This article considers our views on how certain macroeconomic developments may impact the private capital markets.

Macroeconomic overview

We are now halfway through 2025, and the global economy is navigating subdued growth, divergence in monetary and fiscal policy between the United States and the rest of the world and geopolitical fragmentation. Capital and supply chains are adapting to this changing environment and in the process becoming more local. Private capital is repositioning itself due to liquidity constraints and weaker fundraising, shifting towards defensive, income-generating strategies. Deployment is concentrating in sectors with structural resilience and supportive policies, such as professional and financial services, defence and education, while private credit and secondaries are providing additional flexibility and liquidity.

Tariffs, trade tensions and the global slowdown

In 2025, the United States raised import tariffs, citing high trade deficits, national security and US President's push for a more "reciprocal" trade policy. A 10% tariff was imposed on all imports plus additional 25% on goods from Canada and Mexico1, pushing trading partners into new trade talks. China faced further duties, bringing total tariffs on Chinese imports to as high as 145%. In response, China imposed retaliatory tariffs of up to 125% on US goods. On 10-11 June, the US and China reached a trade truce: US tariffs on Chinese goods were lowered to 55%, while China reduced its tariffs on US products to 10%.2 However, key issues such as rare earth exports restriction and sensitive technologies controls remain unresolved, leaving the outlook uncertain.3

The European Union has responded with proportional countermeasures, resisting US pressure to relax its rules on data privacy and digital services.4 In contrast, the UK, the first country to strike a trade deal with the US under President Trump's renewed tariff agenda on 8 May 2025, has pursued a more pragmatic path. The deal, formally implemented on 16 June 2025 after the US President signed an executive order, grants targeted reliefs on UK car, aerospace and agricultural exports, but steel producers remain excluded as negotiations over market access and compliance rules continue to drag on5. These changes reflect a structural shift, as governments increasingly use trade measures like tariffs to protect domestic industries and gain advantage, rather than responding to normal economic cycles.

