- within Consumer Protection topic(s)

- within Consumer Protection topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

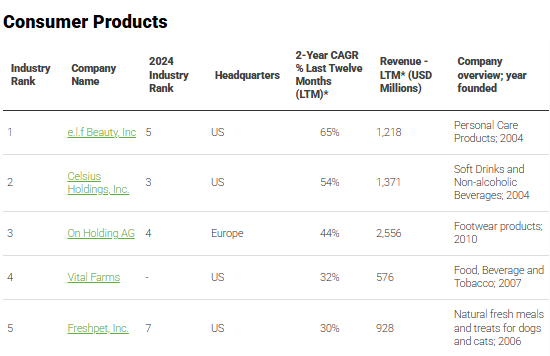

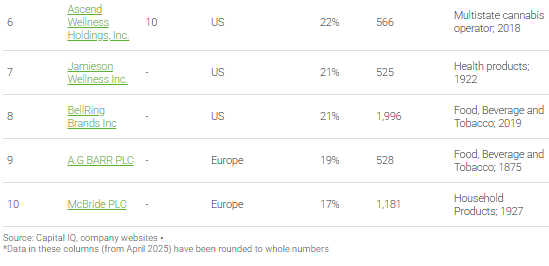

Analyzing growth-leaders in the consumer products sector

While consumer product companies continue to face stiff headwinds—from margin pressure and retailer pushback to changing consumer priorities—a standout group of growth leaders has found strategic ways to scale. These supergrowers—the ten publicly-traded consumer products companies that have grown fastest over the last two years—have shown that distribution scale, product innovation, and standout marketing continue to be the strongest drivers of consumer brand momentum and top-line growth.

One of the clearest differentiators was the growth leaders' relentless expansion of distribution. Companies such as Celsius Holdings, Inc. and Vital Farms have reached widely across channels, retailers, and regions, ensuring their products are visible and accessible where customers shop. Nearly every company on this year's list, from e.l.f. Beauty to On Holding, is pursuing retail and geographic expansion as a top lever for growth. Though international expansion played a less important role this year than last, direct-to-consumer and digital growth strategies continued to be an important path to growth.

Product innovation remained another major driver. e.l.f. Beauty continues to roll out fast-trend, high-impact SKUs that dominate TikTok and shelves alike, while BellRing Brands leans on flavor innovation and portfolio depth in the booming protein drink market. Jamieson Wellness and On Holding are doubling down on product development to stay ahead in competitive health-forward categories.

Third, top performers also made meaningful investments in brand marketing. Some of it is about newfangled channels (like TikTok ); some is about old-fashioned messaging as e.l.f. Beauty's "disruptive marketing engine" continued to capture Gen Z and Alpha via viral content, while On Holding focused on authentically connecting with runners through performance communities. Vital Farms, too, attributed part of its growth to consumer connection and its "ethical food" message.

Each company offers its own playbook, but the formula remains clear: deliver where the customer is, offer differentiated value, and make your brand unforgettable.

Fastest Growers Spotlight

On Holdings AG

A pair of Cloudsurfer running shoes, engineered with Helion" superfoam and computer-optimized cushioning, retails for around $160. But every sale of this sleek, Swiss-designed sneaker has added fuel to one of the fastest-growing brands in athletic footwear. In 2024, On Holdings sprinted ahead with over CHF 2.3 billion in net sales—up more than 29% from the prior year—on the back of innovative products, global expansion, and a strong direct-to-consumer push.

The brand has continued to win over performance-minded athletes and style-conscious urbanites alike. In regions such as the Asia-Pacific, net sales nearly doubled in 2024, helping the company build a truly global presence. Meanwhile, its direct-to-consumer channel, now accounting for almost half of Q4 sales, has grown more than 40% year-over-year, driven by seamless ecommerce and immersive retail experiences.

Product drops like the Cloudmonster and new tech platforms like LightSpray" have kept the brand fresh and on-trend. But the company isn't just about gear—it's about the lifestyle. From collaborations with tennis star Roger Federer to near-daily street style sightings, On is evolving into a premium aspirational brand with mass appeal.

