Briefing on the European Commission Green Paper Corporate governance in financial institutions and remuneration policies

Background

The origin of the Green Paper may be traced to the report of The High Level Group on Financial Supervision in the EU ("the de Larosière Report"), published in February 2009, which included corporate governance failures among the causes of the financial crisis as set out in the box below.

"23) Failures in risk assessment and risk management were aggravated by the fact that the checks and balances of corporate governance also failed. Many boards and senior managements of financial firms neither understood the characteristics of the new, highly complex financial products they were dealing with, nor were they aware of the aggregate exposure of their companies, thus seriously underestimating the risks they were running. Many board members did not provide the necessary oversight or control of management. Nor did the owners of these companies – the shareholders.

24) Remuneration and incentive schemes within financial institutions contributed to excessive risk-taking by rewarding short-term expansion of the volume of (risky) trades rather than the longterm profitability of investments. Furthermore, shareholders' pressure on management to deliver higher share prices and dividends for investors meant that exceeding expected quarterly earnings became the benchmark for many companies' performance."

The European Commission (The Commission) accepted these findings and accordingly committed itself in March 2009 to examine and report on current corporate governance practices in financial institutions and to make recommendations, including for legislative change where appropriate.

The Commission views the Green Paper as "the first step to the reform of the corporate governance mechanisms in the financial services sector."

Part of the Green Paper concerns remuneration which the Commission has already addressed in various initiatives in the wake of the crisis. The main factor driving the Commission's returning again to this topic in the Green Paper is its perception that further consideration of legislative proposals is warranted. This conclusion is based on the consideration that EU legislation in this area is not uniform across different types of financial firm and on the finding that implementation of existing Commission recommendations across the EU has been partial and in some areas "neither uniform nor satisfactory".

What categories of financial institution are covered? Does the Green paper also cover other types of company?

The Commission states that, while the Green Paper is of relevance for all regulated financial institutions, its primary focus is on banks and life insurance companies. The Commission also notes that whilst lessons learned from the crisis are probably also relevant to corporate governance in listed companies in general, the scope of the Green Paper is essentially limited to financial institutions, given the particular role they play in the economy and their potential impact on financial stability. A further Green Paper on corporate governance of listed companies in general is to be issued in the autumn.

The main suggestions

The main suggestions which the Green Paper submits for public consultation are to:

- limit the number of directors' board memberships, for example to 3;

- require more expertise in boards;

- widen the "fit and proper test" to include evaluation of expertise and individual qualities of candidates;

- enhance the role of supervisors in the review of corporate governance structures;

- mandate risk committees at board level tasked with setting policy on risk appetite to be disclosed publicly through a risk statement;

- strengthen the legal liability of directors via an expanded "duty of care";

- strengthen the authority of the risk management function, potentially giving the Chief Risk Officer equal standing to the Chief Financial Officer;

- regulate or restrict stock options and golden parachutes;

- separate the functions of the Chairman and the Chief Executive Officer;

- put in place a stricter duty for auditors to flag anything serious to boards and supervisors and to look at whether they should have an enhanced role to check the risk systems. This enhanced role would be in addition to the planned review by the Commission of auditors' existing role; and

- mandate that institutional investors publish their voting and engagement policies and records and adhere to stewardship codes.

