- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United Kingdom

- with readers working within the Banking & Credit, Telecomms and Construction & Engineering industries

The U.K. altnet (alternative fibre broadband networks) sector is moving closer to further consolidation as the focus on commercialisation sharpens.

Since 2023, the sector has been moving away from a singular push to grow networks, with altnet financing activity slowing considerably into 2024. By early 2025, debt volumes for financing had fallen to around £170m across a handful of deals.

The cooling funding context and reassessment of the sector's potential have led banks to set aside funds to cover potential defaults and completely rethink altnet strategies. Companies are no longer judged on their network expansion capability; it's now a question of commercialising existing infrastructure.

The outcome is a sector marked by inconsistent core business foundations, with some companies far better placed to succeed with this new strategic focus, intensifying M&A expectations.

Amidst the drop-off in debt financing, CityFibre announced in July that it had secured £500m in new equity and had agreed with lenders to an expansion of its debt facility up to £960m. A specific line of £800 million "accordion" funding has been agreed to finance the company's "M&A pipeline and cement its position as the sector consolidator."

Is an uptick in altnet M&A therefore imminent? The current waiting state is likely to be due to valuation gaps, as buyers' perspectives have fallen out of sync with sellers' projections and scrutiny is locked onto consumer take-up, cost to serve, and integration overheads. However, looming refinancing and a growing consensus on today's altnet opportunity could soon push the market into action.

Realism around market penetration

Few altnets planned for their current situation, but growth-focused business models built on high penetration rates haven't materialised. Our 2025 European Fibre Survey highlighted how much expectations have changed.

Pre-2024, no altnets targeted penetration lower than 30%; the majority were targeting 40% to 60%+. However, as we entered 2025, our survey respondents were more likely to target penetration levels between 30-50% or sub-30%.

.jpg)

These rates are a measure of progress in turning network coverage into customer revenue and reflect the difficulty that businesses have had in achieving that goal.

A combination of regulatory inertia and weaker demand than expected for ultrafast connection speeds has contributed to delays in switching off copper connections, suppressing demand. Incumbent companies have retained more of their existing customers than first envisaged, who have no need to switch to full fibre services.

Competition has also been greater than anticipated, from new entrants and the aggressive strategies of the existing providers. Estimates suggest that the combined network coverage targets of the U.K. altnets, if realised, would have connected 100 million homes, more than triple the number of homes in the U.K.

This level of fibre performance and realisation of a new market reality comes at a time when lending to altnets is estimated to have reached £1 billion, with much of that debt approaching maturity.

In a sign of how stressed some situations have become, funds are being set aside to cover loans and creditors have entered talks over repayments. These talks are likely to cover shareholder cash injections, debt-for-equity swaps, or extended credit facilities. However, the structural imbalances in the sector – too many operators, overbuild, and increasing costs – mean lenders are pushing for sponsor-led funding injections rather than taking on ownership.

Consolidation could be the way to rebalance the market, driving cost efficiencies and strengthening returns.

Taking positions

In the first half of 2025, an industry survey revealed 96% of altnets were considering M&A or partnerships, signalling that preparations were underway for transactions.

The changing focus that has swept through the sector means that any transactions will now be negotiated around monetisation, installation costs, and platform resilience rather than simple coverage statistics.

Investors are scrutinising the downward pressure on average revenue per user (ARPU), customer lifetime value, and operational gearing with unprecedented intensity. Net debt per home passed is a key value indicator – revealing how efficiently capital is deployed by altnets and, while it averages at more than £500, it varies significantly across companies, from £263 to more than £1,000. These figures are clearly impacted by location – rural-focused altnets have much higher build costs vs altnets focused on dense urban/suburban builds. Net debt per home connected is even higher at more than £4,000, on average.1

Consolidation activity in 2024 and 2025 has been underpinned by technical alignment, clear integration theses and the ability to compete effectively through combining mid-sized footprints. As mentioned earlier, CityFibre's new financing package positions the company as a primary consolidator, with Netomnia also exploring acquisitions with new debt and investor financing that brings its total debt funding to £1.2 billion.