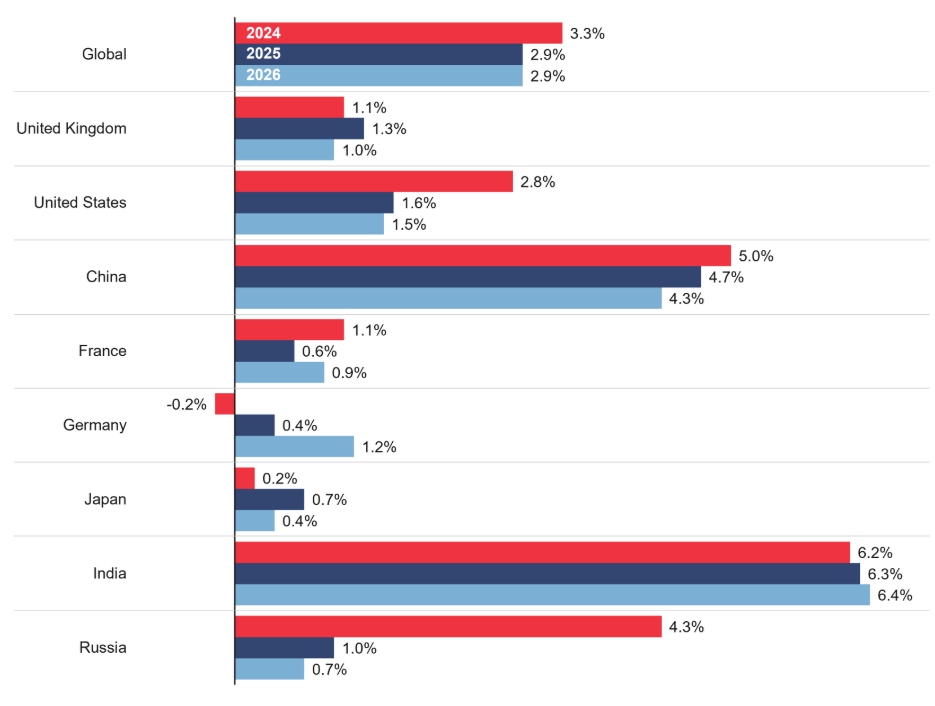

Against this backdrop of higher trade barriers and trade policy uncertainty, the OECD has lowered its global GDP forecast to 2.9% for both 2025 and 2026, the slowest pace since the COVID-19 pandemic, citing higher trade barriers, lower business confidence, and tightening financial conditions.6 The UK economy is particularly exposed: the OECD forecasts a sharp slowdown to just 1.3% growth in 2025 and further to just 1% growth in 20267, as the UK economy contends with weak productivity, subdued consumer demand, and limited fiscal headroom. In response, the UK Government is proactively forging external trade ties to drive growth. In May, the UK secured a landmark reset agreement with the EU which reduces barriers on food, emissions trading and steel.8 Around the same time, it also signed a trade deal with India, projected to add £4.8bn to the UK's GDP by 2040.9

Figure 1: Global economic outlook

Source: OECD Economic Outlook, Volume 2025 Issue 1.

Monetary-fiscal divergence in a fragmented global economy

As trade tensions intensify and global demand softens, policymakers are increasingly using divergent monetary and fiscal tools to stabilise growth.

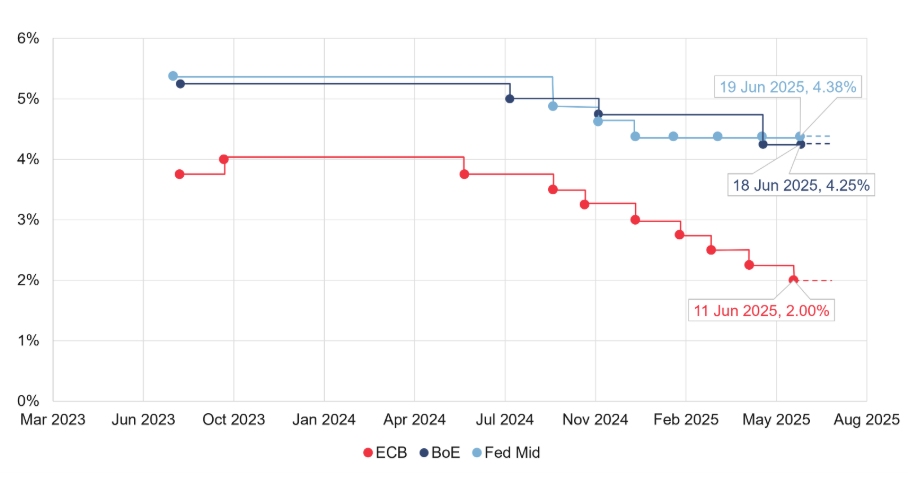

The eurozone and the UK are cautiously moving towards more accommodative monetary policy: the European Central Bank (ECB) has led with two successive cuts - bringing rates to 2% - as inflation falls below target and credit conditions tighten. The Bank of England (BOE) held rates at 4.25% on 19 June, after a 25 basis point cut in May, as persistent services inflation and Middle East tensions kept the outlook uncertain. Despite headline inflation falling to 3.4% in May, elevated wage growth and rising oil prices remain key concerns. However, BoE signalled a possible rate cut as soon as August, citing signs of a weakening labour market.10

In contrast, US remains an outlier – the Federal Reserve has held rates at 4.25-4.5% since December 2024, as tariffs and persistent core inflation slow progress. However, the Federal Reserve is now split on when to start cutting interest rates – some support a cut as early as July 2025, while others, including the Federal Reserve's Chair Jerome Powell, still prefer to keep rates on hold.

Figure 2: Bank of England, European Central Bank and Federal Reserve interest rates

Sources: ECB, BoE, Federal Reserve.

On the fiscal front, governments are shifting towards more strategic stimulus. The US is expanding deficit-financed industrial policy despite elevated debt levels, while the euro area is gradually loosening rules to accommodate green and defence investment. In the UK, however, fiscal headroom remains narrow. Chancellor Reeves has committed to strict borrowing limits, yet the International Monetary Fund has explicitly endorsed a more flexible framework to prioritise public investment without jeopardising credibility.11 Economists now warn that she will be forced to raise taxes this autumn to fill the fiscal hole exacerbated by sluggish growth and rising borrowing. Sustaining growth without undermining stability will hinge on calibrated coordination between monetary easing and strategic public investment.