And it's doing so profitably: with gross margins north of 60% and nearly CHF 1 billion in cash, On is building staying power. As it continues expanding its retail network, enhancing CRM capabilities, and deepening customer engagement, On is proving that high performance and high growth can run in lockstep.

Vital Farms

A dozen pasture-raised eggs from Vital Farms might retail for a premium price, but each carton represents a commitment to ethical farming and sustainable practices. In 2024, Vital Farms (a certified B corporation) scrambled expectations, achieving a 28.5% increase in net revenue to $606.3 million, driven by strong consumer demand, strategic expansion efforts (the company has products in over 24,000 retail stores), and increasing brand strength and consumer loyalty.

The company's growth was not just about numbers; it was about nurturing relationships. By adding over 125 new family farms, expanding its network to more than 425, Vital Farms reinforced its dedication to humane animal treatment and sustainable agriculture.

Marketing initiatives like the "Good Eggs. No Shortcuts." campaign showcased real farmers, connecting consumers to the origins of their food and emphasizing transparency. This authentic storytelling resonated with a growing demographic seeking integrity in their food sources.

Looking ahead, Vital Farms is investing in infrastructure with the construction of a new egg washing and packing facility in Seymour, Indiana, set to support the company's goal of reaching $1 billion in annual net revenue by 2027.

In an industry often criticized for opacity, Vital Farms stands out by putting its values on display, proving that doing good and doing well can go hand in hand.

Jamieson Wellness Inc.

You might not expect one of the fastest-growing players in consumer goods to be a century-old vitamin brand from Canada—but Jamieson Wellness is exactly that.

While others tread cautiously in a post-pandemic economy, Jamieson is charging ahead—globally, digitally, and strategically. Its international business has jumped 65% since 2021, now accounting for over a quarter of total revenue. In China, where wellness demand is booming, Jamieson saw sales surge over 80% in Q1 2024, thanks to a localized distribution model and smart marketing investments (source).

The U.S. is heating up, too. Since acquiring Youtheory in 2022, Jamieson has planted deep roots in lifestyle supplements like collagen, sleep, and stress relief—with 37% growth to show for it.

Back home? The company remains Canada's #1 health brand, and in Q3 2024, domestic revenue grew 15%, boosted by a campaign spotlighting its 102-year legacy of trust.

What's behind all this growth? Smart portfolio diversification, digital-first innovation, and agile execution. From e-commerce platform Tmall in China to influencer-led launches in the U.S., Jamieson is acting less like a legacy brand and more like a nimble DTC disruptor.

With record Q3 revenue and strong full-year guidance, Jamieson is showing what sustainable, global growth really looks like. It's not loud or flashy; it's just quietly winning.

BellRing Brands Inc.

BellRing Brands is kicking growth into high gear—and it's all by design. After posting another quarter of double-digit top-line gains, the company, a manufacturer of energy drinks and powders, credits a few key levers for its supergrower status.

First up: using its distribution muscle. Premier Protein shakes scored fresh shelf space at Walmart, Costco, and Amazon, fueling a major volume bump without sacrificing the "grab-and-go" convenience shoppers crave. Behind the scenes, Dymatize powders are threading into specialty channels outside the U.S., pushing international sales past the 10% mark.

Next, brand buzz. BellRing's "Premier Shakers" influencer program taps micro-creators and fitness ambassadors to showcase real-life recipes and workouts, turning protein into a social-media must-try. Add in purpose-driven campaigns like the new "Shakes for Shifts" initiative supporting frontline workers, and you've got a recipe for both goodwill and word-of-mouth.

Meanwhile, smart cost plays—like streamlined co-manufacturing partnerships and targeted marketing spends—keep margins healthy even as raw-material prices climb. A steady rollout of new flavors and formats also helps BellRing stay relevant on crowded store shelves.

Put it all together—distribution wins, viral marketing, global expansion, and operational finesse—and you've got a growth engine firing on all cylinders. BellRing Brands isn't coasting; it's charting the course for what a modern consumer-goods powerhouse looks like.

Return to the Supergrowers homepage to view the full list, or learn more about our methodology

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.