commercial, residential, and corporate loans and trade receivables); and

- green bonds.

"Qualifying Portfolio Undertakings" must not be:

- established in a third country which is considered "high‑risk" or deemed non‑cooperative in tax matters;

- a "financial undertaking" (excluding a financial holding company or a mixed‑activity holding company), unless authorised or registered more recently than 5 years before the date of investment; or

- admitted to trading on a regulated market or multilateral trading facility (each as defined in MiFID II) or admitted to trading on a regulated market or multilateral trading facility but has a market capitalisation of less than €1.5 billion.

The "Retailisation" of Private Funds – Key Considerations for Private Fund Managers

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.