Trade regionalisation and capital realignment

Global supply chains are reorienting around regional blocs after the pandemic, and recent escalation in US tariffs has accelerated this shift. Vietnam, India and parts of Latin America are emerging as alternative hubs, capturing diverted trade flows from the US–China axis. UK manufacturers no longer view the US as a top growth market, with only 18% of them expecting positive demand over the next three months.12 Additionally, although trade tension is expected to slow global trade growth to 1.7% in 2025,13 they are also accelerating supply chain regionalisation by 5-6% annually, compelling companies on both sides of the Atlantic to localise production.14

This regional shift is mirrored in global capital flows. Investors are increasingly reallocating capital away from the US, driven by high treasury yields, persistent fiscal deficits, and monetary policy divergence. The ECB's accommodative policy, stable inflation, and coordinated fiscal efforts has bolstered demand for European assets – sovereign bonds and equity markets across the continent are seeing increased inflows.15 Additionally, Asia is attracting interest, benefiting from a combination of easing monetary conditions, stronger medium-term growth prospects and favourable valuations.16

Rather than returning to pre-pandemic levels of globalisation, countries are now adjusting based on geopolitical risks and different policy directions. This is changing how trade and investments flow across borders.

Impact on private capital industry

The private capital industry entered 2025 with cautious optimism for a robust recovery, but it is now confronting a complex and evolving macroeconomic and geopolitical landscape. Total assets under management continue to grow steadily, as investors seek diversification and enhanced returns amid persistent volatility. However, inflationary pressures, interest rate hikes, and trade tensions have introduced uncertainty that slows both fundraising and deal activity. As mentioned above, the shifting geopolitical order, notably rising tensions between major economies, is prompting capital to flow towards more stable regions.

Private equity: strained liquidity meets selective optimism

Midyear 2025 finds the private equity landscape under continued strain. Following a strong Q1, April saw buyout deal value fall 24% and deal count drop 22% compared to the monthly average in Q117, as a result of fiscal uncertainty. IPO activity remains generally low, compounding pressure on exits and fund distributions. Dry powder continues to rise which is resulting in mounting pressure to deploy capital.

As liquidity constraints continue, traditional private equity strategies – particularly buyouts – are under pressure. Funds raised in 2018 have a Distributed to Paid-in Capital (DPI) ratio just above 0.6x, far below the historical 0.8x benchmark.18 This mismatch has limited LPs' ability to reallocate, triggering a rise in secondary sales. Global secondary transaction volume is expected to exceed $185bn in 2025, driven by institutional portfolio rebalancing.19 Notably, New York City's pension system executed a $5bn secondaries sale to Blackstone in May20, while Yale University is preparing a sale of up to $2.5bn in private‑equity stakes.21

The impact of increasing levels of dry powder and decline in deal volumes has resulted in a reduction in private equity fundraisings. Global buyout fundraising may avoid a sixth consecutive quarterly decline, but no fund above $5bn closed in Q1 – the first such instance in over a decade. Roughly 18,000 private capital funds are seeking $3.3tn globally, a 3:1 supply-demand imbalance.22 LPs are shifting towards income-generating assets, with 28% planning to increase private credit exposure.

Even so, outlooks are slowly improving across certain segments of private equity. Secondary funds, which offer valuation transparency, shorter duration, and liquidity, are well positioned to benefit from liquidity constraints in the private markets. Evergreen structures now represent 5% of private markets, with expectations to reach 20% over the next decade as demand for structural liquidity grows among private wealth and institutional allocators.23 Overall, while volatility lingers, adaptive strategies and selective re-risking may pave the way for a modest H2 recovery.

Private credit: structural yield in a volatile market

Following the dip in private equity activity, private credit has emerged as the liquidity solution LPs are seeking, offering stable cash flows, floating‑rate protection, and reliable yield. Institutional allocations are rising, with insurers and pensions driving demand: recent surveys show 53% of insurers expect private credit to lead returns this year.24 Global AUM approaches $2.1tn25, with forecasts reach $3tn by 203026. Nearly 30% of LPs plan to increase exposure this year, while private debt secondaries attracted record interest.

Unlike private equity, where DPI remains compressed and exit timelines uncertain, private credit delivers strong returns, anchored in senior secured structures. Strategies have diversified across asset-based lending, real estate credit, and NAV financing, with defaults rates remaining generally low. Private credit's appeal is structural, offering floating-rate cash flows, limited mark-to-market volatility, and increasing institutional adoption.

