1. Key takeaways

Who do the topics covered in this briefing apply to? Identity verification ("IDV") will apply to all directors, members and PSCs of all UK companies and LLPs, whether such persons are based in the UK or overseas.

When will IDV come into effect? From Autumn 2025 (with the exact date to be confirmed), all new directors, LLP members or PSCs of UK companies or LLPs who are individuals will need to complete IDV checks. This includes directors, members or PSCs of UK entities that are newly incorporated after the go-live date. Existing individual directors, LLP members or PSCs will need to complete IDV checks by the date that the company's or LLP's next annual confirmation statement is due at Companies House after the Autumn 2025 go-live date.

What action should you take? Reach out to your Travers Smith contact now to start the ball rolling on the IDV process for yourself and relevant persons within your PE group structure.

2. Introduction

A key aim of the Economic Crime and Corporate Transparency Act 2023 ("ECCTA") is to reform the UK's prevention, detection and prosecution measures for economic crime, particularly through strengthening corporate transparency and ensuring that legitimate business activities are not abused for illicit purposes. A crucial element of ECCTA is the implementation of the new IDV regime for individuals associated with UK companies and LLPs.

This briefing focuses on the application of the IDV regime to PE sponsors and PE-backed portfolio companies, both in their lifetime and at the point of a transaction. For a more detailed summary of the new IDV regime more generally, including the verification process and how to prepare for the regime, see our full IDV briefing.

3. PE Sponsors – who needs to complete IDV?

Fund level considerations

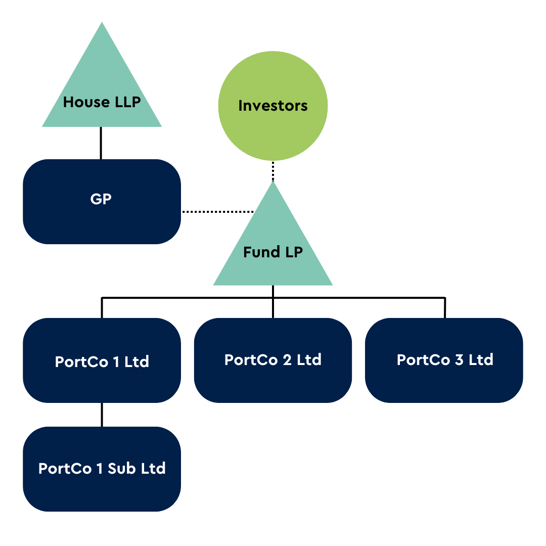

In the context of a typical PE group structure (an example of which is shown in Figure 1 below), at the PE sponsor level, IDV must be carried out by all individuals (whether they are based in the UK or overseas) as follows:

- all new and existing members of the UK PE House LLP (and if any of the LLP members are UK corporate entities all directors of that company will need to complete IDV. If the corporate director/member is a non-UK company, one of its individual directors (or an individual with an equivalent role under the law that applies to it) will need to complete IDV);

- all new and existing PSCs of UK PE House LLP and/or GP;

- all new and existing directors of GP; and

- any person filing documents at Companies House on behalf of UK PE House LLP, and/or GP.

Considerations at portfolio company level

In the context of the PE sponsor's portfolio companies, IDV must be completed by:

- all new and existing directors of the portfolio companies and their respective UK subsidiaries;

- all new and existing PSCs of all portfolio companies and their respective UK subsidiaries; and

- any person filing documents at Companies House on behalf of these portfolio companies.

While the regime extends to individuals in the UK or overseas, all of whom must undergo IDV, it is only UK companies which must comply with these new provisions of ECCTA.

Timing considerations at both fund and portfolio company level

ECCTA is being implemented in stages. From 8 April 2025, individuals were able to voluntarily carry out IDV either directly with Companies House or via an ACSP. However, IDV is expected to become mandatory for all new LLP members, directors and PSCs on incorporation of a new company or LLP from Autumn 2025 (with the exact date to be confirmed). At the same time, a transition period of 12 months will start for all existing LLP members, directors and PSCs to complete IDV. This will be triggered by the relevant company's or LLP's filing of their first confirmation statement after the go-live date in Autumn 2025. After the end of the transition period, compliance with IDV will be compulsory for all directors, LLP members and PSCs and the penalties for non-compliance including fines and prohibitions on acting as a director can be levied.

M&A Transaction Considerations

Due Diligence: Lawyers will need to confirm as part of their legal due diligence that IDV has been carried out for the relevant individuals. Where IDV has not yet been carried out, this process will need to be factored into the transaction timetable.

Incorporation of Newco stacks: IDV will become a compulsory part of incorporating a new company. This provision is expected to take effect from Autumn 2025. PE sponsors will need to make sure that, before incorporating any newco stacks, all incoming directors of the newcos have complied with the IDV requirements.

Post-completion: Following completion of a transaction, any newly appointed directors and/or PSCs of the target group, will need to undergo IDV prior to their appointment (if they have not already done so). PE Sponsors will need to ensure that they have implemented robust internal processes across portfolio companies for ensuring continued compliance with the IDV regime as and when subsequent changes are made to the directors and/or PSCs across their portfolio companies.

4. Authorised Corporate Services Providers

PE sponsors may elect to use an Authorised Corporate Service Provider ("ACSP") to assist with IDV and help verify the identities of individuals within their organisations and portfolio group who are within scope of the new IDV regime. ACSPs are often accountants, company formation agents and legal advisers. Please speak to one of the Travers Smith contacts below, who will be able to assist you in getting your IDV process managed through an ACSP. Once ECCTA comes into force, only those ACSPs which have been authorised by the Registrar will be allowed to deliver documents to the Registrar on behalf of clients.

5. Key dates to remember

.jpg)

6. What can you do now?

Compliance with the new IDV requirements of ECCTA will be a major administrative burden for PE sponsors and may prompt questions from PSCs and directors who will face new identity documentation requests. PE sponsors should ensure:

- they hold up to date records and information regarding their PSCs, directors and LLP members (both at PE sponsor group and portfolio level);

- they maintain open lines of communication with the relevant individuals to let them know about the new IDV requirements under ECCTA and to enable the PE sponsor to request relevant IDV information as required; and

- they have clear processes in place for obtaining IDV information and carrying out IDV at both PE sponsor group and portfolio level, both through the lifetime and on investment/divestment.

Our team at Travers Smith has extensive experience in advising PE sponsors on corporate and regulatory compliance. We are already helping clients prepare for the new IDV regime in a way which is pragmatic and tailored to their business. We encourage you to get in touch if you have any questions or would like further assistance with the IDV process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.