This article explores the shift that has occurred in the investment industry as asset managers have evolved from making ESG commitments using a principle-based approach to an evidence-based approach. This shift has repercussions for both a) the impact asset managers can have on the sustainability challenges we face today; and b) how legitimate their ESG claims prove to be.

In recent years, a new criterion has emerged for asset managers looking to stay relevant: the need to demonstrate how one's investment philosophy aligns with the goal of protecting people and planet1, rather than simply chasing profit. This 'commitment' to ESG has become increasingly widespread, and managers have been pressured by stakeholders to take greater responsibility for tackling societal challenges through their investment approaches. This has resulted in a shift from a principle-based to an evidence-based2 approach to adopting ESG into investment practices. This article investigates this shift to understand how the ESG investing landscape has matured and where managers need to position themselves, in order to ensure their commitments to ESG remain legitimate, in the years to come.

Principle-based approach to ESG commitments

As responsible investing gained momentum in the investment industry, asset managers looked to reputable industry bodies for inspiration on how to draw up a new, more responsible investment philosophy. These largely came in the form of 'principles' – sustainability-oriented beliefs which could be used to guide investment decision-making.

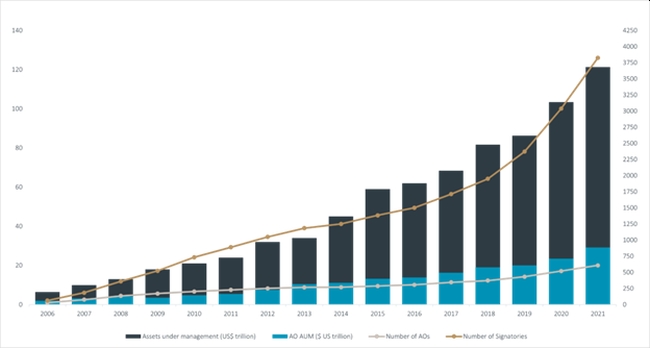

The most widely known of these is the UN Principles for Responsible Investment3 (PRI). The PRI provides a set of six core principles, which lay out a commitment to incorporate ESG in investment analysis and disclosure and to embody active ownership for sustainability over investments. The increasing number of signatories to the PRI since it launched, in 2006, demonstrates the popularity of this principle-based approach, amongst asset managers.

Illustration 1: UN PRI core principles

Chart 1: Cumulative number of UN PRI signatories, 2006-2021

At portfolio company level, a similar commitment to 'sustainability principles' is evident, with companies committing to follow principles set out by the OECD Guidelines for Multinational Enterprises and the UN Global Compact. Both at manager and company level, some players have even become creative in drawing up their own principles! Phrases like 'Driving Social Change' (Blackstone), 'Clean & Conscious' (EQT) and 'Act as One' (SYKES), have begun peppering ESG policies and company mission statements.

The danger of greenwashing

This widespread adoption of principles plays a crucial role in defining a collective understanding of what responsibility entails and how to even begin incorporating ESG into investment and business operations. However, it has also increased the opportunity for greenwashing and distracted from investment outcomes and measuring progress against sustainability goals. Whilst some principle-based approaches, such as the PRI, involve reporting requirements and have an accountability mechanism embedded within the commitment, others do not: they simply pay lip service to responsible investing.

As the scale of the social and environmental challenges facing the world today become increasingly apparent, the action required to mitigate these risks calls for a different approach. Investors wanting to prove they understand the scale of the challenge and are leading the way in terms of tangible ESG progress are turning to an evidence-based approach.

Evidence-based approach to ESG commitments

An evidence-based approach is where a commitment to ESG is made using a combination of critical thinking and the best available evidence. It often involves the creation of a quantified target, with a mechanism to ensure accountability and transparency on progress against that target. In many ways, the evidence-based commitments follow the SMART model, being Specific, Measurable, Attractive, Realistic and Timed. Example ESG commitments which are evidence-based include the publishing of net zero targets, reporting on gender pay gaps and auditing supply chains for human rights abuses.