Despite concerns that private credit's links with banks and insurers could heighten systemic risk, its closed‑end structure has helped avoid forced selling and public market volatility. Enhanced transparency and risk controls bolster its resilience, while policies like the UK's 2025 Pension Schemes Bill which encourages greater private market allocations support growth. Together with regulatory shifts in the US and EU, private credit is solidifying its role as a key, stable income source amid tighter bank lending and volatile markets.

Sector spotlight

Professional services

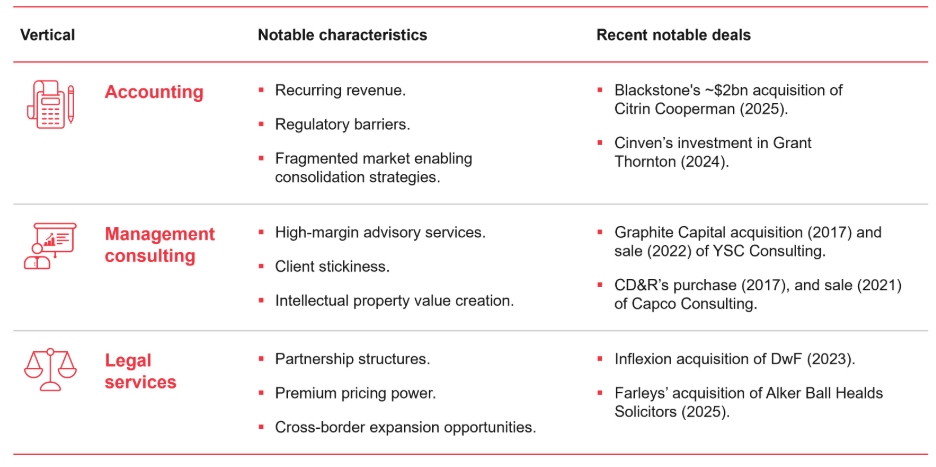

While many industries grapple with supply chain disruption and trade tensions, professional services firms continue to attract substantial private capital investment, leveraging their service-dominant business models as sources of defensive growth. The sector, encompassing law, accounting and management consulting, is rapidly evolving as firms navigate succession challenges and capital constraints, with deal activity increasing substantially in 2024.

As shown in our recent report, professional services exhibit strong insulation from trade volatility through service-dominant business models with minimal direct exposure to goods movement, although some may still face indirect exposure through customer relationships. Total non-US deal volume data shows professional services ranking among the top sectors by transaction value from 2020-2025. The sector also represents a higher proportion contribution to gross value add (GVA) (£223bn) in the UK than either financial services (£208bn) or business services (£125bn).27 This positioning reflects both structural resilience and institutional investor recognition of the sector's growth potential, as shown in the key deals noted in the table below.

Figure 3: Professional services deal activity

Private capital deployment in the accounting sector has accelerated through landmark transactions that demonstrate sophisticated structuring approaches. Most notably, Blackstone's acquisition of Citrin Cooperman from New Mountain Capital in January 2025 represents the first time in accounting history that private equity ownership of an accounting firm has transferred from one investment group to another. The transaction valued Citrin Cooperman at approximately $2bn, representing 15 times EBITDA compared to New Mountain's original 11 times multiple in 2021, with revenues growing from $350m to $850m over three years.28

In management consulting, high-margin advisory services with strong client stickiness have also attracted significant private capital, exemplified by Graphite Capital's acquisition of YSC Consulting in 2017 and subsequent sale in 202229, as well as CD&R's purchase of Capco Consulting in 2017 and exit in 202130. The legal services segment, traditionally constrained by partnership structures, is experiencing transformation through deals like Inflexion's acquisition of DWF in 202331 and Farleys' acquisition of Alker Ball Healds Solicitors in 202532, capitalising on premium pricing power and cross-border expansion opportunities.

These transactions across accounting, consulting, and legal services illustrate how private equity firms are developing strategies to navigate regulatory requirements whilst unlocking value in professional services firms that offer recurring revenue models and operate in fragmented markets that present opportunities for consolidation.