These cases underscore the contrast between wholesale and integrated approaches. The business model adopted can greatly influence how straightforward M&A and integration processes will be, as well as the likelihood of post-merger success if you are one or the other, rather than mixing the two. This difference in business model is evident here, with Netomnia facing competition from Sky, whereas CityFibre benefits from a partnership with them.

Improving positions

Significant obstacles must be overcome for a wave of consolidation to be triggered throughout the U.K. altnet market.

Some sellers may already have chosen to adjust their value expectations, but some are still anchored to pre-2022 perspectives, framed by peak valuations based on build metrics. However, the view looks very different on the buy side.

This valuation disconnect continues to impede transaction progress, alongside a mismatch among sitting investors around timelines, return expectations, and governance. This is compounded by transactional and governance complexity, which is a result of altnet ownership structures via special purpose vehicles (SPV) or holding companies. Many shareholders may soon be faced with the prospect of putting in more money or the risk of losing what's already been put in.

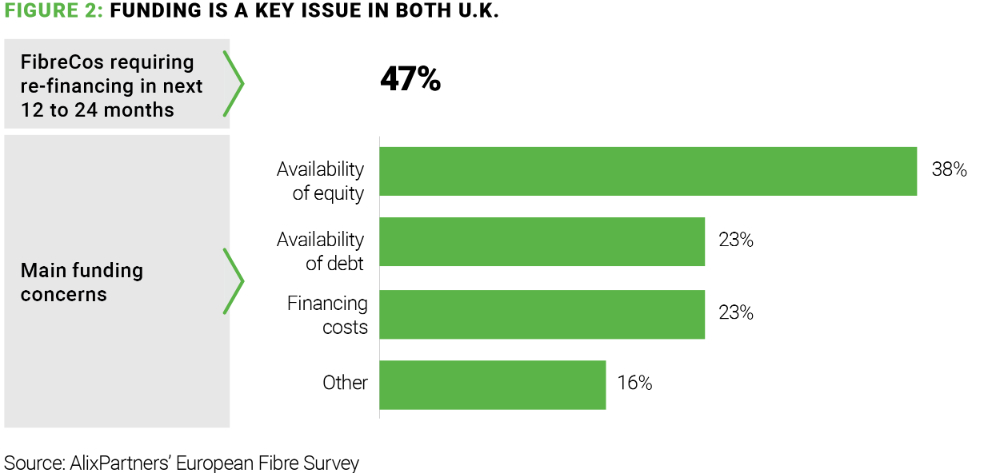

While there is some distance to travel over valuation and fundamentals, a sense of urgency is growing as the need to refinance nears. Our European Fibre Market Survey also showed that 47% of U.K. fibre companies would be refinancing a significant proportion of their debt and/or equity by 2026; we expect this to be significantly higher in our forthcoming 2026 European Fibre Market Survey. This refinancing pressure may force more realistic valuations and accelerate the consolidation process.

But that consolidation comes with inherent complexity:

- Transaction complexity:

- Ownership structures with minority investors mean complex legal negotiations, creditor consents, and potential restructuring of security positions

- Debt in the sector must be successfully navigated by acquirers,

including addressing covenant structures

- Operational / Integration complexity:

- A lack of common wholesale standards in the U.K. fibre industry means every merger requires a tailored approach to integration, making the process more complex and time-consuming.

- Deal viability also rests on technical alignment that is complicated by different network architectures, operations and business support systems (OSS/BSS), and operational processes

Where next?

While the valuation gaps, technical complexities, and diverging capital interests have been headwinds to any altnet M&A and consolidation efforts, there are signs that the market is moving closer to a consensus on the challenges, and work is underway to develop ways to overcome those challenges.

Our forthcoming European Fibre Market 2026 Survey will provide a valuable view of how altnets are positioned to move forward. Looking back at our 2025 survey and the current market dynamics, altnets will need to focus on clear commercial traction that has moved beyond a reliance on organic growth, as well as operational excellence and technical compatibility that can enable scalable platforms.

As lenders proactively explore resolutions for distressed

situations and select altnets prepare to acquire the best-fit

opportunities – with new funding streams targeting

consolidation – that long-awaited increase in M&A

activity could be imminent.

Footnotes

1 Enders analysis: Altnets in the U.K. – Consolidation endgame, June 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.