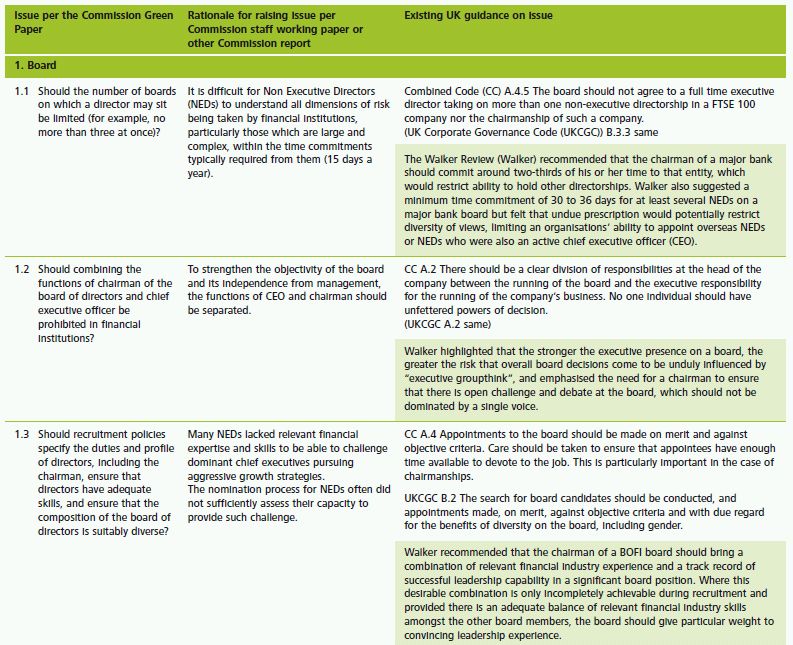

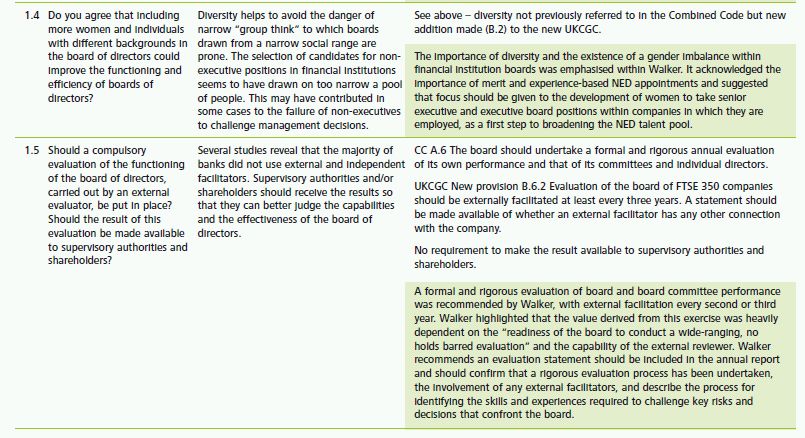

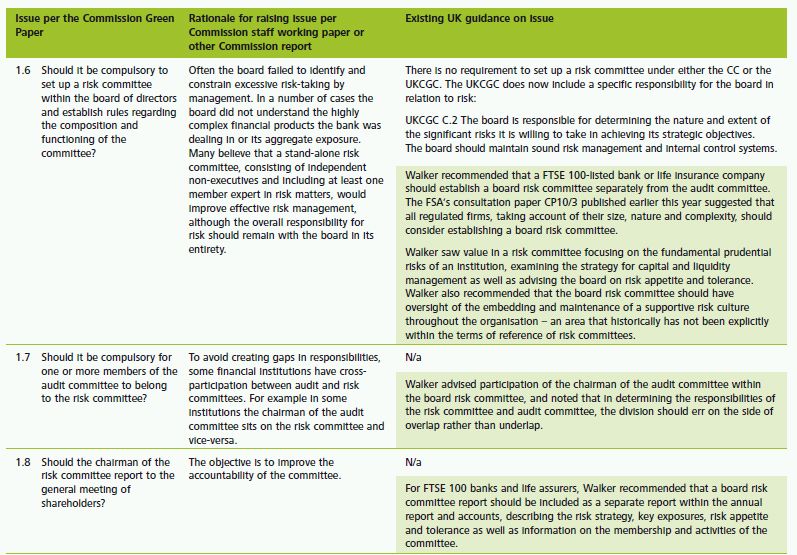

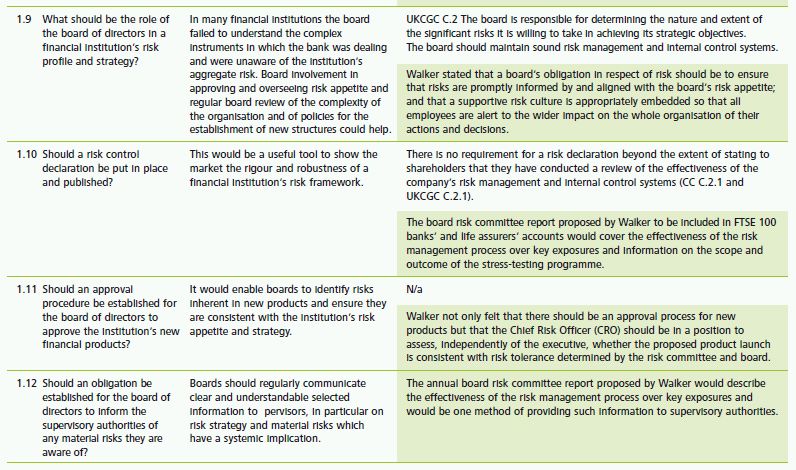

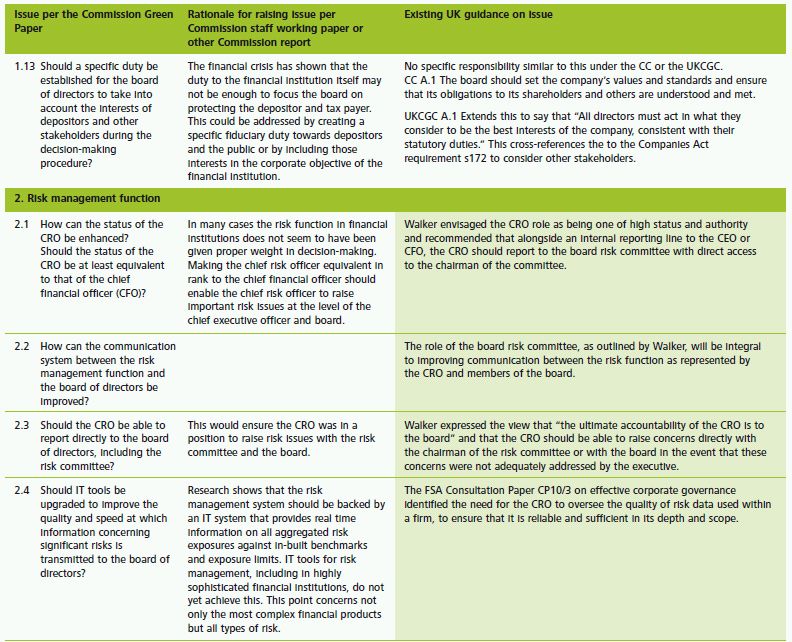

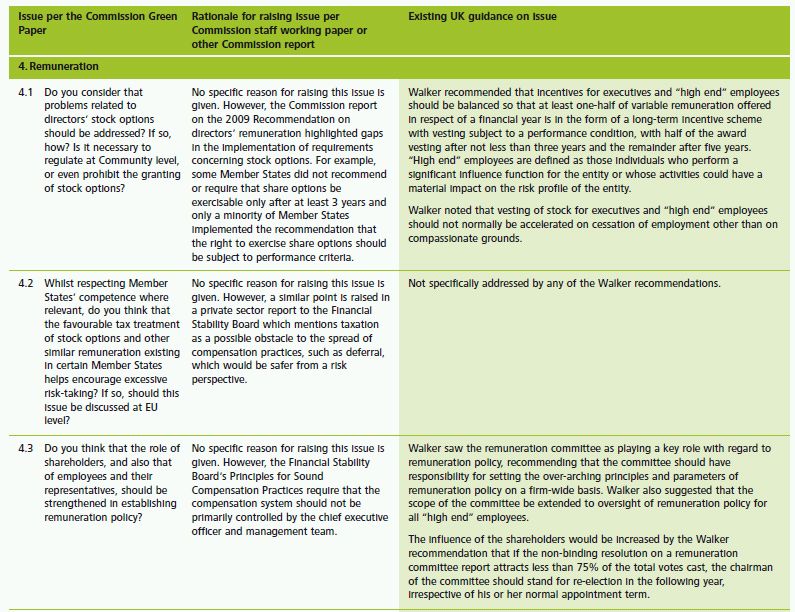

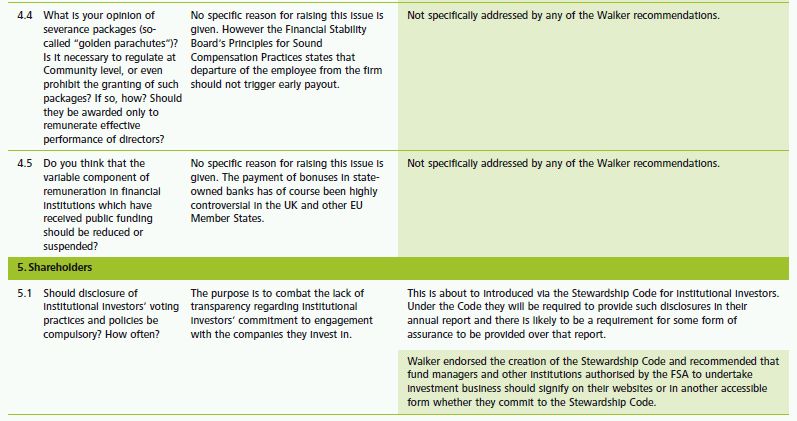

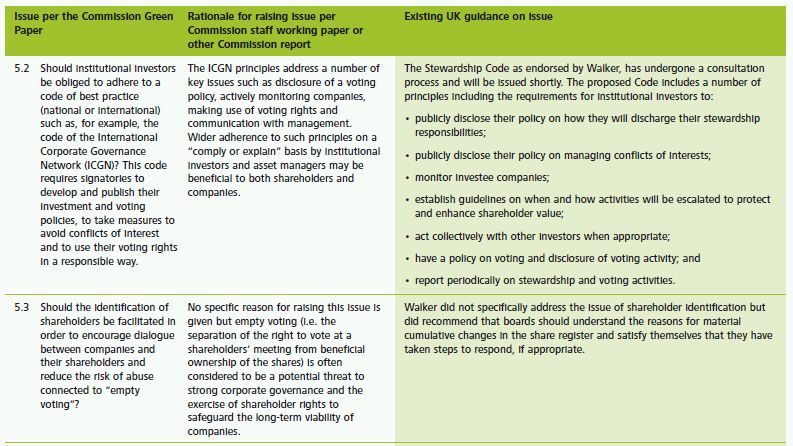

Further detail on the Commission's rationale for the various suggestions in the Green Paper and on the extent to which the suggestions go beyond existing UK guidance are given in the table at the end of this narrative.

The suggestions concerning the role of supervisors and auditors are not further discussed in this briefing.

To what extent do the suggestions of the Green Paper go beyond current UK guidance or proposals?

Many of the proposals contained in this Green Paper reflect the recommendations made in the review carried out by Sir David Walker. The FSA issued a consultation paper (CP10/03) setting out its proposals for implementation of the Walker