Financial services

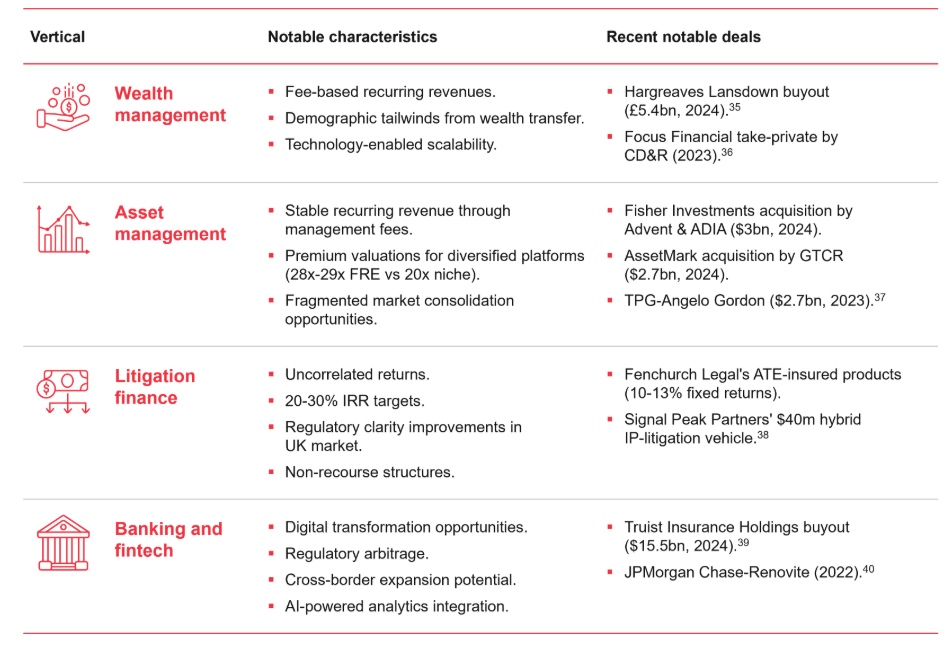

Financial services remain a pillar of the global economy and a segment private capital funds (PCFs) increasingly view as a desirable investment target. In 2024, private capital deployment in financial services built significant momentum with Q1 2024 alone recording 68 private equity deals worth $18.2bn globally, representing a 130% increase in value terms compared to the previous quarter and 75% growth compared to Q1 202333. The UK financial services market demonstrated particular strength, with Q3 2024 recording 12 private equity deals worth $14.1bn, led by the $6.9bn institutional buyout of Hargreaves Lansdown, representing a 93% increase in value terms quarter-over-quarter34. This resurgence spans traditional banking, wealth management, asset management, and increasingly alternative credit strategies, reflecting both regulatory shifts and institutional appetite for income-generating assets with defensive characteristics captured in the table below.

Figure 4: Financial services deal activity

The strategic appeal of wealth management and asset management reflects private equity's systematic pursuit of predictable, annuity-like cash flows that are resilient during economic uncertainty. Wealth management's record transaction volumes are driven by private equity's recognition that aging demographics create a structural tailwind for fee-based advisory services, while AI-powered personalisation and embedded finance capabilities enhance client retention and expand addressable markets beyond traditional high-net-worth segments41. Asset management consolidation follows a distinct geographic playbook, with European buyers deploying larger capital commitments to acquire transformative platform capabilities, contrasting sharply with North American strategies focused on fragmented roll-up opportunities that leverage operational efficiencies and cross-selling synergies across smaller, complementary businesses42.

Banking and fintech investments represent a fundamental reimagining of financial infrastructure, where traditional institutions acquire technological capabilities to defend market position while pure play fintech platforms seek scale and regulatory legitimacy through institutional partnerships. The substantial capital deployment in this vertical reflects private equity's thesis that regulatory compliance costs and technological complexity create natural barriers to entry, enabling established players with hybrid capabilities to capture disproportionate market share as financial services digitise. Litigation finance's evolution demonstrates how alternative credit strategies mature from niche opportunistic investments into institutional asset classes, with regulatory clarity in key markets like the UK enabling pension funds and insurance companies to allocate capital to non-recourse financing structures that offer both portfolio diversification benefits and attractive risk-adjusted returns uncorrelated with traditional credit cycles.

