- within Finance and Banking topic(s)

- within Cannabis & Hemp, Law Practice Management and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Retail & Leisure industries

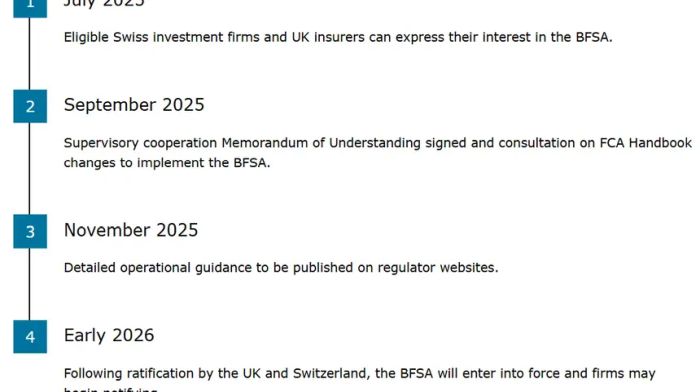

The FCA has issued information about the Berne Financial Services Agreement (BFSA), which aims to make it easier for UK and Swiss firms to do business in each other's country from 2026. Switzerland is the UK's third-largest non-EU trading partner, after the US and China. In 2022, financial and insurance services were worth more than £3 billion.

The BFSA covers insurance, asset management, financial market infrastructures, investment services, and corporate banking.

Eligible firms will need to be authorised to supply those services in their domestic market and placed on the relevant BFSA register. The BFSA uses outcomes-based mutual recognition to enable firms to take part in cross-border trade in financial services to wholesale and sophisticated clients.

This approach recognises the UK and Switzerland's supervisory and regulatory regimes as of a similarly high standard. It removes the need for businesses to navigate unfamiliar rules. This is done by deferring to the relevant regulatory and supervisory rules in the other country.

The FCA's webpage sets out details of the market access arrangements for:

- UK insurance firms. The FCA considers the framework that will apply to UK insurance intermediaries, (particularly in respect of professional requirements) and UK insurers seeking to enter the Swiss market.

- Swiss and UK investment firms. The FCA considers the frameworks that will apply to professional client advisers acting on behalf of UK investment services firms and to Swiss investment services firms with a UK presence providing services to UK high-net-worth clients. It also considers the interaction between access via the BFSA and the overseas persons exclusion in article 72 of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001.

The implementation and application of the BFSA will be reviewed by a Joint Committee, established under Article 23 of the BFSA.

Under Article 46 of the BFSA, unless otherwise agreed, the BFSA will be reviewed every five years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.