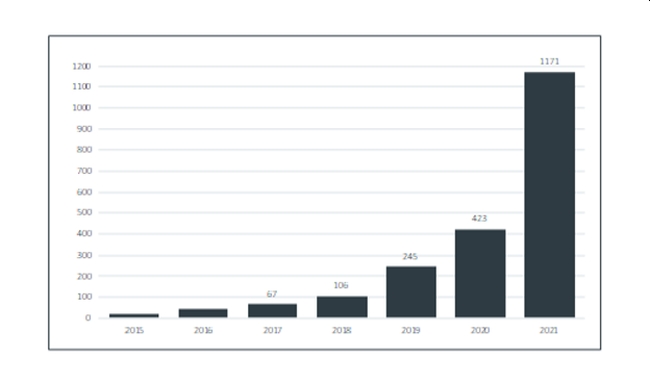

The 2015 Science Based Targets initiative (SBTi) is a great example of a leading standard, which provides companies with a clearly defined path to reduce emissions in line with the Paris Agreement goal of less than 1.5°C warming. Companies that sign up to the SBTi commit to setting a carbon reduction target in line with a 1.5°C scenario, which is validated by the SBTi and then reported on annually by the company. Some investors have used the SBTi to make portfolio wide commitments to decarbonisation. For example, Bregal Investments has committed to ensuring 100% of its direct funds' portfolio companies have science-based targets in place by 20304. The power of setting such a commitment lies in its objectivity and its accountability, increasing the likelihood of its achievement.

Chart 2: Cumulative number of SBTI commitments, 2015-2021

The EU's Sustainable Finance Disclosure Regulation (SFDR) is an interesting example of regulators pushing investors to demonstrate the validity of their ESG claims through providing evidence for the sustainability of their financial products. Under the SFDR, products are classified according to three distinct categories (Articles 6, 8 or 9) based on their approach and commitment to sustainability. Based on their classification, detailed disclosures on the integration of sustainability are required. This regulation has the goal of eliminating 'greenwashing' and it attempts to do so by forcing EU-based investors to provide evidence relating to their commitments to sustainability. As regulation forcing managers and companies to disclose on ESG increases in the future, the need for voluntary disclosures may diminish. Or, conversely, voluntary disclosures which demonstrate clear progress on ESG may serve to position managers and companies favourably on ESG, compared to the competition.

The value of a combined approach to ESG commitments

It is clear that a shift is taking place in the investment industry from principle-based to evidence-based commitments to ESG. Yet, these two approaches need not be mutually exclusive. There is great value to be gained from an ESG approach that can combine the framework of responsible investing principles with evidence that demonstrates progress and ensures accountability towards ESG goals. At MJ Hudson, we believe this combined approach is the most powerful way for managers to make their mark on ESG.

The Taskforce for Climate-related Financial Disclosures5 (TCFD) is a great example of a climate-focused framework which embodies a combined approach. The TCFD recommendations are built upon four pillars (see illustration 2) which frame the suggested approach for financial institutions to manage climate risks and opportunities. Beneath these pillars lie eleven disclosure recommendations, requiring a mix of qualitative and quantitative input, covering areas such as board oversight, scenario analysis and greenhouse gas emissions.

Through this multi-level approach, the TCFD framework is guided by principles, yet accomplished through evidence and detailed disclosure. It is a great example of a sustainability framework which has encapsulated the benefits of both approaches and melded them to create something ambitious and value-driven, yet measurable and transparent. This framework has been so highly regarded that the UK government will introduce mandatory TCFD reporting from 2023, with other countries (e.g. France, Germany, USA) expected to follow in the future.

Illustration 2: TCFD core elements

Looking forward, the importance of ESG commitments is likely to increase as investors and regulators grow more demanding on this front. A commitment to ESG based purely on principle is no longer sufficient to meet the scale of change required to tackle our 21st century social and environmental challenges. The move to integrate evidence into ESG commitments is granting greater legitimacy to asset managers. It also sends a clear signal that real ESG commitment comes from aligning values with decision-making and ensuring ESG goals are tangibly measured and communicated. Only with this holistic approach to ESG commitments, are we better equipped to surmount the sustainability challenges ahead.

Footnotes

1. The Triple Bottom Line: What It Is & Why It's Important

2. Evidence-based practice for effective decision-making | Factsheets

3. About the PRI | PRI Web Page

5. Recommendations | task force on climate-related financial disclosures

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.