Key sectors to watch

Defence and aerospace

The defence sector has become a critical investment focus following geopolitical shifts and increased spending commitments, particularly in Europe, with global military expenditure projected to exceed $2tn in 202543. In 2024, EU member states allocated €326bn to defence – a 30% increase from 2021 – while equipment procurement surged over 50% to €90bn.44 Recent regulatory clarity from the FCA45 and German authorities46 has confirmed that it is possible for sustainable funds to invest in the defence sector, opening the door to investment flows across key verticals such as infrastructure, precision components, cybersecurity, aerospace systems, and AI applications. The sector outlook remains robust despite supply chain and regulatory challenges, particularly as emerging technological innovations in AI and satellite communications drive modernisation programmes across the North Atlantic and Indo-Pacific regions.

Education

The education sector exhibits defensive characteristics through essential service demand and accelerated digital transformation, with institutions demonstrating operational resilience by managing 12-18% cost increases while maintaining service quality during recent supply chain disruptions.47 Private capital deployment has targeted technology-enabled platforms, institutional consolidation opportunities, and specialised compliance service providers, capitalising on the sector's inelastic demand patterns and stable government funding frameworks. The sector's long-term contract structures and predictable revenue streams provide income-focused institutional investors and private capital funds with defensive investment attributes comparable to other essential service verticals, while digital delivery scalability offers operational advantages unavailable to traditional physical infrastructure sectors.

Footnotes

1. BBC (2025), Stock markets sink as Trump confirms tariffs on Canada, Mexico and China.

2. TIME (2025), A Timeline of the U.S.-China Trade War During Trump's Second Term.

4. Bruegel (2025), EU targeting of digital services in tariff retaliation would present challenges.

5. FT (2025), Donald Trump signs executive order to implement US-UK trade deal.

6. OECD (2025), OECD Economic Outlook, Volume 2025 Issue 1.

7. OECD (2025), Global economic outlook shifts as trade policy uncertainty weakens growth.

8. FT (2025), Starmer hopes to banish 'battles of the past' with EU reset deal.

9. News.az (2025), Keir Starmer plans India visit to pursue trade deal.

10. FT (2025), Bank of England warns of weakening jobs market as it holds rates.

11. FT (2025), IMF gives Rachel Reeves political cover to 'refine' UK fiscal rules.

12. FT (2025), US no longer a top growth region for UK manufacturers, survey finds.

13. IMF Blog (2025), The Global Economy Enters a New Era.

15. FT (2025), Big investors shift away from US markets.

16. Reuters (2025), Asia could outstrip Europe as key beneficiary of U.S. capital flight.

17. Bain & Company (2025), Leaning Into the Turbulence: Private Equity Midyear Report 2025.

18. Bain & Company (2025), Leaning Into the Turbulence: Private Equity Midyear Report 2025.

19. Jefferies (2025), Jefferies-Global-Secondary-Market-Review-January-2025.

20. Chief Investment Officer (2025), NYC Pensions Sell $5B in Private Equity Secondaries to Blackstone.

22. Bain & Company (2025), Leaning Into the Turbulence: Private Equity Midyear Report 2025.

23. J.P. Morgan Private Bank (2025), 2025 Mid-Year Outlook: Comfortably Uncomfortable.

26. Macfarlanes Private Capital Solutions (2025), Unpacking private credit secondaries.

29. Graphite Capital (2025), Graphite Capital sells YSC Consulting to global strategic.

30. CD&R (2025), CD&R Fund IX Exits Capco in $1.45 Billion Strategic Sale to Wipro.

31. Inflexion (2025), Inflexion completes take private of DWF.

32. Farleys (2025), Farleys Fuel Growth with Acquisition of Alker Ball Healds Solicitors.

33. Leasing Life (2025), Private equity deals in financial services increased in Q1 2024.

37. S&P Global (2025), "Private equity deals in asset management sector hit 3-year high."

38. Business Wire (2025), Litigation Finance Company Signal Peak Partners Launches in Texas.

40. J.P. Morgan Chase (2022), J.P. Morgan to acquire Renovite Technologies, Inc.

41. Informa (2025), The Top 10 Wealth Management M&A Deals in 2024.

42. S&P Global (2025), Private equity deals in asset management sector hit 3-year hig.

44. European Council (2025), "EU defence in Numbers," 2025; Council of the EU.

45. FCA (2025), "Our Position on Sustainability Regulations and UK Defence."

46. BMVG (2025), National Security and Defence Industry Strategy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.