Some areas within consumer-linked debt are under pressure, but certain pockets of the market remain attractive.

What is securitized credit and what can it offer investors?

Securitized credit encompasses a wide range of pooled assets backed by consumer, commercial and corporate debt. Typically, a diversified securitized credit strategy tends to have a large portion of its exposure in consumer-related risks, mainly from residential mortgage-backed securities (RMBS) and consumer asset-backed securities (ABS). The remaining exposures include corporate and commercial related risks via collateralized loan obligations (CLOs), commercial ABS and commercial mortgage-backed securities (CMBS).

Securitized credit can offer investors valuable diversification from more traditional fixed income asset classes, notably via consumer-linked debt. Additionally, it commonly offers higher yields than similarly rated corporate debt.

What is our current outlook for consumer debt within securitized credit?

The fundamentals driving U.S. consumer-related debt have shifted meaningfully in the past few years. On average, U.S. consumers entered the higher interest rate environment of 2022 with elevated savings and significantly higher home equity compared to the years leading up to the Global Financial Crisis, causing household debt service ratios to sit near historic lows.

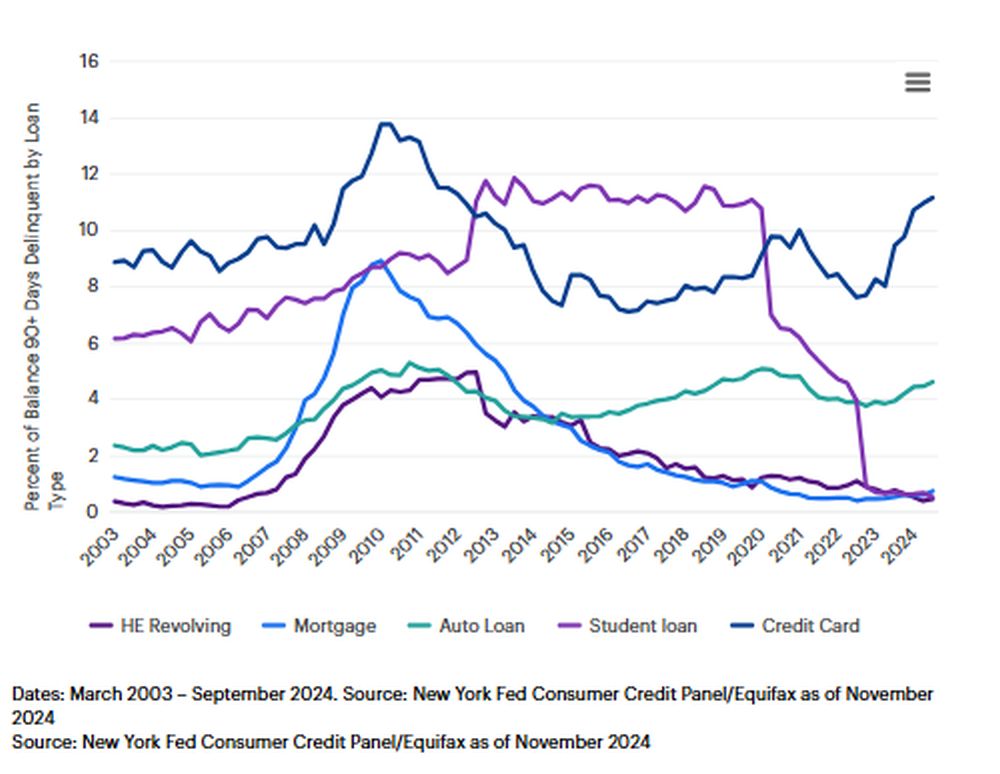

Fast forward to November 2024, consumers were showing resilience on average, but credit performance varied by loan type and income cohort. Mortgage and Home Equity Line of Credit (HELOC) delinquency rates remained consistently low; however, credit card, auto and unsecured personal loan delinquencies increased, especially within the subprime cohort. This largely stems from the heavier debt service burden that these borrowers are facing compared to prime consumers, driven by higher interest rates and depleted savings. Given the performance dispersion within consumer-linked debt, we believe skilled managers with strong underwriting capabilities can sift through the nuances to find attractive risk-adjusted opportunities.

Delinquency rate by consumer cohort

| Auto 60+ days delinquent |

Bankcard 90+ days delinquent |

Unsecured Personal Loan 60+ days delinquent |

|

|---|---|---|---|

| Super prime | 0.0% | 0.0% | 0.0% |

| Prime plus | 0.0% | 0.0% | 0.0% |

| Prime | 0.2% | 0.2% | 0.1% |

| Near prime | 0.6% | 1.5% | 1.1% |

| Subprime | 9.8% | 23.2% | 14.3% |

The table shows the percentage of loans by risk tier that are 60+ days delinquent for auto and unsecured personal loans and 90+ days delinquent for bankcards as of December 2024.

Source: TransUnion Credit Industry Snapshot, as of December 2024. Numbers may be subject to rounding.

Where should investors focus today?

Within the more liquid securitized market, experienced managers are finding value higher up the capital structure in consumer ABS due to its attractive income and shorter duration profile. In private credit, we see alpha opportunities in asset-backed lending for specialist managers with strong sourcing and structuring expertise, as these managers can craft bespoke transactions with strong structural covenants.

With the potential for delinquency rates to increase further, consumer ABS originators may tighten their credit underwriting, which can improve the quality of the underlying collateral. The degree of tightening and the quality of underlying collateral varies widely by originator. In our experience, managers who have invested through multiple credit cycles are best positioned to find the most attractive investments in today's market.

To harness the potential yield advantage, diversification benefits and the improvement of investor protections within securitized credit, we believe identifying experienced, specialist managers is the best route to help investors maximize value within securitized credit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.