recommendations. We await the outcome of this consultation process but what is clear is that the FSA has decided against implementing more detailed rules to cover the Walker recommendations but will instead address the issues raised via more focussed ARROW visits. It is also worth noting that the Financial Reporting Council has recently published the new UK Corporate Governance Code effective for periods commencing on or after 29 June 2010 and the Stewardship Code for institutional investors. These Codes address some of the matters raised in the Green Paper. The following are the key areas where the Green Paper goes beyond current and expected UK guidance:

- measures to increase the accountability of members of the board of directors;

- review of the tax treatment of stock options;

- increased regulation of severance packages;

- reduction or suspension of the variable component of remuneration in financial institutions which have received public funding; and

- reinforcement of measures to combat conflicts of interest in the financial services sector.

What will be the follow-up to the Green Paper?

Once it has considered the results of the public consultation (responses are due by 1 September), the Commission will decide in the first quarter of 2011 on the need for non-legislative and legislative proposals.

With regard to remuneration, the Commission has already committed to come up with legislative proposals to regulate pay in all sectors of the financial services industry. The first legislative proposal to modify the Capital Requirements Directive was adopted by the Commission in July 2009 and is part of CRD III which isstill proceeding through the EU legislative process. The Commission affirms that "Other legislative measures will follow".

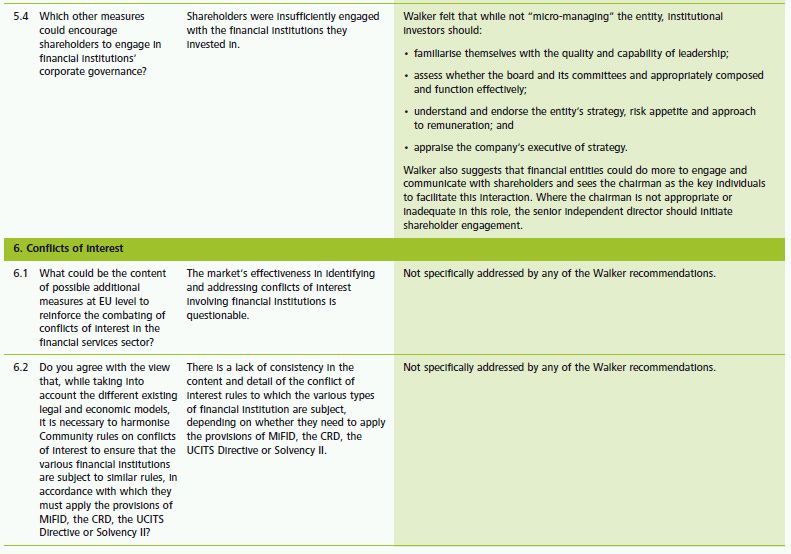

The table that follows compares in detail the Green Paper proposals with the UK Corporate Governance Code and the Walker Review.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.