- in United States

- with readers working within the Banking & Credit industries

- within Family and Matrimonial, Privacy and Environment topic(s)

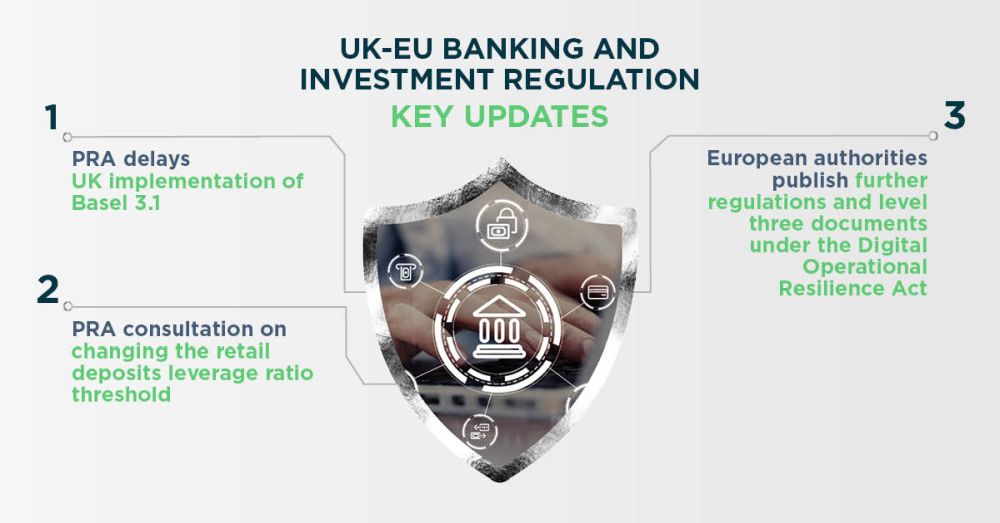

In this edition, we discuss the recent announcement from the Prudential Regulation Authority (PRA) on the delay of the UK implementation of Basel 3.1. This issue also includes an update on the PRA's ongoing consultation on changing the retail deposits leverage ratio threshold. Our edition also features key EU publications including the several regulations and level three documents recently published by the European authorities and the EU Commission in relation to the Digital Operational Resilience Act (DORA).

PRA delays UK implementation of Basel 3.1

On 17 January 2025, the Prudential Regulation Authority (PRA) published a press release announcing that, in consultation with HM Treasury, it has decided to delay the UK implementation of the Basel 3.1 reforms to 1 January 2027.

Read here to know more on the PRA's next steps on the delayed timeline

PRA consults on changing the retail deposits leverage ratio threshold

On 5 March 2025 the Prudential Regulation Authority (PRA) published a consultation paper on its proposals to raise the retail deposits leverage ratio threshold, increasing it to £70 billion to reflect nominal GDP growth since 2016. This increase would ensure that the threshold continued to capture major UK firms, whilst smaller firms below the new threshold would have more space to grow before becoming subject to the leverage ratio requirement.

Click here to read further on what these proposals are

Regulations and level three documents recently published under the Digital Operational Resilience Act

The European authorities and the EU Commission have recently issued several regulations and level three documents under the Digital Operational Resilience Act (DORA). These include final guidelines on ICT and security risk management in context of DORA application, new Delegated Regulation on RTS on threat-led penetration testing and the roadmap for designation of critical ICT third-party service providers under DORA.

Read more on these publications here

Upcoming events

For information on all our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page on our website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.